Ministry of Finance: In August this year, the increase in tax revenue in the country has increased from negative to normal public budget income from April.

Author:Daily Economic News Time:2022.09.18

The latest news shows that in August this year, the increase in tax revenue in the country has achieved negative to positive.

A few days ago, the website of the Ministry of Finance issued a document introduced in August 2022's fiscal revenue and expenditure. According to the data released this time, from January to August, the general public budget revenue of the country was 13804.3 billion yuan. After deducting the retained tax refund factors, it increased by 3.7%, and the calculation of the natural caliber decreased by 8%.

Source: website of the Ministry of Finance

In the current period, the national tax revenue was 11324.9 billion yuan. After deducting the retained tax refund factors, it increased by 1.1%, and the calculation of natural caliber decreased by 12.6%; non -tax revenue was 2479.4 billion yuan, an increase of 21.2%over the same period last year.

It is worth noting that according to CCTV reports, in August, the national tax revenue increased by 0.6%, achieving negative to positive, and after deducting the retained tax refund factor, it increased by 5.5%year -on -year.

From January to August, the national general public budget revenue deduction increased by 3.7% after retained tax refund factor

"Daily Economic News" reporter noticed that on September 16 this year, the official website of the Ministry of Finance released data related to the financial revenue and expenditure in August 2022.

According to the data released this time, from January to August, the general public budget revenue of the country was 13804.3 billion yuan. After deducting the retained tax refund factors, it increased by 3.7%, and the calculation of the natural caliber decreased by 8%. The reporter noticed that this is the cumulative data decline in general public budget revenue for three consecutive months.

Source: website of the Ministry of Finance

Specifically, of which, the general public budget revenue of the central government increased by 6361.6 billion yuan. After deducting the retained tax refund factors, an increase of 2.8%, and a decrease of 9.7%according to the natural caliber. The increase of 4.5%, a decrease of 6.5%according to the natural caliber. The national tax revenue was 11324.9 billion yuan. After deducting the retained tax refund factors, it increased by 1.1%, and the calculation of natural caliber decreased by 12.6%; non -tax revenue was 247.94 billion yuan, an increase of 21.2%over the same period last year.

