Later, the "Walker Age" has a maximum rate of interest rate hikes!The Federal Reserve will raise 75 basis points this week, but the discussion of 100 basis points has not yet ended

Author:Daily Economic News Time:2022.09.20

In the early morning of September 22 (Thursday), Beijing time, the Fed FOMC will announce the policy statement of the September meeting under the gaze of the global market.

Last week, after a series of economic data, including the CPI in August, the futures market's betting on the Fed in September was heating up. "Come down. As of press time, the futures market believes that the possibility of the Federal Reserve's 100 -basis points on Thursday has dropped to 18%, and the possibility of the remaining 82%is 75 basis points in interest rate hikes.

Nevertheless, the controversy of whether the Federal Reserve has added 75 basis points or 100 basis points this week is far from over.

part of the point of view believes that because the 5-10-year inflation expectations announced last Friday are not bad, the Federal Reserve ’s interest rate hike will still be 75 basis points this week, and 100 basis points of interest rate hikes may result The panic of the market. However, some views also believe that inflation in August, especially the core inflation increased by the Fed's attention far exceeding expectations, which proves that there are still many jobs to be completed by the Federal Reserve, and no one knows how the long -term inflation expectations are formed. Therefore The probability of the 100th interest rates of 100 interest rates is greater than 50%.

However, regardless of whether the Federal Reserve raises 75 basis points or 100 basis points on Thursday, this will be the maximum continuous interest rate hike after the Federal Reserve President Paul Volcker period.

The interest rate range of this round of interest rate hikes is at least 4.5%~ 4.75%?

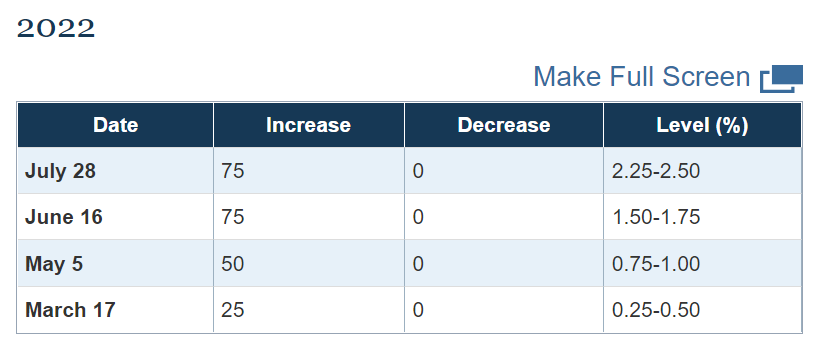

Since the start of a new round of interest rate hikes in March this year, the Fed has accumulated four interest rate hikes, a total of 225 basis points. Since entering the interest rate hike cycle, the Fed has always regarded inflation as the primary task. The Federal Reserve President Powell reiterated his position while attending the Cato Research Institute this month. In the future, the "firmly committed" to control the inflation to the target level. The greater the risk.

Picture source: Federal Reserve

According to the Fed's forecast in June, the final interest rate of interest rate hikes was 3.8%. However, the severe inflation situation forced the futures market to continue to repair the Fed's interest rate hike scope and amplitude.

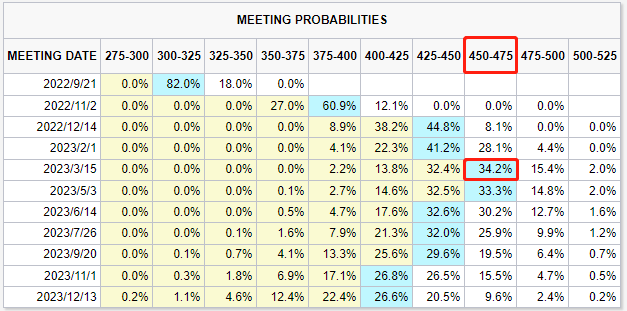

According to the "Fed Observation" tools of the Zhishang Institute, as of press time, the futures market believes that the final interest rate range of the Federal Reserve ’s interest rate hike cycle will reach at least 4.50%to 4.75%, which is close to the level of the global financial crisis at the end of 2007, and the last time will be added Best is most likely to occur at the meeting on March 15, 2023.

