Hong Kong stocks were wealthy, and another "Super Demon Stock" was born, soaring 17 times a day!

Author:Jiang Dongwen Time:2022.06.21

The summer solstice is here, as the saying goes: the winter solstice dumplings summer solstice ...

Today's A shares seem to be on the roller coaster, wandering back and forth between the morning and falling, and diving collectively in the afternoon. In short, the overall performance is plain, and the market stocks have fallen more.

Although A shares lack passion, Hong Kong stocks next door are full of passion today!

The Hang Seng Index of the Hong Kong stocks rose by nearly 2%, the Hang Seng Technology Index rose by more than 2%, and the Nikkei 225 increased by more than 1%... But the biggest thing of Hong Kong stocks today was a fairy stock that once skyrocketed!

One game and a dream, today Hong Kong stocks have made us dream again.

Today, Hong Kong's South -South resources rose more than 1700%, which was much fierce than New Oriental, and how much wealth it created! New Oriental is 7 times a week, and now it is 17 times a day. They are all myths for making wealth in Hong Kong stocks.

I have to say that the Midsummer Hong Kong stocks are too "hot"!

one

Recently, with the "bilingual live broadcast and cargo", the new Oriental online stock price of the new Oriental online stocks listed on Hong Kong stocks has skyrocketed. On the 5th, the stock price has risen by up to 6 times. With the popularity of live broadcast and soaring stock price, New Oriental has repeatedly boarded the boarding ones many times. Hot search!

However, New Oriental's online stock price rose 6 times 6 times that it could not meet the "stomach" of Hong Kong stock investors, and it was their ultimate pursuit to create ten times a day.

On June 21, another summer solstice, the new "Super Demon Stock" also arrived as scheduled! As well as

Hong Kong stocks South South Resources Industrial Co., Ltd. (South South Resources, 01229.HK) once rose by over 1700%today, and dive near the end of the end. HK $ 570 million.

It is worth noting that the market value of South -South resources was only 57 million Hong Kong dollars yesterday. Today's opening price is HK $ 0.102. HK $ 100 million.

The transaction volume on a trading day on South -South resources is still "zero". Today, it sold 441 million Hong Kong dollars, with a turnover rate of over 83%. In other words, some people earn 16 times a day, and some people lose 50%a day.

New Oriental's online skyrocketing 1,000%used more than a dozen trading days. Today, the South -South resource plate of Hong Kong stocks rose by more than 1700%. It took only one day to surpass New Oriental. It was really shocking!

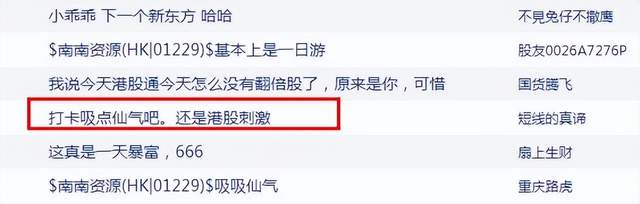

In this regard, stock friends were also rising.

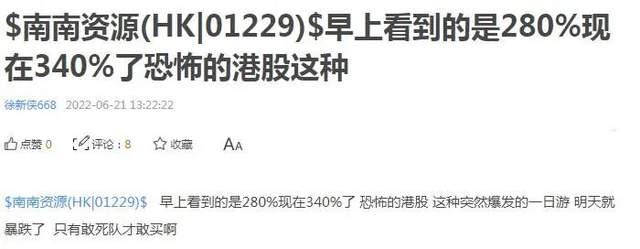

Some friends said, "It means that the leek of Hong Kong stocks is already poor", "280%of the time I saw in the morning is now 340%of the horrible Hong Kong stocks. Buy. "

You know, it is not uncommon for Hong Kong stocks to rise by more than 10 times as much as New Oriental online for a period of time, but stocks that have risen by more than 10 times in a single day are rare.

On the news, South -South resources are expected to turn losses in the year, and the net profit attributable to shareholders of listed companies is HK $ 66 million. The company's industries are coal and consumer fuels. In addition, there is no benefit.

So, what happened behind South -South resources?

