The central bank has issued 90 billion yuan offshore ticket in Hong Kong during the year

Author:Hubei Daily Time:2022.09.21

The central bank has issued a 90 billion yuan offshore central ticket in Hong Kong during the year to highlight the attraction of RMB assets

Reporter Liu Qi

On September 20, the People's Bank of China (hereinafter referred to as the "central bank") successfully issued a 5 billion yuan 6 -month RMB bill of RMB central bank in Hong Kong, China, with a bid interest rate of 2.2%.

The central bank said that the issuance was widely welcomed by overseas investors, including banks, funds and other institutional investors in many countries and regions such as the United States, Europe, Asia, and international financial organizations. The 4.5 -fold circulation has shown that RMB assets have a strong attraction to overseas investors and also reflect the confidence of global investors in the Chinese economy.

It is worth mentioning that Wang Chunying, deputy director and spokesman of the State Administration of Foreign Exchange, said recently that the cross -border income and expenditure surplus of goods trade in August was US $ 55.2 billion, an increase of 31%over July. At the same time, the net inflow under the direct investment of Lai China increased from July. The continued improvement of overseas investors' investment in domestic bonds and stock markets, highlighting the long -term investment value of my country's market and RMB assets.

Zhou Maohua, a macro researcher at the Everbright Bank Financial Market Department, told a reporter from the Securities Daily that the strong attraction of RMB assets to overseas investors stems from the long -term development prospects of my country's economy. , my country's financial industry has developed rapidly, the market has accelerated maturity, and the financial industry is actively promoted to open to the outside world to facilitate global investors to participate in the domestic capital market. Investor assets, convenient for investor risk management.

According to a reporter from the Securities Daily, since this year, the central bank has issued a total of 90 billion yuan in central bank bills in Hong Kong, China. Among them, the three -month, 6 -month and 1 -year central tickets were 30 billion yuan, 15 billion yuan and 45 billion yuan, respectively.

It is worth noting that the bid interest rate of the 6 -month central bank bills of 5 billion yuan each year has continued to decline. The first two phases were 2.6%and 2.3%, respectively, and the issuance of this month was further dropped to 2.2%.

Zhou Maohua said that the decline in the bid interest rate on the one hand reflects the liquidity of the offshore market, and on the other hand, it is affected by the supply and demand of the offshore central ticket market.

At present, the central bank's normalization of RMB central bank bills in Hong Kong, China, not only enriches the Hong Kong market RMB investment product series and liquidity management tools, but also drives other subjects such as domestic financial institutions and enterprises to issue RMB bonds in the offshore market. In recent years, RMB government bonds, financial bonds and corporate bonds issued in the offshore market have increased, and the increasingly diversified issuance methods and distribution sites have shown that the Hong Kong RMB central bank bill has played a positive role in promoting the development of the offshore RMB market. (Securities Daily)

The Hubei Daily client, paying attention to the major events of Hubei and the world, not only pushing the authoritative policies for users, fresh hot information, and practical convenience information, but also launched a series of features such as reading newspapers, newspapers, learning, online interactives.

- END -

Yonghe Medical: It is expected to have a net profit of about 11 million yuan to 20 million yuan in the first half of 2022

On July 29, 2022, Yonghe Medical (Code: 02279.HK), a listed company of Hong Kong stocks, released the 2022 financial annual report performance preview. As of June 30, 2022, the performance declined sh

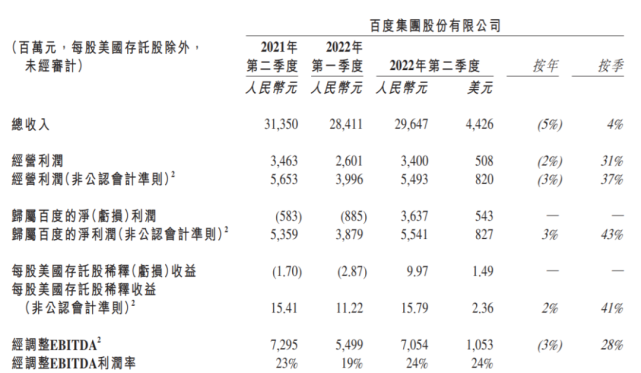

Why is there a clue of China's economic growth in Baidu's financial report?

Wen | Tao WeibinAutonomous driving is very close to us. On September 1st, at the o...