Han Mono fell to the lowest level in 13 years, and the yen was short!South Korea has launched a "defense war". Will Japan still "do not move"?

Author:Daily Economic News Time:2022.09.20

Under the continuous interest rate hikes of the Fed, the US dollar has strengthened, and the depreciation pressure of Asian currencies such as Japanese yen and won.

The exchange rate of the Han Dynasty to the US dollar has recently approached the psychological barrier of 1400, the lowest level since March 2009. The Japanese yen continues to be weak and is short -short by international capital. The increase in vacant contracts last week was the largest since March.

Under the pressure, South Korea began to adopt a series of combined boxing defense exchange rates, requiring banks to report foreign exchange transaction data per hour and convene representatives of corporate circles to discuss stable exchange rate measures.

In Japan, in addition to the implementation of the exchange rate inspection mechanism, the intervention of exchange rates still stays at the oral stage. The market is expected to continue to raise interest rates this week, and Japan and the United States will be further expanded. At the Bank of Japan held on the same day, whether the bank will tighten the loose monetary policy that runs counter to the world's major developed countries and has become the focus of market attention.

The Korean Hall has a decline, and South Korea has launched a "defense war"

As a series of warning measures last week, the unable to alleviate the decline in the exchange rate of the Korean won, the Central Bank of Korea began to require major banks to report foreign exchange data such as USD transactions per hour to strengthen the surveillance of the Korean foreign exchange market and prevent Korean won from further decline.

According to the report from the "Korea Economic News" on September 19th, quoting people familiar with the matter, last Friday (September 16), foreign exchange dealers received a notice asking them to report the demand and supply of the US dollar every hour from this Monday this Monday. Essence Earlier, the country's bank only needed to report 3 times a day, in the morning, lunch break, and closing.

It is reported that the purpose of the measure is to prevent international capital speculation and enhance market intervention. South Korean foreign exchange authorities also demanded that banks prohibit the use of foreign exchange management to make profits.

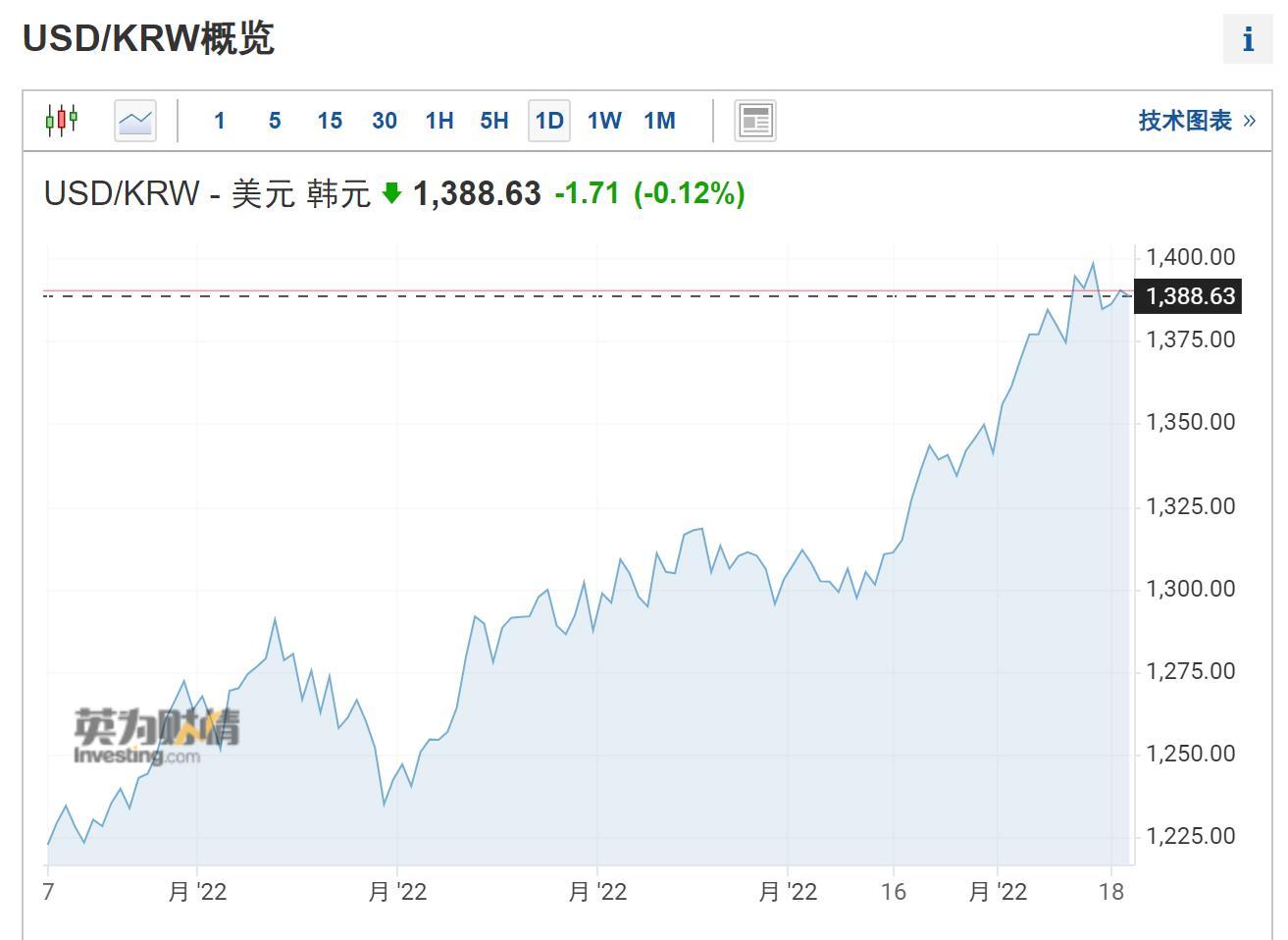

Behind the central bank's shot is concerns about the continuous depreciation of Han Yu. Last week, the exchange rate against the US dollar was only one step away from the psychological barrier of the US dollar. It could be deducted from 1399.95 won for each US dollar, the lowest level since March 2009. As of press time, the exchange rate of the US dollar was reported to the US dollar at 1388.63.

