Henan people overthrow the rules of the diamond industry, tens of thousands of diamonds sell cabbage prices?

Author:Financial and economic Time:2022.09.20

Wen | Xiao Tian

1993 was an extraordinary year in the history of Chinese diamonds.

This year, in order to seek to enter the Chinese market, the international diamond giant Dobels found Chinese translation for its classic "A Diamond is Forever" through the Hong Kong Ogilvy Advertising Company. The university teacher's "diamonds are long and long, a forever spread" was successfully selected.

This well -known slogan later became almost the starting point of Chinese diamond culture.

Since then, the Chinese wedding has been completely changed with the traditional customs of wearing gold and emeralds, and it has formed a new concept of "no diamond without marriage".

However, while a diamond ring becomes the most beautiful token of the two people's love, its high price has once become a stumbling block on the road of partners.

In recent years, with the increasing maturity of artificially cultivating the technology of the diamond industry and the birth of diamonds, it seems that the shy men in the pocket have found a good replacement.

In the capital market, on September 24 last year, the power diamond was listed on the GEM of the Shenzhen Stock Exchange, with an increase of 1112.42%on the first day. Soon afterwards, many of the cultivation of diamond concept stocks were sought after.

According to the cultivation diamond index of Oriental Wealth, from October 15 last year to September 7 this year, a cumulative increase of 25.24%. Among them, there was a wave of rose from April 26th to August 18th of this year, and the range increased by nearly 90%. At present, the total market value of 12 listed companies in the sector has reached more than 240 billion yuan.

Judging from the interim reports that cultivate diamond concept stocks this year, the profit of the National Aircraft Seiko (002046.SZ), the Power Diamond (301071.SZ), the Bingbing Red Arrow (000519.SZ), the Yellow River Whirlwind (600172.SH) and other profits Gas increased, and many increased increases exceeding 100%, with high performance. Some institutions even claim that this sector is an electric car three years ago!

So, what is the fiery logic of artificially cultivating diamond tracks? What is the industry pattern of Chinese cultivation of diamonds in the road of cultivating diamonds? Who can become the last "cow ear"?

What are the underlying logic of the sought after diamond?

The cultivation of diamonds is not mysterious. Its birth is to a certain extent the result of the market for smaller thanks.

As we all know, natural diamonds, as the hardest diamonds in the world, are carbon, but because the conditions formed in nature are very harsh, it belongs to "non -renewable resources."

However, like oil and natural gas, although the formation process is relatively long and long, it does not mean that the number of diamonds in natural worlds is scarce. An example is that huge diamond mines were found near the Olanzhi River in South Africa in 1870, and the number of diamonds in the natural world was calculated in tons.

The precious attributes of diamonds in consumer long -term cognition are derived from a considerable part of the natural diamonds that belong to the industrial -grade diamonds, and there are very few diamonds that can achieve jewelry -level diamonds. On the other hand, the scarcity of diamonds is the result of artificial creation.

As early as 1888, several major diamond vendors jointly established Daibels to control the world's largest diamond ore output from the source, and pioneered the trading mechanism of rough diamonds, and gradually grasped the global diamond trade.

Since then, around the eternal emotional value and symbol of loyal love concepts, Daibels has marketing diamond rings into one of the most successful products in the 20th century. Because of the power of the terminal pricing, it has made a lot of money for many years. Full.

How long the market is eager for natural diamonds is to be artificially cultivating diamonds.

Since a Swedish company in 1953 has synthesized diamond micro -crystals in the laboratory, people have never given up the exploration of artificially cultivating diamonds. For many years, artificial diamonds have long been comparable to natural diamonds.

From the perspective of the industrial chain, cultivation diamonds can be divided into upstream rough manufacturing, midstream processing and polishing, and downstream terminal retail, corresponding to China, India and the United States, respectively.

Related data from India show that from January to July this year, India cultivated a total of US $ 1.01 billion in imports, an increase of 64%year -on -year; the export volume of the cultivation of diamonds was 1.01 billion US dollars, an increase of 73%year -on -year. The growth trend of the global cultivation of diamond exit and demand is verified from the side.

But in fact, the cultivation of diamonds has always been in the consumer market, but the current popularity comes from the common role of multiple factors.

First of all, from the perspective of cultivating diamond itself, at the same quality, it has an unparalleled price advantage, and the price is only one -third of the natural diamond.

It is also the weight of one carat. The average price of natural diamonds is about 60,000 to 80,000 yuan. The top diamonds of large brands will even exceed 100,000 yuan. Essence

Taking the largest consumer market in Diamonds as an example, in the context of the global economic situation, many consumers who tighten their pockets are increasingly choosing to cultivate diamonds for marriage.

Secondly, from the perspective of the natural drill industry, with the rise of ESG investment in various industries, the outside world has also put forward higher requirements for the sustainable development of enterprises.

A movie "Blood Diamond" starring Leonardo exposes the inside story of diamond illegal mining, environmental destruction, illegal use of children's workers and gray transactions. Since diamonds are promoted to be related to marriage and love, people have naturally put forward higher moral requirements, and diamonds that symbolize technology and environmental protection have successfully boarded the stage.

