Chuang Investment Weekly | Zhong'an State has a 50 billion satellite industry fund Del Technology financing exceeding 2 billion

Author:Zhongxin Jingwei Time:2022.09.17

Zhongxin Jingwei, September 17th (Deng Yiruo) This week (September 10th-September 16th), a total of 68 investment and financing incidents occurred in the domestic venture capital circle. The total amount of investment and financing was 7.3 billion yuan, including Fluorine new material developer Del Technology completed a Pre-IPO round of financing of 2.036 billion yuan, which was the largest financing incident disclosed this week. What are the dynamics of the first -level market worth paying attention to? Jingwei Jun combed you one by one.

【Key Focus】

The largest scale of financing: Del Technology, a new material developer, completed 2.036 billion yuan Pre-IPO round financing, is the largest amount of financing this week.

New Consumption: Nuts Reading Chain Brand Xue Ji Fixed Restaurant Complete 600 million yuan in Series A financing

Medical and Health: Biopharmaceutical Company, which focuses on providing breakthrough immunotherapy plans, completes about 400 million yuan in Series B financing

Automotive traffic: mid -to -high -end smart electric motorcycle companies Shark Bay Technology completes 10 million US dollars A round financing

Semiconductor and chip: New Energy Vehicle Drive IGBT Module Supplier Cui Zhan Microelectronics Complete nearly 100 million yuan round financing

Energy and Electricity: Lithium battery diaphragm manufacturer Hou Lifeng New Energy Complete 1.37 billion yuan D round financing

【Industry Information】

New consumption

Xue Ji repurchase completed 600 million yuan A round A financing

Xue Ji, a church chain brand Xue Ji, has completed a round A financing of 600 million yuan. This round of financing is jointly invested by Meituan Dragon Ball and Qisheng Capital. Xue Ji was founded by Xue Xingzhu in Jinan in 2002. It is a chain brand that integrates the research and development, production and sales of strong roasted products. Essence

Siku Group completes 200 million yuan strategic financing

Luxury e -commerce Tezu Group completes a strategic financing of 200 million yuan. This round of financing is invested by Aladdin Holdings Group to cooperate by subscribing to the shares of the Saku listed entity. Siku.com is a luxury e -commerce company. It has four core business segments of Siku Mall, Siku Intelligent, Siku Auction and Siku Financial. Conservation, re -circulation of luxury goods, and other all -round "one -stop" luxury professional services.

medical health

Micro light medical completion exceeds 100 million yuan D round financing

Domestic laser diagnosis and treatment technology innovation enterprises have completed a round D financing of over 100 million yuan. This round of financing is led by Huajin Capital and Rehabilitation Capital. Established in 2012, the microchaser is based in Shenzhen. It is a medical industry company incubated and supported by the Xi'an Optical Machinery of the Chinese Academy of Sciences. The microcream medical treatment is deeply cultivated in the field of laser medical technology, and is committed to the independent research and development, global innovation and independent production of minimally invasive laser intervention in innovation diagnosis and treatment equipment.

Bailian Nobunza completed about 400 million yuan B financing

专注提供突破性免疫治疗方案的生物制药公司百明信康完成约4亿元的B轮融资,本轮融资的投资机构包括佳辰资本、安吉百明瑞兴资本、凯泰资本、龙磐投资、普China Capital. Established in 2018, Baiming Nobunaga focuses on providing breakthrough immunotherapy plans to effectively fight allergies, autoimmune diseases, and other diseases that have not met medical needs.

Sepupon has completed hundreds of millions of yuan B financing

Cell culture consumable manufacturer Sepupon has completed hundreds of millions of yuan in Series B financing. This round of financing is jointly invested by Yuansheng Venture Capital and CICC Capital Capital Capital, Xiamen Venture Capital and Zhongxin Group followed up. Hui Capital, Oriental Jiafu, Jiale Capital, Yuanhe Houwu, Yuanhe Holdings, and Shunrong Capital continued to bless. Established in 2018, Sip Biology is specializing in the research and development, production and sales of high -end biomedical consumables, and is committed to providing high -quality consumables and customized services for global customers with molecular diagnosis, cell culture, immunotherapy and other aspects.

