Two -way fluctuation is the normal Chinese assets still attractive

Author:Xinhuanet Time:2022.09.19

The RMB exchange rate "Break 7" does not have the basis of continuous depreciation

Two -way fluctuation is the normal Chinese assets still attractive

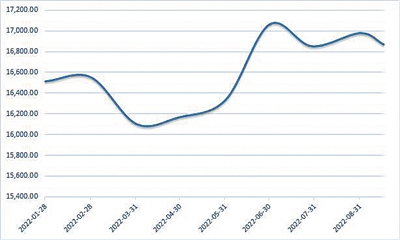

Recently, the offshore RMB and the coastal RMB exchange rate continued to fluctuate at the "7.0" mark, causing market attention. Experts said that due to the influence of the Fed's tightening of monetary policy, most of the non -US dollar currency depreciated to varying degrees, but the depreciation of the RMB was relatively small, and the RMB exchange rate index was generally stable. On the whole, the RMB exchange rate overall maintains a wide range of fluctuations in two -way fluctuations, and there is no basis for continuous depreciation. Data in August also showed that in the context of exchange rate fluctuations, the situation of overseas investors invested in domestic bonds and stock markets continued to improve, and China's asset attraction was strongly supported.

There is no basis for the long -term depreciation of the renminbi

For this RMB exchange rate to the US dollar exchange rate on the offshore and the shore market, Wen Bin, chief economist of China Minsheng Bank, believes that it is mainly affected by the Federal Reserve to suppress high inflation and accelerate the tightening of monetary policy. With The US dollar index is continuously strengthened, and the non -US dollar currency, including the RMB, has different degrees depreciation. Compared with the currency of major developed economies such as the pound, euro, and yen, the RMB depreciation is relatively small, and the RMB exchange rate index is generally stable. Essence

The bank -setting data released by the State Administration of Foreign Exchange on the 15th also confirmed this. Data show that in August, banks' foreign exchange sales and foreign -related income and expenditure were surplus. The Chinese foreign exchange market was expected to be stable, the transactions remained rational, and the RMB exchange rate performed steadily among major global currencies.

Specifically, the data shows that since mid -August, the US dollar index has risen by more than 4%, up to 110, a new high of 20 years. British pounds, yen, etc. have depreciated about 5%of the US dollar, and the euro has fallen below the US dollar by 1: 1; the depreciation of the RMB against the US dollar is relatively low. From the perspective of multilateral exchange rates, the RMB has remained basically stable on a basket currency index.

"Whenever the RMB exchange rate is approaching the integer pass, the market will always have various concerns and speculations. However, similar situations have been encountered many times from April 2018 to May 2020, and the market is shocked." BOC Guan Tao, the chief economist of securities, believes that the market has been preliminarily tested by the "rapid fall". The new policy is introduced, and the RMB exchange rate may rebound, and the broad fluctuation trend of two -way fluctuations will be maintained.

Wen Bin pointed out that from the perspective of my country's economic fundamentals, it is expected that the growth rate of GDP in the third quarter is significantly recovered from the second quarter. The level of inflation is mild and controllable, and the international revenue and expenditure conditions are good. Especially for regular projects and direct investment basic projects such as income and expenditure Maintaining a high surplus has laid the foundation for the stability of the RMB exchange rate and the stable operation of the foreign exchange market, and there is no basis for the renminbi.

Wang Chunying, deputy director of the State Administration of Foreign Exchange, also said that the current policies and measures for the stability of the economy are gradually taking effect, the national economy continues to recover, and the long -term good fundamentals have not changed. In the future, my country's foreign exchange market will continue to maintain a stable trend in the operation of the foreign exchange market.

Chinese assets have long -term attraction

As the RMB exchange rate decreases in the short term, the northbound funds have fluctuated recently. However, a number of data show that the net inflow under direct investment in China has increased from July, and foreign investment has still increased its holdings of Chinese assets. People in the industry also said that the depreciation of the short -term RMB on the outflow of capital is limited. The formation of the normally fluctuations of the RMB exchange rate also helps to provide strong support for the long -term attractiveness of Chinese assets.

"Everyone is worried that the depreciation of the exchange rate outflow of foreign capital will form a vicious circle, but for foreign investment, investment in foreign investment naturally bears the risk of exchange rate fluctuations. They are not worried about the rise and fall of local currency exchange rates, but they are worried that they have to ask for help due to rigid exchange rate rigidity. Some capital control methods have caused the irreplaceable risks. "Guan Tao said that after the exchange rate was elastic, it increased the autonomy of monetary policy, and at the same time reduced the dependence on administrative means, helping to boost the domestic territory Foreign investor market confidence.

Data from the State Administration of Foreign Exchange also showed that the net cross -border capital inflows under the trade of goods in August continued to have a high scale, and foreign capital inflows such as direct investment and other channels increased steadily. The cross -border income and expenditure surplus of goods in August was US $ 55.2 billion, an increase of 31%over July. At the same time, the net inflow under the direct investment of Lai China increased from July. The continued improvement of overseas investors' investment in domestic bonds and stock markets, highlighting the long -term investment value of my country's market and RMB assets.

For foreign -funded institutions, the general trend of increasing China's assets is still unchanged. According to the equity disclosure information of the Hong Kong Stock Exchange on September 6, Morgan Chase increased its holdings of approximately HK $ 423 million in Xiaopeng Automobile on September 1, an increase of 4.66%to 5.12%. In addition, from the recent positions released by foreign institutions such as JP Morgan Chase, Belle, and Angben, its funds have added stocks such as Ningde Times, Industrial Bank, and Moutai of Guizhou.

Wind data also shows that as of September 18, foreign investment has bought more than 50 billion yuan in A shares through the Shanghai and Shenzhen Stock Connect since this year. From 2016 to 2021, the north -wing capital has maintained a net purchase trend in the A -share market for six consecutive years.

"In the face of inflation pressure at the rate hike cycle, the global major currencies have a great depreciation of the US dollar, and the RMB is relatively strong." Xie Zhengxi, director of investment, business strategy and development in Jingshun, said that the continued export of China exports is that the export of China's exports continuesThe expected growth proves that the export capacity of Chinese products has not been affected by the epidemic.The thickened trade surplus also helps the worries of capital outflows caused by the depreciation pressure of the hedging part.On the whole, most foreign investors hold long -term vision of Chinese stock investment.(Reporter Luo Yiying Xiang Jiaying) (Luo Yizhen Xiang Jiaying)

- END -

Historical high!From January to August, the cargo throughput of Tangshan Hong Kong was 502.47 million tons

It was learned from the Tangshan Ocean Port and Port and Airlines Administration that from January to August of this year, Tangshan Port's total cargo throughput was 502.47 million tons, a record high...