Xun Yugen's latest heavy point: A -share valuation is approaching the end of April, and the new low probability is small.

Author:Discovery net Time:2022.09.19

Recently, A -shares have fallen significantly. Some investors have begun to worry about whether the market will fall below the low end of April, and whether there will be a new round of decline in the future. Six consecutive new wealth best strategy analysts and chief of Haitong Securities Strategy, Yu Yugen, the latest point of view on September 18, "① Adjustment since 7/5, A -share valuation is close to the end of April. The fundamentals are better than the market. It has been reversed and the new low probability is small. ② Drawing on the reversal of the first five markets in the first five markets, this round of adjustment has come to an end. Even in 18, 11, and 08, there are two waves of opportunities in the year. ③ From the analysis of the intensity of the screened comparison and stable growth policy, the style is difficult to change, and the market stability path may be the growth and singing of the market. "At the industry level, the Yugen is clearly optimistic about the domestic alternative of semiconductor equipment and the new energy sector.

1. A -share valuation returns to the end of April, the new low probability is small

After the adjustment since 7/5, the valuation of A shares returned to the end of April. As of 2022/9/16 (the same below), the largest decline in the Shanghai Stock Exchange 50 was 13.1%, the Shanghai and Shenzhen 300 was 13.2%, and the GEM refers to 18.0%. On September 16, the Shanghai Stock Exchange 50 Index fell to 2678 points, which was approaching 2668 points on April 27.

Except for the Shanghai Stock Exchange 50, the other index is still higher than the end of April, but the valuation of each index has been returned to the level at the end of April. The number is 15.2 times/26.3%, the Shanghai and Shenzhen 300 is 11.2 times /25.9%, the GEM refers to 40.1 times /13.4%, and the latest value of all A shares is 16.8 times/32.7%, the Shanghai and Shenzhen 300 is 11.5 times /26.8% The GEM refers to 44.9 times /25.8%.

At the same time, from the perspective of risk premium, the current risk premium rate of all A -share risk is 3.28%, which is close to 3.75%on April 26. At the end of the month, it can be seen that the current market risks have been fully released.

From the perspective of investment clock and beef bear cycle, the market low on April 27 was the bottom of 3-4 years. At that time, the valuation bottom had appeared. Three of the five fundamental leaders (monetary policy, fiscal policy and manufacturing The rising) has been rebounded, and the other two (real estate sales area and automobile sales) have gradually stabilized, that is, confirming the market reversal. Because the economic data improved significantly in August, the probability of renewing the market is very low.

Second, the path of market stability may be valuable to set up a platform, growing up and singing

A shares in 3-5 years of style switching, and the relative trend of prosperity is a decisive variable. According to the latest disclosed interim reporting data, the net profit of the 22Q2 National Certificate Growth Plate has a single quarter growth rate of 10%, the value of the national certificate is 3%, and the growth rate of growth and value profit is 7%, which is -6%from 22Q1. It is more difficult to go from the view of the style.

At present, the central bank issued a statement on September 16th that the central bank issued "not engaged in large water irrigation and the future of impersonation". The "housing and living" tone of real estate policy is still there. Essence In the context of a gentle economic recovery, the value will be stabilized, and the growth is expected to be better than value because of the higher prosperity. That is, the path of stabilizing the market is more likely to be valuable to set up and grow up.

3. At the industry level, continue to be optimistic about the growth of high prosperity, such as new energy and digital economy

Although the recent growth sector has fallen a lot due to the changes in overseas policy. In fact, from the perspective of the industry's fundamental perspective, the high prosperity of the growth industries such as new energy and digital economies is still there. For example, the retail sales of new energy vehicles in August will increase year -on -year. 111%, it is expected that the sales of new energy vehicles will reach 6.5 million vehicles throughout the year. Policy support in the digital economy -related fields is also increasing. On July 28, the upper -level meetings "implement normalized supervision of the platform economy, and focus on the launch of a batch of 'green lights' investment cases". Infrastructure investment such as cloud computing and data centers is current Continuously add. At present, the domestic new energy industry has advantages, and domestic and foreign photovoltaic air installed capacity will promote the increase in global market share of domestic enterprises. In terms of digital economy, the US "Chip and Science Act" and the possible Chip4 alliance will bring greater uncertainty to the security of my country's semiconductor supply. It is imminent to achieve autonomy of the core link of semiconductors in my country. Demand+policy -driven lower semi -conductive equipment (2%of the global market share of mainland Chinese companies) and materials (13%) domestic replacement will speed up.

