Zhejiang Commercial Bank Zhengzhou Branch Financial Living Water Moisturizing Small and Micro Enterprises

Author:Henan Daily Client Time:2022.09.17

Li Peng Correspondent Wang Xiaoran Wang Qian, a reporter from Henan Daily Client,

"Some government orders can be loaned to the payment, the procedures are simple, and the efficiency is fast. Zhejiang Commercial Bank helped me solve the big problem." The person in charge of a technology company just signed a government procurement order. Support, seeing very excited.

In recent years, governments at all levels have successively introduced a series of policies to support small and micro enterprises to participate in government procurement in order to support the development of small and micro enterprises. However, after winning the bid procurement project of small and micro enterprises, because of its limited ability, it is often difficult to raise corresponding funds to provide services in a short time. The phenomenon of insufficient ability and lack of funds occur from time to time. In response to the pain point of small and micro enterprises, the Zhengzhou Branch of Zhejiang Commercial Bank on the basis of the standard "Political Loan" product expands the scope of the purchaser. For large -scale central, state -owned enterprises and their subsidiaries, small and micro enterprises can also use their procurement orders to purchase orders. Applying for loans directly has greatly expanded the business scope and financing acquisition of small and micro enterprises.

The technology company is a small and micro enterprise engaged in the supply of electronic equipment. Recently, it has won 4 million yuan in procurement projects in Henan subsidiaries. This project has a tight construction period and a large investment. After learning about the Zhengzhou Branch of Zhejiang Commercial Bank, they contacted the enterprise for the first time to give full play to the advantages of the product of "loan lending", and completed all processes such as investigation, reporting, approval, lending and other processes in 7 working days. Metal capital support, solving customers' urgency, ensure the smooth implementation of the project.

"Police acquisition" is just a microcosm. In terms of serving the new, intelligent manufacturing, and science and technology enterprises, Zhejiang Commercial Bank Zhengzhou Branch has played an advantage. Based on the platform of the small and micro enterprise park, it has launched an exclusive financial service plan. Financial recruits to help stabilize the economic market.

As the main force of national scientific and technological innovation, manufacturing enterprises grow up to a certain stage, mature technology and good reputation will bring a sharp increase in orders. Existing factory buildings are difficult to meet the production needs, but due to its industry characteristics, it Most of the funds are occupied by production. It is difficult for the factory buildings to purchase funds for a while, and it is difficult to take out for a while, and it is dilemma in the dilemma of expanding production capacity and abandoning orders. In this regard, Zhejiang Commercial Bank Zhengzhou Branch launched the "5+N" exclusive financial service solution to a package of characteristic financial products such as factory loans, amount loans, weekly loans, rental loans, and loans, which meets the enterprise's settlement in the park and the park after entering the park. Full -process financial needs such as production, procurement, research and development, and sales.

A Zhengzhou electronic technology enterprise located in a park in Zhengzhou High -tech Zone is a national high -tech enterprise. The main business is the development, production and sales of commercial vehicle electronic control and information systems. In April 2020, customers needed to purchase factories due to expanding the scale of production, but due to insufficient funds, they failed to land. After the Zhengzhou Branch of Zhejiang Commercial Bank learned this situation, it quickly acted and took the initiative to docking. It issued a ten -year installment repayment business for the company within 3 working days. The capacity also relieves the pressure of short -term funds.

According to statistics, Zhejiang Commercial Bank Zhengzhou Branch has entered 31 parks in the province, providing financial support for more than 500 households entering the park, with a cumulative investment amount of over 1.3 billion yuan. As of the end of August 2022, the balance of loans of small and micro enterprises at the Zhengzhou Branch of Zhejiang Business Bank was 1.6 billion yuan, an increase of 552 million yuan, an increase of 52.7%.

- END -

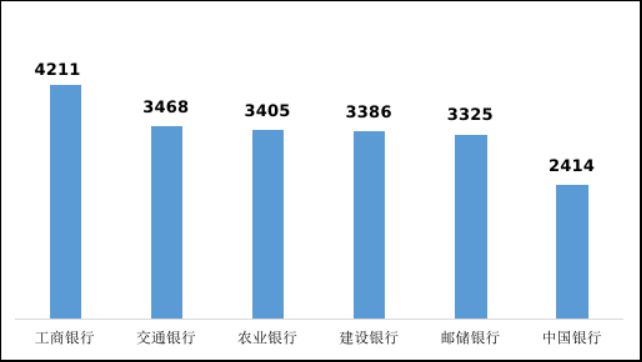

The CBRC names many banks!ICBC complaints for the first state -owned bank

Zhongxin Jingwei On July 28th, the website of the China Banking Regulatory Commiss...

Shandong Shouguang: From "one good variety" to "one table of good dishes" to enhance the competitiveness of the vegetable industry

Shouguang's tomato is colorful.Entering the Danhe Facilities of Shouguang City in Shandong Province, the Danhe Facilities Standardized Production Demonstration Park Testing Center, the display area is...