REITS Research Weekly News 丨 Price Cancellation Capital Capital New Passionate Passionate Passionate Capital and Public Sales Percent Records have been refreshed again!Industrial Park REIT rapid expansion

Author:Daily Economic News Time:2022.09.19

Every time a reporter Li Peipei is edited by Xiao Ruidong

In the public offering REITs dynamics last week, of course, the most concerned is of course the "Golden King" of the recent market -Huaxia Hefei High -tech REIT. This fund not only refreshes the subscription multiple records of the online inquiry, but also the proportion of public offering for sale is also a new record. The cumulative funding of 129.397 billion yuan (before the proportion) has been issued, which has become a recent sought after incense.

In fact, in addition to Huaxia Hefei High -tech REIT, two public offerings REITs also announced the results of the inquiry last week. Among them, the release price of the REIT of Guotai Junan Lingang Industrial Park is 4.120 yuan/conclusion, the subscription multiple is 148 times, and the total amount of funds raised is 824 million yuan. The total amount of funds raised was about 1.517 billion yuan, showing the high enthusiasm of capital. These two funds will be officially released on September 19 and September 20.

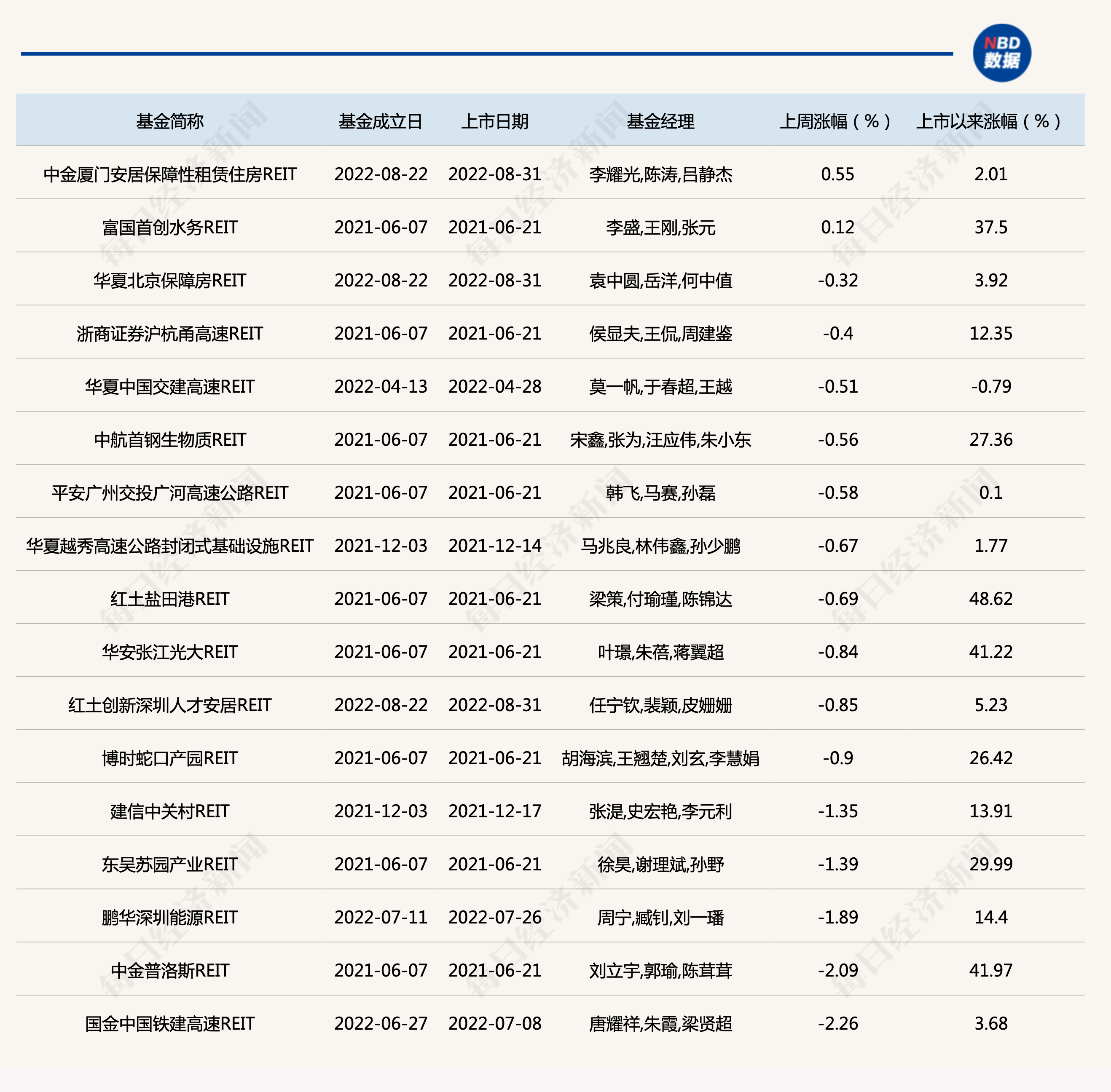

Judging from the performance of 17 public offering REITs, the prices in the secondary market have generally recovered last week, and the largest decline reached -2.26%. The price of only two public offerings Rate rose. One of them was one of the previous fire housing REIT -Zhongjin Xiamen's residential housing rented housing REIT, which rose slightly by 0.55%.

