There are counts | In July, the balance of bank structure deposits of banks was 5635.22 billion yuan, an increase of 1.4% month -on -month

Author:Cover news Time:2022.09.19

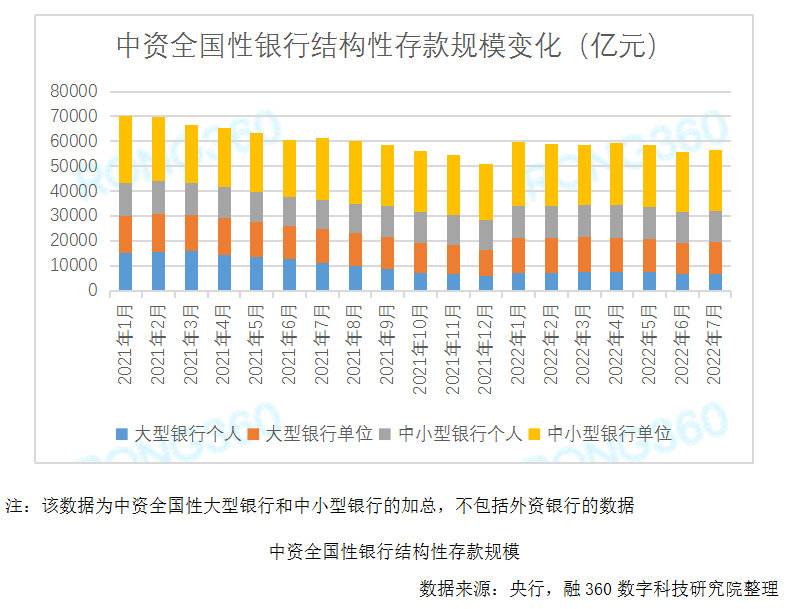

According to data released by the People's Bank of China, as of the end of July 2022, the balanced deposit balance of Chinese national banks was 5635.22 billion yuan, an increase of 1.4%month -on -month, a year -on -year decrease of 8.41%.

Specifically, the size of large -scale banks and small and medium -sized bank units decreased from the previous month, with a decrease of 0.09%and 2.49%; the scale of personal structural deposits of large banks and small and medium -sized banks increased month -on -month, with an increase of 4.64%and 2.18, respectively. %.

On the whole, the scale of structural deposits this year is relatively stable, and the trend of pressure drop is not obvious.

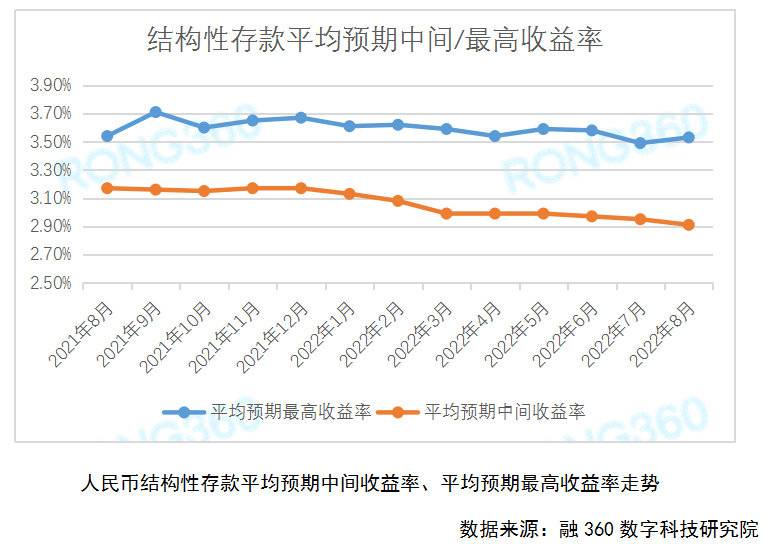

Structural deposit middle layer return rate continues to decline

According to the incomplete statistics of Rong 360 Digital Science and Technology Research Institute, the average period of the RMB structural deposit issued by the bank in August 2022 was 146 days, which was shortened by 7 days from the previous month. The expected intermediate yield is 2.91%, a decrease of 4bp from the previous quarter; the average expected maximum yield is 3.53%, an increase of 4bp from the previous month. Structural deposits are relatively close to actual yields, and the average expected intermediate yield has decreased for three consecutive months.

