Falling below 200 trillion yuan!In April, the total scale of private equity funds suddenly dropped, and the size and number of new filing funds were "doubled" by more than 25%. What was the situation?

Author:Daily Economic News Time:2022.06.21

On the evening of June 21, the reporter of "Daily Economic News" was informed that the China Securities Investment Fund Industry Association (hereinafter referred to as the China Foundation Association) announced the monthly report of the private equity fund manager and product filing of the private equity fund manager.

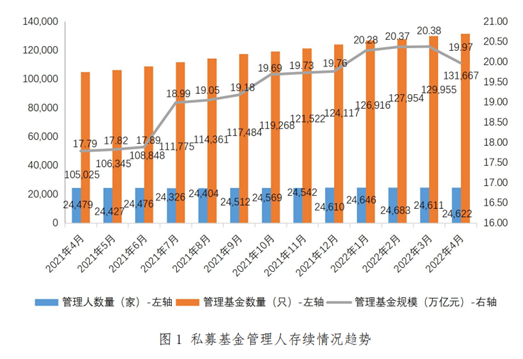

Data show that as of the end of April, the scale of private equity funds for survival was 1.997 trillion yuan, a decrease of 411.675 billion yuan compared with the 20.38 trillion yuan in March, a decrease of 2.02%month -on -month. In terms of new filing funds, there are also obvious "double drops" of the number and scale, of which the number of newly recorded private equity funds is 2278, a decrease of 1064 from the previous month, and a decrease of 31.84%from the previous month. A decrease of 18.814 billion yuan, a decrease of 26.55%month -on -month. In addition, from the perspective of the distribution of the registration place, the private equity fund manager registered in Hainan continues to maintain a rapid growth.

Photo source: Photo Network-500769677

The size and number of new filing funds exceed 25%

In January this year, the total private equity scale exceeded 200 trillion yuan in one breath. Since then, the number has risen for three consecutive months, and it has declined until April.

The monthly report shows that as of the end of April 2022, there were 24,622 private equity fund managers, an increase of 11 from the previous month, and an increase of 0.04%from the previous month. The scale of the fund was 1.997 trillion yuan, a decrease of 411.675 billion yuan from the previous month, a decrease of 2.02%month -on -month.

Among them, there were 9,152 private equity investment fund managers, an increase of 35 from the previous month, and an increase of 0.38%month -on -month; 15,000 private equity and entrepreneurial investment fund managers, an increase of 1 from the previous month, an increase of 0.01%month -on -month; private equity allocation allocation; private equity allocation allocation; Nine fund managers were the same as last month; 467 other private equity fund managers, a decrease of 25 from the previous month, and a decrease of 5.08%from the previous month.

In terms of newly filing private equity products, the number of new private equity funds in April was 2,278, a decrease of 1064 from the previous month, and a decrease of 31.84%from the previous month. In other words, the number of new filing funds has a very obvious "double drop" in terms of quantity and scale.

Not only the newly recorded private equity funds, but also the total scale of the Duke Fund has declined. Among them, the most powerful private equity securities investment since this year, its duration scale has decreased by 555.412 billion yuan compared with the previous month, and a month -on -month decrease was 8.75%. Essence

The number of Hainan private equity fund managers continues to grow rapidly

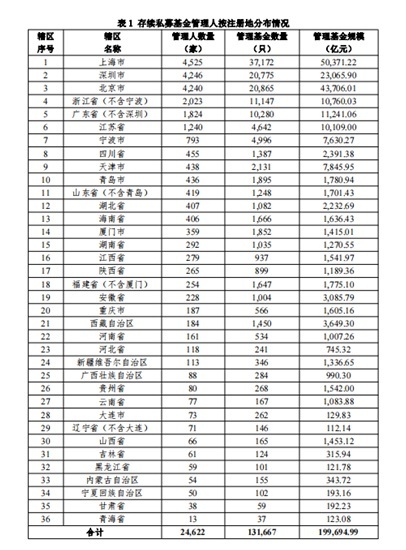

The monthly report shows that as of the end of April, there were 24,622 private equity fund managers. From the perspective of the registered place of registration (according to 36 jurisdictions), it is concentrated in Shanghai, Shenzhen, Beijing, Zhejiang Province (except Ningbo) and Guangdong (except Shenzhen), accounting for a total of 68.47%, which is lower than in March. 68.69%.

Among them, 4,525 Shanghai, 4,246 Shenzhen, 4,240 Beijing, 223 in Zhejiang (except Ningbo), and 1,824 in Guangdong (except Shenzhen), the number accounted for 18.38%, 17.24%, 17.22%, 8.22 %And 7.41%.

It is worth noting that the private equity fund manager registered in Hainan in April has continued to maintain a rapid growth trend, from 364 in March to 406, and 42 newly added within a month. As of the end of April, the private equity fund manager registered in Hainan has reached 406, which is about to surpass 407 in Hubei Province, and there is still a momentum of continuing to rise.

From the perspective of the size of the management fund, the top 5 major jurisdictions are Shanghai, Beijing, Shenzhen, Guangdong (except Shenzhen) and Zhejiang Province (except Ningbo), accounting for a total of 69.68%, which is lower than 70.10 in March 70.10 %.

Among them, Shanghai Municipality 5.04 trillion yuan, Beijing City 4.37 trillion yuan, Shenzhen City 2.31 trillion yuan, Guangdong Province (except Shenzhen) 1.12 trillion yuan, Zhejiang Province (except Ningbo) 1.08 trillion yuan, the scale of scale is respectively. 25.22%, 21.89%, 11.55%, 5.63%, and 5.39%. However, compared with March, the size of these registered management funds has declined differently. Among them, the most decreased in Shanghai, which was seriously affected by the epidemic, a year -on -year decrease of 182.272 billion yuan.

Daily Economic News

- END -

How can "live economy" be stable and far away

Live and cargo. Photography: Tan MeiEditor's note: With the development of the dig...

what happened?This brokerage management and general manager were warned together

China Fund reporter Yan YingRecently, there have been repeated brokerage firms for...