Tianqi Lithium responded to the follow -up letter of Shenzhen Stock Exchange, explaining the rationality of the employee holding plan of "0 yuan"

Author:Red Star News Time:2022.09.17

On the evening of September 16, Tianqi Lithium (002466.SZ) announced the response letter to the Shenzhen Stock Exchange, explaining the rationality of the performance assessment indicators and the price of 0 yuan/share transfer price.

Tianqi Lithium said that the company's implementation of employees' shareholding plans to repurchase shares with 0 yuan/share transfer shares will help the company to promote the implementation of medium and long -term strategic landing, and can effectively attract, retain and motivate outstanding talents. Operating status and future development plans, the prices of transfer are rational.

Tianqi Lithium industry emphasized that the employee shareholding plan provides a solid talent guarantee for the company's future sustainable development, which is conducive to the company's long -term sustainable development. Interests are not harmful to the interests of listed companies and all shareholders.

However, in an interview with the Red Star Capital Bureau, industry insiders believe that Tianqi Lithium industry should use output or net profit as an assessment indicator, not production capacity. In addition, the assessment indicators of 90,000 tons of annual capacity within 3 years are too loose. The company can achieve this goal as long as it is under construction.

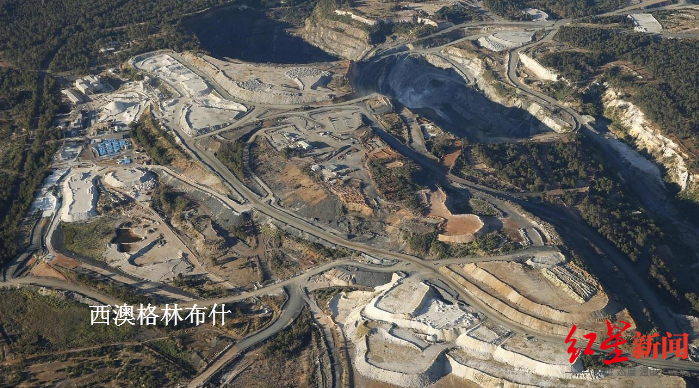

↑ Tianqi Lithium Industry

The Shenzhen Stock Exchange has attracted attention to the employee's shareholding plan

On August 31, Tianqi Lithium revealed the "2022 Employee Stable Plan (Draft)" (hereinafter referred to as the "Draft") "Announcement on Buying the Company's Share Plan with a concentrated bidding transaction". The source of the shareholding plan for the employee's shareholding plan is the company's repurchase of the listed company's shares. share. The price of the employee shareholding plan is 0 yuan/share. The performance assessment indicator at the company level is "as of the end of 2024, the company's lithium chemical product production capacity has reached 90,000 tons of lithium carbonate (equivalent)."

According to the "Draft", the employee shareholding plan uses the "portion" as the subscribed unit. The share per share is 1.00 yuan. Employees participating in this employee shareholding plan include company directors, supervisors and executives, and no more than 231 other personnel. The proportion of nine directors and supervisors is 5.37%.

On September 9th, the Shenzhen Stock Exchange issued a letter of attention, focusing on the requirements of the employee holding plan company level performance assessment index only included the main consideration of production capacity indicators, and no other income and net profit performance assessment indicators were set. The business development and performance improvement requirements, how the company intends to ensure the employee holding plan to effectively produce incentive effects.

It is required to explain the pricing method, basis and rationality of the price of the employee shareholding plan, and whether the employee holding plan is conducive to establish and improve the interest sharing mechanism of employees and the company with 0 yuan/share transfer shares. Is the basic principle of "profit and loss and risk at its own risk" in the "Guiding Opinions on the Pilot of the Implementation of the Employee Stock Plan for Listed Companies", whether it is conducive to improving the competitiveness of the company and the damage to the interests of listed companies and small and medium shareholders.

The attention letter also requires the company to combine the specific contributions of the 9 directors and supervisors of the employee holding plan to participate in the objects, etc., to supplement the method of participating objects and their rationality, and explain that the employee holding plan rather than the equity incentive plan is not an equity incentive plan. Specific consideration.

Tianqi Lithium believes that production capacity can better reflect the actual operating effect

For only lithium salt production as an indicator of performance assessment, not business income, net profit, net asset yield, etc., Tianqi Lithium Industry replied: It mainly considers factors such as industry characteristics, market competition pattern, and company operating characteristics, which is the greatest extent. Stimulate the enthusiasm of employees' work, and combine the comprehensive formulation of market practice.

"Because the product sales price fluctuates with cyclical, the company's income or profit indicators are greatly affected by market fluctuations to a certain extent. For work, there are still many uncontrollable factors; relatively speaking, production capacity indicators will not be directly affected by market changes. Regardless of the rising period of the industry or decline, the stability of production capacity can reflect the actual business results of management. "

From the perspective of the supply and demand relationship of lithium chemical products, there is still a supply gap, and the production capacity of the middle and upper reaches is still the main factor restricting the development of the industry. Therefore, the increase in the production capacity of lithium chemical products at this stage can bring actual performance contribution. The increase in production capacity also requires a certain degree of sales to increase the sales volume, and further increase the market share.

