Western test test solid controller invested in the empty glove white wolf creditors accurately receiving or floating profit nearly 10 million yuan

Author:Jin Ziyan Time:2022.06.21

"Golden Syllabus" Southern Capital Center Drinkness/Author Mu Lingying Wei/Risk Control

In the past 2021, Xi'an High -tech Zone has promoted the listing scene of "fast entry" in the market, and 8 listed companies have been added. In 2022, Xi'an Western Testing Technology Co., Ltd. (hereinafter referred to as "Western Test Test"), as a member of the queue and listing, has been approved for the first time on April 12th. remote".

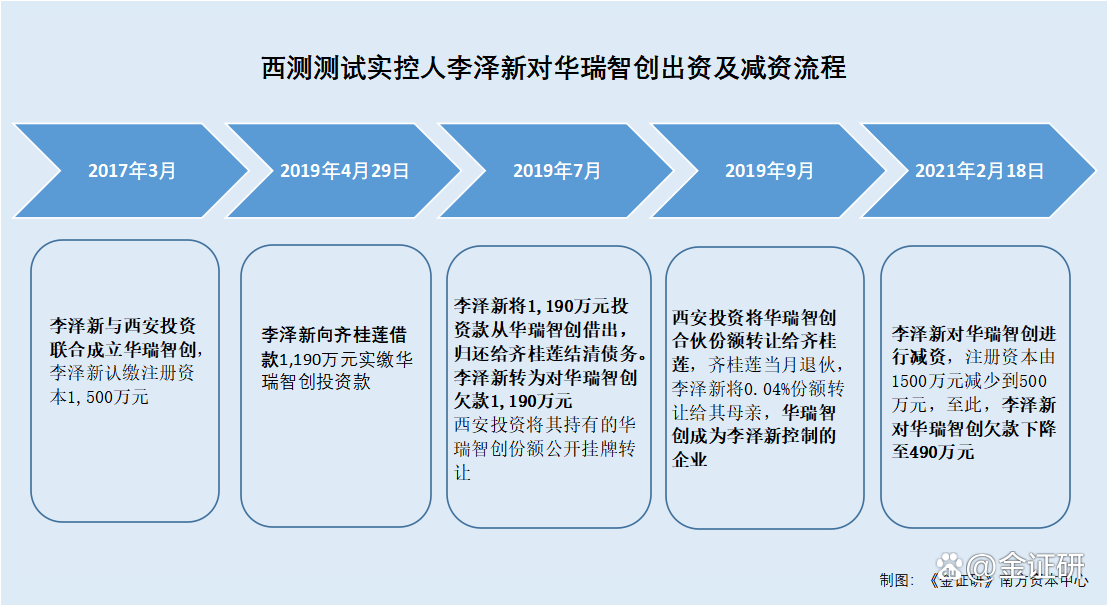

Behind the listing, Li Zexin, who is the actual controller of the Western Test, has a "experience" of capital contribution. In March 2017, Li Zexin joined forces Xi'an Investment Holding Co., Ltd. (hereinafter referred to as "Xi'an Investment") to jointly set up Xi'an Huarui Zhichuang Consulting Management Partnership (Limited Partnership) (hereinafter referred to as "Huari Zhichuang"), and subscribed to the registration Capital is 15 million yuan. Until April 2019, Li Zexin borrowed from Qi Guilian to invest in Hua Ruizhi, and then returned the borrowing road to Qi Guilian in less than three months. That is, as a funder of Huarezhi, Li Zexin borrowed and borrowed the operation through the aforementioned borrowing to turn his contribution obligation to Huari Zhichuang into his debt to Huari Zhichuang. Not only that, Li Zexin then reduced his debt to Huari Zhichuang through the method of reducing capital.

