Do you want to run a card for merchants?Digital currency "Yuan Butler" is here

Author:Hunan Daily Time:2022.09.19

Following the "Yuan Universe", the concept of "Yuan Butler" was also hot.

Recently, the Institute of Digital Currency of the People's Bank of China released a digital RMB smart contract prepayment fund management product- "Yuan Butler", which has aroused heated discussion among industry insiders.

What is "Yuan Butler"?

"The gym boss is running, what to do in the Carius" "The training class suddenly closed, and I paid the tuition fee for a year, or I would like to return." ...

In recent years, many consumers have suffered the suffering of prepaid consumption. Prepaid consumption has also become the difficulty and pain points in consumer rights. "Yuan Butler" is the pain point for prepaid consumption in the prepaid consumption.

(Screenshot of Digital RMB APP)

Kan Caijun opened the Digital RMB APP, which has the function of "Yuan Butler". According to the APP, users purchase prepaid consumption services in the card issuer, put funds in the operating institution in advance, and specially used consumer behaviors used in merchants. Prepaid consumption funds will be managed by the operating institution in the form of digital RMB to complete consumption in actual consumption in actual consumption. After transferring it to the merchant.

Simply put, parents reported their children's training classes and kept the hours of class fees in digital RMB wallets. Every time the child last class, the smart contract loaded on the digital RMB wallet will automatically pay the training institution. In this way, parents don't have to worry about merchants' misappropriation of funds or even rolls.

Eliminate human operation and misappropriate prepaid funds

In the traditional prepaid consumption, the difficulty and risk of consumers' rights and interests are that before the contract is fulfilled, all their prepaid funds are owned by merchants. The subsequent contract performance and capital security are difficult to guarantee.

The emergence of "steward" has fundamentally changed this. It writes the contract terms into a smart contract. When the consumer completes the actual consumption, the merchant initiates the request for execution of smart contracts. Only the conditions of the smart contract can allocate the prepaid funds to the merchant.

In this way, merchants cannot transfer the funds for consumer prepayments at will. And before the actual consumption, the prepaid funds are still owned by consumers.

("Yuan Butler" takes the lead in the field of education and training, screenshots of the small program of "prepaid butler".)

With such a favorable good, Kan Caijun rubbed his hands expecting. However, the "steward" is still in the pilot stage and is currently only open to some businesses. It takes the lead in the education and training scenarios of Beijing, and will be promoted to various types of prepaid funds management needs such as retail, catering, sports, and employee benefits in the next step.

Professionals are optimistic, there are many application scenarios

Digital RMB smart contracts are not only optimistic in the prepaid consumption field. Many professionals believe that there are strict limits of the targets of funds and the use of payment in fiscal subsidies, involving the scenes of complex funds between multiple subjects, as well as cyclical payment, deposit refund, etc. In the scene, digital RMB smart contracts have better application prospects.

(Screenshot of Digital RMB APP)

For example, in August this year, the first digital RMB penetration and payment in the country landed in Xiong'an. Through the payment through the intelligent contract technology, transfer the salary funds in the form of digital RMB, from the digital wallet flow of the total contracting enterprise to the digital wallet of the subcontracting enterprise, and finally penetrate the digital wallet paid to the individual of migrant workers. In this process, the subcontracting enterprises only have query rights, and they cannot intercept and misappropriate wages, thereby protecting the legitimate rights and interests of migrant workers.

However, digital RMB smart contracts have just started, and smart contracts are the key. Experts believe that the legitimacy, consistency, and universality of the contract template are an important foundation for smart contracts to play the value of compulsory performance. It is necessary to establish an effective mechanism to strengthen management. At the same time, pay attention to allow ordinary users to understand digital contracts, better allow contract development standardization, reduce development difficulty and input costs.

Although the application of new technologies helps solve real problems, what Kan Caijun wants to remind is that smart contracts do not eliminate native risks of various industries.

Comprehensive from Economic Daily, Surging News, Beijing News, etc.