two

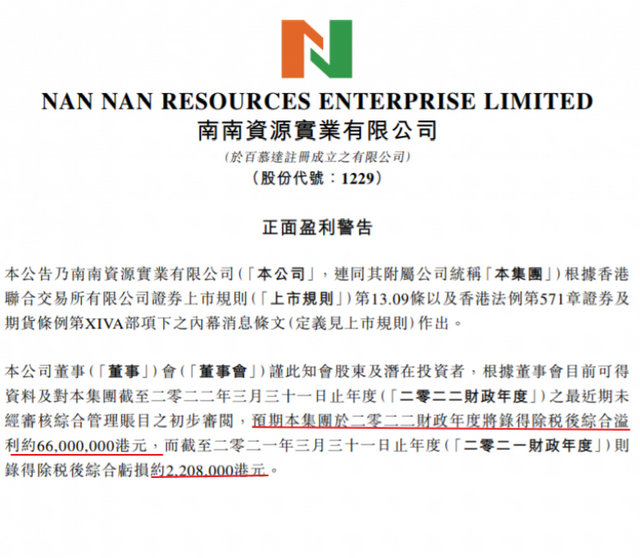

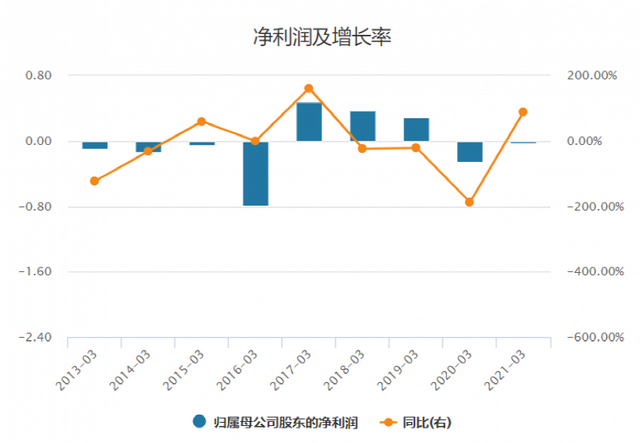

Nannan Resources announced on June 20 that the company is expected to turn a loss to HK $ 66 million by the fiscal year of 2022 (April 1, 2021 to March 31, 2022), and the comprehensive loss after tax removal in 2021 will occur in 2021 About 2208,000 Hong Kong dollars;

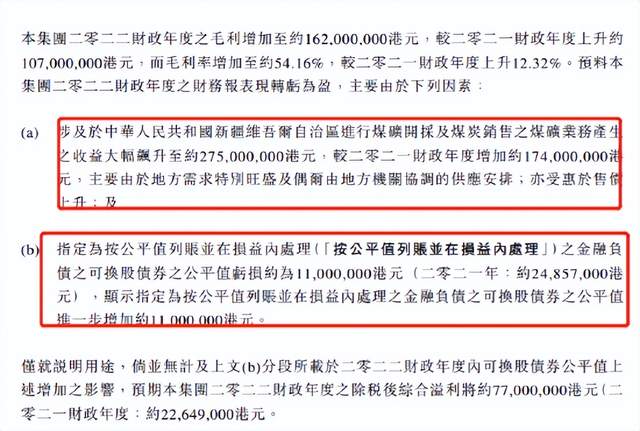

Gross profit increased to HK $ 162 million, an increase of about 107 million Hong Kong dollars from the 2021 fiscal year; the gross profit margin increased to 54.16%, an increase of 12.32%from the 2021 fiscal year.

The company stated in the announcement that there are two main factors in the profit of turning losses:

First, the demand for coal is strong and prices have risen. The significant surge in coal business revenue has brought about HK $ 275 million in sales revenue, which is significantly increased from 174 million years before the previous fiscal year.

Second, the accounting profit and loss treatment involving convertible bonds brings about 11 million Hong Kong dollars.

To be honest, this performance is found in A shares, but it has been fried in Hong Kong stocks. It is based on it is a coal stock. Coal is now making money, and its performance turned to profit. It should also rise.

Moreover, with the market value of HK $ 1 billion and a net profit of 066 million, the static price -earnings ratio of South -South resources was 15.2 times. From this dimension alone, the stock price of South -South resource seems to have a 10 -fold confidence.

Looking at the coal sector of Hong Kong stocks, since 2020, the rise has continued for two years and has increased by more than two times.

For example, the stock price of South South Resources came out of the 6 -linage of the annual line from 2016 to 2021. The stock price of South -South resources has risen this time, which can be regarded as a "replenishment" to a certain extent.

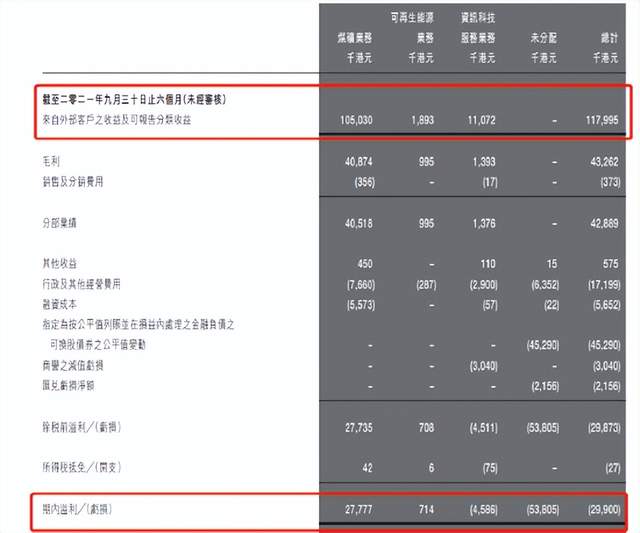

According to the medium -term financial report, the company's business income is mainly concentrated in the mining and sales of coal mines, with medium -term revenue of HK $ 105 million, accounting for 89%of the company's total revenue. Coal mining services have achieved a period of HK $ 27.77 million. At HK $ 4.56 million, the Group's overall loss was HK $ 29.9 million, while the net loss of the ownership company was HK $ 29.64 million.