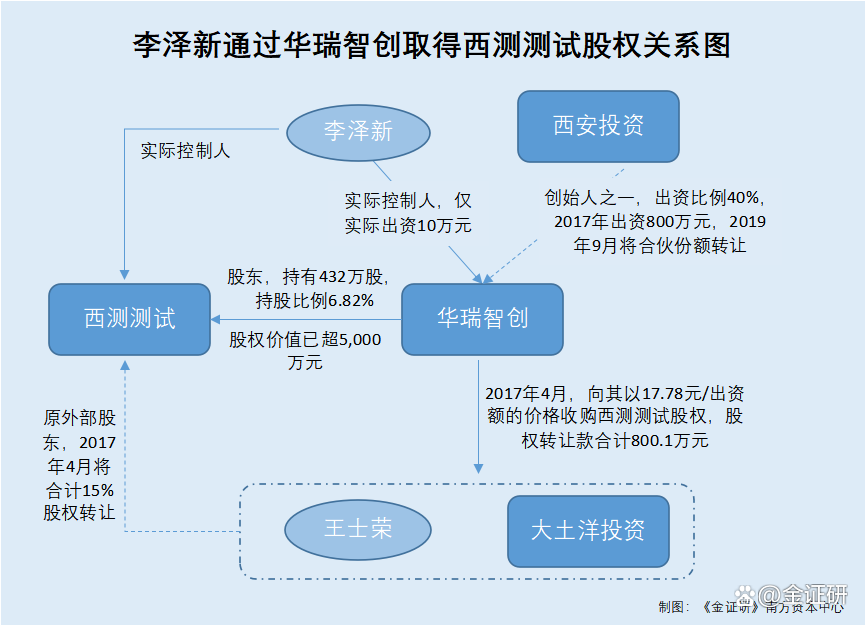

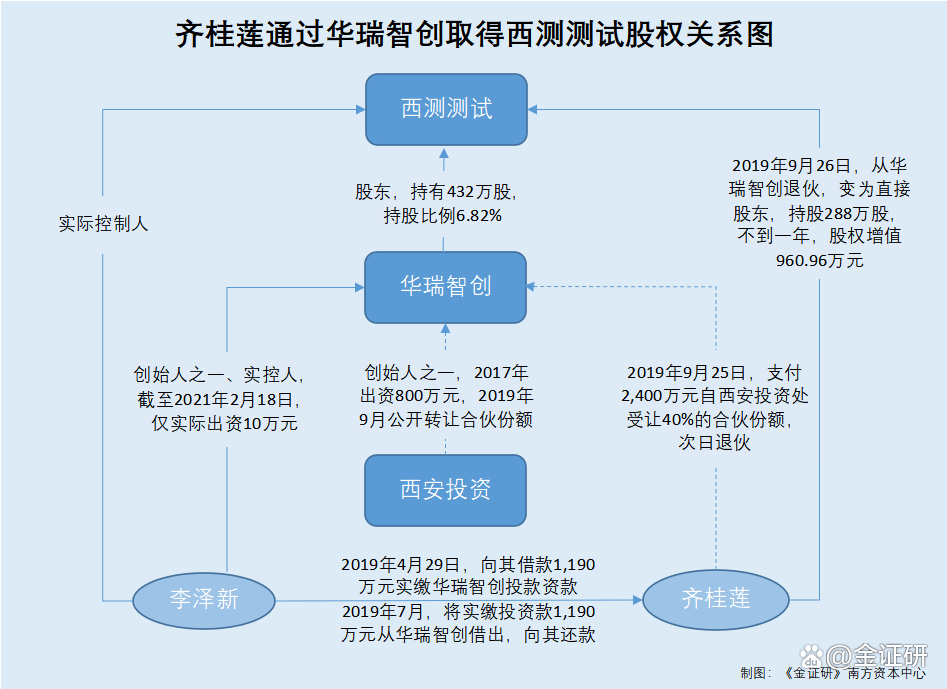

Behind the above -mentioned disguised "escape capital", Hua Ruizhi was actually established by Li Zexin to repurchase the equity of Western Test Testing held by external shareholders. The operation of the western test is obtained indirectly if the script is not produced. In addition, in the case of or known the West test testing plan, Xi'an invested in "exiting" Huarui Zhichuang to transfer its equity through the open platform, and the receiver was Li Zexin's original debtors Qi Guilian. Less than a year after Qi Guilian's shares held, the equity of Western Test Test or Approval of nearly 10 million yuan. Is the equity transfer price involved in the above process that is not fair? To be considered.

1. The actual controller has evolved the "escape" of the shareholders Hua Ruizhi, and the original road is returned with less than 3 months.

When it is true, it is true and false, and there is nothing or not. Investment is a basic obligation for shareholders, and it is also the prerequisite for shareholders to enjoy shareholders' rights and liability for limited liability. Among them, in the process of contributing, false investment and escape capital are often considered to infringe the interests of other shareholders, enterprises and creditors.

This aspect is back to the beginning of the Western Testing test, Li Zexin, the actual controller of the Western Test Test, had falsely contributed it.

1.1 At the establishment of 2010, four shareholders such as Li Zexin had false investments "black history"

According to the prospectus on May 11, 2022 (hereinafter referred to as the "prospectus"), as of the date of signing the prospectus, on May 11, 2022, Li Zexin directly held 54.98%of the Western test test and passed Xi'an Huarui. Zhi testing enterprise consulting and management partnership (limited partnership) indirect control of Western test test 9.48%of the shares, passing Huarui Zhichuang's indirect control of Western testing 6.82%of the shares, Li Zexin directly controlled the total of 71.28%of the shares of the Western test test passed and indirectly controlled the Western test test 71.28%of the shares. , For the controlling shareholder and actual controller of Western Test Test.

According to the prospectus, Xi'an Western Testing Electronic Technology Service Co., Ltd. (hereinafter referred to as "Western Test Electronics") was established on June 1, 2010, with a registered capital of 3 million yuan. Among them It accounts for 40%of the registered capital; Li Zexin contributed 900,000 yuan for monetary funds, accounting for 30%of the registered capital; Sun Lihua contributed 450,000 yuan for monetary funds, accounting for 15%of the registered capital; 15%of capital.

On May 20, 2010, Xi'an Jindu United Accounting Firm reviewed the situation of shareholders' capital contribution during the establishment of Western Testing Electronics, and issued the "Xi Jinzi (2010) No. 05/276" "Capital Examination Report". On May 20, 2010, Western Test Electronics (raised) has received a total of 3 million yuan in registered capital paid by all shareholders with monetary funds.

After verification, when Western Testing Electronics was established, due to the irregular inspection of capital, four shareholders including Li Zexin actually did not form contributions to the establishment of Western Testing Electronics; After the transferee Xu Caiying, the relevant funding funds were all Li Zexin made up for money funds from June to December 2015. The accountant of Tianjian Accounting Firm (Special Ordinary Partnership) conducted a capital verification of the above -mentioned supplementary funds and issued the "Tianjian Examination [2021] 272" "Inspection Report". As of December 2, 2015, Western Test Electronics has received it. Li Ze's newly paid solid capital was 3 million yuan.

The above situation or explanation, when the Electronics on the west side was established, four shareholders, including Li Zexin, had false funds.

In addition, Li Zexin's capital contributing to Hua Ruizhi's capital, maybe to avoid the situation of "evasion".

1.2 Hua Ruizhi is an enterprise controlled by the actual controller.

According to the first public offering of stocks on the Western Test on November 15, 2021, and the response to the inquiry letter of the application document on the GEM (hereinafter referred to as the "first round of inquiry letters"), in February 2017, Li Zexin With Xi'an Investment, the "Xi'an Huarui Zhichuang Consultation Management Partnership (Limited Partnership) Partnership Agreement" was signed with Xi'an Investment to conduct the registered funds, partners, contributions and capital contribution methods, and the rights and obligations of partnerships, etc. Promise. On March 7, 2017, the Hua Ruizhi Economic Economic and Commercial Department was approved to be established. The partners and contributions at the time of establishment were Li Zexin's subscription of 15 million yuan, 60%of the capital contribution; , 40%of the capital contribution. At that time, Hua Ruizhi's registered capital total was 25 million yuan.

1.3 Li Zexin contributed 11.9 million yuan to Hua Ruizhi with borrowing.

However, Li Zexin did not pay the fund after the establishment of Hua Ruizhi. Two years after the establishment of Huarui Zhichuang, in April 2019, Li Zexin borrowed from others to invest in Hua Ruizhi.

According to the first round of inquiry letters, in the issue of the "funding of funds", the Western test disclosed the specific details of the single payment amount of the actual controller Li Zexin's personal bank account exceeded 500,000 yuan.

Among them, on April 29, 2019, Li Zexin paid 11.9 million yuan to Hua Ruizhichuang Bank's account, which was used to pay Huari Zhichuang's investment funds. At less than March, from July 17, 2019 to July 25, 2019, Li Zexin transferred 8 to Qi Guilian's bank account for a total of 11.9 million yuan. 11.9 million yuan, now settled.

