There are nearly 4,000 dividends in public funds in the year, and "red envelopes" are distributed over 170 billion yuan

Author:Dahe Cai Cube Time:2022.09.21

Since September, the market shock has continued. Although the funding effect of the fund has not changed significantly, the dividend of the fund has increased. From September 20th to 22nd trading days, there are more than 40 fund products ( Calculate the separation of different shares, the same below) to distribute dividends.

Wind data shows that as of now, there have been 334 funds in September, and the distribution amount has exceeded 9.8 billion yuan, which has recovered from 8.324 billion yuan in August. Since this year, a total of 2311 fund products have implemented dividends in the entire market, with a cumulative dividend of 3951 times and a total dividend of nearly 171.1 billion yuan.

From the perspective of the industry, the dividend of the fund is related to the operation time and profit performance of the fund. Secondly, dividends can make the income "settle in the bag", which is intended to share profit results with investors, which can improve the holder's investment experience. At the same time, the scale of the fund can be appropriately reduced through dividends, which is conducive to product management.

The dividend of nearly 10 billion since September

On September 21, 42 funds including Changsheng Shengqi A, Wells Fargo Juli Pure Bonds, Three months, and Yongdan Jiuli issued dividends. Except for Xincheng Happiness Consumption and the high -quality development of the rich country A/C is an active equity fund, the remaining funds are bond funds. Among them, the proportion of medium and long -term pure debt funds accounts for more than 70 %.

Wind data shows that 334 fund products have implemented dividends in September, with a total amount of 9.844 billion yuan. Among them, the total dividend of 22 fund products exceeded 100 million yuan. Among them, the total dividend of Xin'ao's advanced intelligent manufacturing is 527 million yuan. This product is also the highest dividend of the unit, with a dividend of each share of 0.6203 yuan.

In terms of stretching time, in the first quarter and second quarters of this year, the total amount of dividends of the fund was 94 billion yuan and 46.9 billion yuan, respectively, accounting for 54.94%and 27.41%of the total fund dividends during the year. The end of the third quarter has ended, with a dividend amount of only 27.4 billion yuan, less than one -third of the first quarter of this year.

The first financial reporter sorted out and found that the fund's dividend amount showed a downward trend, which may be related to the performance of equity funds (including ordinary stock funds, partial stock hybrid funds, flexible configuration funds, and balanced hybrid funds, and the same).

Among the total dividend of 94 billion yuan in funds in the first quarter, the dividend of equity funds reached 48.45 billion yuan, accounting for more than 50 %. Since the second quarter, the dividends of equity funds have gradually "shrunk", with 12.406 billion yuan in the second quarter, and only 4.097 billion yuan in the third quarter.

As of September 21, the total annual dividend of the equity fund was 65.094 billion yuan, a decrease of 25.23 billion yuan from the same period last year, a decrease of nearly 28%year -on -year. This also directly led to this year's dividend efforts than the performance of the same period last year.

Wind data shows that there have been 2,311 funds in the market this year, a year -on -year increase of 13.17%; the cumulative dividends reached 3951 times, an increase of 16.69%year -on -year; 100 million yuan.

Among them, Baoying's core advantage A has carried out 12 dividends this year, the fund with the largest number of dividends. The fund has accumulated 104 dividends since its establishment in March 2009. It is one of the few fund products with hundreds of dividends. In addition, the number of dividends of 36 fund products including Castrol Super Short Debt A and ICBC Ruian's three -month fixed bonds and diversified opening of the south have exceeded 5 times.

