Earlier, "blood transfusion" was drafted, and the stock price increased by 60% of the new Lun New Materials for more than a month.

Author:Daily Economic News Time:2022.06.21

On the evening of June 21, Xinlun New Materials (SZ002341, a stock price of 4.68 yuan, and a market value of 5.392 billion yuan) issued an announcement saying that the company's overdue loan amount is still 1.039 billion yuan.

Xinlun New Materials said that the company will continue to actively communicate with various creditor banks, and strive to actively return overdue loans by increasing the recovery of accounts receivable and asset disposal, and strive to properly solve the problem of overdue debt.

For more than a month, it has benefited from the overall heating of the A -share lithium battery sector. The stock price of Xinlun New Materials has risen from 2.84 yuan/share on April 27 to 4.68 yuan/share at today (June 21). More than 64%.

On May 28, Xinlun New Materials also disclosed a fixed -increase plan to issue shares to the company's chairman Liao Yan and its company (plan to establish) to raise funds, with a maximum limit of about 902 million yuan. Xinlun New Materials said in the announcement at the time that after the implementation of the issuance plan to a specific object, the company's net asset scale will further increase, and the asset -liability ratio will be further reduced. As of the end of 2021, the company's asset -liability ratio was 61.91%.

Newly added over 300 million more than 300 million more than 300 million yuan in two months

This is not the first time that Xinlun New Materials has disclosed the debt overdue. As early as August 12, 2021, Xinlun New Materials issued an announcement saying that the company's loan balance reached 1.052 billion yuan. By January of this year, the company reduced the balance of overdue loan to 741 million yuan through renewal.

However, in April and June of this year, Xinlun New Materials owed Shenzhen High -tech Investment and Financing Guarantee Co., Ltd. and CITIC Bank Co., Ltd.'s two debts in Shenzhen Branch, respectively, with a total amount of 314 million yuan, which also allowed the company's overdue debt to debt The scale returns to the level before the renewal. It can be seen that the company is facing continuous debt pressure.

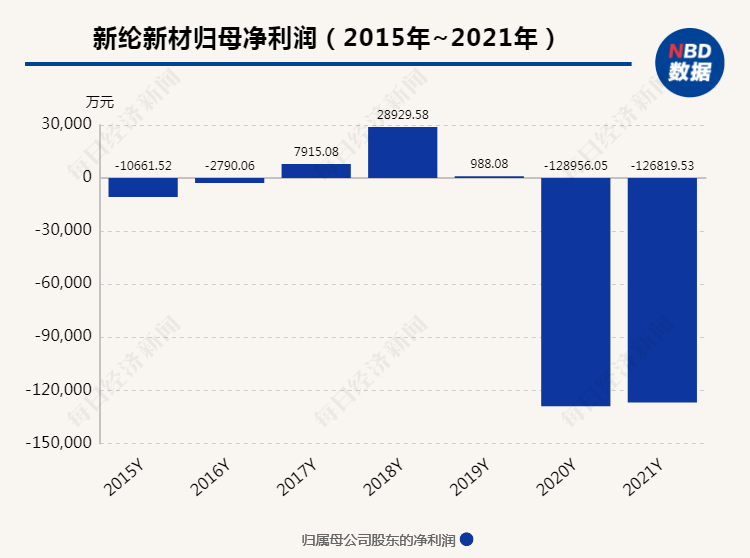

Where does these debts come from? Where did Xinlun New Materials "burn money" before? Mainly radical expansion. In 2015, the company's net profit lost 107 million yuan. Under the pressure of performance, it chose to drive performance by mergers and acquisitions.

For example, in 2017, Xinlun New Materials acquired 100%equity of Ningguo Qianhong Electronics Co., Ltd. (hereinafter referred to as Qianhong Electronics). The transaction consideration was as high as 1.5 billion yuan and the premium amount exceeded 1.2 billion yuan. As of the end of 2018, the company's goodwill book value exceeded 1.74 billion yuan, accounting for 33.87%of net assets.

Originally, Xinlun New Materials wanted to use the above -mentioned acquisition to expand the company's layout in the field of electronic functional materials to develop precision manufacturing business. As a result, Qianhong Electronics was too high to dependence on the two major customers of OPPO and VIVO. In 2017, these two customers contributed more than 60 % of their income. Later, due to the affected by the epidemic and the internal adjustment of the customer, Qianhong Electronics's supply to OPPO and vivo When the share fell sharply, the performance fell straight. In 2020, Xinlun New Materials put forward a goodwill for the goodwill of 620 million yuan.

The above cases are just one of the previous reflection of the new M & A in Xinlun New Materials. In 2020 and 2021, the company provided a total of over 1.07 billion yuan in goodwill impairment preparation.

At the same time, Xinlun New Materials has also fallen into a financial fraud. On April 15, the company disclosed that the former controlling shareholder Hou Yi received the "Criminal Judgment" issued by the Shenzhen Intermediate People's Court of Guangdong Province. Three years, a fine of one million yuan.

Previously, on May 21, 2020, the Securities Regulatory Commission issued the "Administrative Penalty Decision" to Xinlun New Materials, revealing that from 2016 to 2018, Xinlun New Materials increased income and profits through fictional trading business and other behaviors and other behaviors. Essence

The development of new energy business is rapid

At present, Xinlun New Materials, while facing the "messy stalls" left by the previous radical mergers and acquisitions and financial fraud, also has the opportunity to "re -get new life".

In 2021, Xinlun New Materials clarified the strategic development direction of the main business of new materials. During the reporting period, the company's new material sector realized revenue of 795 million yuan, a year -on -year decrease of 19.7%.

According to the statistics of the China Chemical and Physical Power Industry Association, Xinlun New Materials has a market share of 75%in the domestic aluminum plastic film market in 2021.

In addition, Xinlun New Materials may usher in new controlling shareholders and actual controllers. On May 28, Xinlun New Materials issued an announcement that the company intends to issue the company's chairman Liao Yan and the Shenzhen Shangyuan Huizhi Investment Partnership (Limited Partnership) (hereinafter referred to as "Shangyuan Huizhi"). Without more than 346 million shares, the total amount of funds raised was about 902 million yuan.

After the completion of the fixed increase, Shangyuan Huizhi (proposed to be established) will hold 20.07%of Xinlun New Materials, becoming the company's controlling shareholder, Liao Yan control the company's shares of 23.41%, and will become the actual controller of the company.

However, for Xinlun New Materials, the fixed increase has not yet been settled, and the debt pressure faced by the company has also increased day by day. A few days ago, there were new overdue debts. Whether the "mess" can be properly solved, it also affects how far the company can go out in the direction of new materials.

Daily Economic News

- END -

After the 90s returning to the country, the wisdom of Yantai is provided for the dwarfing of the big

Jiaodong Online June 8th News A few days ago, \Taking the world is fresh, love Y...

State -owned Enterprise Reform 丨 China Merchants Group officially converted into a state -owned capital investment company

Recently, the State -owned Assets Supervision and Administration Commission of the...