The liquor industry in the change: it has crossed the off -season sales, but is it still difficult to speak in the second half of the year?

Author:Daily Economic News Time:2022.09.18

In the second quarter of the off -season, it was overlapping for more than half a year's epidemic. In the first half of 2022, it was difficult for liquor companies to speak easily.

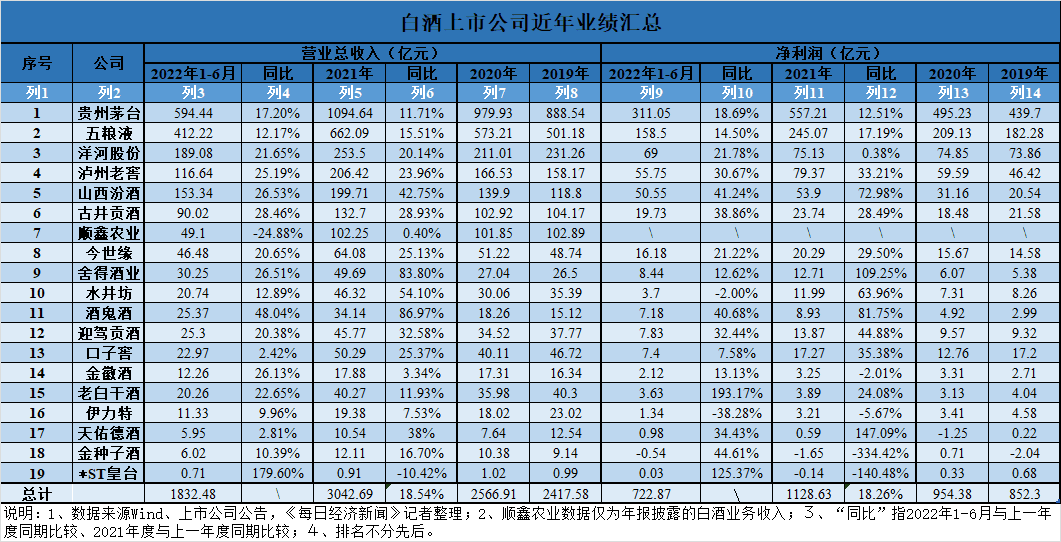

However, from the first half of the transcript, the toughness of the liquor industry still exists. Of the 19 listed companies, 18 were profitable, and the top five in the top five achieved revenue of exceeding 100 billion yuan. Specifically, the high -end process is still the "victory player" of liquor companies under fierce competition. Shunxin Agricultural (SZ000860, the stock price of 20.37 yuan, and a market value of 15.11 billion yuan), which is known as the "King of Luming Wine". In the first half of the year, it became the only company of 19 liquor listed companies with a decline in revenue.

Regarding the lack of consumption scenarios caused by the epidemic factors in the future, on September 14, Wang Xinguo, president of the China Alcohol Circulation Association, suggested in an interview with the reporter of the Daily Economic News: Don't put too much pressure on the market. It is relatively stable in price, and you can't always want to increase prices. This is not good. "

In the first half of the year, the transcript of the wine company showed toughness

In the first half of the year when the epidemic was affected by the epidemic, the liquor industry handed over a semi -annual transcript full of toughness.

Generally speaking, the China Wine Industry Association data shows that in the first half of 2022, the total brewing output of liquor companies above designated size above designated size was 37.509 million liters, an increase of 0.42%year -on -year; the cumulative product sales revenue was 343.657 billion yuan, a year -on -year increase of 16.51%; the cumulative realization was achieved; The total profit was 136.670 billion yuan, a year -on -year increase of 34.64%.

At the specific performance level, Wind data shows that in the first half of 2022, 19 liquor listed companies achieved a total of 183.248 billion yuan in revenue, with a net profit of 72.287 billion yuan.

Of the 19 white wine listed companies, 15 wine companies maintained a double -digit revenue growth rate in the first half of the year; 18 wine companies remained profitable. Yuan) Lost loss. Regarding the cause of loss, gold seed wine said that on the one hand, because the company's liquor product structure is in the adjustment period, the sales of sub -high -end products account for relatively low sales, and the comprehensive sales gross profit is relatively low; on the other hand, due to the domestic epidemic prevention and control in the first half of the year, As a result, sales decline.

