Haitong Strategy: This round of adjustment has come to an end, and the value of the value of the value of the Taiwanese

Author:Broker China Time:2022.09.18

Source: Stock Market Xunye ID: xunyugen

Core conclusions: ① Adjustment since July 5th, the valuation of A shares is close to the end of April. The fundamentals are better than the time, the market has reversed, and the new low probability is small. ② Drawing on the background of the first five market reversal in the first five markets, the adjustment of this round of adjustment has come to an end. Even in 2018, 2018, 2018, and 2008, there are two waves of opportunities. ③ From the analysis of the intensity of the screened comparison and stable growth policy, the style is difficult to change, and the market stability path may be the growth of the value of the Taiwan.

Recently, a relatively obvious decline in A shares has caused some investors to worry about whether the market will fall below the low end of April, and whether there will be a new round of decline in the future. In this regard, this article will analyze the above issues through comparison of the current market environment and characteristics.

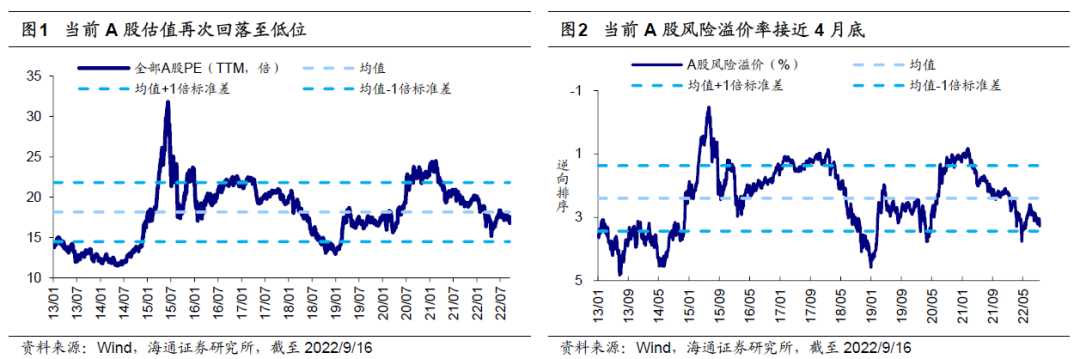

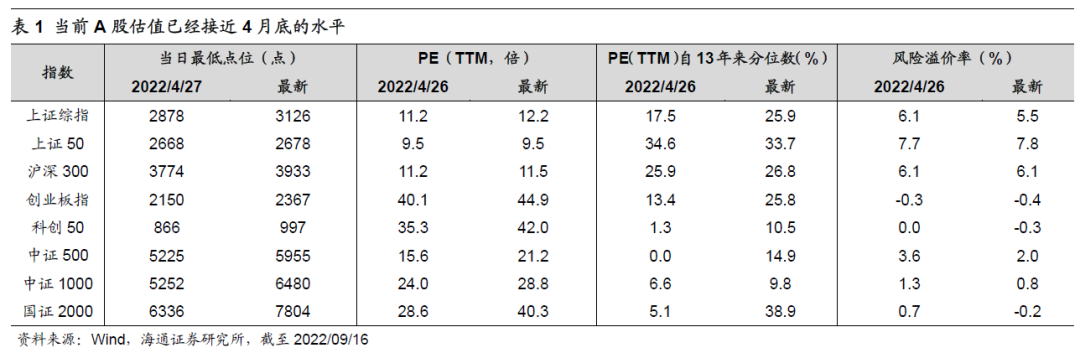

After the adjustment since July 5, the valuation of A shares returned to the end of April. In the past week, the market has fallen relatively in the past week. The largest decline in the Shanghai Stock Exchange 50 was 3.7%in the week, the Shanghai and Shenzhen 300 was 4.7%, and the GEM refers to 7.9%. In fact, the market has been adjusted since July 5th, and the index has fallen greatly. As of September 16, 2022 (the same), the largest decline in the Shanghai Stock Exchange 50 was 13.1%, the Shanghai and Shenzhen 300 was 13.2%, the GEM refers to 18.0 at 18.0 %. On September 16th, the Shanghai Stock Exchange 50 Index fell to 2678 points, which was approaching 2668 points on April 27, which also caused investors to worry about the market's lower low. Except for the Shanghai Stock Exchange 50, the other index is still higher than the end of April, but the valuation of each index has been returned to the level at the end of April. The number is 15.2 times/26.3%, the Shanghai and Shenzhen 300 is 11.2 times /25.9%, the GEM refers to 40.1 times /13.4%, and the latest value of all A shares is 16.8 times/32.7%, the Shanghai and Shenzhen 300 is 11.5 times /26.8% The GEM refers to 44.9 times /25.8%. At the same time, from the perspective of risk premium, the current risk premium rate of all A -share risk is 3.28%, close to 3.75%on April 26. The 50 risk premium rate of Shanghai Stock Exchange is already higher than the end of April. The level of the current market can be seen that the current market has been fully released.