Edit: Hu Panpan

Source: Kancai

- END -

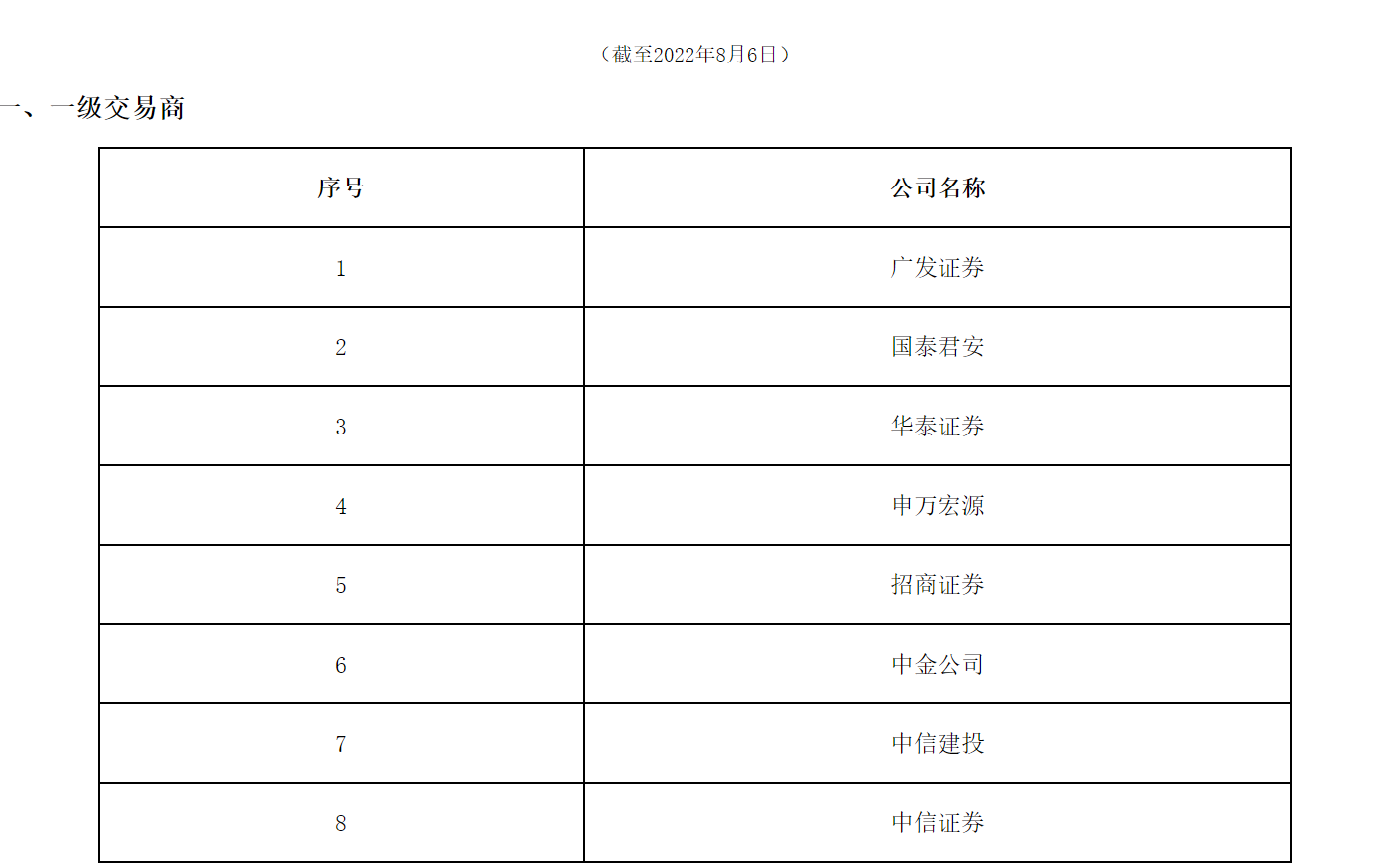

China Securities Association released the list of the latest off -site options dealers: a total of 44 brokers are listed, but these 5 have entered a transition period

On August 5th, the China Securities Association released the list of the latest ou...

The Central Plains Securities Investment Bank project frequently spreads domestic and foreign businesses to bloom more

Henan Daily client reporter Wang YinanOn September 8th, the domestic Children's Book First Stock Rongxin Education Cultural Industry Development shares (hereinafter referred to as: Rongxin Culture)...