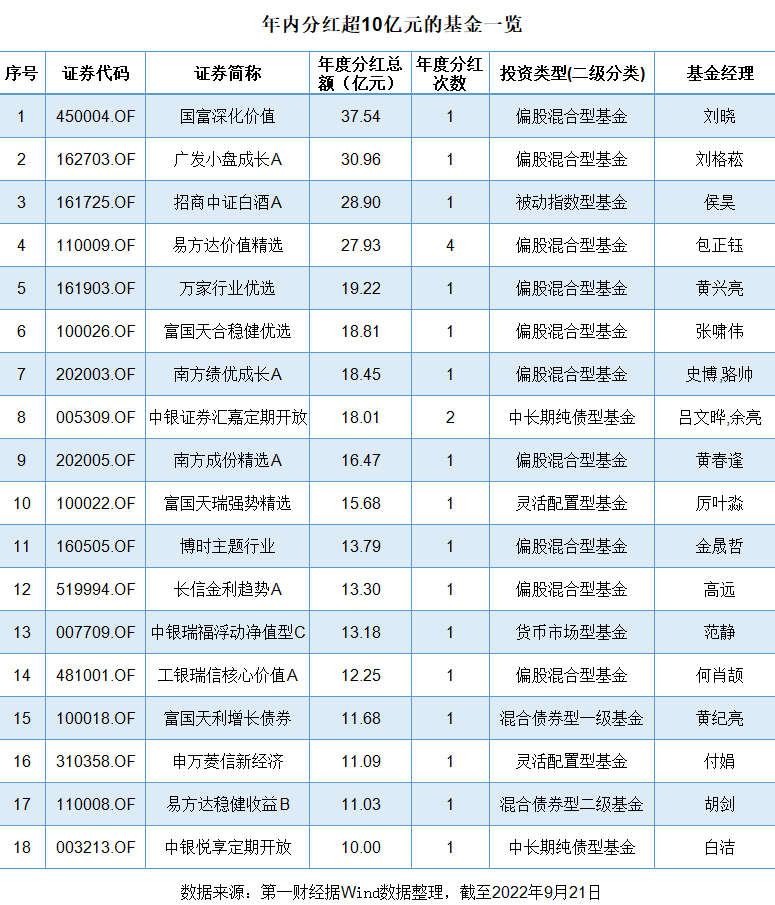

In addition, there are many funds who also send "red envelopes", and 18 fund products have divided over 1 billion yuan this year. For example, the deepening value managed by the fund manager Liu Xiao, the amount of dividend of only 3.754 billion yuan, ranked first; followed by Liu Gezheng's Gangfa Small Plate grows A and Hou Hao's investment promotion, China C Security Management, China C Security Baijiu A, dividend of 3096 billion yuan and 2.89 billion yuan, respectively.

The division of division in the shock market can make a timely profit

"Generally speaking, good performance is the foundation of fund dividends." A fund industry researcher told reporters, "In the first quarter, there are more dividends of equity funds, which has achieved good performance last year. The downturn, especially the income performance of the products of the equity fund, is not very good, and the products that meet the dividend conditions are naturally relatively small. "

According to the reporter's understanding, the fund dividend means that the fund sends part of the income to investors in cash and needs to meet three conditions at the same time: first, the fund's income of the year can make up for the previous year's losses. Later, the unit net value cannot be lower than the face value; the third is that the net loss of fund investment cannot be allocated.

At present, the dividend of the fund is mainly divided into two types, namely cash dividends and dividend reinvestment. Investors who choose the dividend reinvestment method will convert the net value of the fund shares after the dividend of the dividends to the fund share for reinvestment; if the investor does not specify the dividend method, the default income distribution method is the cash dividend.

So, the more the fund dividends are for investors?

A large fund company told reporters that "the essence of fund dividends is part of the net value of the fund unit. In other words, it is to change the left hand to the right hand. If it is from this perspective The performance will not be too bad. In addition, the use of dividends can also reduce the scale of management and reduce the pressure of centralized redemption of investors. "

When asking why you choose to make multiple dividends, another fund company says that fund products will not be divided into dividends for no reason. Generally because of the provisions of the product contract, there are certain restrictions on the net value or distribution of the product.

The reporter consulted multiple fund announcements and found that there were indeed some funds that made multiple dividends or large dividends, and made clear stipulation on the "dividend" in the contract.

For example, the core advantage of Baoying, the largest number of dividends this year, according to the fund contract, when the fund realizes the distribution income of 0.04 yuan or when the net value of the fund reaches 1.10 yuan or more, and meet the legal dividend conditions, the income distribution; in line with the compliance Under the premise of the fund dividend conditions, the fund income distribution is allocated at least once a year, and the fund income distribution is up to 12 times a year.

During the year, the fund contract with more than 1.8 billion yuan in Southern Growth A Growth A also stipulated that on the premise of meeting the conditions of the fund dividend, the annual income distribution of each type of fund shares of the fund was up to 12 times, and the share categories of each fund all year round. The distribution ratio shall not be lower than 90%of the annual distribution income of this type of fund shares.

"Dividends can enhance investors' investment experience. Under the shock market, funds that implement dividends are locking in advance to allow investors to make timely profits, keep the income, and avoid losses caused by the continuous decline in the market." If investors are cautious and conservative in the market outlook, they can choose the way of cash dividends; if they are more positive for the market outlook, it is recommended to get more benefits by re -investing in dividends.

At the same time, many people also emphasized that fund dividends are only a way to fulfill the fund's net value growth. Whether dividends do not mean the quality of product performance. Essence

Responsible editor: Wang Shidan | Audit: Li Zhen | Director: Wan Junwei

- END -

Decoding Financial Report | R & D first, the bottom of the performance, how to resolve the embarrassment of "more losses and more money"

Fengkou Finance reporter Xu YaowenAs of August 25, more than 70 companies in the 1...

Jiajiang County: The district drives the "new picture" of the rural revitalization

Recently, the reporter walked into Tuanjie Village, Xinchang Town, Jiajiang County...