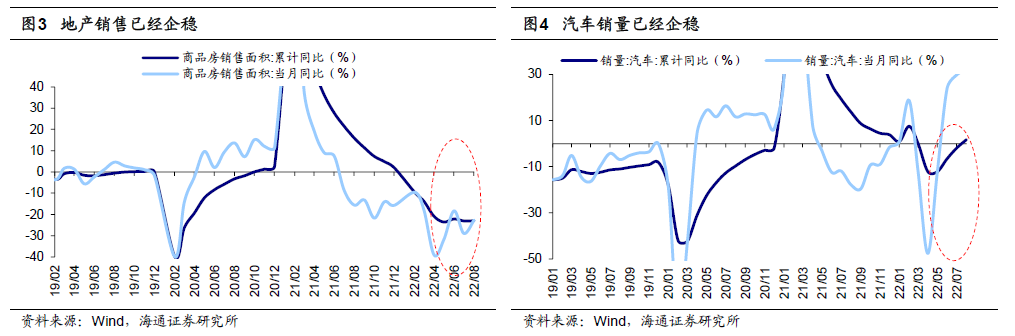

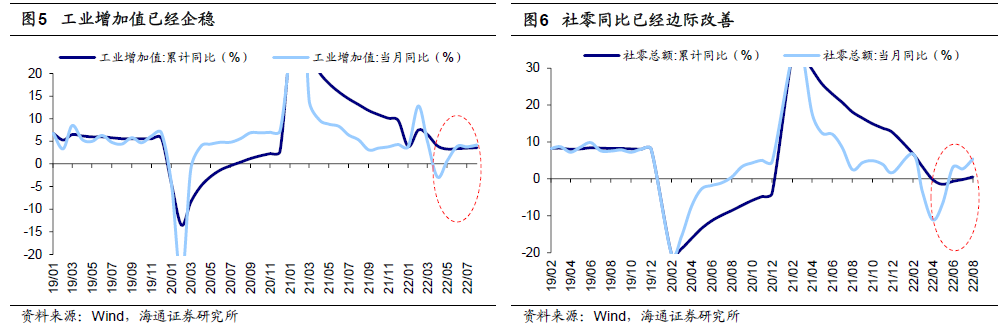

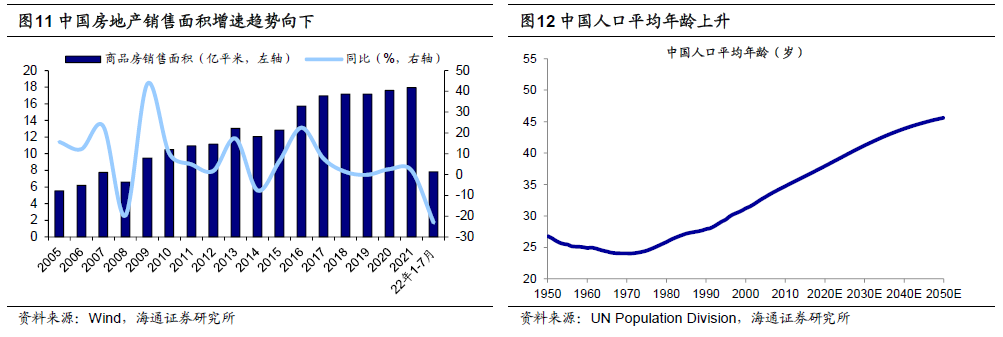

The probability of low market innovation is very small, and the market has reversed at the end of April. At present, some investors are worried that the market will be renewed, but we judge that the low point at the end of April is the reversal bottom. We have been emphasizing in many previous reports that from the perspective of the investment clock and the cycle of the bull and bear, the market is low on April 27th. It was the bottom of 3-4 years. At that time, the valuation bottom had appeared. Three of the five fundamental leading indicators (monetary policy, fiscal policy, and manufacturing prosperity) had been rebounded. Sales) Gradually stabilize, that is, confirm the market reversal. Economic data in the past few months has also confirmed our point of view. The accumulation of real estate sales has been stabilized year-on-year. The year-on-year low of the month has been recovered from April to 22.6%in August. From -12.1%in April to 1.7%in August, it reached 32.0%year-on-year in August. From the perspective The month rose from -2.9%in April to 4.2%. In addition, the domestic epidemic was serious in April, especially the outbreak of the Shanghai epidemic on the economy has a greater impact on the economy. The current impact of the epidemic is relatively weakened, and the suppression of the epidemic has eased consumption. -11.1%in April rose to 5.4%. Therefore, the current economic situation is better than at the end of April, and we think that the market has a low probability of renewing the low.