At the same time, the Western Test test stated that during the reporting period, Hua Ruizhi did not actively operate, and there was no large cash withdrawal situation. A total of 1 large payment of large amounts greater than 100,000 yuan was a total of 11.9 million yuan provided by Li Zexin. The money is Li Zexin's investment funds in place.

It can be seen that when the Western test test was established in 2017, Li Zexin subscribed for 15 million yuan in capital. On April 29, 2019, Li Zexin borrowed 11.9 million yuan from Qi Guilian to pay his investment in Huari Zhichuang. In less than March, in July 2019, Li Zexin borrowed 11.9 million yuan in investment funds from Hua Ruizhi, and "the original" returned to Qi Guilian to settle the debt without interest. The so -called real -time payment, or just put the borrowed money for less than three months in Huarui Zhichuang's bank account.

After this operation, Li Zexin's obligation to contribute 11.9 million yuan in Huarui Zhichuang became his debt to Huari Zhichuang.

It is worth noting that the above behavior is suspected of "escape", and its compliance has been inquired by the regulatory level.

1.4 Li Zexin's above -mentioned behavior compliance was questioned, and the "Dipping Eye Eye" replied to deny the funds to escape

According to the "reply to the first round of public offering of stocks and the second round of review of the application documents on the GEM list" (hereinafter referred to as the "second round of inquiry letter reply"), the Shenzhen Stock Exchange requested the Western Test Test instruction After Hua Ruizhi paid the capital, he also borrowed 11.9 million yuan from Hua Ruizhi to return to Qi Guilian's borrowing compliance.

In this regard, the Western test quoted a number of regulations to explain that the borrowing between Li Zexin and Hua Ruizhi belongs to Li Zexin's personal loan. Li Zexin's borrowing from Hua Ruizhi does not constitute a funds.

Among them, the Western Test Test quoted the "Answer to whether the borrowing of shareholders' lending of shareholders" (abolition on July 14, 2014), "the company's borrowing to shareholders is It is reflected that the relationship between shareholders and the company belongs to borrowing relationships, and legal loan relationships are protected by law. The company enjoys corresponding claims for legal borrowed funds in accordance with the law. Therefore, the Western Test test stated that without sufficient evidence, it was determined that the shareholders were identified as shareholders to escape from the company with a loan of shareholders.