In addition, on the official website of the Shenzhen Stock Exchange on September 14, the domestic first single biopharmaceutical park REIT, Huta Hi -Tech Park REIT, has been accepted, and its underlying assets are the first phase of the Herhaida Valley project and incubator project. From the recent situation, the Reit of the industrial park is still rapidly expanding.

The price is generally adjusted, and it is difficult to stop the capital of capital to play new enthusiasm

The public offering market reproduces the hot scene. Recently, the Huaxia Fund issued an announcement that the proportion of distribution and sale of Huaxia Hefei High -tech REIT public sale is 0.23%, and once again refreshed the public offering of public offerings, the public offering ratio record. In addition, the proportion of offering and sale of the offline institutions was 0.64%, and the cumulative payment of 129.397 billion yuan (pre -sale) was issued this time.

Earlier, the subscription multiples of Huaxia Hefei Production Park REIT reached 156.89 times, and it has set a new high for the currently listed Reist subscription multiple. At the same time, two public offer REITs products announced the results of the inquiry last week, and the subscription multiple also exceeded 100 times, showing the high enthusiasm of the market and investors.

In fact, from the perspective of the market performance, the overall price of the public offer REITs last week has appeared. According to the statistics of each reporter, there are 17 public offerings REITs, which have been listed in the market, and 15 of them have fallen, and there are two more than 2%. Among all listed public offerings REITs, only Zhongjin Xiamen Anju's safe rental housing REIT and the first pioneering water REIT have risen slightly, which is in sharp contrast to the situation of more than 2%of many funds weekly increases.

The transaction situation also declined. According to CITIC Securities Research Report, the cumulative transactions of various REITS products listed on the market last week were 217 million, a decrease of 6%from the previous month; the cumulative transaction value reached 1.256 billion yuan, a decrease of 4%from the previous month; REITS decreased by 1.9 percentage points from the previous month, and the operating rights REITs dropped by 0.9 percentage points from the previous month.

Specifically, the six types of REITs show different ups and downs. Among them, the park's infrastructure, warehousing and logistics, clean energy, ecological environmental protection, transportation infrastructure, and affordable rental housing trading amounts this week were 201 million, 114 million, 81 million, 131 million, 358 million, and 120 million. In addition to ecological environmental protection, the transactions of other types of REITs have declined to varying degrees.

Many policies are favorable, and the Reit of the industrial park is still expanding rapidly

Under the coordinated advancement of multiple departments and the entire market institutions, the new public offer REITs projects have maintained a certain listing rhythm, of which the industrial park REIT is rapidly expanding.

Every reporter consulted the exchange website and found that on September 14, Huaxia and Dada Hi -Tech Industrial Park REIT had been accepted by the Shenzhen Stock Exchange. This is another industrial park REIT, and it is also the first single biopharmaceutical park REIT in my country. The underlying assets are the first phase project and incubator project of the Harma Valley. The total construction area is about 258,000 square meters. Fund managers Huaxia Fund, special plan manager CITIC Securities, and custodians Xingye Bank.

If the two -single industrial park REIT, which is about to be released on September 19th and September 20th, then the industrial park REITs on the market has 7 orders, and the speed of expansion can be said to be very fast.

According to the fundraising instructions, the expected annualized distribution rates of Huaxia and Da Gao Hi -Tech Industrial Park REIT in 2022 and 2023 were 4.53%and 4.64%, respectively. From this perspective, market funds are also foreseeable for REITs's new enthusiasm. Taking Huaxia Hefei High -tech REIT as an example, Tianfeng Securities analyzed that one of the reasons for this product is the annualized cash division rate of Huaxia Hefei REIT in 2022 The annualized cash distribution rate is high.

On the other hand, the favorable policy is also an important factor in supporting the sustainable development of public offer REIT. At the press conference of the Yangtze River Delta Integrated Demonstration Zone held on September 15, the three places of Shanghai and Jiangsu and Zhejiang jointly issued the "Several Policies and Measures on Further Supporting the High -quality Development of the Ecological Green Integrated Development Demonstration Zone in the Yangtze River Delta" (hereinafter referred to as "measures" "), Put forward 17 measures in 10 aspects of scientific and technological innovation empowerment and the revitalization of stock assets. Among them, in terms of existing asset activation, the "Measures" proposed "supporting the joint operation of some key stock infrastructure projects to support the demonstration zone" "actively strive for infrastructure such as transportation, water conservancy, ecological environmental protection, warehousing and logistics, parks, affordable rental housing, tourism and other infrastructure, tourism and other infrastructure, tourism and other infrastructure Reist Products "and so on. At the same time, Shanghai, Chongqing, Hangzhou, Nanjing and many other cities actively prepare for the pilot of the REITs of affordable rental housing. In the future, with the expansion of the regional expansion of the REITS pilot and the increase in the types of underlying assets, the public offer REITs may further expand.

In addition, some professionals have pointed out that the repeated local epidemic may affect the operation of the underlying assets of REITs. In addition, some REITs implementation of rental reduction may affect the distribution amount. These are the risks that investors need to pay attention to when paying attention to public offering REITs.

Daily Economic News

- END -

Domestic lithography machine past: Difficulty, really difficult ...

Breakthroughs and changes are happening.Wen | Chinese Business Tao Li Mu BaiWhen t...

Huaihua International Lugangcai Light Industry Products Freight Train Line Departure

At 11:30 am on August 16th, Chenxi — Beibuwan MTR MTR joint transportation train ...