What are the reporting skills in the 2022 Brokerage Jun Ding Award?The Almighty version is here!It's about half of the time, hurry up

Author:Broker China Time:2022.09.20

Click on the picture to participate in the registration

The selection of the "2022 China Securities Industry Jun Ding Award" hosted by the Securities Times is being registered.

The registration time is from 10:00 September 13, 2022 to 18:00 on September 30th. The organizing committee has reserved sufficient data collection, material review and filling time for the securities company. Online registration address:

https://vote.stcn.com/cbib/2022/bm/

This year's selection activity focused on the new business direction and differentiated competition strategies of securities companies, and added awards such as the fund investment consulting business, the Beijing Stock Exchange business, the public offering REITS business, the specific industry investment bank, and the regional investment bank.

Since the selection activity was officially launched on September 13, the organizing committee received a consultation with many securities companies on the design of indicators. It has summarized the issues as follows for reference.

Report

Q: Do you have to register an account or more?

A: It is best to unify a company's account, which can effectively avoid repeated reporting and avoid error leaks from the organizing committee in the later period of the organizing committee. However, considering that the subdivided business of securities companies belongs to different departments, we allow a securities company to apply for awards with different lines of accounts.

Q: What should I do if some data is inconvenient?

A: First of all, the data we filled in this time belongs to the rough lines on the business bar line. It does not involve the core financial indicators of each company, and there is no situation of conflict with the letter;

Secondly, China Securities Association has collected the main data of various securities companies, so you can also use the data to fill in the data of the CSI to fill in the corresponding award data;

Third, the data filled in is strictly confidential. Whether the selection organizers or expert judges, we have strictly abide by the confidentiality agreement. The data is limited to internal selection and strictly prohibit foreign biography.

Q: There are comprehensive awards in the three major business categories.

A: The "omnipotent" and "emerging" awards of each type of business cannot be declared at the same time, and one can only be selected.

Wealth broker

Q: What does the "brokerage business line income" mentioned in the Jade Fortune Broker Jun Ding Award refer to?

A: It refers to the net income of the agent in the business income table in the annual report. This is the same as the net income of agents in the Almighty Wealth Broker Jun Ding Award. And the net income of the agent includes the seat.

Q: Is the Chinese Securities Industry Wealth Service Brand Jun Ding Award, whether the company participates in the company or the financial brand (or wealth management department)?

A: Participate in the company with the company.

Q: What does the "effective cover number of customers" mentioned in the Chinese securities industry retail broker Jun Ding Award refer to?

A: It refers to the total number of securities customers with transactions or assets. Airlines and dormant accounts must be removed.

For example, the total number of customers in a company is 5 million households. If 3 million households are asset -free accounts or dormant accounts in 2021, the indicator is 2 million households.

Q: How to calculate the indicator of the China Securities Industry Wealth Service Brand Grand Ding Award?

A: (Customer assets at the end of the period-customer assets served at the beginning of the period)/Customer assets of the initial service*100%.

Q: In 2021, how to calculate the "new and value -added ratio of service assets" by the China Securities Investment Consulting Team Jun Ding Award?

A: Added scale calculation formula: Customer assets at the end of the period-customer assets of the early service service.

Calculation formula for the value-added ratio: (customer assets at the end of the period-customer assets at the beginning of the period)/Customer assets of the first-time service*100%.

Q: How is the "customer asset preservation rate" mentioned in the Grand Ding Award of China Securities Investor Education Team?

A: First of all, customer asset preservation and appreciation is the goal pursued by all wealth management institutions. It is no exception to the brokerage business of securities companies. Only after preservation before the value of value, this is not conflicting with the nature of investor education.

Secondly, the customer's asset preservation rate inspection is the final result of the institutional service, mainly because the customer's period at the end of the assets at the end of the period is compared to the initial assets.

The specific calculation formula of the "customer asset preservation rate" is: the number of assets without loss / the number of customers*100%.

For example, at the beginning of the year, the asset of a customer was 1 million, and the assets became 2 million at the end of the year. This year and no assets transferred out and transferred, the customer asset preservation rate was 200%. If a client's assets at the beginning of the year are 1 million, the client will be transferred to 1 million at a certain time in the middle of the year, and the end of the year is still 2 million, then the customer's asset preservation rate is 100%. If a client's assets at the beginning of the year are 1 million, at some time, the customer will transfer 1 million at one time, and the end of the period is still 2 million at the end of the period. The customer asset preservation rate is 300%. If a client's assets at the beginning of the year are 1 million, the customer has transferred 500,000 some periods in the middle of the year, and then it will be transferred to 1 million shortly later. At the end of the period, it is still 2 million, and the customer's asset preservation rate is 150%.