Car traffic

Shark Bay Technology Complete the 10 million US dollars A round A financing

The mid -to -high -end intelligent electric motorcycle company Shark Bay Technology has completed a round A financing of millions of dollars. This round of financing is led by Maixing Investment. Founded in 2018, Shark Bay Technology is an international technology company that builds smart electric travel products and services. It is committed to removing the electric two -wheeled car industry with automobile technology and providing users with high -tech solutions for short -to -medium -to -medium travel. The company mainly provides the overall solution of software and hardware for large -scale brands.

Chase cars to complete tens of millions of yuan A round of financing

The comprehensive solution provider of the vehicle acoustic system providers chased the car to complete the Ten -million -dollar Series A financing. This round of financing was led by Yongsheng Capital, and Ralph Venture Capital followed. Founded in 2019, Chasing Motors is a high -tech enterprise specializing in the design, development, production, and sales of car -carried sound systems. The company's main products and technologies include high -level audio systems, active noise reduction, intelligent connected car communication modules and other hardware products. And the acoustic algorithm, sound effects, underlying software architecture, Internet communication and OTA upgrade in the field of acoustic acoustics.

Semiconductor and chip

Cui Zhan Micro Electronics completes nearly 100 million yuan round A financing

New Energy Vehicle Drive IGBT Module Supplier Cuizhan Microelectronics has completed a round A financing of nearly 100 million yuan. This round of financing is led by Chenfeng Capital, and the strategic investment of Tianlong Electronics and Chongyuan Na Star. Cuizhan Microelectronics was established in 2020. It focuses on automotive -level power devices, simulation integrated circuit design and sales, and provides users with power devices, LED lighting, auxiliary driving, networking, and infrared sensors. The funds raised in this round of financing will be used to develop new products such as 2-3 vehicle-level IGBT module production lines, IGBT modules, and SIC modules. Energy power

Thick Life and New Energy Complete 1.37 billion yuan D round financing

Lithium battery septum manufacturers have completed 1.37 billion yuan of round D financing of 1.37 billion yuan. This round of financing is 11 companies including National Kaikai Fund, Jiangsu Luanquan, Xingye Asset Management, National Tune Fund, CCB Fund, Guangfa Ganhe, Cornerstone Capital Investment institutions jointly invest. Shengsheng New Energy is a company that specializes in developing, producing, and selling various specifications of various specifications and functional coating diaphragm. Link.

Delan Minghai completed hundreds of millions of yuan B+round of financing

New energy service provider Delan Minghai has completed hundreds of millions of yuan of B+rounds of financing. This round of financing is invested by source codes capital, Chinhuman Aluminum Zhejiang Junrong Fund, Kunpeng Guangyuan, Dachen Caizhi, and well -known head strategies in the industry. Established in 2013, it is located in 2013. It is a new energy service provider that provides photovoltaic power service providers, providing photovoltaic power generation equipment, solar energy storage power supply, portable emergency power supply, portable photovoltaic energy storage power box and other products.