At the same time, the Western Test Test quoted the Supreme Court's "Regulations on the Application of the According to this, the Western Test test states that Li Zexin borrowed from Huarui Zhichuang to repay personal debt, and the relationship between the debt and debt really existed, which did not affect the survival and continuous operation of Huarui Zhichuang; The creditor's losses caused no loss, and the above behavior of Huarui Zhichuang, his partners, and creditors that harmed Huarui Zhichuang's rights to request the court to determine the evasion of the capital. The real debt and debt relationship referred to the Western test, which is the debt relationship of Li Zexin's borrowing from Hua Ruizhi to repay the personal debt because of the payment of investment funds from Qi Guilian. A scene of return. If this type of claims and debt relationships can be avoided by the court as escaped by the court, does it mean that "the company can pay the fund through borrowing, and then borrow the company's registered capital for repayment"? And Li Zexin's borrowing to pay for Hua Ruizhi to pay less than three months and return the contribution to the capital, in fact, Huarui Zhichuang's "real -time capital" is well -known. In addition, the Western Test Test quoted the "Notice of the Supreme Procuratorate and the Ministry of Public Security on strictly handling the registered capital and false investments in accordance with the law" stipulates that "from March 1, 2014, in addition to the implementation of registered capital payment system in accordance with the law Outside of the company, the units and individuals registered by the company shall not be held criminally responsible for the crime of registered capital; the company's shareholders and initiator shall not be investigated for criminal responsibility for false funds and evasion of capital. " Based on this provision, the Western Test Test stated that Hua Ruizhi who does not belong to the provisions of the regulations should implement a registered capital payment system. Therefore, Li Zexin's borrowing to repay personal debt will not cause criminal responsibility for evading capital to escape from the current valid laws and regulations. However, the above -mentioned regulations only stipulate that the criminal responsibility shall not be investigated for the crime of fake capital contribution or escaped, and whether it can be held accountable for civil liability. The Western test test has not been explained. At the same time, Hua Ruizhi is not a company that needs to implement a registered capital system in accordance with the law. So why did Li Zexin suddenly borrow his money from others after the establishment of Hua Ruizhi? unknown. In the end, the Western Test test stated that Huarui Zhichuang was a limited partnership, and Li Zexin was an ordinary partner and assumed unlimited liability for the debt of the partnership. As far as a limited partnership was concerned, in accordance with Article 17 of the "Partnership Law", The partners shall fulfill their investment obligations in accordance with the investment method, amount and payment period agreed in the partnership agreement. However, the "Partnership Enterprise Law" does not have the rules for escape. At the same time, the Western Testing Test quoted Article 159 of the Criminal Law stipulated that "the initiator of the company and the shareholders' violation of the company law have not been delivered to the company's law, the real object or the property right is not transferred. Escaping its capital, with huge amounts, serious consequences, or other serious circumstances, with different degrees of punishment. " According to this regulation, the Western Test "Dipping Eye" type claims that the scope of applications for escape funds is limited to "companies" and its shareholders or initiatives, and they are not suitable for partnerships and their partners. In summary, the Western Test Test replied that after Li Zexin contributed to Hua Ruizhi, he also borrowed 11.9 million yuan from Hua Ruizhi to borrow from Qi Guilian. , Law and compliance. 1.5 After the obligation to contribute to the debt, the capital reduction is reduced, and Li Zexin's arrears of Huarui Zhichuang's arrears decreased by 7 million yuan After the ingenious avoidance of "escaped capital" borrowed the payment fund to repay the payment, then, Li Zexin reduced the capital of Hua Ruizhi, which reduced Li Zexin's arrears from Huari Zhichuang from 11.9 million yuan to to 11.9 million yuan to 4.9 million yuan. According to the first round of inquiry letters, Hua Ruizhi was established from March 2017 to September 2019. Its capital contribution structure is 60%of Li Zexin's investment ratio and 40%of Xi'an investment capital. In July 2019, Xi'an Investment will be transferred to the Western Property Exchange for 40%of Huarui Zhichuang's 40%partnership. In September 2019, Xi'an Investment transferred 40%of Hua Ruizhi's 40%partnership share to the natural person Qi Guilian through the Western Property Exchange. Qi Guilian obtained Huarui Zhichuang's partnership share in the month, and then retired. The "story" of Qi Guilian, the new partner Qi Guilian, will be introduced in detail later, and now "eyes" will be put back on Li Zexin. After the new partner Qi Guilian retired, Hua Ruizhi had only a new partner of Li Ze. According to Article 61 of the "Partnership Enterprise Law", the limited partnership is established by two or less partners; however, except for the law, there are other provisions of the law. Or in order to meet the requirements of the number of limited partnerships, according to the first round of inquiry letter, on the day of the new partner's withdrawal, that is, September 25, 2019, Li Zexin will hold the 0.04%capital contribution that he holds ( A total of 10,000 yuan) was transferred to Xu Caiying, and the transfer price was 1 yuan/contribution. After the above -mentioned retreat and partnership share transfer was completed, Hua Ruizhi registered capital became 15 million yuan. Since then, Li Zexin subscribed for 14.99 million yuan in capital, with a capital contribution of 99.93%. According to the prospectus, Xu Caiying is Li Zexin's mother. At this point, through the transfer of the above -mentioned series of partnerships, Hua Ruizhi became a limited partnership of the two -person partnership actually controlled by Li Zexin. Under Hua Ruizhi's above -mentioned funding structure, Li Zexin decided on some matters that all partners agreed. Hua Ruizhi's control has been held in the hands of Li Ze. Then, in February 2021, Hua Ruizhi reduced capital for the first time. Through this capital reduction, Hua Ruizhi became a practical enterprise. At that time, Li Zexin's arrears against Huaruizhi also fell to 4.9 million yuan. According to the first round of inquiry letters, on February 18, 2021, with the unanimous consent of all partners of Hua Ruizhi, Hua Ruizhong's registered capital was reduced from 15 million yuan to 5 million yuan. Among them, Xu Caiying reduced the capital contribution of 06,500 yuan, and Li Zexin reduced the capital contribution of 9.9935 million yuan. According to the second round of inquiry letters, on February 18, 2021, Hua Ruizhong's registered capital was reduced from 15 million yuan to 5 million yuan. As Hua Ruizhi paid 12 million yuan in capital, Li Zexin and it should be refunded and it should be returned. His mother Xu Caiying was 7 million yuan. After the refund amount was offset with Li Zexin's owe Huarui Zhichuang's loan, Li Zexin still owed Huarui Zhichuang 4.9 million yuan to be repaid. It can be seen that as of the second round of inquiry letter replies, on January 6, 2022, Li Zexin still owed Huarui Zhichuang 4.9 million yuan. As a result, as of the first round of inquiry letter replies, on November 15, 2021, Li Zexin still owed Huarui Zhichuang 4.9 million yuan. According to the prospectus, as of the date of