Investment bank

Q: How to understand the number of reports of investment bank projects must not exceed 2? It is only 2 newspapers for the seven major project awards, or 2 in one project award.

A: It is the award of each project.

It also means that there are currently seven major investment bank projects. In theory, a single broker can participate in a total of 14 project awards.

Q: How should the "region" of the XX District Investment Award be understood? Is the reporting data divided according to the regional team of the brokerage company, or is it divided by the location of the project? A: We examine the company's overall deep cultivation capabilities in a certain area, so it is divided according to the "location of the project".

Q: Can I declare it many times in the XX District Investment Bank Jun Ding Award? For example, the South China and North China regions at the same time.

A: No, you can only choose. This is also the same in the XX Industry Investment Bank Junding Award.

Q: What is the statistical caliber mentioned by the "project financing" mentioned by the XX Investment Bank Junding Award and the XX Industry Investment Bank Jun Ding Award?

A: Equity financing+bond financing.

Asset -pipeline

Q: How to understand the concept of "per capita income" by multiple awards of asset management?

A: The calculation formula is: operating income/total number.

Q: How does the "Equity and Intellectual Management Plan Jun Ding Award" and "Public Fundamental Products Jun Ding Award" be distinguished this year's new public offering product awards?

A: For public offering products and ginseng collections, please declare the public offering product award.

Q: What are the different standards of the "Solid Harvest" Asset Management Award and the "Solid Harvest+" Asset Management Program?

A: The proportion of fixed income products invests in debt assets such as deposits and bonds is not less than 80%. Then, on the other hand, the solid income+products are more than 20%of the equity assets (stocks, convertible bonds) in the solid -income product.

Q: Can public offering of solidaries+products apply for public offering solid -hardened product Grand Ding Awards?

A: This year's selection activity has added public offering products awards, which are two major awards of equity and solid harvest. However, considering that the total amount of public fund products issued by securities companies at this stage, the total amount of public funds issued by securities companies is not a more detailed division of the public offering products of securities firms this year. Receive the product Jun Ding Award, but the declared brokers need to explain in detail in the product introduction to prepare the expert judges to investigate more accurately.

Q: What is the "performance average performance" calculation formula?

A: In the awards of asset management categories, many of them involve the average performance, that is, the total share of net earnings throughout the year.

Q: In the ABS team award of the securities industry, how to calculate the "average performance of all ABS products"?

A: The calculation of the weighted interest rate of the ticket.

Nearly half of the selection registration time, a warm reminder, the deadline for registration is at 18:00 on September 30th, you can log in to the registration website before this time:

https://vote.stcn.com/cbib/2022/bm/

If you conduct the application awards and modification materials, you can also contact the organizing committee if you have any questions:

Fortune broker: Robs Sisi 18610533071

Investment bank category: Wu Qinghua 13510299390

Asset management category: Ni Yingya 13575763616

Editor -in -chief: Wang Lulu

School pair: Yao Yuan

- END -

Say goodbye to "running two places", Xinyang Luohe and Hubei Guangshui Cooperation Commerce Registration Cross -provincial Township

Henan Daily Client reporter Hu Dacheng Henan Daily All -Media reporter Yang Jingji...

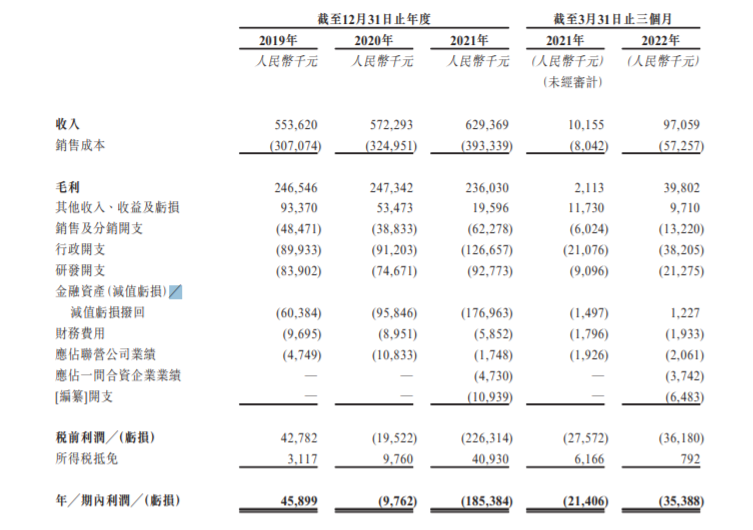

Fuel battery system manufacturer Yitong Second Delivery Table Stock Exchange, intended to be listed on A+H

On the evening of August 1, 2022, Beijing Yitong Technology Co., Ltd. (Yitong) sub...