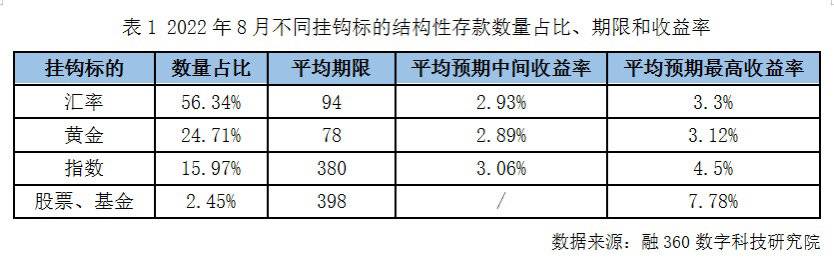

From the perspective of the number of structural deposits of different hook bids, the ratio of the exchange rate of structural deposits issued in August is 56.34%, the proportion of linked gold is 24.71%, the proportion of the hook index is 15.97%, the proportion of hook stocks and funds is the proportion of shares and funds to the fund to be 2.45%, the proportion of other targets linked is 0.53%.

Judging from the yield of structural deposits of different hook bids, the average hook exchange rate in August is expected to be 2.93%, and the average expected maximum rate of return is 3.3%; It is 2.89%, with an average expected maximum return rate of 3.12%; the structural deposit of the hook index an average expected intermediate yield of 3.06%, the average expected maximum yield is 4.5%; the average expected maximum rate of return on hook stocks and funds is the highest rate of return. It is 7.78%.

Compared with July, the average hook exchange rate and gold's structural deposits are expected to fall slightly.

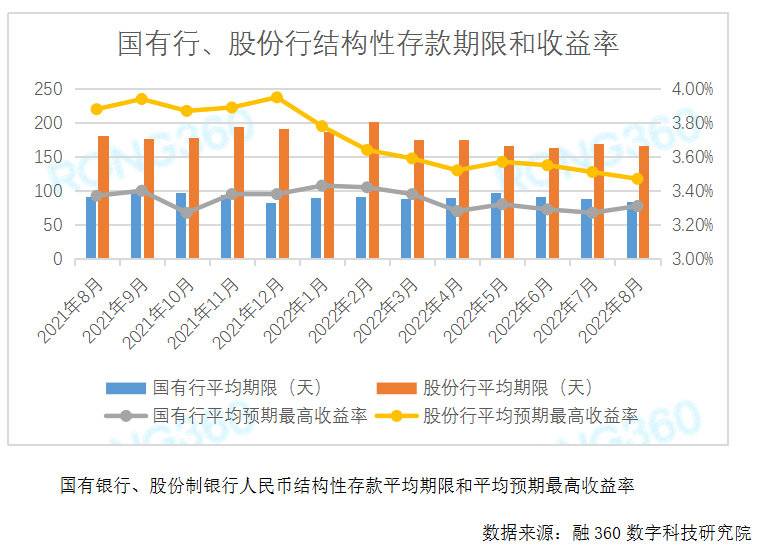

The average expected maximum return on shares continues to fall

From the perspective of different types of banks, the average structural deposit period of state -owned banks in August was 84 days, which was reduced by 5 days from the previous month. The average expected maximum rate of return was 3.31%, which increased by 4bp from the previous month. Last month shortened 3 days, the average expected maximum rate of return was 3.47%, a decrease of 4bp from the previous month; the average period of urban commercial banks was 119 days, which was shortened by 2 days from the previous month. The average period of banks is 351 days, and the average expected maximum rate of return is 5.88%, an increase of 113bp from the previous month.

Among the four state -owned banks that issued structural deposits, the average expected maximum return rate of Agricultural Bank in August was 1.88%, which was flat month -on -month. It is 3.39%and 3.4%, which is relatively high in state -owned banks.

The second round of the deposit interest rate will be reduced during the year

On September 15th, a number of state -owned banks and joint -stock banks lowered the interest rate of living deposits, regular deposits and large deposit deposits. Among them, the 3 -year interest rate was reduced by 15bp, the other regular interest rates were reduced by 10bp, and the current interest rate was reduced by 5BP. The 5 -year deposit interest rates have different adjustments, and some state -owned banks have been reduced to 2.65%, a decrease of up to 50bp.

This interest rate is reduced, especially the 3 -year and 5 -year interest rate, which involves a wide range of scope, and the current and short -term interest rates are completely reduced. In addition, some banks are eaten tightly, and individual large and medium -sized banks cannot be purchased.

In the past two years, bank deposit interest rates have experienced three sharp adjustments. In addition to this time, the deposit interest rate quotation method was adjusted in June 2021, and the upper limit of the bank's long -term deposit interest rate was greatly reduced. In April 2022 The joint -stock banks first lowered the long -term deposit interest rate, and local banks followed up in May to reduce interest rates.

Cover reporter Ran Zhimin

- END -

Taxi drivers who have not changed a civil servant now, what's going on now?

With the deepening of the degree of the internal society, there is another wave of...

Shijiazhuang City starts small catering quality improvement and online catering "food safety sealing" activity

The launching ceremony of the quality improvement of small catering in Shijiazhuan...