Regarding the explanation of Tianqi Lithium Industry, the industry pointed out to the Hongxing Capital Bureau that Tianqi Lithium, as a leading domestic lithium industry, mainly comes from the sale of lithium ore and lithium salt. The performance is closely related to lithium prices and output. In the past two years, Tianqi Lithium has fully benefited from the industry dividend brought by lithium prices. The industry estimates that the price of lithium carbonate will still be maintained during the year, but as the resource end is continuously released, lithium prices will fall to about 300,000 yuan/ton in the next 2-3 years. "As a listed company in the resource industry, production or net profit is a common assessment indicator, and operating income is indeed inappropriate.

The Red Star Capital Bureau noticed that Tianqi Lithium's market similar cases listed in the letter of attention. The three companies selected production capacity/output indicators as listed companies with the assessment indicators. The actual selected assessment indicators are output or net profit.

↑ The official website of the Overseas Mining of Tianqi Lithium

0 yuan purchases are not uncommon, but they are linked to key financial data. For employees' shareholding plan to repurchase shares at 0 yuan/share transfer, Tianqi Lithium said that the price meets the requirements and review procedures, and the company's operating status and future will be in line with the company's operation status and future. Development planning is determined on the basis of comprehensive consideration of talent incentives, employee willingness and investment capacity, and long -term factors such as industry cycle fluctuations and capital market risks during the shareholding period.

The company's employee shareholding plan adopts the transfer price of 0 yuan/share to meet the "Guidance Opinions on the Pilot Pilot Pilot Pilot Plan for the Implementation of the Employee Stock Plan". Most of the participants are the backbone employees who develop with the company. This plan is a positive and reward for the work and contribution of the employee's work, which is conducive to preventing talent loss. At the same time, the employee shareholding plan has set up a 36 -month lock -up schedule to evaluate the company's overall and personal performance of employees, thereby achieving incentives and restraint balance.

According to the compensation strategy set by the company, the company adopted the strategy of tilting towards the middle and grass -roots employees when distributing the overall shareholding. According to the "Draft", the total shareholding of senior managers in the company accounted for about 5.37%, and the remaining parts were mainly held by the medium -based employees. Nine directors and supervisors work in key positions in the company. They are the company's core backbone employees and signed a labor contract with the company or holding subsidiaries. The shareholding shares in this shareholding plan are matched with their actual salary and position.

Tianqi Lithium said that due to the consideration of improving the comprehensive salary system, the employee shareholding plan determined that the individual awarding value based on the individual standards was also calculated by the company's shareholding costs. Different stock prices or incentive/holding tools lead the company's incentives for differentiated incentives. The total value of the total grant value of the employee's shareholding plan is the total value of the granted value of each level of standards. The level of holding the holding price will not affect the incentive costs assumed by the company, and will not harm the interests of listed companies and the interests of small and medium shareholders.

Data show that since this year, a total of 12 listed companies in A shares have launched employees' shareholding "0 yuan purchases", of which many directors and supervisors have participated, but these companies have made a net profit, net profit growth rate, operating income, and revenue growth. Clear key financial data such as rates are the company's performance assessment indicators.

For example, BYD (002594.SZ )'s 2022 employee holding plan, participating objects include the company's employee representative supervisors, senior managers, and the middle management personnel of BYD Group, and core backbone employees, the total number of people is not more than 12,000.

BYD takes the three accounting years from 2022-2024 as the annual performance assessment. Each accounting year is assessed once, and it is unlocked in three phases. Among them, the previous year's operating income was base, the growth rate in 2022 was not less than 30%, the operating income growth rate in 2023 was not less than 20%, and the operating income growth rate in 2024 was not less than 20%.

Cui Dongshu, Secretary -General of the Federation, said that BYD's performance goal is too high to achieve.

The 90,000 -ton production capacity consideration indicators of Tianqi Lithium are not difficult to achieve. Tianqi Lithium said at the semi -annual performance briefing meeting that the company's current lithium compound and derivatives have the production capacity of 68,800 tons/year, and the future planning capacity is 114,800 tons/year.

At present, the production capacity of Tianqi Lithium has 48,000 tons of lithium hydroxide projects in Qunana in Australia, Suining Anju's annual output of 20,000 tons of lithium carbonate projects, and the 2,000 -ton metal lithium project in Chongqing is in the planning and construction stage. "The assessment indicators are too loose, and it is difficult to not doubt that it is 'sending money'." The above -mentioned industry insiders said.

Red Star News reporter Wu Danruo

Responsible editor Deng Yiguang Editor Yang Yan

- END -

Yuyao will focus on building seven major areas!The Urban Development Conference of Ningbo Yuyao City was held

Jiangnan Tourism Media on July 9th Ningbo Electric (Reporter Chen Chong Correspond...

Haida Co., Ltd.: selected by the ideal car as a dynamic sealing supplier of a project

On July 7, Capital State learned that A -share company Haida (300320.SZ) received an ideal car Designation of Suppliers.In recent days, Haida has received the Designation In intention issued by Ch