In the first half of the year, Guizhou Maotai (SH600519, stock price was 1859 yuan, market value was 2335.272 billion yuan), Wuliangye (SZ000858, stock price was 161.08 yuan, market value of 625.249 billion yuan), Yanghe shares (SZ002304, stock price was 145.02 yuan, market value was 218.543 billion yuan), and Luzhou Old The cellar (SZ000568, the stock price is 218 yuan, the market value is 320.812 billion yuan) and the Shanxi Fenjiu (SH600809, the stock price is 289.5 yuan, and the market value is 353.211 billion yuan) as the top five wine companies, all of which have achieved revenue of more than 10 billion. Among the 19 companies, the top five wine companies contributed a total of nearly 80%of the total revenue, and the proportion of net profit accounted for nearly 90%.

Specific to the second quarter of the plain period of the liquor industry, Wind data shows that except for the Gujing Gongjiu (SZ000596, the stock price of 256.6 yuan, the market value of 119.019 billion yuan) and the old white dry wine (SH600559, the stock price of 23.38 yuan, and the market value of 21.387 billion yuan) Family wine companies, the growth rate of revenue in the second quarter declined compared with the first quarter.

However, Guoxin Securities Research Report shows that, as a whole, the revenue and net profit growth of the liquor sector in the second quarter were 10.6%and 12.9%, respectively. From the perspective of the annual rhythm, the second quarter is the low demand for liquor, and the whole year may show the trend of "front low and high".

In addition, in the first half of the year, a number of wine companies exerted live and e -commerce channels. Shanxi Fenjiu's semi -annual report mentioned that during the "618" shopping festival in 2022, the official sales of JD Fenjiu's official flagship store maintained the first flagship store in the liquor brand, and the top three in the industry in Tmall Fenjiu's official flagship store; 23.5 yuan, a market value of 11.091 billion yuan) The semi -annual report showed that during the reporting period, its e -commerce company's key deployment online goods festival, "6 • 18" activities, in terms of important resource levels, promotion activities, live broadcast and cargo, etc. , Achieve sales revenue of RMB 63 million, an increase of 19.86%year -on -year.

Wang Xinguo believes that although e -commerce is also a way, "but it will never be offline. It can only be a new way of sales, new channels, but it cannot replace offline."

For the transcripts of the liquor industry in the first half of the year, Hou Hao, deputy director of the Investment Department of China Merchants Fund, and the manager of China Merchants China Securities Liquor Fund, told the reporter of "Daily Economic News" that the performance in the first half of the year is for most wine companies. A good transcript, there are some very eye -catching companies in this transcript. "It may achieve this achievement through some channel changes or the price system, or through its own efforts and grasp of regional market opportunities, and some of them are worthy of highlights."

The industry Matthew effect continues to strengthen

Regarding the performance of the liquor industry, Wang Xinguo's observation summarizes: a minority of high -end selling well, and the middle and low -end or the emerging liquor brands in the past two years are facing sales pressure.

From the perspective of performance, the Matthew effect of the liquor industry is becoming more and more obvious. In the first half of the year, Guizhou Moutai and Wuliangye's two heads were revenue of 98.839 billion yuan, and the other 17 wine companies realized operating income of 84.189 billion yuan. At the same time, high -end products of head wine companies grew bright in the first half of the year. Taking Wuliangye as an example, in the first half of this year, high -end products including the main product "Puwu" brought revenue of 31.973 billion yuan, an increase of 17.82%year -on -year. But on the other hand, other wine products including Lane Chun and other low -priced products decreased by 6.10%year -on -year to 6.540 billion yuan. In the first half of the year, the revenue of the mid -to -high -end liquor of Yanghe and Luzhou Laojiao was 16.2 billion yuan and 10.4 billion yuan, respectively, accounting for 88%and 90%of the company's alcohol revenue; In the first half of the year, sales revenue was 6.1 billion yuan, a year -on -year increase of 56%.