Picture source: Zhishang Institute

The "Fed Observation" tool also shows that the futures market is expected to reach 4.25%-4.50%at the end of the year, which means that the remaining three conferences will be raised at the remaining three conferences within the year this month. After the peak value of 4.50%-4.75%in March, the interest rate level will remain at least in July.

Goldman Sachs issued a report that the fund interest rate at the end of 2022 will reach 4%-4.25%, and will rise to the peak of 4.25%-4.5%in 2023, and then reduce interest rates once in 2024. In 2025, the interest rate will be reduced twice. The long-term interest rate will remain maintained. Unchanged in 2.5%.

Wells Fargo issued a report saying that despite the tough wording, few Federal Reserve officials advocated that the peak interest rate of federal funds was much higher than 4%. The median forecast of federal funds in 2023 is expected to be 4.125%. For 2024 and 2025, inflation is expected to promote the gradual relaxation of policies.

75 basis points in interest rate hikes: inflation pressure relief, long -term inflation expectations stable

In addition to interest rate hikes, the scale of the Federal Reserve's reduction in the balance sheet has also reached the upper limit this month. The tightening of monetary policy under the combination of "interest rate hike+shrinkage" is rare in recent decades. According to the previously announced plan, since June this year, the Fed has begun to support securities (MBS), which has not been partially expired at a rate of $ 47.5 billion. The speed of shrinkage in September will double to $ 95 billion. Because of the speed of quantitative tightening, this has also become an important factor in recent asset price fluctuations.

Derek Halpenny, director of Global Market Research on Mitsubishi Daily Financial Group, pointed out in the comment email sent to the Daily Economic News that we should not ignore the quantitative tightening (QT) speed of the Fed in September, plus last Monday The series of data shows that the US economy is slowing, and the Fed has reason to adhere to the current tightening pace.

Halpenny predicts that FOMC will adhere to the pace of interest rate hikes of 75 basis points this week, because 100 basis points raising 100 basis points at this critical moment will be considered a panic risk. He said that although the US CPI data released in August last week was bad, there were still a lot of evidence that the pressure of inflation in the future would be alleviated.

Rick Roberts, who served as the Federal Reserve Risk Credit Director During the 2008 financial crisis, also pointed out to the reporter of "Daily Economic News" through WeChat that because the expectations of the University of Michigan, the University of Michigan announced on Friday, are not bad, so he expects the Federal Reserve This week's interest rate hike will still be 75 basis points.

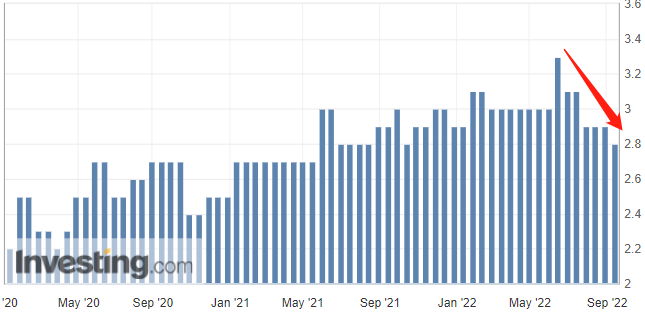

According to the data released on Friday, September 16, the final value of the University of Michigan's September 1 year was 4.6%, the lowest since September 2021, with an expected 4.6%and a previous value of 4.8%; %Is the lowest since July 2021, with an expected 2.9%and a previous value of 2.9%. The University of Michigan's 5-10 years of inflation expectations (picture source: British love)

Regarding the above data, Roberts told a reporter that in the current financial environment, once long -term inflation is expected to exceed 3.25%, the Fed will become very disturbing (with radical interest rate hikes). Therefore, 2.8%of long -term inflation expectations indicate that the Fed's interest rate hike this week will still be 75 basis points.

"Daily Economic News" reporter noticed that the data shows that in the past year, Michigan's 5 -year inflation is expected to be in a narrow -range fluctuation range of 2.9%to 3.1%, and the early value of June once broke the range , Reaching 3.3%, the highest since 2008, making the market pay great attention, and believes that it is the performance of long -term inflation expectations. The concerns of inflation expectations may be relieved.