Finally, as the Z -generation and millennials became the main consumer army, the rise of self -ism, coupled with a large number of cultivation of diamond brands to promote "diamond freedom", the concept of diamond consumption began to change little by little. According to Bain's consultation data, the proportion of diamonds' "pleasing self -consumption" in China is as high as 46%, exceeding 36%of wedding demand; 29%in the United States, which is also higher than 25%of wedding demand.

In addition to jewelry consumption routes, the cultivation of diamonds is expected to cut into the field of a new generation of semiconductor materials, which is also an important reason for it to be popular with capital.

Who has the "alchemy" to cultivate the diamond?

In 2005, Mao Heguang, a foreign academician of the Chinese Academy of Sciences, took a 2 -carat diamond and handed it to an expert identification with GIA appraisal. The cost of less than $ 5,000 in this cost, experts gave a slight conservative price of $ 200,000.

Compared with natural diamonds, the price is the most obvious advantage of cultivating diamonds, but this small story also eliminates a question in the market: the cultivation of diamonds is essentially the same as natural diamonds, which has such a high valuation.

Natural diamonds are formed by a long high temperature and high pressure in the depths of the carbon monotonous layer, and are brought to the shallow surface by lava activities such as volcanic eruption. Cultivating diamonds is the product of the laboratory and belongs to the artificial diamond.

Although the path formed by the two is different, the cultivation of diamonds is not a diamond imitation product such as Mosang Stone and vermiculite. Its crystal structure, physical, chemistry and optical properties are exactly the same as natural diamonds.

What's more, the price of diamond depends on its size, color, clarity, and cutting, which is often referred to as the "4C standard" in the industry. Artificial cultivation of diamonds also apply this standard.

There is a very vivid metaphor in the industry -the difference between the two is that one is "ice in the refrigerator" and the other is "Antarctic Ice". In other words, cultivating diamonds is "real diamonds".

At present, the laboratory has two most mainstream methods to cultivate diamonds, namely high -temperature and high pressure (HTHP), and chemical gas precipitation method (CVD).

High temperature and high pressure method (HTHP) simulate the formation of natural diamonds. The production time is relatively short and the cost is low, which can reach colorless. However, because the metal powder is added to the production process as a catalyst, it may contain a small amount of impurities;

The chemical gas deposition method (CVD) is injected into the inert gas in the environment. The production cycle is high and the cost of the rough needs to be changed. Most of the clarity is above VS, and it is also more suitable for the cultivation of 5 carats and more than 5 carats.

The preparation of the laboratory diamonds has to be mentioned in Zhengzhou Sancha.

The establishment of this institution in 1958 was originally to solve the problem of Vajrayana in New China ’s homemade industrial diamond. Wang Guangzu, the founder of Chinese artificial diamonds, and the team after three years of research and development, finally successfully cultivated artificial diamond at the end of 1963.

At the same time, in order to completely solve the problem of "stuck neck", the team also developed a forged artificial diamond equipment -six -sided top compressor, which has been increased by nearly 20 times compared to the two -sided top compressor in other countries in the same period. Since then, Drive the rapid increase in the scale of Chinese artificial diamond industry.

Because the trial base in diamonds was located in Zhengzhou, the six -sided top compressor was naturally settled in the Sanmo Research Institute, and Zhengzhou also became the China Super Hard Materials Center. In the process, a large number of talents were cultivated. After he left his office, he started his business and created a number of artificial diamond enterprises in Henan.

From the perspective of the industry, most research institutes, design institutes, and leading enterprises associated with the diamond industry gathered in Henan. At the same time, Henan also has the industry's standardized organization and quality testing center, and the industry ecology is relatively sound.

After the technical entry threshold was overwhelmed, the Central Plains region without natural diamond mines formed the cultivation of the diamond industry cluster.

This can also explain why China has contributed half of the world's cultivation diamond output, and Henan contributes 80%of China's output.

At present, the global cultivation of the diamond market is showing a three -legged situation. In the upper reaches of the industrial chain, China occupies more than 40%of the worldwide cultivation of diamond market share, of which 90%of the HTHP method is occupied; India occupies more than 90%of the market in the middle reaches of rough processing, cutting, polishing, and inlay links; In the link, the United States has become the largest cultivation of the diamond consumer market, accounting for 80%of the global share.

It is worth mentioning that according to the forecast of Zhejiang Business Securities, the demand for rough diamonds in the global cultivation of diamonds from 2022-2025 increased from 14.3 billion yuan to 31.3 billion yuan, with a compound growth rate of 35%. The market was still in short supply in 2025. Under the favorable, many listed companies have also increased their production.

This means that who can seize the opportunity to stand proudly, who can take the lead in a share.

Who can divide the largest cake at the wealth feast of diamonds?

Back to the level of listed companies, for many years, Henan cultivated the diamond industry with a number of companies rising rapidly by Dongfeng, and many leading companies.