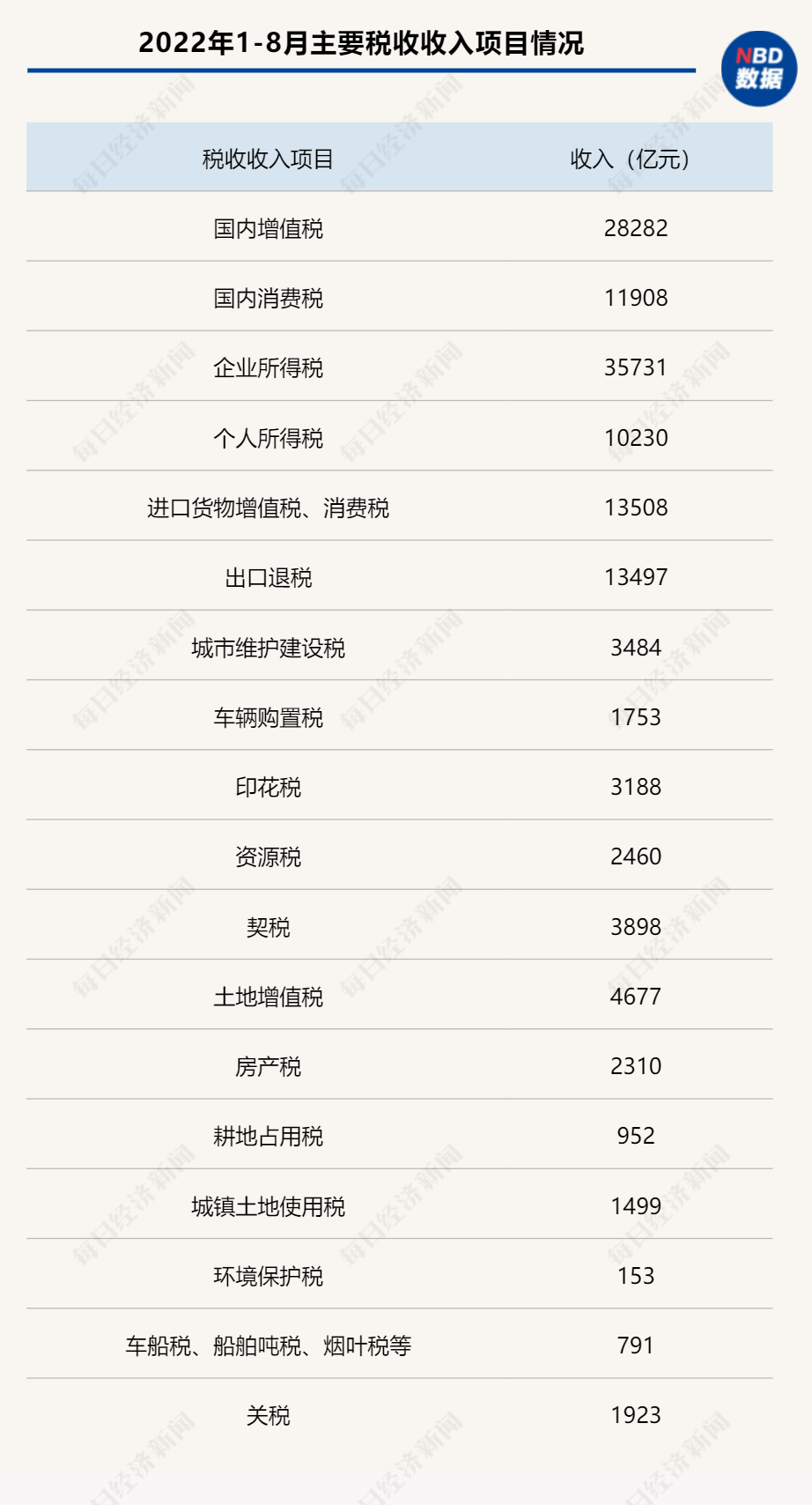

From the perspective of the main tax type, the domestic consumption tax increased by 8.7%compared with the same period last year, the corporate income tax increased by 2.5%over the same period last year, and the personal income tax increased by 8.9%compared with the same period of the previous year. The domestic value -added tax was 2828.2 billion yuan, and it increased by 1.4%after deducting the retained tax refund factors. The export tax refund has refunded 207.8 billion yuan over the same period last year, an increase of 18.2%, which has effectively promoted the steady development of foreign trade exports.

There are many aspects such as scientific and technological expenditure grow rapidly

It is worth noting that after the relevant news of the Ministry of Finance was released, according to CCTV News, the Ministry of Finance data showed that in August, the national tax revenue increased from negative to positive. Data show that in August, the national tax revenue increased by 0.6%, achieving negative to positive, and after deducting the retained tax refund factor, it increased by 5.5%year -on -year.

In addition, it is reported that in August, after the deduction of reserved tax refund factor in general public budget revenue across the country, it increased by 9.5%over the same period last year and 5.6%according to the natural caliber.

The relevant person in charge of the Ministry of Finance said that this is mainly to stabilize the effectiveness of the economy's policies to continue to appear, and the economy continues to resume the development trend; after the large -scale retaining tax refund redefrontation tasks are basically completed, the income factors are obviously weakened. The income increased by 5.6%according to the natural caliber, and has achieved positive growth for the first time since April.

Li Chao, chief economist of Zhejiang Business Securities, told reporters of "Daily Economic News" through WeChat that the stronger fiscal revenue performance reflects economic restoration that drives the steady growth of fiscal revenue.

Li Chao said that after the concentrated large -scale reduction tax reduction and the impact of the impact of the epidemic, it can be used through a series of normalized epidemic prevention and control measures to coordinate economic growth and epidemic prevention and control to achieve normalized growth, thereby driving the general public budget income significantly significantly Stability, the fiscal revenue of deducting taxes, revenue reduction and reduction in June and July has improved significantly compared with April and May, and this view is verified on the side.

In August, although the domestic epidemic and real estate disruption of economic restoration process, a series of normalized epidemic prevention and control measures effectively coordinated economic development and epidemic prevention and control, and the operation of the industrial production and service industry improved significantly compared with the beginning of the year. On the basis of the base at the end of August last year, after the deduction of tax refund factor in general public budget revenue in August in August, it increased by 9.5%over the same period last year.