Photo source: take by reporter Zhu Wanping (data map)

The Guotai Junan Research News mentioned that high -end is a necessary condition for nationalization. The nationalization of the white wine cycle in this round of liquor cycle began in the context of industrial structural prosperity. High -end and higher -priced large products are necessary conditions for wine companies to achieve nationalization.

On the other hand, local wine companies on the low -end route are more affected by the epidemic, and even some companies have suffered losses.

In the first half of this year, the revenue of the Beijing local wine company Shunxin agricultural liquor business, which is famous for "Niulan Mountain", has declined significantly. In 2021, the company's high -end and low -end wine revenue also showed a growth trend year -on -year. In the first half of this year, the company's high -end, mid -range wine, and low -end wine revenue fell. Among them, high -end wine revenue fell 55.2%year -on -year, and low -end wine income fell more than 20%.

"Drink less and drink better", gradually becoming a new trend of liquor consumption, high -end card battle, is still the "victory player" for liquor companies to deal with fierce competition.

Mid -Autumn Festival liquor sales "bland"

"This year's Mid -Autumn Festival liquor sales are not very good. Because of the impact of the epidemic and other factors, the consumption scenarios have become less. Many places can not go out and have less communication. Since last year, the market has a large inventory, and (inventory situation) is not very good. Ideal. "Wang Xinguo said.

Wang Xinguo said nothing.

Relevant sources of a liquor listed company said that at present, the current problem of unsatisfactory terminal sales in the wine industry is that the main reason for this phenomenon is that the current lack of consumption scenarios leads to insufficient terminal consumption power. Not only that, in the second and third quarters, it is the off -season of liquor consumption, so consumption will be reduced.

On September 13, Wang Quanzhou wine merchant in Fujian revealed to reporters on the phone that his sales amount of Mid -Autumn Festival this year was only over 200,000 yuan. Although the sales increased dozens of times year -on -year, it was because the Quanzhou was impacted by the epidemic last year, and the sales volume fell to the bottom. The monthly sales were only 12,000 yuan. "At that time, it was not a cut, but to the ankles." During the Mid -Autumn Festival in previous years, under normal circumstances, Wang Wei's sales were at the tens of millions of levels.

"No one dares to say that he is good now, except for selling Moutai." Wang Wei said.

The Quanzhou, where Wang is located, did not have an epidemic during the Mid -Autumn Festival this year, but according to his observations, the local spending power is not as good as before. "This year, Fujian is also affected by the epidemic, but better than last year. However, compared with 2019, it does not reach 1/3 of 2019." Wang said.

Right now, the only thing that makes Wang feel more at ease is that unlike fruits such as fruits, liquor can be stored, and it will not be bad for a while. "At least don't worry about smashing it in your hand." Wang said.

Photo source: take by reporter Zhu Wanping (data map)

"Last year, we had some predictions about some things (liquor markets). Before that, everyone also expected that there would be some differentiation in the liquor market this year, but I did not expect that this year's sales scene will be such a process of interpretation." Hou Hao told reporters told reporters to reporters Essence

"From June to August this year, the operating conditions of wine companies have improved from the previous month, but the recent outbreak has spread multi -point, some areas have tightened prevention and control, the frequency and scale of banquets have declined. The channel side is relatively pressured, and the wine companies are cautious and optimistic about the annual goals. "On September 13, Huachuang Securities stated in a research report.

Can the National Day season "return"?

During the Mid -Autumn Festival this year, an epidemic occurred in Chengdu, Beijing, Guiyang, Shenzhen and other places, which caused the sales of liquor to some shock. "During the Mid -Autumn Festival this year, we closed the business for 8 days, and the sales were only about 80 % of the same period last year." An Chengdu wine merchant told reporters.

