Selling another Xinhua Insurance Yuyuan Hyuna Co., Ltd.

Author:Cover news Time:2022.09.20

Cover Journalist Zhu Ning

On the evening of September 19, Xinhua Insurance and Yuyuan Co., Ltd. issued the Founder's Holding Announcement Announcement.

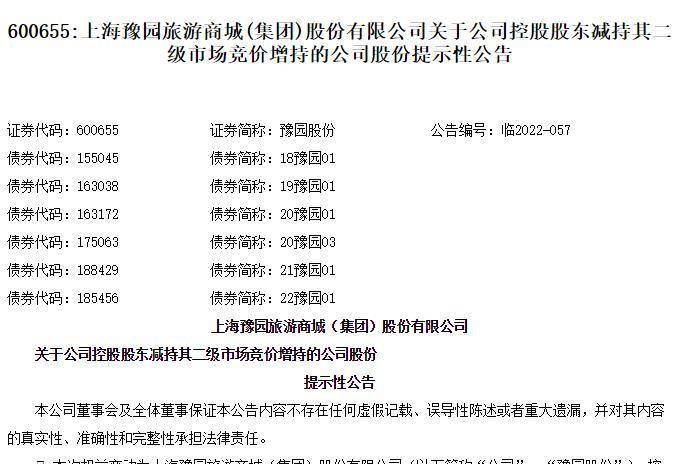

On the evening of September 19, Xinhua Insurance issued an announcement that Fosun International Co., Ltd. reduced its holdings of 26.1595 million H shares on September 15, accounting for about 0.84%of the total share capital. The total shareholding ratio of consistent actors will be reduced to 4.9999%, which is lower than 5%. The amount reduction is about 447 million Hong Kong dollars, equivalent to about 400 million yuan. At the same time, Yuyuan Co., Ltd. was reduced by Shanghai Fosun High Technology (Group) Co., Ltd. 38.926 million shares, accounting for 1%of the total share capital, with a reduction of nearly 300 million yuan.

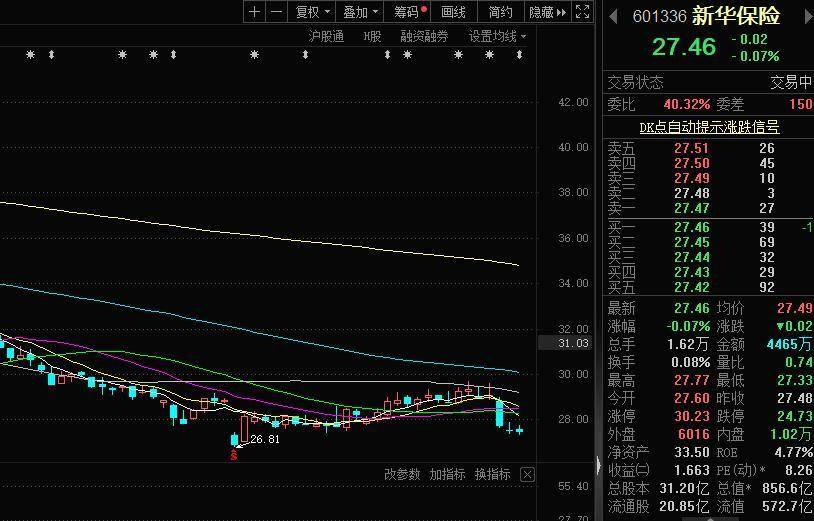

As of press time, Xinhua Insurance fell 0.07%to 27.46 yuan per share; Yuyuan shares fell 1.96%to 7.01 yuan per share.