100 basis points in interest rate hikes: The risk of high inflation and deep ingrains is underestimated

"Daily Economic News" reporter noticed that after the release of the CPI data in August, Nomura became the first trip to Wall Street that the Fed will raise interest rates to raise interest rates this week.

According to the report written by the managing director and senior economist Aichi Amemiya team by the reporter of the "Daily Economic News" reporter, Nomura believes that the history of gradually increasing the rate of interest rate hikes shows that the Fed may underestimate high inflation and become high inflation. The risk of deep -rooted.

The former foreign exchange supervisor and the co -founder and CEO Jeffrey Young of the DeepMacro of Citi Group made the same prediction with Nomura. He said to each reporter through WeChat that he agreed to the long -term inflation expectations of the University of Michigan's long -term inflation. This is also one of the reasons for the decline in the inflation factor in his model.

However, he added that "No one really knows (at the University of Michigan) how long -term inflation is formed. Now we have a group of‘ bear fires ’, and some people have to“ extinguish the fire ’.”

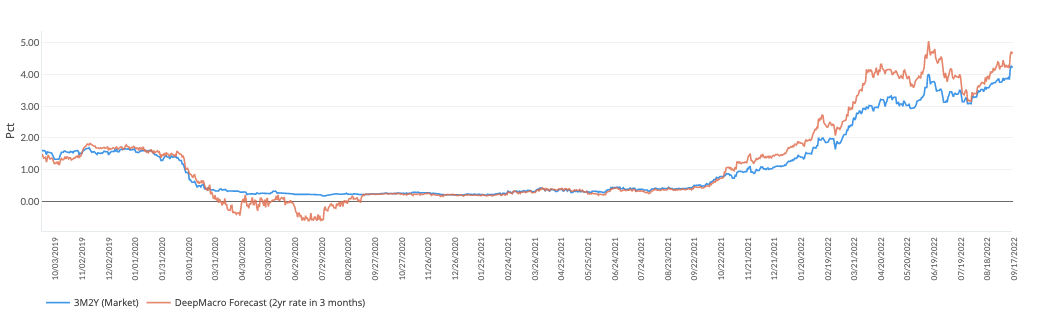

Jeffrey Young insists that the Fed will raise interest rates of 100 basis points this week. He pointed out that Deepmacro's short -term interest rate model (below) shows that the two -year exchange rate (now 4.25%) may be 47 basis points higher than the market long -term water (4.23%) in the next three months. This model predicts the two -year drop rate interest rate, because this is a liquidity market interest rate, which is closely related to the Fed's FOMC policy. Therefore, the model means that in the next two years, the rise in interest rates of the Federal Reserve will exceed the current market expectations. However, this does not necessarily mean that this will inevitably happen at the next FOMC meeting.

Image source: DeepMacro

"However, the Fed seems to have formed a preference for" earning interest rate hikes in advance. The benefit of doing so is to avoid the rise of potential wages-price spiral. In the future, higher interest rates and greater economic costs in the future can squeeze inflation from the economy. The risk of doing so is to cause potential financial market fluctuations, because a larger interest rate hike will force leverage to be flat. Warehouses affect the balance sheet of financial intermediaries. "Jeffrey Young added.

Jeffrey Young believes that even if the Fed has not raised 100 basis points this week, it is not because the Fed is worried about the strong interest rate hikes and triggers a recession. He pointed out, "If the Fed does not take sufficient measures to reduce inflation, then the US economic recession will eventually come, and the depth of decline will be greater than earning a significant interest rate hike in advance, and the duration will be longer."

Daily Economic News

- END -

Taiyuan Agricultural and Rural Bureau held a city's three agricultural economic indicators analysis and scheduling meetings

In order to thoroughly analyze the operation of the three agricultural economic in...

Dagang Co., Ltd.: The company's existing main business does not involve the concept of lithium battery

On July 5th, Capital State learned that A -share company Dagang Co., Ltd. (002077.SZ) disclosed the announcement of the Different Movement.During the bankruptcy reorganization stage, the company only