As the first place for the 6th consecutive strategy analysts of New Wealth, why is Yu Yugen so optimistic about domestic A -share semiconductor equipment/materials? Let ’s take a look at the overview of these two semiconductor semiconductor industries.

◆ Semiconductor equipment

According to the latest global semiconductor equipment shipment report released by the International Semiconductor Industry Association, in the second quarter of this year, global semiconductor equipment shipments reached US $ 26.43 billion, an increase of 6%year -on -year, a record high. In terms of regions, due to the vigorous expansion of TSMC, the shipping of semiconductor equipment in Taiwan in Taiwan reached US $ 6.68 billion, a growth rate of more than 30%, becoming the largest market.

CICC believes that the domestic semiconductor equipment company's 1H22 revenue has achieved a year -on -year high -speed growth. Although considering that the 1H22 epidemic affects some semiconductor equipment companies shipped, some companies in 3Q22 have an impact on the customer's side acceptance or impact on the side of the customer, but looking forward to 2H22 Considering that each semiconductor equipment company has sufficient orders in hand, various manufacturers are expected to achieve their original goals through class discharge production. , Maintain a high growth rate of revenue/net profit. ◆ Semiconductor material

In the semiconductor industry chain, semiconductor materials are located in the upstream of manufacturing, and together with semiconductor equipment, the core of the manufacturing link

The upstream supply chain of the heart is different from other industry materials. Semiconductor materials are electronic -grade materials, and have stricter requirements for precision purity. Therefore, whether the chip can successfully flow, the selection and reasonable selection and reasonable semiconductor material during process preparation process It is particularly critical to use.

According to SEMI data, among the global wafer manufacturing materials in 2020, the proportion of silicon wafers is the highest, 35%; electronic gas ranks 2nd, accounting for 13%; Compared with 6%; optical glue supporting materials accounted for 8%; wet electronic chemicals accounted for 7%; CMP polishing materials accounted for 6%; target materials accounted for 2%. Among the global packaging materials in 2019, the proportion of packaging substrates is the highest, 48%; the lead framework, bonding wire, packaging materials, ceramic substrates, chip bonding materials are ranked 2-6, accounting for 15%, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, and 15%, respectively. 15%, 10%, 6%, and 3%.

From 2006 to 2021, the global semiconductor material market fluctuated and overall. After 2017, it benefited from the needs of consumer electronics, 5G, automotive electronics, IoT and other needs. $ 64.3 billion, it is expected to reach US $ 69.8 billion in 2022, an increase of 8.6%year -on -year, and it is expected to exceed $ 70 billion in 2023.

Looking forward to 3Q22, semiconductor material companies have benefited from the expansion of the wafer plant in the second half of the year, and the overall demand side remains strong, and some companies have been affected by the epidemic in the first half of the year. In the use of the consignment model, the number of device delivery in the second half of the year is usually higher than the first half of the year, so the income end in the second half of the year has increased faster from the previous half of the year. At present, mainland Chinese enterprises are currently available in metal processing, vacuum valve, and gas conveying pipelines. Involved that the future high growth rate of downstream equipment companies is expected to drive the needs of component enterprises and the rapid increase in domesticization rates. In 2022/2023, it is a stage of income/profit growth in semiconductor materials/components.

For investors who are optimistic about the semiconductor industry chain for a long time, we may wish to pay attention to the technology ETF (515000), the technology ETF tracking and copying the China Securities Technology leader index. Leading stocks, consumer electronics/semiconductor/chips are the largest heavy warehouse, accounting for over 45%, concentrated on behalf of A -share technology core assets, and risk income characteristics are more balanced than other single track ETFs.