signing the prospectus, on May 11, 2022, Li Zexin held 99.93%of Hua Ruizhi, and Xu Caiying held 0.07%of Hua Ruizhi. Under the current funding structure of Hua Ruizhi, when will Li Zexin finally repay his arrears of 4.9 million yuan in Huari Zhichuang? It is not known yet. Based on the above situation, when the Western test test was initially participated in the establishment of the Western test, Li Zexin, the actual controller of the Western test test, had falsely contributed. Not only that, in March 2017, Li Zexin cooperated with Xi'an to invest in Huarui Zhichuang to subscribe to 15 million yuan in registered capital. Two years after Hua Ruizhi was established, on April 29, 2019, Li Zexin borrowed 11.9 million yuan from Qi Guilian to pay the investment funds of Huari Zhichuang. In less than March, Li Zexin borrowed the "all" investment funds of 11.9 million yuan to Hua Ruizhi and returned to Qi Guilian to settle in debt. Moreover, the above -mentioned compliance was inquired by the regulatory level, and the Western test staged a reply to the "Dipping Eye". In the end, the Western Test test stated that Huarui Zhichuang was a limited partnership, and the "escape capital" determined by the regulations was only applicable to "companies" and its shareholders or initiatives, and they were not applicable to partnerships and their partners. However, it should be noted that through the aforementioned series of "operations", Li Zexin transformed his contribution obligation to Huari Zhichuang 11.9 million yuan into his arrears with Huari Zhichuang, and Hua Ruizhi has passed a series of partnerships through a series of partnerships After the person's change eventually became Li Zexin's own company alone, on February 18, 2021, Li Zexin reduced the capital of Hua Ruizhi, reducing Hua Ruizhong's registered capital from 15 million yuan to 5 million yuan. The above situation made Li Zexin not only form a real payment of Huari Zhichuang, but also his arrears of Huari Zhichuang also dropped from 11.9 million yuan to 4.9 million yuan. At this point, did Li Zexin's actual capital contribution to Huarui Zhichuang "escaped" in disguise? Second, the actual controller or "empty glove white wolf" obtains the equity, "with small bloggance" 100,000 yuan to change 10 million yuan Kiki Kezheng, Zhizhang Zhiwei. By understanding the historical revolution of Huarui Zhichuang, in addition to Li Zexin's investment in Huaruizhi, Hua Ruizhi's establishment itself is also worth investigating. Before that, it was clear that in June 2015, the Western Test was introduced for the first time, and then 15%of the Western Test Test was held for the repurchase of external shareholders. Huarui Zhichuang. 2.1 In June 2015, Western Test Test first introduced external shareholders Da Tuyang Investment and Wang Shirong According to the aforementioned mention, at the beginning of the establishment of the Western Test in 2010, the registered capital was 3 million yuan, and the equity structure was Bo Zhan Li's capital of 1.2 million yuan, accounting for 40%of the registered capital; 30%; Sun Lihua's amount of 450,000 yuan, accounting for 15%of the registered capital; Lu Jianrong's contribution of 450,000 yuan, accounting for 15%of the registered capital. According to the first round of inquiry letter, from July 2011 to March 2015, the Western Test was transferred four equity transfer. Specifically, in July 2011, the Western Test was transferred for the first equity transfer. In November 2011, the Western Test was transferred for the second equity transfer, and Sun Lihua transferred the 450,000 yuan capital contribution to Li Zexin. In March 2012, the Western Test was transferred for the third time. In March 2015, the Western Test was transferred for the fourth equity. Lu Jianrong transferred the 450,000 yuan capital contribution to Li Zexin. According to the calculation of the Southern Capital Center of "Jin Securities", as of March 2015, in the equity structure of the Western test test, Li Zexin's capital contribution was 2.04 million yuan, and the shareholding ratio was 68%; 32%. It should be pointed out that according to the prospectus, in July 2011, after the first equity transfer of the Western test, the Western Test Test equity held by Xu Caiying was held for Li Zexin. In other words, as of March 2015, Li Zexin has actually held all the equity of Western test test. According to the first round of inquiry letters and the prospectus, in June 2015, the Western Test conducted the fifth equity transfer and introduced external shareholders. Xu Caiying transferred him to Li Zexin's 405,000 yuan capital contribution to Beijing Daguyang Investment Management Center (limited partnership) (hereinafter referred to as "Da Tuyang Investment") and transferred 45,000 yuan to Wang Shirong. At that time, Xu Caiying transferred a total of 15%of the shares of the Western test. 2.2 In order to repurchase the shareholders of external shareholders, Li Zexin "draws" Xi'an Investment to establish Huarui Zhichuang In less than two years of holding, in April 2017, Da Tuyang Investment and Wang Shirong transferred the equity of Western Test Testing for Western Testing. In order to repurchase this part of the equity, Li Zexin Investment established Huari Zhichuang. According to the first round of inquiry letters, the "Historical Revolution" section, the Shenzhen Stock Exchange requested the basic situation of the Western Testing to supplement the Basic Investment, actual controllers, equity structure, and the acquisition of Western testing equity in the acquisition of Western test testing equity. The reasons and pricing fairly withdrawn the following year. In this regard, the Western Test Test replied that on June 9, 2015, Xu Caiying signed an equity transfer agreement with Da Tuyang and Wang Shirong, respectively. The amount of 10,000 yuan contribution was transferred to Wang Shirong, and the transfer price was 7.78 yuan/contribution. At the same time, the Western Test Test stated that Da Tuyang Investment and Wang Shirong invested in the Western Testing Electronics Department to be optimistic about its future development, and there are expectations for listing the New Third Board. Because the Western Test did not launch the New Third Board listing plan, on March 29, 2017, the Great Earthwriting Investment, Wang Shirong and Hua Ruizhi signed an equity transfer agreement, and transferred the Western Testing electronic equity to Hua Ruizhi. The transfer price is negotiated by all parties to 17.78 yuan/contribution, and the price is fair. According to the first round of inquiry letter, in April 2017, the Western Test was transferred for the sixth equity transfer. Transfer to Hua Ruizhi. It should be pointed out that Hua Ruizhi was established in order to undertake the equity transferred by external shareholders. According to the second round of inquiry letters, when explaining that Xi'an Investment and Li Zexin jointly established the background of Hua Ruizhi's withdrawal, the Western Testing Test stated that the Xi'an Investment Department comprehensive investment enterprise was optimistic about the inspection and testing industry where the Western test test was located. Together with Li Zexin and Li Zexin and passed Hua Ruizhi into the Western Test of Western Test. In March 2017, Xi'an Investment, Li Zexin and Western Testing stipulated that Xi'an Investment and Li Zexin jointly invested in the establishment of Huarui Zhichuang to acquire the equity of Western Test Testing held by external shareholders. Xi'an Investment is a limited partner. On March 7, 2017, the Hua Ruizhi Economic Economic and Commercial Department was approved to be established. The partners and contributions at the time of establishment were Li Zexin's subscription of 15 million yuan, 60%of the capital contribution; , 40%of the capital contribution. At that time, Hua Ruizhi's registered capital total was 25 million yuan. According