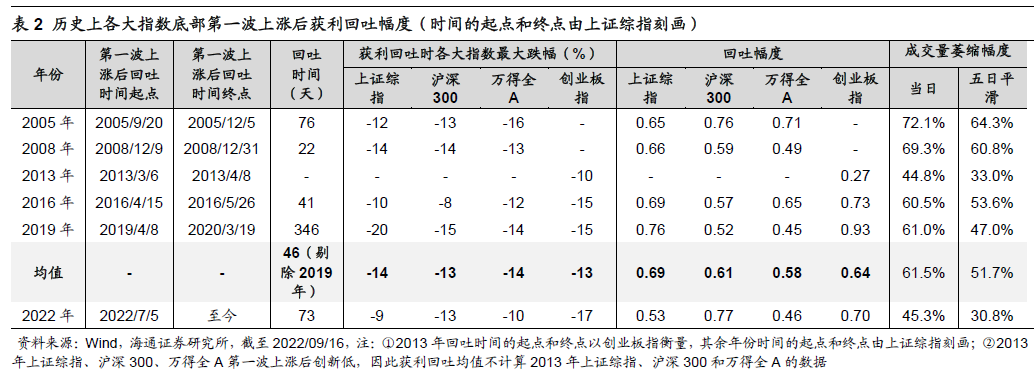

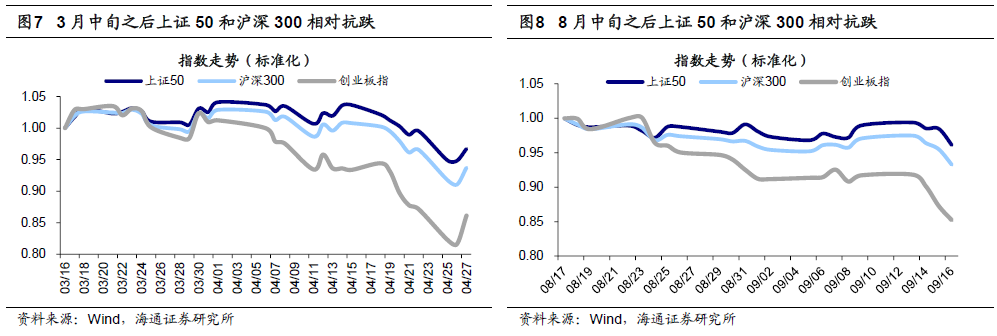

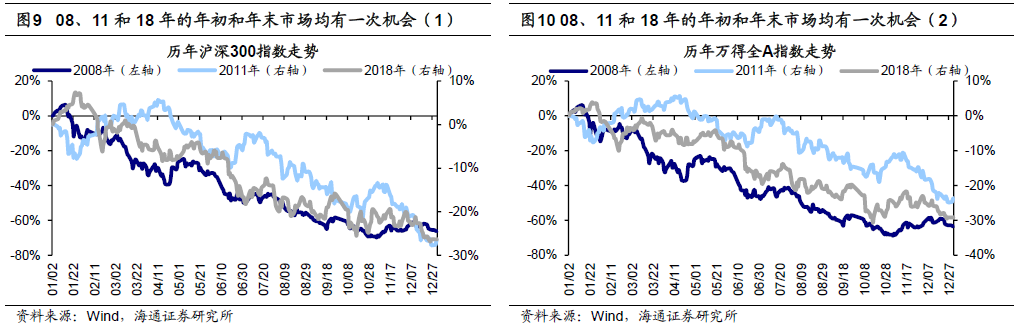

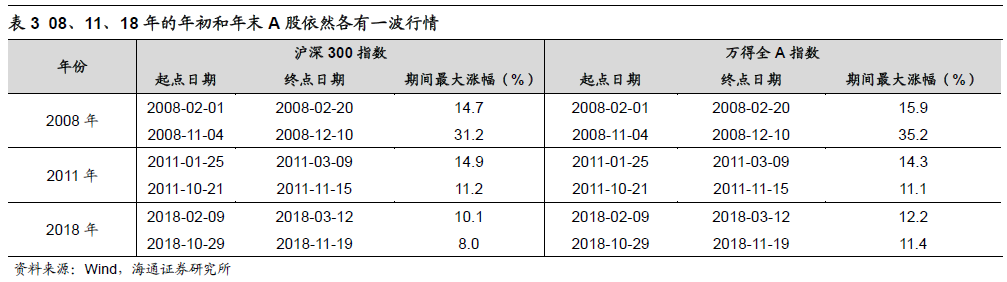

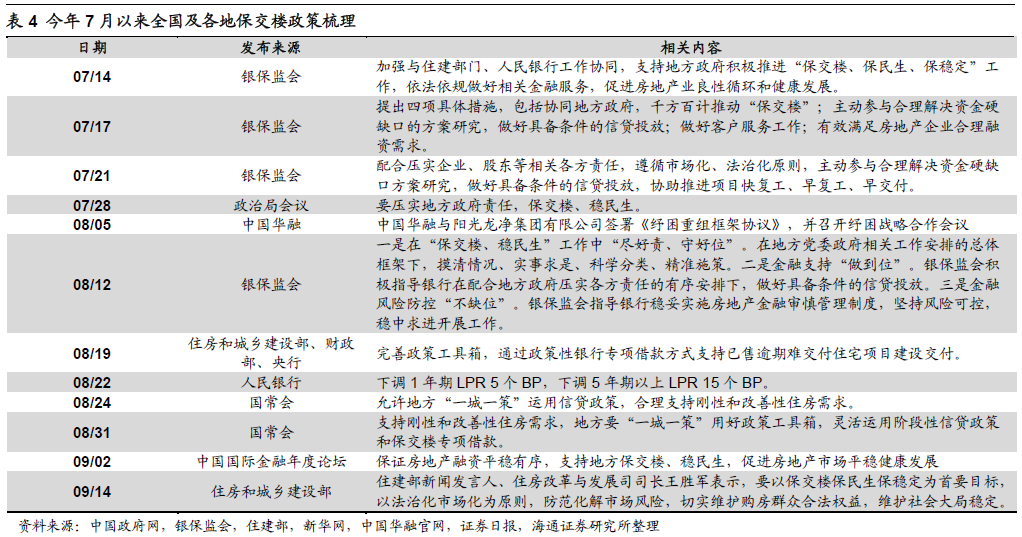

Since July 5th, the adjustment of the second retreat has ended. The decline since July 5 is the entry and retreat after the market reversal at the end of April. At present, this round of adjustment is close to the end. From the general perspective of the market, the first wave of rising quotes after the bottom of the five bears in the history of the history of the history, and the market will often make a profit. In the process, the Shanghai Stock Exchange Index fell 46 days on average. All A. GEM refers to an increase of about 13%of the retracement of about 13%, and the upsurge in the early stages of an increase of about 0.5-0.7. At present, the adjustment since July 5 has lasted 72 days, of which the Shanghai Composite Index has fallen by 9%(0.53 of the early increase in the early stage), the Shanghai and Shenzhen 300 300 dropped 13%(0.77 in the early stage of the vomiting), Falling 10%(0.46 of the early increase in the early stage), and the GEM fingers fell 17%(0.70 in the early stage of the period). In addition, during the historical profit, the average contracted volume of the total A transaction was 62%(52%smooth on the 5th). See Table 2 for details. As of September 16, 2022, the total A transaction volume of A was reduced by 45%compared with the previous high, and the 5 -day smooth caliber was reduced by 31%. From a structural point of view, historical adjustment usually falls first and then grows. Adjustment of later value often stabilizes and grows first. With reference from the decline in March-April, from mid-March to the end of April, the Shanghai Stock Exchange 50 and the CSI 300 began to fluctuate, and they fell at the end of April. The overall performance was stronger than the GEM finger. The current market style also has the same characteristics. Since mid -August, the Shanghai Stock Exchange 