China's artificial diamond industry has run out of the "three -driving carriage", namely Zhongbing Red Arrow, Yellow River Whirlwind and Power Diamond. The proportion of CR3 is 86%, and the market share is very concentrated.

From the perspective of financial and economic, the upstream competition in my country ’s cultivation of diamonds is also like the photovoltaic industry of that year. Heavy asset attributes have superimposed diamond quality requirements.

Specifically, the Bingjia Red Arrow, a listed company starting from the inside, acquired Central South Diamonds under the Chinese weapon in 2013, becoming an absolute leader in the cultivation of diamond concept stocks. Zhongnan diamonds have always produced super -hard materials, and diamond single crystals and production equipment for cultivating diamonds are interconnected. Therefore, Zhongnan diamonds have also stepped into the field of cultivation diamonds. Vajrayana and the development of diamonds.

As mentioned earlier, it is also limited to cultivate diamonds in HTHP method. A large barrier of Chinese companies is to break through the Great carat technically.

In recent years, Central and South Diamonds has also continued to break through the CVD method. At present, it has mastered the synthesis technology of "20-50 carat cultivation of diamond single crystal".

According to the financial report, in 2021, Diamond Revenue and net profit of China South China were 2.41 billion yuan /+ 25.2%, 657 million yuan /+ 60.2%, and the net profit margin in 211 was 27.3%/+6.0pct. In the first half of this year, Central and South Diamonds achieved operating income of 1.604 billion yuan, and its net profit reached 680 million yuan.

However, a fact that cannot be ignored, Zhongnan Diamond's parent company also has a military business business to deploy military -civilian dual -use industries. From the perspective of investment, although Central and South Diamonds is a good target, it is also easily affected by the multi -main gross profit margin of the Chinese soldier Red Arrow.

Secondly, the Yellow River whirlwind, as a veteran who started to cultivate diamonds in 2002, has a technical precipitation of nearly 20 years. At present, 5-6 carat cultivation has been achieved by 5-6 carats. High-end quality products accounted for relatively high, about 50%.

However, in recent years, the diversified failure of the Yellow River whirlwind. In the context of cultivating diamonds and industrial diamond high prosperity, it is one of the few companies in the industry. Now trying to return to the main business of super hard materials, it still takes time to slowly heal injuries. Essence

Compared with the Bingbing Red Arrow and Yellow River whirlwind, the power diamonds listed last year seemed to be a dark horse that cultivated diamonds.

As an industry recruit, for more than two decades, the power diamond has always focused on the research and development and production of artificial diamond products. Through independently develops the five core support technologies of artificial diamond production, it has formed a relatively complete core technology system.

It is particularly worth mentioning that in the industry, there are "people who have the world", "those who have high performance machines can get the world", and the power diamond is closely related to Zhengzhou Sanmo. The courtyard, the latter preferred to ensure the supply of high -type press.

One detail is that from 2019 to 2020, the number of presses signed a contract with the company and Sanmo Institute is 136 units. According to the National Aircraft Seiko Announce The relationship is unusual.

Obviously, with the continuous advancement of artificially cultivating diamond technology, the beautiful dreams and value systems weaving the diamond mining merchants and retailers over the years will not be broken. At that time, more and high -quality value targets will also be. Approved by the capital market.

- END -

Innovation refers to the reddish daily limit, TOPCON batteries, energy storage and other concepts have risen sharply.

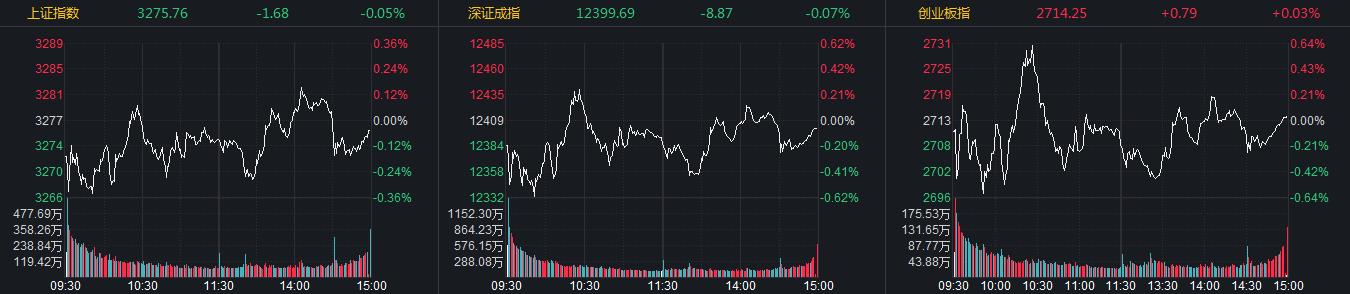

Zhongxin Jingwei, July 27th. On the 27th, the three major A -share stock indexes o...

In the first August, Guangdong's local foreign currency loan balance increased by 11.3%year -on -year. Shenzhen's first batch of policy development financial instruments landed.

【Market News】The Ministry of Finance successfully issued 3 billion yuan in Treasury bonds in AustraliaOn September 7, the Ministry of Finance successfully issued 3 billion yuan in Treasury bonds in...