to the public information of the Market Supervision and Administration Bureau, as of May 11, 2022, Xi'an Investment Equity structure was 100%of the Xi'an Finance Bureau. As of May 11, 2022, Xi'an Investment did not have a record of changes in shareholders. In other words, in April 2017, the only external shareholder Da Tuyang Investment and Wang Shirong at the time of the Western Test at the time were withdrawn because the Western Test did not start the New Third Board listing plan. At the same time, Huarui Zhichuang, which was jointly invested by Li Zexin and Xi'an Investment, acquired the equity of Western Testing and Western Test Testing held by Da Tuyang Investment and Wang Shirong. In the end, Hua Ruizhi acquired a total of 15%of the equity of Great Turkic Investment and Western Test held by Da Turbuya Investment and Wang Shirong at the price of 17.78 yuan/contribution. According to the investigation of the capital capital when Hua Ruizhi was established, after Hua Ruizhi undertake the equity of Western Testing and Western Test Test held by Wang Shirong, Li Zexin passed Huari Zhichuang's indirectly holding 9%equity of Western Test Test, Xi'an Xi'an, Xi'an, Xi'an, Xi'an, Xi'an, Xi'an, Xi'an. Investment through Huarui Zhichuang's indirectly holding 6%equity of Western Test Test. It is worth mentioning that the above -mentioned equity transfer price is fair or unable to withstand. 2.3 Hua Ruizhong's receipts allowed external shareholders to equity in just 7 months, the price of the Western test test may rise to nearly six times According to the first round of inquiry letter, the Western Testing test said when disclosed its confirmation of the fair value of the shares payment, and in 2018, the fair value of the Western Test Test confirmation of the equity instrument of the share payment rights and interests was based on external investors in November and April 2019 The capital increase price of the Western test is 106.67 yuan/contribution. According to the first round of inquiry letters, from Hua Ruizhuan's equity in April 2017 to the period of capital increase of external investors in November 2017, only one equity transfer occurred in the Western test, that is, in July 2017, Xu Caiying held it on behalf of him to hold it on his behalf The amount of capital contribution of 510,000 yuan was transferred to Li Zexin without increasing or reducing capital. During this period, the registered capital of the Western test did not change. That is to say, in November 2017, the capital increase of foreign investors tested from Western testing was 106.67 yuan/capital contribution. In April 2017, Da Turkic Investment, Wang Shirong at the price of 17.78 yuan/contribution, to China, to China, to China Rui Zhichun transferred a total of 15%of the equity of Western Test. It can be seen that in November 2017, after 7 months after the obtained equity of Western testing from Huarui Zhichuang and the registered capital of Western testing, the investment price of the Western test test increased by 599.94%. The Western Testing test states that the transfer price of Da Tuyang Investment and Wang Shirong to Hua Ruizhi is fair and difficult to be convincing. 2.4 Huarui Zhichuang's equity transfer is invested from Xi'an. It is also worth noting that, in combination with the aforementioned, the next month of Hua Ruizhi acquired Western test equity held by external shareholders. In the case of Li Zexin only borrowed from Huarui Zhichuang Investment on April 29, 2019, Hua Ruizhi was transferred to the transferor Da Tuyang Investment and Wang Shirong's equity transfer model, or all from Hua Ruizhi Chuang another other. Shareholder Xi'an Investment. It can be seen from the aforementioned that before the transfer of equity to Hua Ruizhi to Hua Ruizhi, Da Rong and Wang Shirong held a total of 450,000 yuan in Western testing. Based on the price of 17.78 yuan/contribution, it can be seen that the total transfer price of equity transfer is 8001,000. Yuan. That is, in April 2017, Hua Ruizhi should pay a total of 801,000 yuan in equity transfer to Da Tuyang Investment and Wang Shirong. According to the study of the Southern Capital Center of the "Jin Securities", the above -mentioned equity transfer funds may be invested from Xi'an. According to Xi'an Investment's 2017 Audit Report, Xi'an Investment lists Huarui Zhichuang's investment as "the end -of -the -end period of cost can be sold for the sale of financial assets." In 2017, at the end of the period, the amount of financial assets was available for sale of financial assets at the end of the period, and the amount of the book balance of Xi'an Investment's investment in Huari Zhichuang was 0 yuan at the beginning of the year, an increase of 8 million yuan in this period, and the end of the period was 8 million yuan. At the same time, according to the 2018 audit report of Xi'an Investment, in 2018, at the end of the period, the book balance of Xi'an Investment was 8 million yuan at the end of the account balance of the financial assets at the end of the cost. According to the 2019 report of Xi'an Investment, in 2019, Xi'an Investment's investment in Huari Zhichuang has changed. At the end of the period, the amount of financial assets was measured at the end of the period. At the end of the year last year, the amount was 8 million yuan, a decrease of 8 million yuan in this period, and the final amount was 0 yuan. Then Xi'an Investment reported in 2019 to disclose the changes in the investment in Huarui Zhichuang, which is consistent with the situation of the transfer of Huarui Zhichuang's partnership with the shareholding of the Hualui Zhichuang in September 2019 to the natural person Qi Guilian. It can be seen that in 2017, Xi'an Investment invested 8 million yuan to Huarui Zhichun, and the amount of "just happened" and the transfer price of Hua Ruizhi's acquisition of external shareholders in 2017 was almost consistent. Since then, Xi'an's investment has not increased investment to Huari Zhichuang until it transferred Huarui Zhichuang's equity in September 2019. Considering that Li Zexin borrowed 11.9 million yuan from Qi Guilian's investment in Qi Guilian at the end of April 2019, and borrowed this pen to return to Qi Guilian in July 2019. Based on this situation, Hua Ruizhi established the equity transfer model required for 15%of the equity of Western Test Testing Testing Test the following month, or all from the 2017 Investment in Xi'an Investment to Huari Zhichuang. Under the above -mentioned visions, in March 2017, Li Zexin "attracted" Xi'an Investment to establish Huarui Zhichuang. Is it intention to repurchase the equity of Western Test Testing held by foreign shareholders in Xi'an? If so, Li Zexin then may "have not been released" at that time. 2.5 Li Zexin's actual capital contribution to Hua Ruizhi is only 100,000 yuan, and the equity obtained may have exceeded 50 million yuan According to the previous article, on April 29, 2019, Li Zexin borrowed 11.9 million yuan from Qi Guilian to pay 11.9 million yuan from Huaruizhi Zhichuang. In July 2019, Li Zexin borrowed 11.9 million yuan from Hua Ruizhi to return the loan from Qi Guilian. Based on the situation of the above "borrowing funds and returning", Li Zexin or only put Qi Guilian's funds in Hua Ruizhi's bank account less than March to return it. Its debt to Huarui Zhichuang, this process, Li Zexin or "has not been issued." According to the second round of inquiry letters, on February 18, 2021, with the unanimous consent of all partners of Hua Ruizhi, Hua Ruizhong's registered capital was reduced from 15 million yuan to 5 million yuan. Among them, Hua Ruizhi paid 12 million yuan in capital. It can be seen that as of February 18, 2021, Li Zexin also actually contributed 100,000 yuan to pay 100,000 yuan in addition to paying 10.9 million yuan from Qi Guilian. Compared with 100,000 yuan, Li Zexin's equity value of Western test test held by Huarui