299.88 yuan!The most expensive new shares in the year are coming, and the one -China one must pay 150,000!In -depth binding "Ning Wang", BYD ... Will it be a big meat sign?

Author:Broker China Time:2022.09.19

Source: Securities Times ID: wwwstcncom

On Monday, Wanrun Xinneng was about to welcome the purchase. The company's issuance price was 299.88 yuan, the corresponding price -earnings ratio was 72.48 times, and the total issuance was 21.3 million shares. Data show that the new shares with the second highest issue price for A shares for A shares are second only to Hermo's issuance price of 55.7.80 yuan; Wan Run New Energy is also the highest issue price for the current year. 150,000.

Since the implementation of the registration system, the pricing efficiency of new shares has increased significantly, and high issue prices and high -value -earnings ratios are frequent. According to statistics from reporters, there are 41 companies with a issuance price of more than 100 yuan in the history of GEM and science and technology boards, of which 40 have appeared after July 2019. Previously, the only issue price of the GEM has exceeded 100 in 2010. The issue price is 110.00 yuan.

Since 2019, the main board's launch has not exceeded the issue price of 100. The only one who is closer to 100 yuan is the Kaidi shares in May 2020, with a issuance price of 92.59 yuan; Haipuiri (then a small and medium -sized board), the issue price was 148 yuan.

High -priced shares are generally good on the first day of return.

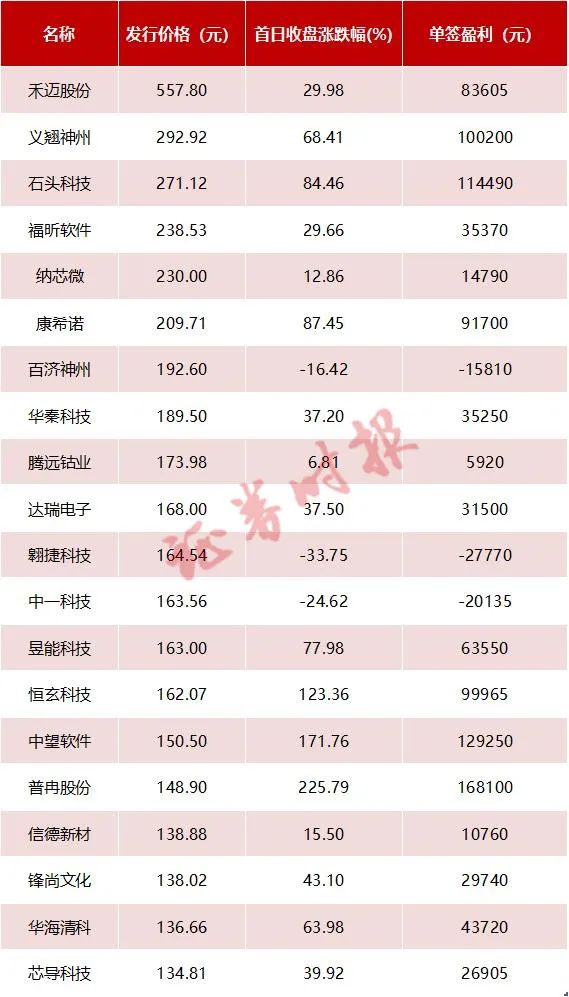

Data show that since the opening of the science and technology board, of the top 20 stocks with the highest issuance price of the two cities, 17 rose on the first day, 3 declines, the maximum increase was Pan Ran (225.79%), and the largest decline was Zujie Technology ( -33.75%). The highest issue price closed up 29.98%on the first day, and a single -signing profit (calculated at the closing price on the first day, the same below) 8,3605 yuan.

Yiliao Shenzhou, Stone Technology, Zhongwang Software, and Pan Ran all realized the benefits of more than 100,000 yuan in single signing. Among them, the signing income of Pulan shares is as high as 16,8100 yuan.

Hengxuan Technology and Kangshino's signed income exceeded 90,000 yuan.

Since 2022, a total of 13 new shares with a listing price of more than 100 yuan (not included on Monday, which is about to be listed on Monday), and arranged according to the issuance price: NAN core micro, Huaqin Technology, Tengyuan Cobalt Industry , Zujie Technology, Zhongyi Technology, Yu Neng Technology, Xindexin Materials, Huahai Qingke, Dongwei Half -Director, Jingwei Hengrun, Jiquan Technology, Lianying Medical, and Sanyo Biology, of which three of them achieved the first day of decline, 10 rose on the first day, the biggest decline was Cijie Technology (-33.75%), and the maximum increase was Yuneng Technology (77.98%), with an average increase of 18.52%. The highest profit of the single sign is Yuneng Technology (63550 yuan), and the highest single signing loss is Zujie Technology (-27770 yuan). Huaqin Technology, Huahai Qingke, and Lianying Medical Signing have exceeded 35,000 yuan.

