Xiaomi, who was spit out by the former vice president of Evergrande, had fallen from 36 to HK $ 10?

Author:First financial Time:2022.09.20

20.09.2022

Number of this text: 1813, the reading time is about 3 minutes older

Introduction: The long -term replacement cycle has led to a decline in sales of smartphones.

Author | First Finance Li Yan

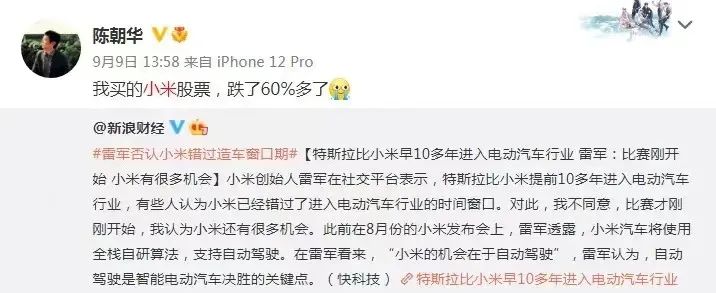

On September 15, former Vice President of Evergrande Chen Chaohua posted on Weibo: "I bought Xiaomi's stock, my finances became increasingly uncomfortable."

The stock price of Xiaomi Group (01810.HK) fell from HK $ 36 to HK $ 10, down more than 70%from the highest point. Smartphone sales were lower than market expectations and fell into a dilemma of negative growth. The stock price is the main reason for Xiaomi's stock price.

Xiaomi Group has repurchased many times, and the founder Lei Jun also invested a lot of resources in innovative businesses such as cars, but the effect is still unsatisfactory. On September 9, Chen Chaohua carried the blog post during Xiaomi missed Xiaomi to miss the window of the car.

However, the First Financial reporter found that the above Weibo has been deleted, and Chen Chaohua released these Weibo use is iPhone12Pro.

Negative growth of mobile phone sales

Smart phones are not as easy to make money as many investors' minds. Xiaomi's gross profit margin has been around 10%, and its average price has always been around 1,000 yuan. It is not easy to expand the product line to high -end. The shrinking demand in the second quarter has further declined Xiaomi's stock price.

When it comes to the sharp decline in Xiaomi's stock price, Lin Jiayi, CEO of Xuanjia Fund, told the First Financial reporter that the global central bank's interest rate hike suppression of science and technology stocks and other asset prices are expected to have two or three sharp interest rate hikes; many events such as international geopolitics also hit market risks In terms of preferences; in terms of Xiaomi itself, the fundamentals and industry competition patterns have deteriorated in the short term, smartphones have declined, driving expected deterioration, but long -term demand can still return to stability.

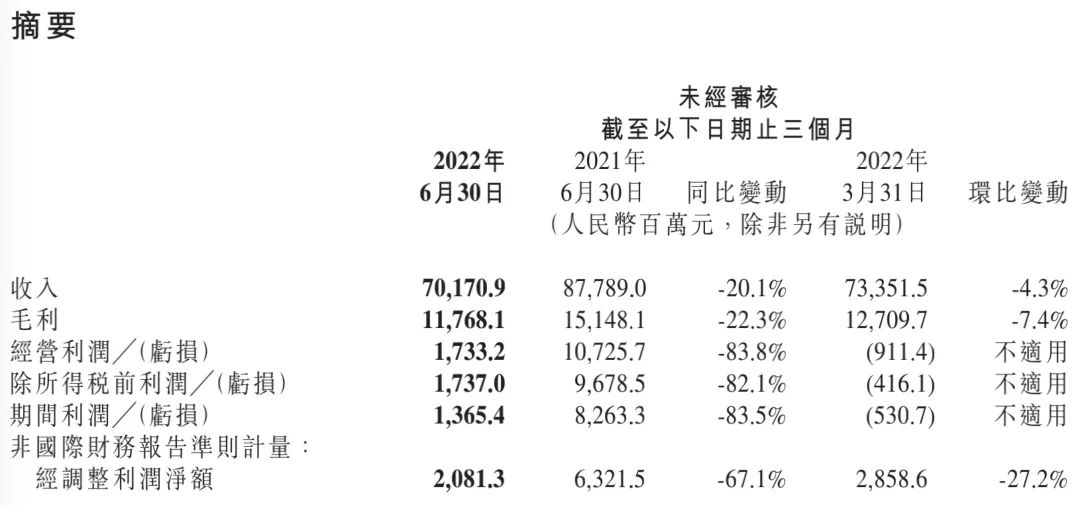

In the second quarter of 2022, the total revenue of Xiaomi Group reached 70.2 billion yuan, a year -on -year decrease of 20.1%. The adjustment of net profit was 2.081 billion yuan, a year -on -year decrease of 67.1%, "the cost of innovative business such as smart electric vehicles was 611 million yuan." In the second quarter of 2022, Xiaomi mobile phone shipments were 39.1 million units, a year -on -year decrease of 26.2%.