Zhichuang may exceed 50 million yuan. According to the prospectus, on July 22, 2020, the Western test was held for the first interim shareholders meeting in 2020, and the proposal of the registered capital increased from 60 million yuan to 63.3 million yuan. The new registered capital of 3.3 million yuan was subscribed for 38.5 million yuan in monetary capital of the Star Entrepreneurship Investment Partnership (Limited Partnership) (hereinafter referred to as "Smart Selection Venture Capital"), and the premium part was included in the capital reserve. On September 15, 2020, after the completion of the capital increase, in the Western Testing Testing equity structure, Huari Zhichuang held 4.32 million shares, with a shareholding ratio of 6.82%. That is, on September 15, 2020, according to the income price of 11.67 yuan/share at that time, the Western Test of Western Test held by Hua Ruizhi was worth 4.0414 million yuan. Moreover, after the capital increase in September 2020, as of May 11, 2022, the western test and testing of the equity structure of the Western test has not changed. It can be seen from the above situation that in March 2017, 15%of the Western Test Test held in order to repurchase foreign shareholders withdrawing from the exit of external shareholders, or to acquire equity in order to use the funds invested by Xi'an, Li Zexin, the actual controller of the Western Testing Test, and the establishment of Xi'an Investment. Huarui Zhichuang. When acquiring the equity, Hua Ruizhi needs to pay an equity transfer of 801,000 yuan to foreign shareholders. Hua Ruizhi indirectly holds 9%of the equity of the Western Test. After several changes in Western test testing and Huarui Zhichuang's equity, as of February 18, 2021, Li Zexin's investment funds actually paid from Hua Ruizhi may only be 100,000 yuan. In accordance with the latest capital increase of the Western test test, that is, on September 15, 2020, the price of an external shareholder's share price was 11.67 yuan/share, and Li Zexin passed the Western Testing equity held by Hua Ruizhi or has been worth 5,0414,400 yuan. Third, the actual controller's original debtor Qi Guilian "precise reception", less than one year's equity appreciation of nearly 10 million yuan In the Go, each chess piece is equal, but when does a pawn appear and where the position appears, the value is never the same. The change of equity changes to the west side test and the background of the shareholder, there is a "receiving party" named Qi Guilian, which is quite clever. Zhichuang Investment, this appearance is the new partner of Hua Ruizhi, a shareholder of Western Test Test. 3.1 Xi'an Investment Public Transfer of Huarui Zhichuang Partners As mentioned earlier, in March 2017, 15%of the Western Test Test held by external shareholders, Li Zexin jointly invested in Xi'an Investment to establish Huarui Zhichuang. When Hua Ruizhi was established, Li Zexin held a 60%partnership share and Xi'an investment held 40%of the partnership. The following month, after Hua Ruizhi acquired the equity of the Western Test of the Western Test held by external shareholders, Li Zexin indirectly held a 9%equity of Western Test Test through Hua Ruizhi, and Xi'an Investment passed the indirectly holding 6%equity of the Western Test Test. Since then, Hua Ruizhi has not changed its funding structure. Until July 2019, Xi'an's investment intention to withdraw, 40%of Hua Ruizhi's 40%partnership shares held through the Western Property Exchange were publicly listed. The final partnership was assignee, and Qi Guilian, a "old acquaintance" who had provided borrowings to Li Zexin for his payment of Huarui Zhichuang investment funds. According to the first round of inquiry letters, in July 2019, Xi'an Investment will be transferred publicly on the Western Property Exchange for 40%of Hua Ruizhi's 40%partnership. In September 2019, Xi'an Investment signed a contract with Qi Guilian's right to produce (stock) rights transaction contracts, and agreed to refer to the "Asset Evaluation Report Book" issued by Shaanxi Zhisheng Asset Asset Evaluation Co., Ltd. in June 2019 with April 30, 2019 as the benchmark date. "(Shaanxi Zhi Review Report (2019) No. 078) The evaluation value of Huarui Zhichuang Pure Assets, Xi'an Investment transferred the 40%property share of Huarui Zhichuang to Qi Guilian at a price of 24 million yuan. On September 19, 2019, with the unanimous consent of all partners of Hua Ruizhi, Xi'an Investment transferred 40%of Hua Ruizhi's 40%property share to Qi Guilian. On September 25, 2019, Qi Guilian paid a partnership property share transfer consideration at one time through the Western Property Exchange. Regarding the transfer of Huarui Zhichuang's partnership share this time, the reasons why the Western test equity is not held indirectly, the Western Test Test in the second round of inquiry letter said that it is due to the investment income of Xi'an Investment as a financial investor as a financial investor. It has reached expectations and therefore decided to withdraw. After the completion of the partnership share transfer, Hua Ruizhi's investment structure, Li Zexin subscribed for 15 million yuan, 60%of the capital contribution; Qi Guilian subscribed for 10 million yuan in capital, 40%of the contribution ratio. It is worth mentioning that on the payment of the price date, Qi Guilian signed a retirement agreement and became a direct shareholder of the Western test. 3.2 In order to avoid Qi Guilian's payment on the same day, Qi Guilian retired, and became a direct shareholder of the Western test test. According to the first round of inquiry letters, on September 25, 2019, with the unanimous consent of all partners of Hua Ruizhi, Li Zexin transferred the 0.04%contribution share he held to Xu Caiying, and the transfer price was 1 yuan/ The amount of contributions agreed that Qi Guilian voluntarily retired, and refunded the property share, including Western Testing Electronics, which was held by Hua Ruizhi, in Hua Ruizhi. On September 26, 2019, Li Zexin, Qi Guilian, and Xu Caiying of Hua Ruizhong signed the "Xi'an Huarui Zhichuang Consultation Management Partnership (Limited Partnership) Retirement Agreement". After the transfer of the retreat and partnership share, Qi Guilian no longer holds Huari Zhichuang's property share, but directly holds the capital contribution of 2.88 million yuan in Western test (accounting for 4.8%of the registered capital of 60 million yuan). Qi Guilian was asked by the Shenzhen Stock Exchange. According to the first round of inquiry letters, the Shenzhen Stock Exchange requested the Western Testing to supplement the background of the natural person Qi Guilian's investigation of the Western Test. In September 2019, he retired from Huarui Zhichuang and adjusted to the rationality of directly holding the Western testing shares. In this regard, the Western Test Test response said that as an individual investor, Qi Guilian was optimistic about the development prospects of the Western test testing and testing business. Indirect shareholders, who retired from Huarui Zhichuang and obtained its original shareholders of Western Test Testing Stocks that had passed Huari Zhichuang indirectly held. At the same time, the Western Test Test stated that Hua Ruizhi created as a company controlled by Li Zexin, and the Western Test Test shares held by the Western Test Testing shares must be locked for 36 months from the date of listing. There is no connection between the controller, directors, supervisors, and senior managers. In order to avoid the above -mentioned shares lock -up period, Huarui Zhichuang retired from Hua Ruizhi. Direct shareholders. 