"Lithium Mine War" that China cannot afford to lose

Author:FM95 Zhejiang Economic Broadca Time:2022.09.21

Recently, in the new energy vehicle market, there is a "interesting" phenomenon: new energy vehicles are sold, but vehicle manufacturers shouted that they did not make money and said that the money was sold by the battery; the battery manufacturer also said that they did not make money. It was said that money was made by selling raw materials on the goal; then the manufacturer who sold lithium resources on the game said: The money is indeed earned by us.

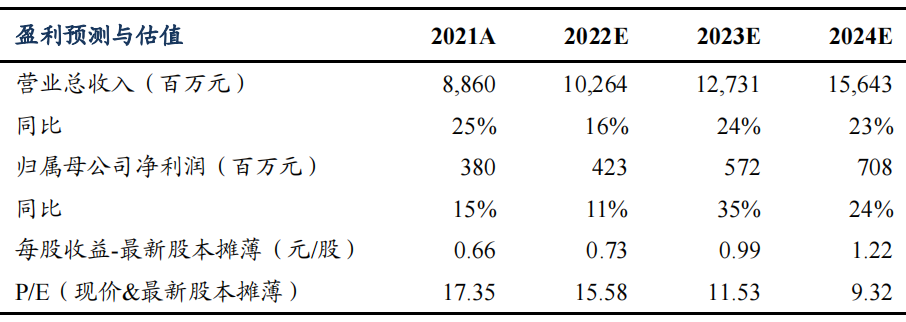

In the first half of 2022, Tianqi Lithium Industry and Ganfeng Lithium Industry Financial Report

Can you make money? In the past year or two, the price of power battery raw materials, the price of battery -grade lithium carbonate, has skyrocketed more than 10 times.

According to the Shanghai Steel ’s joint data, the battery -class lithium carbonate increased by 2500 yuan/ton per ton on September 19, and the average price was reported at 505,000 yuan/ton.

At this price, you have to buy it. Some manufacturers vomit: For example, the shipment is released at 9 o'clock in the morning, and the payment is not available at 3 pm. This batch of goods is not yours.

Today, I will talk to you about the white blood of new energy vehicles -lithium.

What is "lithium", why is it important?

Lithium, a silver -white luster under pure state, soft, is the smallest metal, and the content in the crust is 0.0065%.

Lithium is widely used, known as "industrial MSG". Lithium is now the main raw material for new energy vehicle power batteries.

A new energy vehicle requires about 30 to 60 kg of lithium carbonate or lithium hydroxide. With the sales of new energy vehicles, lithium has changed from the previous "industrial monosodiuman" to Essence

Lithium metal is strong, and generally exists in the form of lithium carbonate and lithium hydroxide. Lithium iron phosphate and ternary batteries equipped with new energy vehicles are lithium ion batteries.

Battery -grade lithium carbonate

There are two main sources of lithium: first, salt lake brine lithium, lithium chemical products from salt lake brine — lithium chemical products -lithium carbonate and lithium chloride; the other is to extract carbonate from ore lithium (spindy pyroxin, lithium cloud mother, etc.) lithium.

Lithium resources distribution: South America Three Kingdoms+Australian Xiao Ao Global

Global lithium resources are mainly distributed in Chile, Argentina, Bolivia, and Australia, China, and China in South America. Among them, Chile, Argentina, and Bolivia are mainly "salt lake lithium" resources, and Australia is mainly based on "savory" resources. Both of China are available, but there are not many countries in reserves.

Latin America is the area with the largest lithium content in the world. The "lithium triangle" in South America spans the border between Argentina, Bolivia, and Chile. It has formed a lithium resource geographical triangle under the salt beach, which has about 58%of the world's lithium resources.

Australian Lithium Mine

Among them, Bolivia has the world's largest lithium reserves, about 21 million tons, accounting for about a quarter of the world's total. The world's largest salt beach, Uyuni Salt, is in Bolivia. But Bolivia's lithium resources have a low degree of development, not as good as Argentina and Chile.

At present, salt lake brine lithium resources account for 61%, ore lithium resources account for 26%, and oil fields and resource recovery account for about 13%. The global proven lithium reserves are equivalent to about 120 million tons of LCE (lithium carbonate equivalent).

In terms of output, Australia Lithium Mine and South American Salt Lake are the main sources of supply of carbon resources in the world. In 2021, Australia accounted for 55%of the global lithium ore production, the world's largest lithium ore supply country, followed by 26%of Chile.