US dollar exchange rate picture source: British love for wealth

In the context of the Federal Reserve's interest rate hike, Asian currency continued to pressure. For South Korea, the weak economic situation has also strengthened its losses to the country's currency. In August, due to the rise in oil prices, South Korea recorded the worst trade deficit ever. Since the conflict between Russia and Ukraine, the cumulative decline in the exchange rate of the US dollar has been close to 15%.

Han Yu's weakness attracted the shortness of international capital. According to data disclosed by the Korean Exchange, as of August 29, the proportion of foreign investors in the KOSPI index of South Korea this year accounted for about 72%of foreign investors.

According to reports, officials of the Ministry of Planning of South Korea said that regulators will meet with representatives of the Korean corporate community on September 20 to discuss measures for stable US dollar needs and supply. As one of the measures for discussion, South Korean importers will be encouraged to use the offshore bond market to obtain US dollars to reduce the pressure of domestic US dollar supply.

On September 15, Qiu Qinghao, Vice Premier and Minister of Planning of South Korea, had verbally intervened in the foreign exchange market. He said that the depreciation of the Han Dynasty's recent depreciation of the US dollar has continued to decrease, causing restlessness. The government is also paying close attention to the movement of the foreign exchange market. If the foreign exchange market has a backfrontation or the overshadowing psychology of the market, the government will take appropriate market stability measures in a timely manner.

In addition to the exchange rate, a series of economic indicators also let the market start to worry about whether South Korea will experience the Asian financial crisis in 1997 or the global financial crisis in 2008: South Korea inflation recorded 6.3%in July, the highest since November 1998, 1998 Level; foreign exchange reserves shrunk by 9.4 billion US dollars in June, the largest decline since November 2008. As of August, the country has recorded a five -month trade deficit for five consecutive months. time.

Oral intervention does not work, the hedge funds are short to short yen

In the case of raising interest rates in major developed countries around the world, Japan, which still adheres to the loose monetary policy, is also facing great pressure on the depreciation of the currency.

According to data from the US Commodity Futures Commission (CFTC), the hedge fund increased the net vacant contract of 18,836 yen last week, the largest increase since March this year.

Goldman Sachs pointed out in the latest research report that if the Bank of Japan maintains the rate of yield curve control (YCC) policy unchanged, and US debt yields have upward, the yen depreciation will continue, and the exchange rate of the yen to the US dollar may fall to 1 US dollar. Yuan, this makes the short yen favorable.

Since 2022, the yen exchange rate to the US dollar has fallen by 20%, becoming the worst currency in the G10 countries. As of press time, the dollar reported to the yen at 143.12.

US dollar to yen exchange rate picture source: British love

Japan and the United States are likely to further expand due to policy differences. As the US CPI data increased in August, the market is generally expected to be at the monetary policy conference on September 22, Beijing time, the 75 basis points of the Federal Reserve ’s interest rate hikes are already“ nailing on the board ”, and at the same time, the possibility of 100 basis points in interest rate hikes does not rule out.

On the other hand, the Bank of Japan is still a policy tone through unlimited purchase of Japanese Treasury bonds and keeping low interest rates in stimulating the economy, and the intervention measures for exchange rates are still insufficient. Although the Japanese authorities issued a series of verbal warnings, they failed to curb the decline in the yen.

According to CCTV news reports, the Japanese Minister of Finance, Suzuki Suzuki, said on September 14 that the possibility of adopting all means to interfere with the exchange rate is not ruled out.The Bank of Japan began to implement the exchange rate inspection mechanism on the same day, that is, the details of the major commercial banks in Japan provided foreign exchange transactions to the central bank.It is reported that this is considered a stronger way than oral intervention.Karen Reichgott Fishman believes that whether the devaluation of the yen can reverse mainly depends mainly on two aspects: First, the risk of economic recession in the United States has increased significantly. By thenBounce; Second, the Bank of Japan transforms its monetary policy and directly intervene in the exchange rate market, but the possibility of the present stage is relatively low.

On September 22, after the Federal Reserve resolution, the Bank of Japan will also announce the interest rate resolution, and then the Governor of the Bank of Japan Kuroda Kuroda will hold a press conference on monetary policy.Whether the Bank of Japan will tighten the monetary policy will become the focus of market attention.

Daily Economic News

- END -

Yanji reached a cooperation consensus with the Gyeonggi -do Co., Ltd.

On August 5th, Yanji City Commerce Bureau and the Yanbian Business Office of the G...

7 times of impact IPO failed, and had valued tens of billions. Can Luo Zhenyu still be a "friend"?

The business that pays for knowledge has been blocked outside the door of the IPO....