Cinda Securities analyst Feng Cuiting said that in the second quarter of 2022, Xiaomi's smartphone business revenue was 42.3 billion yuan, a year -on -year decrease of 28.5%, and a 7.64%month -on -month decrease. In the second quarter of 2022, Xiaomi Group's mobile phone shipments were 39.1 million units, an increase of 1.5%month -on -month. Mainly, Xiaomi has increased optimistic growth in overseas markets such as Latin America and Africa. The main factors affecting the increase in shipments.

The gross profit margin fell from 9.9%in the first quarter of 2022 to 8.7%in the second quarter. Feng Cuiting said that the average mobile phone price of the mobile phone in the second quarter of 2022 was 1082 yuan, a 9%decrease from the previous month, mainly due to the company's active de -inventory increased its promotional efforts, as well as high -end models such as Xiaomi 12S and Xiaomi MIX FOLD 2 due to waiting for chip supply because of waiting chip supply. The release of the third quarter of 2022, the gross profit margin of high -end models is higher, which affects the overall gross profit margin of the mobile phone business.

Many people in the industry believe that the consumer changing cycle has risen from 2 years to 3 years, and the service life has become longer, which also makes it difficult for mobile phone sales to improve.

Regarding the topic of using mobile phones, Chen Chaohua said on Weibo on September 20: "Many of the models I use are second -hand."

Xiaomi "self -rescue": from car building to capital operation

In order to find new growth points, Xiaomi looked at smart cars. At the end of last year, Lei Jun said that it is expected to invest 100 billion R & D costs in the next 5 years.

In the second quarter of data, the ideal car (02015.HK) sold an average loss of 23,000 yuan, Weilai (09866.HK) sold an average loss of more than 100,000 yuan in a car. ) It has always been reserved to enter the automotive industry. What can Lei Jun have improved in the automotive field. In such a fiercely competitive market, will the post -hair Xiaomi Xiaomi be able to build their own advantages?

Cinda Securities said that in the second quarter of 2022, Xiaomi Group's R & D costs were 3.8 billion yuan, an increase of 7.7%month -on -month, mainly due to the increase in innovative businesses such as smart electric vehicles, and set up more than 500 R & D elite teams in the autonomous driving field.

Mu Yiling, an analyst of Minsheng Securities Strategy, said that after the penetration rate of some emerging products reaches a certain degree, the downlook of macro variables has a greater impact on its existing part. Among them, new energy vehicles are used as an example. Car sales are related to macro variables such as residential income. The penetration rate of new energy vehicles has exceeded 20%, and even if the penetration rate continues to increase rapidly, the existing part will be greater due to the influence of economic cycle fluctuations.

In addition to cars, smart homes are also one of the direction of Xiaomi Group. As of June 30, 2022, the number of IoT devices (excluding smartphones, tablets and laptops) that has been connected to the AIOT platform reached 526.9 million, a year -on -year increase of growth 40.7%.

In the second quarter of 2022, "Our IoT and living consumer products revenue was 19.8 billion yuan, an increase of 1.7%from the previous month (a year -on -year decrease of 4.5%). The domestic market includes many categories such as smart household appliances (air conditioners, refrigerators, washing machines) to achieve solid realization Growth. But the overseas market revenue is affected by macroeconomic factors such as global inflation, and non -living essential products such as scooters and scanning robots have fallen year -on -year. "In terms of capital operation, Xiaomi has also repurchased its own stocks. In the first half of the year, Xiaomi repurchased a total of 87.248 million shares B. The total cost was HK $ 1.258 billion, and the average price was approximately HK $ 14.42. At present, Xiaomi's stock price is far lower than Xiaomi's average repurchase price in the first half of the year. In addition, increasing foreign investment is also a means for Xiaomi to seek new growth points.

"As of June 30, 2022, we invested more than 400 companies, with a total book value of 63.4 billion yuan, an increase of 9.6%year -on -year." In the first half of 2022, Xiaomi Group disclosed such information. In the second quarter of 2022, the net income of self -disposal investment was 300 million yuan.

- END -

The financial "pioneer" of the financial support to help the enterprise relieves

The financial pioneer of the financial support to help the enterprise relievesJian...

It is hot, and coal ETF performance is also hot

On July 18, A shares continued to rise in the early morning. In the afternoon, the...