Chile, one of the three major salt lakes in the world

China has 7%of the world's lithium resources, mainly concentrated in Qinghai, Sichuan, Jiangxi and other places. Among them, Qinghai is mainly salt lake lithium ore, and the reserves and output are at the forefront. Sichuan and Jiangxi are dominated by ore. Sichuan's proven lithium ore resources account for 57%of the country, ranking first in the country. In terms of mining, the lithium output of Jiangxi in 2021 was 54,000 tons of LCE (lithium carbonate volume), and Sichuan had only 14,000 tons of LCE. However, the current domestic capacity is insufficient and requires a large number of imported lithium resources.

Qinghai Chaka Salt Lake

in conclusion:

1. The supply of lithium resources is mainly concentrated in Australia, Chile, China, and Argentina, and the production capacity has reached 95%of the world's.

2. Australia and Chile are the main exporters of lithium resources in the world, accounting for 55%and 26%, respectively.

3. China needs a lot of imports of lithium resources.

"Lithium" inadequate: "Achilles" in China's new energy vehicle industry

From January to August this year, my country ’s new energy passenger cars sold 3.262 million units, an increase of 119.7%year-on-year. my country's new energy vehicle industry is the world's leading worldwide, and the importance of my country is self -evident. This has a detailed explanation in the first part of the new energy series.

Article Link: Decisive New Energy: July, my country's new energy vehicles sell for 486,000 vehicles, the biggest winner is it!

New energy vehicles have three core components: motor, electronic control, power battery. Dynamic batteries are extremely important for new energy vehicles. Whether it is lithium iron phosphate or ternary lithium battery, a large amount of lithium lithium carbonate or lithium hydroxide is required as raw materials.

In August 2022, domestic new energy vehicle sales list

With the increase in power battery installed capacity, my country's lithium resources production can no longer meet demand. Each year, a large number of lithium resources are required from Australia, Chile, and Argentina, and the foreign dependence is higher than 70%.

According to customs data, in the first half of 2022, my country imported about 1.166 million tons (142,000 tons of LCE) in China, a year -on -year increase of 13.8%. It is worth noting that in the first quarter of this year, my country ’s lithium concentrate imports were 529,000 tons, of which about 502,000 tons were imported from Australia, accounting for 95%.

In terms of lithium carbonate, in the first half of 2022, my country imported 64,940 tons of lithium carbonate from Chile, and 5604 tons of lithium carbonate from Argentina was imported from Argentina. In the past year or two, the price of lithium carbonate has risen, and the price per ton has exceeded 500,000. Power battery factories and new energy vehicle manufacturers have been injured.

Note: The data in the figure is in the first half of 2022

The domestic energy new energy vehicle market explosion -the demand for power batteries is skyrocket -the demand for lithium carbonate in battery raw materials is skyrocket -the price of lithium carbonate has skyrocketed (40,000 yuan per ton to 500,000 yuan), which is the market logic of the skyrocketing price of lithium carbonate Essence

For example, in the past year, Australia's Pierbara Company auctioned eight lithium concentrates, and the price increased from $ 1250 per ton to $ 6,350, and the price rose 500%. Even so, the spot of lithium carbonate was still difficult beg.

Image source: Yuanchuan Research Institute

On September 20, 2022, Australian Pilbala Mining Company held the sixth time of the Sympathetic Essence Mining in the year, and the offshore price of the final transaction was $ 6988/ton.

The price of lithium carbonate has skyrocketed, but power batteries and new energy vehicles cannot increase their prices, and can only rise the cost of raw materials.

Therefore, the current market status: foreign lithium mine suppliers make money and make money, and domestic upstream companies such as Ganfeng Lithium and Tianqi Lithium Industry have also increased their profits; power battery manufacturers have decreased; new energy vehicle manufacturers shouted not to make money.

Domestic new energy vehicles developed fire and flowers, but the profits were earned by the "mine".

related news

The complaints of new energy vehicle companies are helpless because of the upstream lithium carbonate price increase.

Emotional V Ren Zeping also posted on Weibo: "Global lithium resources are mainly distributed in South America, Australia and other places, which may lead to domestic money and money. deficit."

In 2021, China Iron and Steel Corporation made a total of 110 billion yuan, and Australia's three major iron ore ore ore made 380 billion yuan. This is what Ren Zeping said in the iron ore era.

Therefore, in the era of new energy vehicles, in order not to be stuck, we must ensure the safety of lithium resources.

How to break the game? Find "lithium" worldwide!

How do domestic manufacturers break the situation?

First, find mine in China.

Yichun, Jiangxi, has the world's largest lithium cloud mother mine. In the past two years, giants such as Ningde Times, Guoxuan Hi -Tech, BYD and other giants have successively invested in Yichun. At present, Yichun Lithium Electric Industry Chain has 100 companies above designated size, with a total investment of more than 120 billion yuan. Sichuan Suining is adjacent to important mining areas such as Malcon and undertakes the lithium mine processing industry in western Sichuan. There are leading companies in Tianqi Lithium in the lithium industry. The total investment of more than 60 lithium battery projects in the city is more than 60 billion yuan.

