In September LPR "Pressing the Army" analyst: October 5 years, the probability of LPR quotation at or above the 5th year, the probability of the LPR quotation is higher.

Author:Daily Economic News Time:2022.09.20

After the interest rate cut in August, the loan market quotation interest rate (LPR) in September did not move.

On September 20, the central bank authorized the National Bank of China Interbank Borrowing Center to announce that the latest loan market quotation interest rate (LPR) was: one -year LPR was 3.65%, and the LPR of more than 5 years was 4.3%. The two loan interest rates were the same as above. Keep the same period.

Source: central bank official website

"Daily Economic News" reporter noticed that on September 15, the central bank did not adjust interest rates when the central bank launched a mid -term loan convenience operation (MLF). For a long time, the MLF interest rate, as the reference foundation of LPR, will maintain simultaneous adjustment. However, the recently lowered deposit interest rates of many banks have aroused the market's attention to LPR in September.

Zhou Maohua, a macro researcher at Everbright Bank Financial Market Department, said in an interview with reporters that LPR remained unchanged in September, basically in line with expectations. First, the LPR interest rate in August has been greatly reduced; the second is that the real economy has continued to make interest in the real economy. Third, the demand for physical financing is gradually recovered. From the perspective of financial data in July and August, the real economy financing has gradually recovered, the structure continues to optimize, and the policy effect has gradually emerged.

Zhou Maohua predicts: "In the future, the LPR interest rate still has room for reduction. The main reason is that the domestic economy maintains the recovery trend, the quality and efficiency of banks will continue to increase, and the banking department will maintain profitability as a whole; Keep it flexible and moderate. However, LPR adjustments require comprehensive assessment of real economic financing needs, real estate recovery, and bank net interest margins. "

LPR offer in September remains unchanged

Recently, state -owned banks, some shares, and urban commercial banks have successively lowered deposit interest rates. Some views believe that more banks will join the team with a decline in deposit interest rates. In order to alleviate the pressure on the debt end of the commercial bank, LPR has the possibility of lowering the LPR in September.

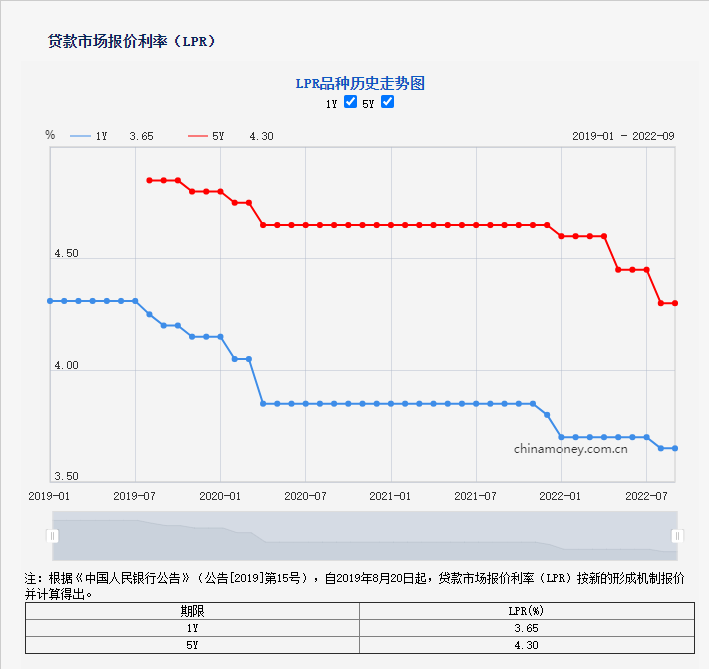

Every reporter noticed that LPR has fallen three times since this year. Among them, the 1 -year LPR was reduced twice, a cumulative decrease of 20 basis points; the LPR of more than 5 years was reduced by 3 times, and the cumulative 35 basis points were reduced.

Source: central bank official website

Today, LPR offers were released in September, and LPRs of one -year and five -year LPR remained unchanged. Dong Ximiao, chief researcher at Zhailian Financial, believes that the current currency supply is moderate, the market has loose capital, and the external environment is complex and changing. In September, LPR remains unchanged, and the market interest rate is stable, which meets expectations. Specifically, the LPR remains unchanged this month. Three reasons: First, the LPR in 2022 has fallen many times, and the superposition effect needs to be manifested.

