How can I leverage the 6.2 billion investment on the account of 334 million?Lithium Player Lightning Review Letter Letter

Author:China Fund News Time:2022.06.21

Learning reporter Wen Xi

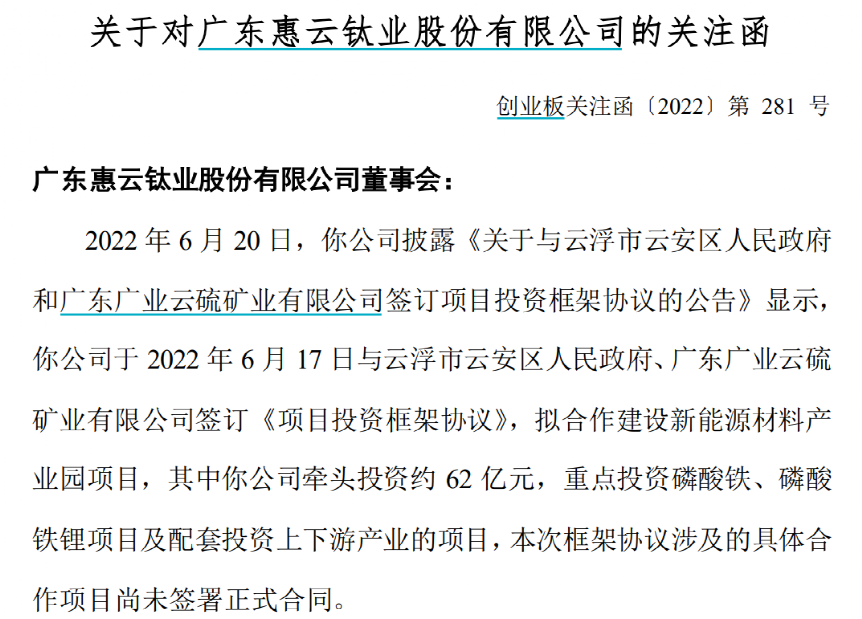

Huiyun Titanium (300891), who has just announced the cutting into the lithium iron phosphate track, was questioned by the regulatory level in less than 24 hours.

On the 21st, the Shenzhen Stock Exchange issued a letter of attention to Huiyun Titanium industry. For the company's signing agreement, 6.2 billion yuan of iron phosphate, iron phosphate projects and supporting investment upstream and downstream industries, it required it to explain the investment and construction of new energy material industrial parks The project is related to the existing main business of the company, while disclosing the source of funds for the investment.

Affected by this news, Huiyun Titanic Industry rose the daily limit this morning, and finally closed up 15.72%. It is worth noting that as of the end of the first quarter of this year, Huiyun Titanium's account was only 334 million yuan. How to pry 6.2 billion yuan of investment has a lot of questions for this new player with a revenue of only 1.553 billion yuan last year.

Requires the source of funds

The company with a market value of only 5.3 billion yuan (closing as of the 21st) announced last night that it planned to build a 10 billion investment scale of the new energy material industry park with the Yun'an District Government and Yunsulse Mining to build a "sulfur-phosphorus-titanium-iron-iron-iron-iron-iron-iron-iron-iron-iron-iron-iron-iron Lithium-calcium "industry ecological chain.

According to the announcement, Huiyun Titanium industry led about 6.2 billion yuan, focusing on projects that invest in iron phosphate, lithium iron phosphate projects and supporting investment in upstream and downstream industries; cloud -sulfur mining investment is about 2 billion yuan, mainly investing in 200,000 tons/annual precise wet wetting French phosphate -related projects.

The announcement mentioned that for these 6.2 billion yuan, Huiyun Titanium industry can be obtained through self -raising, funds, mergers and acquisitions loans, and joint ventures with other partners. Huiyun Titanium said that the cooperation is conducive to the full use of their respective resources and advantages, and it is positive for continuous improvement of its own industrial chain layout.

However, based on the current volume of Huiyun Titanium, it is doubtful whether it can leverage 6.2 billion yuan in investment. Therefore, the Shenzhen Stock Exchange issued a letter of attention within 24 hours.