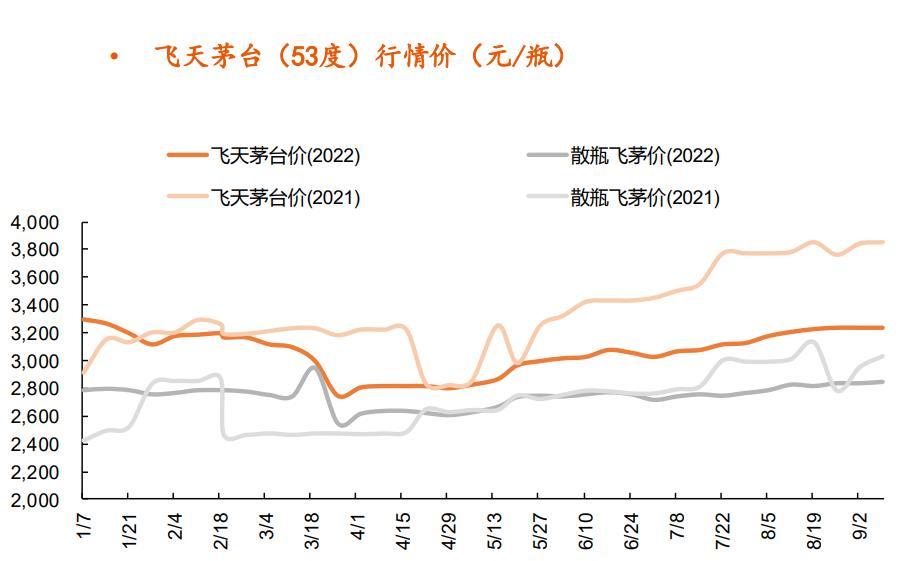

However, although the sales side is cold, there is no selling wave on the channel side, which is also manifested in the batch price of high -end liquor after the Mid -Autumn Festival, and the price trend is relatively stable. According to industry media statistics, as of September 15, domestic high -end liquor prices such as Feitian Maotai, Wuliangye, and Guojiao 1573 were relatively stable. Feitian Maotai's 22 -year loose batch price of 2740 yuan/bottle, about 80 yuan/bottle compared to the Mid -Autumn Festival; Wuliangye's batch price is about 980 yuan/bottle, and the 1573 batch price of Guojiao is about 920 yuan/bottle. Compared with the Mid -Autumn Festival, basically changes are changed. Not big.

Picture source: Screenshot of Research Report

"On the whole, the epidemic has a small impact on high -end wine. After all, consumer groups have strong ability to resist risk." Wang Wei said.

The main thing is the mid -end liquor product of 300 yuan. Originally, his consideration was that "the southeast coastal provinces are relatively economical and have a stronger purchasing power." "Now, unless people do need it, they will purchase goods. They will never be like before, as long as they are optimistic about this product, they will dare to win." Wang Wei said. For the National Day market after the Mid -Autumn Festival, Wang Wei is not optimistic.

Wang Xinguo, who is similar to Wang Wei. "I think the consumption of liquor may not be too much when the Spring Festival," he said.

However, on September 14, a listed wine company in East China told reporters that from the perspective of the Shanghai epidemic in the first half of the year, the liquor consumption will indeed have a certain replenishment after the epidemic is over, but the overall replenishment volume must not have no amount of replenishment. Lost more. "Liquor consumption is still related to the scene. After that solar terms, there will be no existence." It said.

In the current environment, what are the suggestions for wine companies? Wang Xinguo said: "The wine companies should increase brand propaganda, and at the same time, they must hold their breath and do not put too much pressure on the market. It is relatively stable in keeping the price, and you can't always want to increase prices. That's not working."

"Although the current environment is complicated, the liquor industry will still move forward. Even some liquor companies, I believe there is a lot of room for development in the future. Wine is the incense of Chen. The changes in consumer habits are actually the least affected. "Hou Hao also admits that the business model of the liquor industry determines that the inventory is worthy of time. As long as it is on the correct path, it will be able to obtain value -added space in the future.

Daily Economic News

- END -

In the first 7 months, Sichuan foreign trade increased by 12.7% year -on -year higher than the overall level of the country

Cover reporter Ma MengfeiOn August 11, the reporter learned from Chengdu Customs t...

Shandong grain acquisition loan credit guarantee fund has fully operated to effectively alleviate th

On the morning of June 14, the Shandong Provincial Government News Office held a p...