Daoda Investment Notes: Four Company Falls+Land Quantity Mid -line bottoming to the bottom still needs to wait

Author:Daily Economic News Time:2022.09.19

Recently, a well -known game has been on fire. The biggest feeling it gives me is to have the overall situation, because the failure of the customs clearance is accumulated a little bit before, and if you want to pass, you need to start the layout, so that you have left countless opportunities for yourself, and you have left countless opportunities, and you will have countless opportunities and and and you will have countless opportunities and you need to have countless opportunities. It's not just one way in front of you.

This is also very similar to the truth of stock trading. On the premise of observing the trading strategy, it is decentralized. Don't just bet on one direction. No one knows whether there will be a sudden sharpness.

The medical beauty sector was frustrated on Monday

Well, talk about the stock market that has been with us for many years. Yesterday, the performance of the A -share market was not surprised. I swept the news on the weekend. There was no particularly good news, so the market fell into the market inertia. However, a better phenomenon is that the market decline is significantly reduced, and the number of rising stocks is increasing, which shows that the prophet's awareness of funds are trying.

Several big brothers came out last weekend, the most famous of which was Gao Shanwen. His point of summarizing is that A shares are clearly underestimated, optimistic about the autonomous controlled sector, such as new energy, electronic equipment, military industry, etc.

These views are basically no different from the institutions. Gao Shanwen's speech in the impression is still pretty good. I don't know if it can work this time. Urgently need to revive market confidence. After all, the taste of lack of market confidence has been appreciated at the beginning of the year.

Yesterday, the rhythm of killing a section last Monday was last Monday. Last week was CRO, New Energy, and Securities. This Monday was the turn of medical beauty. This is a typical vulnerable market trend. At present, the disadvantaged pattern has not changed, indicating that there are funds using the sector to retreat.

The faucet of the medical beauty is mainly caused by a rumor. In fact, the main plunge of medical beauty is mainly weak consumption, coupled with the low concentration of medical beauty, mixed fish and dragons.

The festival sector is relatively active, including airports, attractions, hotel catering, aviation transportation, winemaking, etc. It is customary to pay attention to these sectors before the National Day holiday. At present, this kind of sector is one of the few varieties that can run above the 10th line. Before the holiday, there should be opportunities for performance, but in the last few days before the festival, be careful in advance.

The car manufacturing sector is strong. According to data from the National Bureau of Statistics, the added value of the automotive industry increased by more than 30%in August. At present, the moving average above the sector index is still short -term arranged, no space can be seen, and it can only be treated with rebounds for the time being. The industrial mother machine is active. The ETF approved by the Huaxia Fund and the Cathay Fund has been approved, becoming the first batch of domestic machine tool ETFs. It is positive for this sector. Essence

The two relatively independent sectors of port shipping and coal mining have a very similar trend structure. At present, they are building the lower edge of small -level boxes. It depends on whether it can stabilize and stop in the current position. As long as the morphology can be stabilized, there is no trend opportunity to be ruled out.

In terms of short -term emotions, it is still relatively weak, but stronger than last Friday. A Xinhua Union appeared in the real estate sector, which has a good effect. This is also the highest level of the market in the market and the high standard of emotions. If you can continue to make money in the future, the stimulation of the short -term should be more positive.

The ground sky and anti -bags are all signal signs that represent emotional repair, and they can come out of the trend when they have a great difficulty in recently, and can observe emotional changes as a wind direction label.

The short -term probability is repaired

Based on yesterday's market, Da Ge felt that the main points were mainly the following:

First of all, the market has a short -term probability of repair, but it should not be involved too deeply on repair. Yesterday, the major indexes continued to shrink. The turnover of the Shanghai market was less than 300 billion yuan, only 289.9 billion yuan. It can be said that the lowest transaction volume since this year shows that the market is short -term failure. Market land volume is considered a signal, and the land volume is available for land prices, but the relationship between the two is often not corresponding, and there is a dislocation of time.

From the perspective of trend structure, the Shanghai Stock Exchange Index has a decline structure of two consecutive small boxes in the 5 -minute level. At present, the decline structure of the second small box is in an unfinished state. It is similar to combining the CSI 1000 index. The possibility of repairing upwards is not ruled out.

However, after Dago is more inclined to explore another wave of decline failure, the short -term will be more stable. If the rebound cycle, look at 1-2 days first. As long as the points mentioned before are not recovered, they are treated weakly. Even if you want to participate, you are fast -moving and fast.

Secondly, the midline still needs to wait. As for the bottom line, you can refer to several declines earlier this year, and the commonality is still very clear -after the main decline, it will enter the entire period of stopping the decline. After the G -line is adjusted sharply, it will probably usher in a small cycle of universal rising pattern.

Dago also said before that the Shanghai Stock Exchange Index has been sideways for more than two months. Once the direction is selected, it will be sustainable. With reference to the adjustment of the market before, investors who do not do funds do not have to think about entering the field on the left. If the market really evolves into a large -level adjustment, it is relatively easy to be injured on the left.

If there is a rebound, it has evolved repeatedly. After the bottom appears, there is enough low position to allow you to enter the field, and there is time to let you see the mainstream direction of the market. There is no need to worry. (Zhang Daoda)

According to the latest regulations of relevant national departments, this note does not involve any operating suggestions, and the risk of entering the market should be borne.

- END -

Biden signed the "Reduction Act", which has been dragging for more than a year, who will benefit?

17.08.2022Number of this text: 2396, the reading time is about 4 minutes olderGuid...

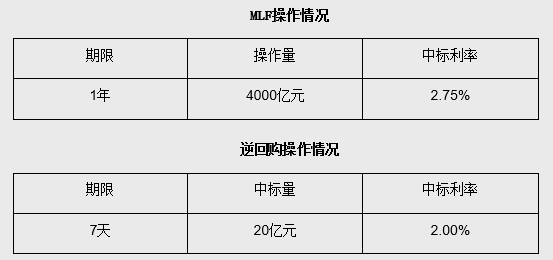

The central bank launched a 400 billion yuan MLF operation and the bid interest rate decreased by 10 basis points

China Economic Net, Beijing, August 15th. According to the website of the People's...