3.3 Investment in Xi'an may have known the Western Test Test Listing Plan, but withdraw from Huarui Zhichuang halfway In fact, Xi'an Investment may have known the West test test plan. According to the first round of inquiry letters, the Shenzhen Stock Exchange had requested the Western Testing to supplement the instructions with the Fengnian Junyue Investment Partnership (Limited Partnership) (hereinafter referred to as "Fengnian Junyue"), and Chengdu Sichuan Chuangjun Junjun Biography The background arranged by the special agreement between the military equity investment fund partnership (hereinafter referred to as the "Feng Nian Jun") is arranged. The specific content has been completely lifted; whether there are other gambling agreements in the Western test. In this regard, the Western Test Test response said that in September 2017, Fengnian Junyue and Feng Nianjun biography totaled a total of 562,500 yuan for the Western test test for 60 million yuan; Ningbo Meishan Bonded Port District, Feng Nianjun and Investment Partnership (hereinafter referred to as "Feng Nian Jun and") under the same actual controller (hereinafter referred to as "Feng Nian Jun and") with a registered capital of RMB 187,500 in Western Test, The capital increase agreement signed between shareholders and their supplementary agreements involve relevant provisions that have a gambling nature and special rights agreed in shareholders. The main terms include the "performance compensation" clause and the "exit arrangement" clause. The relevant parties of the two clauses include Fengnian Junyue/Feng Nian Jun Biography/Feng Nianjun and Li Zexin/Huarui Zhichuang. Among them, in terms of performance compensation clauses, Li Zexin and Hua Ruizhi promised the operating performance of the Western Test 2017-2019. The "exit arrangement" clause stipulates that the following situations appear: Western test testing will not be submitted to the listing and listing materials before December 31, 2019 and is accepted or not completed before December 31, 2020; Western test testing is completed; Western test testing Li Zexin and Hua Ruizhuan have a substantial disorder caused by listing and have not been rectified, resulting in the Western test testing that cannot be submitted to the issuance of listing and listing materials as scheduled, and is accepted or unable to complete the listing as scheduled; Rui Zhichun purchases all or part of the Western test shares it holds. The transfer price is calculated at the higher net assets per share of net assets per share at the end of last month at the end of the month at the end of the month. That is to say, in September 2017 and April 2019, Li Zexin and Hua Ruizhi have signed a gambling agreement with the external shareholders of the Western test, and the Western Test test failed to be listed on the agreement as a trigger an external outside. Shareholders demanded that Li Zexin and Huarui Zhichuang repurchased the conditions for Western testing and testing equity. In other words, as early as 2017, foreign shareholders were introduced, and Western Test Test had signed a gambling agreement with external shareholders. It was planned to submit the issuance of listing materials before December 31, 2019, and the relevant parties include Hua Ruizhi. In this case, Xi'an Investment, who was a partner of Huaruizhi at that time, or had long known that the West testing plan was listed. Then, Xi'an Investment has known the listing plan of the West test test, but only about 3 months of signing a gambling agreement with Huarui Zhichuang and external shareholders, that is, the share of Huarui Zhichuang's partnership shares held in September 2019 will be held. Is it reasonable? What's more noteworthy is that after Qi Guilian obtained the partnership of Huarui Zhichuang, which has obtained Xi'an's investment transfer, "transforming" is less than a year after the "transformation" is the Western test direct shareholder. More than 10 million yuan. 3.4 After the investment of Xi'an's investment, Qi Guilian "accurate receipt" or benefits nearly 10 million yuan After Xi'an Investment withdrew from Hua Ruizhi, Qi Guilian directly held the equity of Western testing as a "pick -up party". According to the prospectus, as of May 11, 2022, Hua Ruizhi was not engaged in other businesses. That is, Xi'an Investment Transfer Huarui Zhichuang's partnership share, which is essentially transferred to the equity of Xi'an Investment's Western Test Test held by Huarezhi. In addition, after Qi Guilian retired from Hua Ruizhi, he no longer holds the share of Huari Zhichuang's property and became a direct holding of 2.88 million yuan in Western testing. Since then, Qi Guilian has not invested additional investment in the Western test test. According to the prospectus, on September 26, 2019, Qi Guilian retired from Huarui Zhichuang. According to the retirement agreement, Hua Ruizhi allocated 2.88 million yuan in the holding of Western testing to Qi Guilian. On the same day, the Western Test and Test Shareholders' Association reviewed and approved the withdrawal of the partners of Huarui Zhichuang. On September 30, 2019, Western Testing completed the registration procedures for industrial and commercial changes. Qi Guilian's capital contribution of Western Test was 2.88 million yuan, and the investment ratio was 4.8%. Later, on September 15, 2020, the first capital increase of the Western test. According to the prospectus, on July 22, 2020, the Western test was held for the first interim shareholders meeting in 2020, and the proposal of the registered capital increased from 60 million yuan to 63.3 million yuan. The new registered capital of 3.3 million yuan was subscribed by Zhixuan Venture Capital at 38.5 million yuan in monetary funds, and the premium part was included in the capital reserve. On September 15, 2020, after the completion of the above capital increase, Qi Guilian held 2.88 million shares in the Western Test and Testing equity structure, with a shareholding ratio of 4.55%. As of May 11, 2022, Western Test Testing equity has not changed. It can be seen that on September 15, 2020, according to the income price of 11.67 yuan/share in external shareholders, 2.88 million shares held by Qi Guilian's Western test may have been worth 3,360,600 yuan. Compared with the consideration of RMB 24 million to pay for Xi'an at that time, it or a value -added of 9.6096 million yuan. The above situation can be seen that in March 2017, Xi'an Investment and Li Zexin, through the establishment of Huarui Zhichuang's acquisition of external shareholders' equity, in September 2017 and April 2019, Li Zexin and Hua Ruizhi created as the clause. Signed a gambling agreement with the external shareholders of the Western Test. In the agreement, the Western Test Test failed to be listed as scheduled as the conditions to trigger external shareholders as required Li Zexin and Huarui Zhichuang to repurchase the Western test equity. In this case, Xi'an invested as a partner of Huarui Zhichuang at that time, or a long -known listing plan for Western Test tests. What is strange is that in September 2019, Xi'an invested "withdrawal from the middle" and transferred Huarui Zhichuang's partnership share through the public property trading platform. Coincidentally, the final assignee actually provided borrowing from Li Zexin to Qi Guilian, who had contributed to Li Zexin's investment in Huarui Zhichuang. After Qi Guilian obtained the share of Huarui Zhichuang's partnership and converted into a direct shareholder of the Western Test, less than a year, the equity value it held was nearly 10 million yuan compared with the consideration paid to Xi'an investment. "Precise pick -up". The world is good, and all the worlds are beneficial. The doubts of the actual controller followed the above claims and staged the "karate" type of equity. - END -

Build "Healthy Wuxi"!10 billion Smart Medical Fund signing a contract

Modern Express News (Reporter Jin Chen Yuliting) On June 16, Taihu New City Group ...

Thanksgiving to the heart -Nan Cunhui, chairman of Jizhengtai Group Co., Ltd.

2021 National Charity Association Charity Work Tour · Charity CharacterThanks for...