How about the "Cultural Tourism Business Scriptures" of 840 million land acquisition in the Park Cultural Investment Holdings?

Author:Daily Economic News Time:2022.06.21

Recently, Wendou Holdings (SH600715, closed price of 2.23 yuan, a total market value of 4.14 billion yuan) to receive the decision of administrative supervision measures in Liaoning Securities Regulatory Bureau in a timely manner due to information disclosure.

This incident mainly involves the relevant situation of the previous cooperation and development agreement of the People's Government of Nanjing Liuhe District (hereinafter referred to as Liuhe District, Nanjing City). "Daily Economic News" reporter noticed that the cooperation between Wendou Holdings and Liuhe District, Nanjing could be traced back to 2018. At that time, Wendou Holdings intends to invest in the construction of Golden Bull Lake theme park and e -sports and entertainment industrial park in Liuhe District, Nanjing.

In fact, since 2018, many film and television companies with many film and television IPs have turned their attention to theme parks and entered the field of real -world entertainment. Wendou Holdings, who had participated in "Chinatown Exploration 2", also bet on the same hand. Today, in the past few years, what is the "cultural tourism business" of Wenjun Holdings in the case of many companies' cultural tourism business?

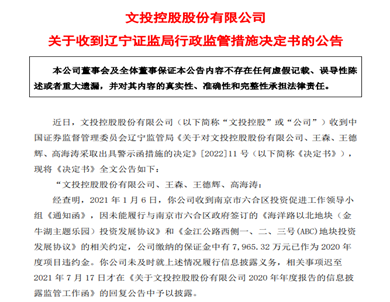

Due to information disclosure, Weitou Holdings was issued a warning letter

The "Decision" pointed out that after being found out, on January 6, 2021, Wendou Holdings received the "Notice letter" from Nanjing Liuhe District Investment Promotion Work Leading Group. Investment Development Agreement on the Northern Land (Golden Bull Lake theme Park) and the relevant agreement on the Investment Development Agreement of the Investment Development Development Agreement, No. 1, Two, and 3 (ABC) Investment Development Development of Jinjiang Highway ", the company paid 79.6532 million yuan in margin paid It has been a liquidated damage for the 2020 project.

Wendou Holdings did not fulfill the information disclosure obligations on the above situation in time. Related matters were disclosed until July 2021, which violated the relevant regulations of the listed company information disclosure. Gao Haitao should be responsible for the above behavior.

Photo source: Wenhuo Holdings Related Announcement

The "Decision" stated that the Liaoning Securities Regulatory Bureau decided to take supervision measures with alert letters to Wenhuo Holdings and General Manager Wang Sen, then financial director Wang Dehui, and then Secretary of the board of directors Gao Haitao, and recorded the integrity file of the securities futures market.

Wendou Holdings stated that the company attaches great importance to the issues raised in the "Decision Book", and will strictly follow the requirements of relevant laws and regulations to strengthen the management of the company's information disclosure and continuously improve the quality of operational awareness and information disclosure. Complete and timely, effectively safeguard all shareholders' rights.

The 840 million land acquisition park was affected by the epidemic situation and failed to start construction as scheduled.

The reporter noticed that the cooperation between Wendou Holdings and Liuhe District, Nanjing could be traced back to 2018.

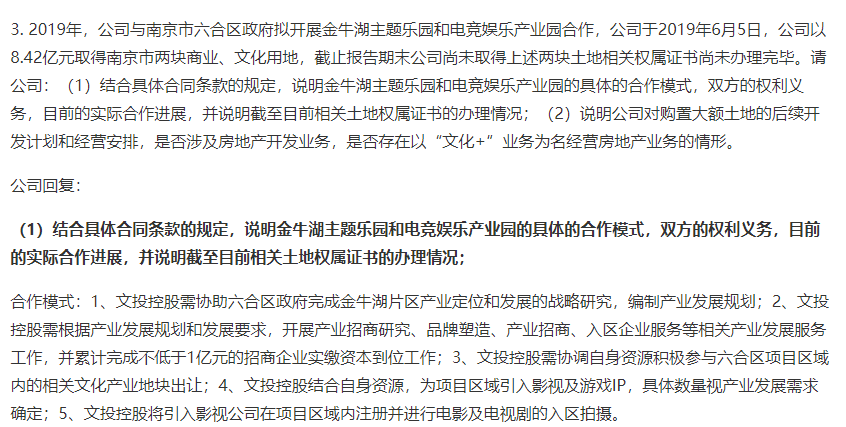

At that time, Wendou Holdings and Nanjing Liuhe District signed a cooperative development framework agreement on the Jinniu Lake area to invest in the construction of Jinniu Lake theme parks and e -sports and entertainment industrial parks in Liuhe District, Nanjing. The specific cooperation model and business terms are refined, and the cooperation agreement is planned to officially launch the park development with a cooperation period of 20 years.