50 and the CSI 300 have been flat, but the GEM finger has continued to fall. In summary, combined with the exponential exponential spitting range, the sewage of the transaction volume, and the characteristics of the market -style structure, the adjustment of this round has reached the later period. Drawing on the weakest three years in history, there may be two opportunities in the year. This year is a difficult year for A shares, and investor confidence has been impacted. However, looking back at history, the three years in 2008, 2011 and 2018 were unilateral bear markets. The largest declines in the three years of CSI 300 were 72%, 33%, and 33%, respectively. 25%. Nevertheless, in these three natural years, there are still two investment opportunities at the beginning of the year and the end of the year, and the increase in the two rising markets has basically exceeded 10%. For details, see Table 3. And this year has only been in this round of the end of April to the beginning of July. Therefore, drawing on historical laws, we believe that there may be an investment opportunity during the year. So what is the catalyst of the rising market in the future? We believe that it is a steady growth and the implementation of the policy of maintaining diplomatic relations. In order to stabilize the economic market, the State Frequently proposed on September 7th that more than 500 billion yuan of special debt limits settled in the local area since 2019. All places must be issued by the end of October to give priority to supporting projects, and formed more physical workloads during the year, and more physical workloads have been formed during the year. Essence In addition, one of the reasons for market adjustments since July 5 is the impact of the "stop loan" incident, which has aroused investors' concerns about fundamentals. Therefore, in order to stabilize the market expectations and the emotions of home buyers, the implementation of the policy of maintaining the policy is still the focus, and it may need to be supported