【A -share top technology ETF Special Tips 丨 Technology ETF: 515000】

1. The performance is high and beautiful, and the high prosperity continues to verify

The 2022 Interim Report shows that the 30 % net profit of 30 ingredients in the ETF (515000) of the Technology increased year -on -year, the eight net profit was doubled year -on -year, the three growth rates exceeded 2 times, and 1 increased by more than 10 times. The overall continued to maintain high prosperity.

2. The index valuation has fallen significantly, and the P / E ratio has a percentage of 8.89%

As of 2022.9.16, the overall PE (TTM) overall PE (TTM) of Technology ETF (515000) was tracked and copied. The historical percentage was 8.89%, which was still in the underestimated area.

3. "Reconstruction" dynamic "re -balance"

Technology ETF (515000) target index -the latest position adjustment of the CSI Technology Leader Index (CSI931087) in 2022, the index update iterative iteration, complete dynamic re -balance, achieve the effect of "weakening weak" and "high throwing low suction" effect.

Technology ETF (515000) officially took effect on June 13th in 2022. This time the position was incorporated into 17 constituent stocks. SMIC, BOE A, San'an Optoelectronics, etc. will temporarily leave, while Mai Rui Medical, Lixun Precision, and Changchun High -tech will return to this big family. After this position adjustment, the leading attributes of the science and technology were strengthened again. As of June 13, the average market value of the newly included 17 ingredients stocks exceeded 80 billion yuan, the 9 market value exceeded 50 billion yuan, and the market value of Mai Rui medical treatment exceeded 30 billion yuan. Precision exceeds 230 billion yuan.

At this point, the CSI Technology leader index has completed a large change of blood, and the composition stocks have maintained 50 unchanged. Based on the latest disclosure of the PCF list of the Shanghai Stock Exchange, the 17 newly included equity stock weights are estimated to exceed 32%.

4. Investing in technology, technology ETF winning rate is higher

The future of science and technology theme is strong, but the uncertainty of individual stocks is large, and the risk of investing in a certain technology stocks is very high. Everyone may wish to effectively disperse risks by holding a basket of stocks. As of December 31, 2021, the leader of the technology leader has increased by 373.61%since its foundation day. The scientific and technological stocks of 81.15%of the same period of the same period have increased, and the investment win rate is significantly higher than that of a separate investment in a technology stock.

- END -

The Chu Village and Town of Weihai High -tech Zone developed the "Star" action in integrity of merchants to create a new model of credit governance

In order to better promote the construction of the credit system and create a good...

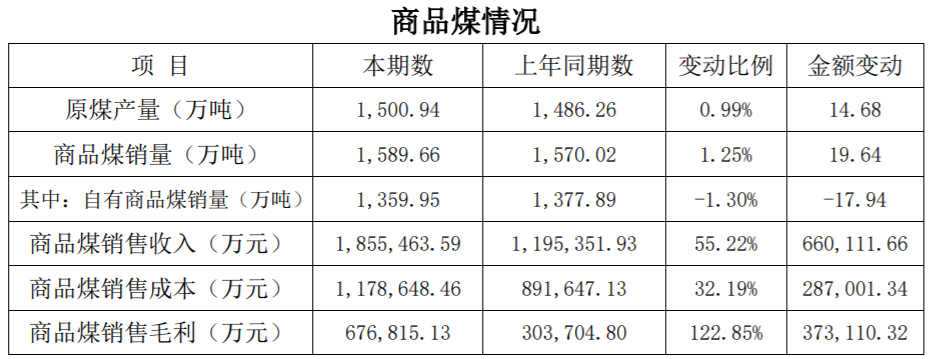

Ping Coal Co., Ltd.: The sales revenue of commercial coal in the first half of 2022 was about 18.6 billion yuan

On July 22, 2022, the A -share company Pingmei (601666.SH) released the business d...