Why did the company's sudden performance improved so much?

Three

Public information shows that South -South resources are a coal resource mining merchant. The company is mainly engaged in the exploration and mining of coal resources and the processing and sales of products. The business also involves mergers and acquisitions of resources.

The subsidiaries of the company include BenQ Kaiyuan Investment Co., Ltd., Mu Bao County Kaiyuan Coal Co., Ltd. and Qitai County Zexu Trading Co., Ltd.. Wooden Kaiyuan holds Kaiyuan open -air coal mine, mainly engaged in coal mines mining, sales and distribution business; Zexu's business holding Zexu open -air coal mine exploration certificate.

In recent years, the company has expanded overseas through mergers and acquisitions:

The first is the acquisition of new energy leasing technology companies in Malaysia in 2018 to expand its business on solar energy.

Although strongly expanded the new business business outside the main business, from the perspective of the performance composition last year, South -South resources are still a typical resource company:

The company's revenue in 2021 was HK $ 130 million, and the coal business revenue accounted for 100 million. About 1.44 million tons of coal sold in fiscal year in 2021, an increase of about 40 % from 1.04 million tons in 2020.

After the company's losses for two consecutive years, the company finally relying on the inflation macro environment to achieve "lying and winning", but with the rapid development of new energy, this may become its final dividend period. The probability is that the funds are made to earn all their benefits in one step.

From the fundamental point of view of the coal industry, global coal supply lacks elasticity, the supply and demand pattern is tight, and the output of major international coal production in China has declined sharply, and imports cannot make up for the gap.

At present, the domestic coal production capacity has entered a contraction period, and coal production capacity has accelerated with the exit of coal production capacity under "carbon neutralization". The price of power coal in my country has risen since the epidemic situation, and it is still in the high fall range.

Unrestrained

If the price of coal prices rises and the supply and demand is tightly balanced, the company's fundamentals are flocked, and there are fewer flow stocks, it is another major factor in pushing the stock price to increase the stock price.

According to Sina Hong Kong shares, the company's actual controller Feng Wanzhang holds 570 million shares and holds 74.51%of the shares. In addition, the second largest shareholder LEV Leviev holds 85.81 million shares, holding 11.21%of the shares. The company's shares are very concentrated. The market circulation is only about 110 million shares, and the company's stock price is extremely low. The small amount of funds can explode the stock price. This is also the reasons for the company's stock price to be speculated by the funds of the company.

From the perspective of the company's business alone, there is no such great excitement. It is a kind of irrational hype that can largely rise to a large amount of funds. It is a silly game. Message to make a short -term hype.

And the company's nearly 500 million shares can be said to be very crazy!

The stock price fell all the way after seeing the high in 2015. As of the rise before the rise, the stock price was less than 1 cents. This stock is called a fairy stock in Hong Kong stocks, and the market value of the stock Hong Kong dollars, the popularity is very poor, the main funds can use a small amount of funds to attract the follow -up. The risks faced by such stocks are often large. After a sharp rise, the stock price inflation will plummet. Today, the shareholding rate of the stock exceeds more than more 80%.

The market will inevitably fluctuate, and it will inevitably have style switching, hot spots, facing short -term rise and falling, maintaining rationality, controlling positions, investing in your own ability circle, and continuous learning to expand your ability circle Essence

Don't forget, risks are rising!

In the stock market, we must first ensure the security of funds and earn reasonable profits under the premise of security.

In short, if people drink water, it is the best for people to know about it.

Reference materials:

"The day burst 17 times, South -South Resources (01229) super roller coaster, is it difficult for retail investors? ", Zhitong Finance

"After a day of rising 17 times a day, diving! Netizens exclaimed: The retail investors who rushed in were all set in this life ", China Fund Newspaper

"Crazy, it has risen 16 times a day! Instantly became 1.7 million, shareholders: I think of "Big Times"! ", Sina Hong Kong stock

- END -

How does finance support the construction of water conservancy infrastructure?Joint deployment of the People's Bank of China and the Ministry of Water Resources

According to the official website of the People's Bank of China, the People's Bank...

[News release] The digital economy becomes "hot words"!Strive to strive to account for more than 50%of the GDP of Harbin New District by 2025

The reporter learned from the press conference of Harbin City's Promoting the Four...