In the follow -up letter, the Shenzhen Stock Exchange requires the company to supplement the specific content, investment purpose, and whether it is related to the existing main business of the company, and whether it belongs to the new business field. At the same time, Huiyun Titanium industry is required to combine project investment, operation plans, corresponding capital needs, timetable, and useable monetary funds, financing channels, etc. to explain the source of investment funds.

In fact, the Shenzhen Stock Exchange is concerned about unreasonable. In the three years from 2019 to 2021, Huiyun Titanium's revenue was 1.02 billion yuan, 955 million yuan, and 1.553 billion yuan, respectively. The net profit attributable to the mother was 98.12 million yuan, 89.12 million yuan, and 197 million yuan. As of the end of the first quarter of this year, the company's account was only 334 million yuan. Moreover, Huiyun Titanium's net profit in the first quarter of this year was about 29.07 million yuan, a decrease of 34.8%year -on -year.

Whether it can digest capacity is doubtful

In addition, the Shenzhen Stock Exchange also requires Huiyun Titanium industry to combine industry development trends, market supply and demand relationships, and industry competition to further demonstrate the necessity, rationality and feasibility of project construction in detail. At the same time, combined with the digestive capacity of related production capacity, there is a risk of overcapacity.

Huiyun Titanium ownership business is titanium pink, with revenue accounting for more than 80 %. In recent years, it is no stranger to cross -border titanium pink enterprises. Since last year, many titanium -white powder companies such as Annada, Longbai Group, and Medium Nuclear Titanium White have entered lithium iron phosphate, increasing profit growth points. At present, Longbai Group has 50,000 tons of iron phosphate and lithium iron phosphate and 25,000 tons of graphite.

All this is one of the hot tracks in the new energy field based on lithium iron phosphate, and iron phosphate is its main raw material. It is understood that the sulfate sulfate produced titanium pink can be used as iron sources of iron phosphate and lithium iron phosphate, which saves production costs and reduces environmental protection costs. Therefore, there are not a few titanium pink manufacturers from cross -border.

In the field of titanium pink this year, Huiyun Titanium has been trapped in costs. This company has also sought to enter the lithium wire. On June 14, the company announced that it disclosed the establishment of a subsidiary of Huiyun New Materials to use the spontaneous waste acids and iron sulfate as iron phosphate production materials to cut into the iron phosphate industry.

It is just that as more and more players entering the lithium iron phosphate cross -border, this field does face the risk of overcapacity in the future. More than 20 listed companies including Germany, Fulin Seiko, Zhongwei, and Wanhua Chemistry have initiated the plan to invest tens of billions of expansion of lithium iron phosphate production capacity.

According to the incomplete statistics of battery China, the scale of lithium iron phosphate expansion announced by various manufacturers plus existing production capacity exceeded 5 million tons. In contrast, domestic iron lithium -lithium shipments in 2021 were 470,000 tons. From January to March this year, there were 9 projects involving lithium iron phosphate materials in China, with planning capacity of 1.19 million tons. Some people in the industry have believed that there will be no surplus capacity in the short term for the time being, but with the continuous release of new capacity, it is expected that lithium iron phosphate may face the situation of overcapacity in the next two years.

It is worth noting that a listed company that has recently entered the lithium iron phosphate has chosen to withdraw. Huayou Cobalt's announcement recently disclosed that the company decided to terminate 100%equity in the acquisition of Saint -Holy Technology through the holding subsidiary of Bamo Technology, and signed the "Equity Acquisition Intent" on June 14. The company explicitly stated that the layout of lithium iron phosphate materials was terminated.

Edit: Captain

- END -

Acting in a park to help enterprises relieve it in time (efficiently do a good job of coordinating the prevention and control of the epidemic and the development of economic and social development, the first -tier exploration)

It is really a timely rain to help the company's rescue policy. Li Hui, the person in charge of Beijing Mingcheng Environmental Protection Technology Co., Ltd., said, The park has won 3 million yua...

2022 China (Yuanyang) prefabricated vegetable industry conference is about to start.

Editor's note | As more and more enterprises cross -border attack prefabricated di...