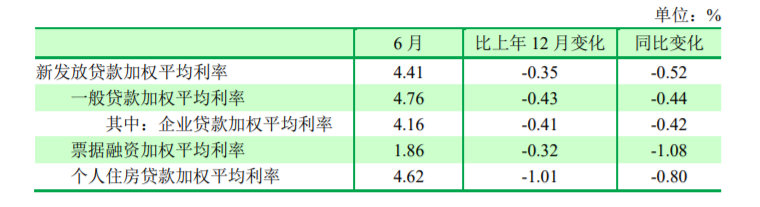

Second, the current loan interest rate is already at a historical low. According to the second quarter monetary policy implementation report released by the central bank, the average interest rate of corporate loans in June was 4.16%, a decrease of 0.42 percentage points from the same period last year, and it was at a low level since the statistics. Therefore, reducing LPR is not a top priority.

Third, the policy interest rate this month has not changed. On September 15, the People's Bank of China shrinks continued to do the mid -term loan convenience (MLF) in September, and the bid interest rate has not changed. Generally speaking, MLF interest rates have not changed, and the probability of changes in LPR is low.

In June 2022, the weighted average interest rate of loans was issued in June 2022: The second quarter of 2022 China Monetary Policy Implementation Report

In addition, Dong Ximiao also believes that under the pressure of high inflation, the pace of interest rate hikes such as the United States and Europe and other major economies has increased. The pressure of the RMB depreciation is relatively large, and the market interest rate is relatively stable. Stablize.

Dongfang Jincheng's chief macro analyst Wang Qing believes: "The foundation of LPR quotation in September has not changed. In addition, the last month has just been lowered. It is currently in the period of effect observation. September LPR quotation does not meet the market's general expectations."

Analysts: October 5 -year LPR quotation is high probability, which is higher

Talking about the impact of LPR this month on the market. Zhou Maohua believes that the LPR unchanged in September, but the financial support of the real economy has not decreased. The domestic economic loan interest rate has reached a historical low, and the financial sector continues to increase the weak links of the real economy. Manufacturing, green development, key projects and emerging areas support At the same time, in addition to reducing loan interest rates, the financial sector is also actively reducing financial service fees to help steady growth. The interest rate of LPRs above 5 years remains unchanged, but it does not affect the actual situation of various regional patterns. Due to urban policies, the real estate market supports the steady recovery of the real estate market.

"The interest rate of LPR above 5 years is unchanged, and the real estate market support has not decreased. It does not mean that the regional mortgage interest rate has no room for reduction. The LPR of more than 5 years this month remains unchanged. The above LPR interest rate is reduced by 35bp, and the bank avoids short -term narrowing from the short -term rate of net interest rates; on the other hand, the interest rate of LPR interest rates above 5 years is unchanged, which does not mean that the mortgage interest rate of various banks does not adjust the space. Regional macro -control policies, using comprehensive real estate regulation policies such as full mortgage interest rates and down payment ratios to promote the return of the property market to the three -stabilized track due to urban policies and precise regulation. "Zhou Maohua pointed out.

In the next stage of the LPR trend, Dong Ximiao said that in the next step, my country's monetary policy still has room for power. For example, the weighted average deposit reserve ratio of financial institutions in my country is 8.1%(data source: "Implementation Report of China Monetary Policy in the Second quarter of 2022"), (central bank) can continue to implement the reduction in time. Recently, the major banks have lowered deposit interest rates and reduced liability costs help the bank's compression increase, and the possibility of continuing LPR continues to decline. In short, my country's monetary policy should be strengthened from multiple aspects, more strongly boosting confidence and expectations, more powerful economic growth, and continuously helping economic and social recovery. Source: central bank official website

Zhou Maohua predicts: "In the future, the LPR interest rate still has room for reduction. The main reason is that the domestic economy maintains the recovery trend, the quality and efficiency of banks will continue to increase, and the banking department will maintain profitability as a whole; Keep it flexible and moderate. However, LPR adjustments require comprehensive assessment of real economic financing needs, real estate recovery, and bank net interest margins. "

In Wang Qing's opinion, in order to support the property market as soon as possible, driven by the recent bank deposit rate of deposit, the probability of LPR quotation above October 5th.

Wang Qing analysis pointed out that in the context of the downward market interest rate, the state -owned bank has launched a new round of deposit interest rates from September 15, and other banks are following. This will effectively reduce the cost of bank funds and provide motivation for the lower LPR quotation. It can be seen that after the first round of deposit interest rates were reduced in April this year, the LPR quotation of more than 5 years had a separate reduction of 15 basis points. Based on the above, we judge that LPR quotations above October 5th may be reduced by 10-15 basis points.

Daily Economic News

- END -

Yanyan, Hebei: "Company+Farmers" Tremella planting model helps rural revitalization

Great Wall Network · Jiyun Client News (Reporter Guo Qingmin Correspondent Zha...

The notice of the Hebei Provincial Department of Science and Technology on the release of the first batch of "unveil the list" science and technology project list in 2022

Relevant units:According to the relevant provisions of the Hebei Science and Techn...