The development plan of lithium battery industry in some cities

Second, overseas buying mine.

Saying upstream and going to overseas acquisition of lithium ore is the "tacit understanding" of domestic manufacturers.

On June 20, 2018, Tianqi Lithium revealed the draft, plans to acquire 23.77%of the equity of SQM company at a price of $ 4.066 billion. SQM has a mining right to SALDEACAMA salt lake. This salt lake is considered to be the world's lowest salt lake in the production of lithium carbonate and lithium hydroxide.

On July 5, 2021, Tianqi Lithium announced that 51%of TLEA registered capital, Australian IGO holds 49%of TLEA registered capital. TLA, a new joint venture co -owned by Tianqi Lithium and IGO, has a 51%equity of Terrison Green Bush Mine Mine, with the highest global hard rocky mines in the world's highest quality, the highest reserves, and the lowest cost. Qi Lithium is a 100%equity of 48,000 tons of battery -grade lithium hydroxide factories in Quenana, Australia.

Green Bush Winji Mine

Quina lithium hydroxide factory

In addition to Tianqi Lithium Industry, Ganfeng Lithium Industry, Ningde Times, Tibet Mount Everest and other Overseas Lithium Mines have been deployed earlier.

In early October 2021, Zijin Mining spent nearly 5 billion yuan to win the new lithium Canadian lithium;

On November 17, 2021, Ganfeng Lithium Industry's lithium industry quoted $ 400 million in the lithium industry, and agreed to pay a US $ 20 million liquidated damage to Ningde Times to get the Canadian millennium lithium industry;

On December 22, 2021, Huayou Cobalt announced that the company plans to acquire the prospect lithium mines located in Zimbabwe through the subsidiary Huayou International Mining for $ 422 million, and the first batch of lithium products have been sold in ships.

On July 11, 2022, Ganfeng Lithium announced that the company's wholly -owned subsidiary Ganfeng International or its wholly -owned subsidiaries intend to acquire 100%of Lithea's shares of Lithea with no more than 6.5 billion yuan. Lithium reserves.

On August 8, 2022, Ganfeng Lithium announced that Shanghai Ganfeng has completed the acquisition of the Bacanora Company. One of the resource projects.

In addition, it is reported that BYD is negotiating for six African lithium mines and has reached the intention of acquisition. According to BYD's internal estimates, among the six lithium mines, the amount of lithium oxide products of 2.5%has reached more than 25 million tons, and the extracted battery -grade lithium carbonate can reach 1 million tons.

Native

Overseas finding mine is a "lithium mine war" that cannot afford to lose and must win. at last

According to the Shanghai Steel ’s joint data, the battery -class lithium carbonate increased by 2500 yuan/ton per ton on September 19, and the average price was reported at 505,000 yuan/ton.

Some securities firms said that the mainstream transaction price of battery-class lithium carbonate was 5.02 million yuan/ton, and there was a market quotation of 530,000 yuan/ton. At present, the market has a heavy rise in the market, and it is strong that the market is strong, and there is still room for upward prices in the market outlook. The lack of supply is difficult to reverse, and it is optimistic about the high -level sustainability of lithium prices throughout the year.

The more rising the price of lithium resources, the more urgent the demand for lithium ore resources at home and abroad.

As for whether there is a risk of overcapacity in the future, most market participants believe that the market space is still very large now, and the iron ore must not be repeated by the same mistakes.

Today, the hard currency attributes of commodities are becoming more and more obvious. We import $ 250 billion in oil, $ 180 billion in iron ore, $ 60 billion in copper mines, $ 50 billion in natural gas, and countless resources. The supply of energy and resources is very important.

In the context of the era of great powers, the conflict of Russia and Ukraine, and the global quantitative easing, the learning of natural gas prices that have caused huge harm to Europe is staged. We must plan ahead to ensure the safety of energy and resources.

Business war, never dinner, gentle and respectful.

come on.

- END -

"Fengkou Research Report · Company" IVD testing laboratory+intensive purchasing in the hospital+self -developed quality spectrum/glycae. This company has accumulated more than 4,000 testing laboratories and extension to join hands with the Chinese Medicine Communist Market.In the end

①Ditid test laboratory+intensive purchasing in the courtyard+self -developed mass...

The risk of a single main business operating, Wolong Real Estate may be cross -border mining 丨 Company

Gao Zhengkun/From BeijingWolong Real Estate's reorganization is constantly advanci...