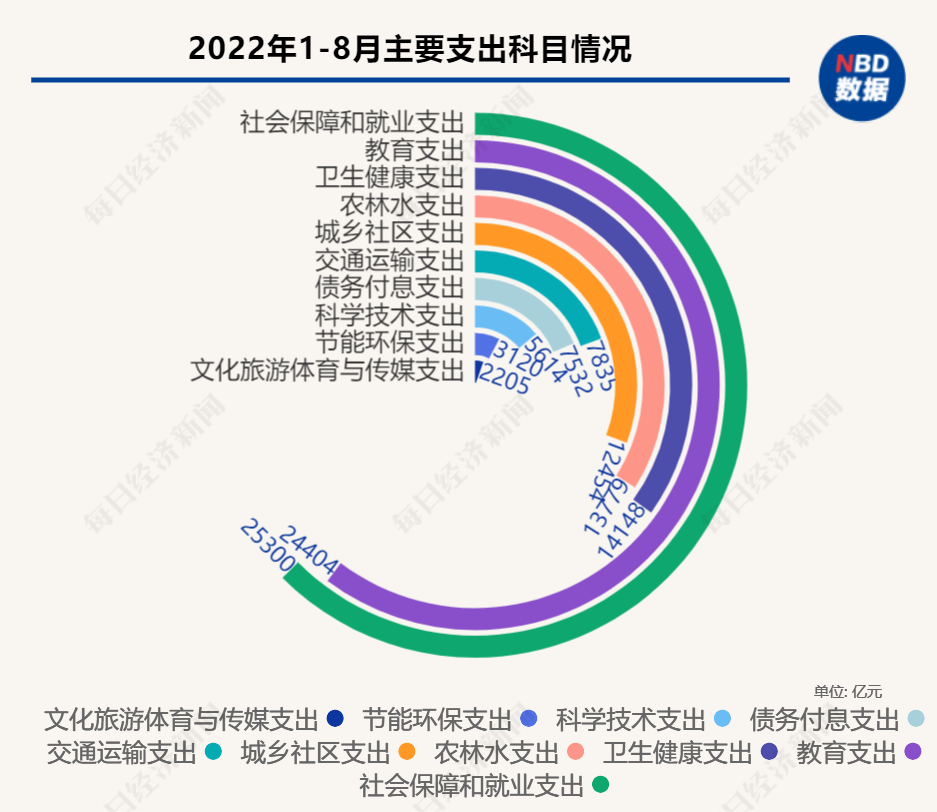

In terms of general public budget expenditures, data showed that from January to August, the general public budget expenditure across the country was 16517.7 billion yuan, an increase of 6.3%over the same period last year. Among them, the general public budget of the central government was 2116.3 billion yuan, an increase of 6.7%over the same period last year; the local general public budget expenditure was 14401.4 billion yuan, an increase of 6.3%over the same period last year.

Source: website of the Ministry of Finance

"Daily Economic News" reporter noticed that expenditures such as scientific and technological expenditures increased rapidly. From the data released by the Ministry of Finance, from January to August, scientific and technological expenditures were 561.4 billion yuan, an increase of 20.6%over the same period last year; transportation expenditure was 783.5 billion yuan, an increase of 11.3%over the same period last year; 8.9%over the same period last year.

Li Chao said to the reporter of "Daily Economic News" that from the latest data, the fiscal expenditure structure in 2022 is similar to 2020. On the one handIn terms of active implementation of the Sanbao, the mainstay of the market subject, the progress of social security -related expenditures is significantly ahead of other fields, and the expenditure of transportation under the demands of steady growth has also performed active.Daily Economic News

- END -

Wealth Weekly Dynamic Prospective | This week will announce the economic data of August. A total of 10 new shares will be issued

A -share1. From June 1st to September 8th, 55 A -share companies released their ho...

Gongling Ling City, Jilin Province, strengthen the corn industry chain -black soil planting "golden business card"

Figure ① On June 24, in the cornfield made by Mi Doujian, Dongxing Longong Machin...