by the top and bottom through the special loan of policy banks to support the insurance diploma. On August 31st, the State Frequently proposed that supporting rigid and improving housing demand, local "one city, one policy" should be used to make good use of policy toolboxes, and flexibly use phased credit policies and special borrowings of insurance diplomatic relations; on September 14 It is necessary to take the stability of the security of the people's livelihood as the primary goal, based on the principle of marketization of the rule of law, and prevent the resolution of market risks.

Insufficient conditions for style switching, the path of stable markets may be valuable to stand up and grow up. Regarding the style, we have previously analyzed that the A-shares 3-5 years of style switching, and the relative trend of prosperity is a decisive variable. According to the latest disclosed interim reporting data, the net profit of the National Certificate of the Q2 National Certificate in 2022 was 10%in a single quarter of the mother's net profit, and the value of the national certificate was 3%. -6%is widening, so it is difficult to have a large reversal from the view of the prosperity cycle. Will that style have a staged swing? We resumed two style switching at the end of 2012 and 2014. At that time, a more obvious policy catalysis appeared. For example, after the 18th National Congress of the Communist Party of China at the end of 2012, investors expected to heat up the reform, and the central bank's asymmetric interest rate reduction in November 2014. Back to the moment, the central bank issued a statement on September 16th that the central bank said "not engaged in large water irrigation and the future of an overdraft". It's difficult to reproduce. In the context of a gentle economic recovery, the value will be stabilized, and the growth is expected to be better than value because of the higher prosperity. That is, the path of stabilizing the market is more likely to be valuable to set up and grow up.