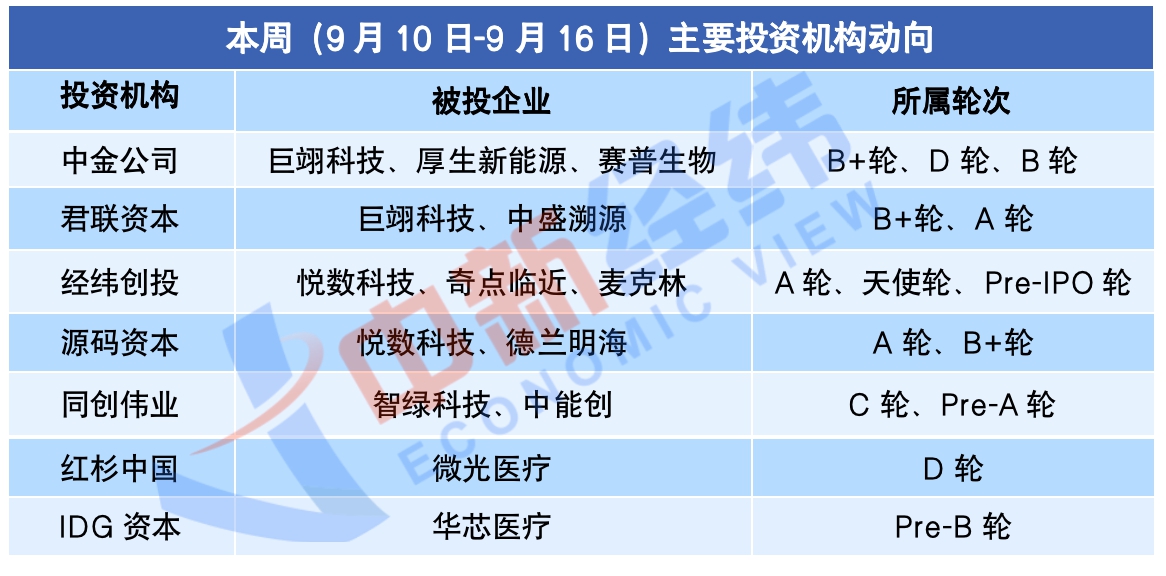

【Investment institution movement】

Source: Tianyancha APP

This week, CICC has invested in the B round of the B round of the Joyang Technology B+, the new energy D round, and the C round of the B -round; Invest in Yue Digital Technology A round, the magic point is approaching the angel round, and the PRE-IPO round financing of Maclin; the source code capital has invested in the B+round of the B+round of Yue Digital Technology A, the B+round of the Delan Minghai; Ring and Zhongnengchuang's Pre-A round of financing; Sequoia China has invested in the D-round D financing of micro-light medical; IDG has invested in the Pre-B round financing of Huaxin Medical.

【Funding incident】

Zhongan Guotong Satellite Technology Development Co., Ltd. and Shenzhen Jinchu Fund Management Co., Ltd., Shenzhen Zhaoyuan Industrial Co., Ltd., Zhongqing Bench (Shenzhen) Investment Holding Co., Ltd. and other well -known fund investment companies and industrial investment companies, jointly initiated the establishment of the establishment Zhongan Guotong Satellite Industry Fund. The total size of the fund is 50 billion yuan, raised in three phases, 5 billion yuan in the first phase, 15 billion yuan in the second phase, and 30 billion yuan in the third phase. The fund will focus on investing in related industries in the fields of satellite communications, navigation, remote sensing, and satellite technology applications, which will help Shenzhen to build a global satellite and application industry innovation highland.

New Energy Power Equipment R & D manufacturer Sunshine Power has recently announced that it will jointly invest in Hefei Sunshine with Hefei Renfa New Energy Investment Fund Management Co., Ltd., Anhui Railway Development Fund Co., Ltd., Hefei High -quality Development Guidance Fund Co., Ltd. Renfa Carbon neutralization. The total scale of the fund is 1 billion yuan, focusing on the growth period of the new energy industry, including but not limited to photovoltaic and wind power application technology, advanced energy storage, hydrogen energy technology, power electronic conversion related technologies, energy saving and environmental protection technology, smart energy energy sources , Carbon neutralization and other related fields. (For more report clues, please contact the author of this article Deng Yiruo: dengzhiruo@chinanews.com.cn) (Zhongxin Jingwei APP)

(The views in the article are for reference only, do not constitute investment suggestions, have risks in investment, and need to be cautious to enter the market.)

Copyright Copyright Copyright, without written authorization, no company or individual may reprint, extract or use it in other ways.

Editor in charge: Chang Tao

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

How does Meicheng India's "largest trading partner" affect China?

Indian workers work in the coal wholesale market. Coal is an energy product import...

6 years ago, Wugang Baosteel planned strategic reorganization | Wuhan Calendar

Coordinating | Chen Zhi Design | Wang Yuzhe【Edit: Zhang Jing】For more exciting con...