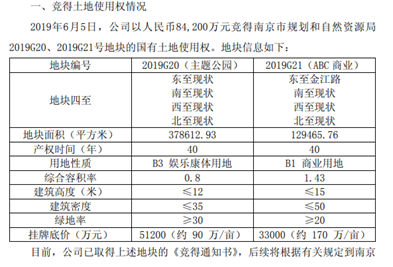

In order to successfully promote the construction of the park, in 2019, Wenhuo Holdings spent 842 million yuan to win the state -owned land use rights of the Nanjing Planning and Natural Resources Bureau 2019G20 and 2019G21.

According to Wendou Holdings, the company will obtain industrial development service revenue according to the scale of the park's investment and construction after competition, and will also obtain the park's operating income and industrial operation support income after completion in the park. The company will strive to achieve the opening of the park within 3 years after competing the land and continue to generate income.

Image source: Screenshot of the relevant announcement of Wendou Holdings

But nowadays, the park has not been opened due to the influence of the epidemic.

In the announcement of the replies of the information disclosure supervision work letter of Wenchou Holdings Co., Ltd. 2020 Annual Report "in 2021, it stated that due to the many times and repeated affected by the epidemic, the project did not start construction as scheduled; The writing and submission of certificates -related materials. The project's commercial land is not available for commercial land, and the theme park's land for property rights is still underway.

The company said: "The project is planned to be completed within the next three years. After completion, Wenhuo Holdings or entrusted third -party professional operation companies to operate. The project does not involve real estate development business. ","

Image source: Screenshot of the relevant announcement of Wendou Holdings

Is it a good business for betting on real -life entertainment?

In the past two years, Wendou Holdings has used the "culture+" business as the company's new business growth point. However, if you want to usher in the harvest period, you may have to wait a few years.

"Our strategy is to cooperate with local enterprises. Wendou Holdings mainly builds a benign financial model through light asset operation management, combined with IP output and community operations." On June 21, Gao Haitao, deputy general manager of Wendou Holdings, In an interview with the reporter of "Daily Economic News".

Choice data shows that from 2019 to 2021, Wendou Holdings' net profit was -40.716 million yuan, -3.513 billion yuan, and -706 million yuan, respectively. Among them, from 2019 to 2021, Wendou Holdings's "culture+" business operating income was 553 million yuan, 42.799 million yuan, and 716.763 million yuan, respectively, a year-on-year increase of 945.3%, -92.33%, and 69.13%. The company's 2021 annual report pointed out that the decline in revenue in 2020 was mainly the impact of the prevention and control of the epidemic, which led to the delay in industrial development services. The growth in 2021 was due to the approaching of the Beijing 2022 Winter Olympics, the winter Olympics related business increased more. From Disney to Universal Studios, many Chinese film and television companies also have a "paradise dream". However, the "park business" does not make money. From the Huayi Brothers (SZ300027, the stock price of 2.58 yuan, a market value of 7.2 billion yuan) and Wanda Group, it may be able to go one or two.

The Huayi Brothers proposed a real -life entertainment strategy as early as 2011, and established the Huayi Brothers (Tianjin) Real Entertainment Co., Ltd. In the following ten years, Huayi Brothers successively signed a number of movie towns such as Suzhou, Zhengzhou, Jinan, and Nanjing.

However, from the data point of view, from 2018 to 2021, the operating income of the Huayi Brothers brand authorization and the real -life entertainment sector was 150 million yuan, 34.678 million yuan, 125 million yuan, and 117 million yuan. In 2021, with the return of the content of the content, the Huayi Brothers disposed of some equity of the Huayi Brothers (Tianjin) Real Entertainment Co., Ltd., and the equity of Huayi Studios (Suzhou) Co., Ltd.

In addition, Wang Jianlin, who had previously promoted the transformation of Wanda, also invested in the theme park of the theme, but by 2018, Wang Jianlin still sold all the equity of 13 Wenta Travel City. HK $ 25 billion).

In the future, the theme park and e -sports industrial park of Wendou Holdings Baobao will bring the company's benefits to the company. It is not yet known. But for film and television companies, even if they hold a lot of IPs, real -life entertainment based on theme parks can not be "lying down to make money."

"The combination of real -world entertainment and film and television in the theme park requires innovation, and is no longer a simple IP authorization. Wendou Holdings is currently developing outdoors, combining community operations, to approach the new consumption of young people to enhance interaction, such as interactivity, such as, for example Camping, music festivals, etc. Because the theme parks are generally large investment and long recovery period, through differentiated operation innovation, it can reduce investment intensity and control project risks. "Gao Haitao said.

Daily Economic News

- END -

[In -depth popular science] After experiencing a journey of space, where to go

In daily life, people's always joked that planting vegetables is the habit of engr...

In the first 5 months, Ningjin County's economy and society showed a good trend of stable and healthy development

Since the beginning of this year, Ningjin County has promoted a positive fiscal po...