Judging from the performance on the first day, the high -priced new shares of the hottest tracks such as chips and new energy performed well on the first day.

High -priced stocks and high abandoned purchase banks, abandoned purchase achievements "picking up"

The high issue price is usually accompanied by the high abandonment purchase amount. Wind data shows that the number of investors on the NAND micro -web have given up the subscription amount of 777 million yuan. The amount of discarded purchases of Jishenzhou, Zujie Technology, Xindexin Materials, Yu Neng Technology, and Tengyuan Cobalt all exceeded 100 million yuan.

The new shares are breaking into the norm, coupled with small and medium -sized investors, limited to the power of funds and the power to pay is the main cause of abandonment, while underwriters need to "balance the balance" on this part of the shares. It is not uncommon for regrets. Some stocks represented by Hemai and Yuneng Technology even came out of the long -term bulls. For underwriters, they can be regarded as leakage of inadvertently inserting willows.

Wanrun Xinneng's market share industry is the first three in the industry, and the performance in the first three quarters is expected to grow high

The main products of Wanrun New Energy include lithium iron phosphate positive materials and front -drives, lithium manganate positive electrode materials, etc. These materials are core materials for manufacturing new energy vehicle power batteries. The company's income is mainly derived from the sales of lithium iron phosphate positive materials. According to data from the China Chemical and Physical Power Industry Association, the company's market share of lithium iron phosphate orthopedic materials in China in 2020 was 13.5%. The company has become a supplier of many well -known lithium battery companies such as Ningde Times, BYD, AVIC Lithium, Yimei Lithium, Wanxiang One Two and Three, Ganfeng Lithium Electricity, etc. The products have been recognized by downstream customers.

From the perspective of market competition pattern, compared with negative electrode, diaphragm, electrolyte, etc., the market concentration of the positive pole material is relatively low, but the current concentration of lithium iron phosphate material market is high. The main reason is:

Affected by the early national subsidy policy, the center of gravity of the new energy vehicle power battery market was transferred to the ternary battery, which drove the demand for lithium iron phosphate batteries and material -related industrial chains to decline, resulting in a significant decrease in the number of lithium iron phosphate materials for upstream;

The energy density and mileage of lithium iron phosphate battery battery are weaker than the three yuan. Previously, the market had less demand for lithium iron phosphate batteries. When the demand for iron lithium material increases sharply, the number of companies that can provide high -cost ratio can be limited, so the concentration is high;

At present, small and medium -sized enterprises that lack core competitiveness in my country have gradually withdrawn from the market, and some lithium battery positive material manufacturers occupy the main market share with the core preparation technology of the front -drive body. The market competition has increased and concentrated. In the lithium iron phosphate orthopedic material industry, in addition to the company, the major companies currently ranked among the top shipping volume also include Germany nano, Hunan Yuneng, Fulin Seiko and Anda Technology. In 2018, the company's market share was second in the industry; in 2019 and 2020, the company's market share is third in the industry. The market share in 2020 was 13.5%.

Financial data show that in 2019, 2020, and 2021, revenue were 766 million yuan, 688 million yuan, and 2.229 billion yuan, respectively; net profit was -73.3857 million yuan, -446.16 million yuan, and 353 million yuan, respectively.

The company previewed that the company's operating income in the first three quarters of this year was approximately 6.68 billion yuan to 7.8 billion yuan, an increase of 483.22%to 581.01%year -on -year; the net profit of the owner of the parent company was about 740 million to 800 million yuan, a year -on -year increase of growth, year -on -year growth 304.44%to 337.23%; it is expected that the net profit attributable to the owner of the parent company after the deduction is about 720 million to 780 million yuan, an increase of 303.12%to 336.71%year -on -year. It is mainly because the demand for downstream new energy vehicle markets and the expansion of the company's production and sales scale has driven the company's operating income to increase significantly.

Editor -in -chief: Wang Lulu

School pair: Liao Shengchao

- END -

Fengtai, Yongding sound: enhance financial competitiveness and endogenous power

Zhao Zhihe PhotoIn the process of economic development, we must continue to expand...

Strong US dollar hurts all other countries

The US CNN article on August 7th, the original title: Strong dollar is hurting all...