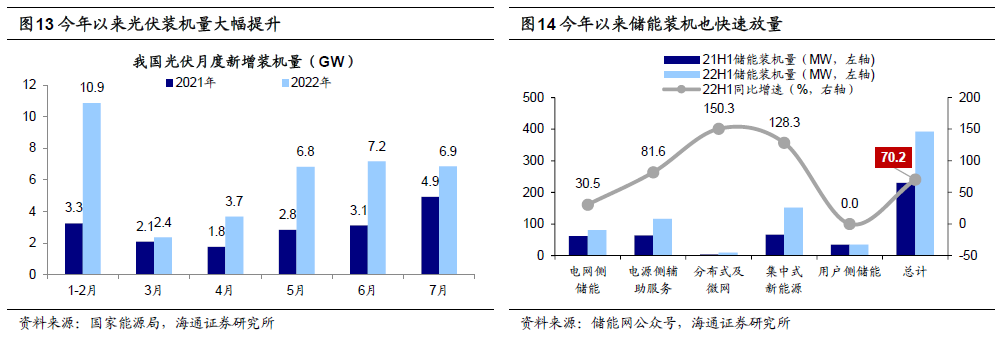

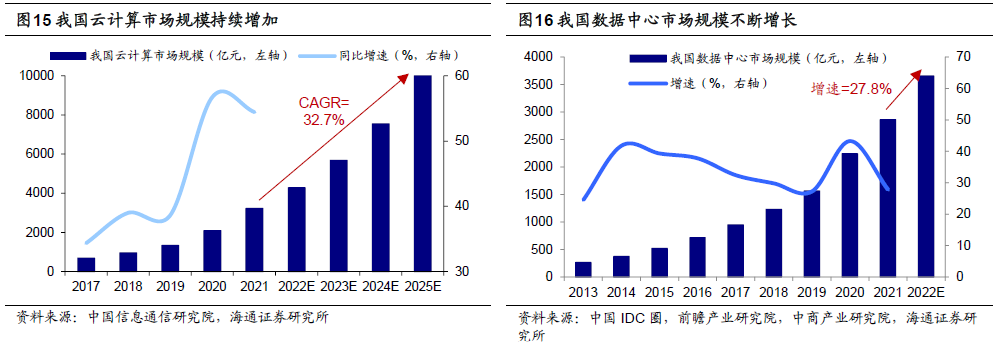

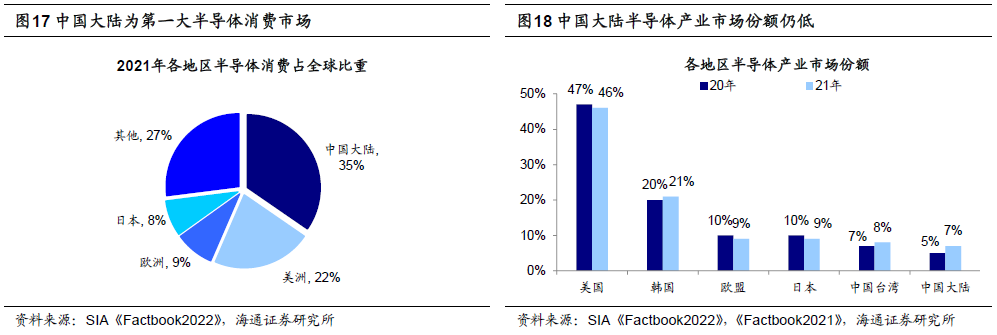

At the industry level, continue to be optimistic about the growth of high prosperity, such as new energy and digital economy. Recently, the growth sector has fallen a lot due to changes in overseas policies. In fact, from the perspective of the industry's fundamentals, the high prosperity of the growth industries such as the new energy and digital economy is still there. For example, the retail sales of new energy vehicles in August will increase %, It is expected that the sales of new energy vehicles will reach 6.5 million vehicles throughout the year. Policy support in the digital economy -related fields is also increasing. On July 28, the Central Political Bureau meeting of the Central Committee of the Political Bureau of the Central Committee "implemented normalized supervision of the platform economy and focused on the launch of a batch Investment is constantly increasing. From the perspective of autonomy, the new energy and digital economy is still worthy of attention. What are the opportunities to be autonomous and controllable in the four major areas? -20220815 We have analyzed that the Russian -Ukraine conflict and the European energy crisis deepen my country's concerns about the high degree of oil and gas dependence on oil and gas, and accelerating the development and application of new energy. It is the focus of energy autonomous and controllable. At present, the domestic new energy industry has advantages, and domestic and foreign photovoltaic air installed capacity will promote the increase in global market share of domestic enterprises. In terms of digital economy, the US "Chip and Science Act" and the possible Chip4 alliance will bring greater uncertainty to the security of my country's semiconductor supply. It is imminent to achieve autonomy of the core link of semiconductors in my country. Demand+policy -driven lower semi -conductive equipment (2%of the global market share of mainland Chinese companies) and materials (13%) domestic replacement will speed up. Risk reminder: inflation continues to rise sharply, and macro policies at home and abroad are tightening.

Editor -in -chief: Wang Lulu

School pair: Gaoyuan

- END -

Baishishan Town, Luohe City vigorously develops beef and beef breeding industry

In recent years, Baishishan Town, Luohe City has vigorously developed the beef cat...

Let's talk about 丨 Bao Tongbao Chang is the overall situation

Xu QingguangEconomy and society is a dynamic circulation system. While implementin...