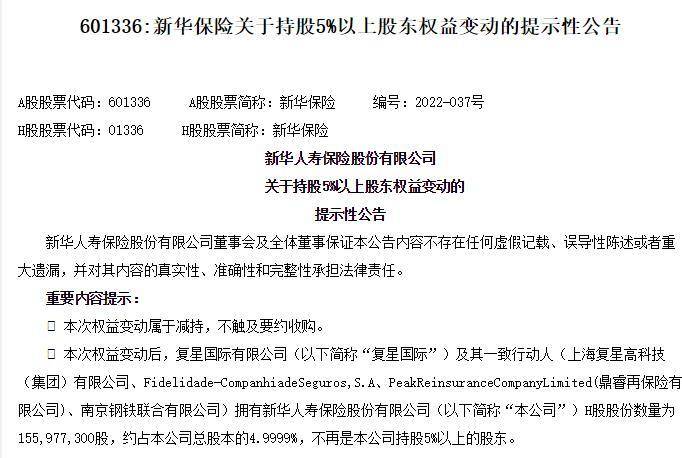

Portwear's holding of Xinhua Insurance is less than 5%

The most noteworthy in this reduction is the value of 4.9999%. The announcement shows that after the reduction of holdings in this round, Fosun International and its consistent actors will have a total shareholding ratio to 4.9999%, which is less than 5%of the important shareholding ratio. The follow -up actions will trigger reveries.

The reporter noticed that the Fosuna's holding of Xinhua Insurance has been more than 5%for more than 6 years. On August 10, 2016, Fosun's "lifting" Xinhua Insurance, which held a total of Xinhua Insurance's equity ratio of 5%. At that time, Fosun said that the increase in holdings was due to the future development prospect of Xinhua Insurance, and it would not be ruled out that it would be further selected to increase its holdings according to market conditions in the next 12 months.

However, according to the announcement recently, before the change of equity, Fosun International and its consistent actors held a total of 182 million shares in Xinhua Insurance, accounting for about 5.8386%of the total number of shares issued by the company. As of the date of this announcement, Fosun International and its consistent actors held a total of 156 million shares held by Xinhua Insurance, accounting for about 4.9999%of the total number of shares issued by the company, and no longer 5% The above shareholders.

Regarding the purpose of reducing holdings, the Fosuna said that it is due to normal investment and retreat, and it does not rule out factors such as the overall status of the securities market, the development of the listed company and its stock price in the next 12 months. The possibility.

Holding 13 listed companies have been reduced

Coupled with the reduction of Yuyuan Co., Ltd. and Xinhua Insurance, which announced on the evening of September 19, the Fosuna has announced at least 13 participation companies that have reduced their holdings and have completed their holdings, including A shares Fosun Pharmaceutical and Yuyuan. Shares, Jinhui wine, etc., as well as Hong Kong stocks of Qingdao Beer and Xinhua Insurance, have reduced their holdings exceeding 10 billion yuan.

Among them, the most noticeable is the reduction of Fosun Pharmaceutical and Golden Best wine. As the flagship assets of Fosuna's family, Fosun Pharmaceuticals have been reduced by the controlling shareholder. In fact, it has been taken the initiative to reduce its holdings since landing in A shares in 1998. On the evening of September 2nd, Fosun Pharmaceutical announced that the controlling shareholder Fosun High Technology intends to reduce its holdings of not more than 80.897 million A shares, accounting for 3%of the company's total share capital, and the closing price of 40.21 yuan/share on September 2nd. This reduction involves a market value of about 3.2 billion yuan.

On the same day, Jin Huijiu issued an announcement that Henan Yuzhu, Hainan Hainan, a wholly -owned subsidiary of Yuyuan and the wholly -owned subsidiary, intends to sell 13 % of the Jinhui wine at 29.38 yuan per share, and the total transaction price is 1.937 billion yuan. Two years of control of Jinhui wine. After the completion of the equity transfer transaction, the Fosuna also plans to continue to reduce its holdings of more than 5 % in the next six months. Previously, the Real Constander of the Fosuna has repeatedly expressed its optimistic about the development of the wine industry.

Regarding the recent frequent reduction incident, Fosun Gaoko said recently that the company's recent reduction and sale are the continuation of the company's financial strategy that the company insists on investing and rebound. Dynamic sorting and optimizing the asset portfolio is a persistent job. The market environment is there. The complex external environment has increased the attention of public opinion to the company's asset disposal, leading to one -sided interpretation of individual asset disposal behaviors, and ignoring the company's asset optimization principle, that is, long -term dynamic optimization.

- END -

V View Finance Report | Is there 100 teachers participating in the live broadcast?Dou Shen Education Follow: Is it true?

Zhongxin Jingwei, June 17th. On the 17th, Dou Shen Education announced that it received a letter of concern, asking the company to explain whether it was shifted from the education business to the liv

The air outlet transformation of the Internet, the office building knows all the office buildings

China Economic Weekly reporter Sun Bing | Beijing reportThe air outlet transformati...