Well worse!The 470 million US dollars litigation is not over, and the London Metal Exchange is facing a collective lawsuit of five institutions

Author:Daily Economic News Time:2022.09.16

According to Reuters on Friday 16th, Eastern Time, London Metal Exchange (LME) is facing collective lawsuits from multiple investment institutions.

The report quoted unreasonable court documents that hedge funds AQR Capital Management (hereinafter referred to as AQR), DRW Commodities LLC, Flow Traders BV, Capstone Investment Advisors LLC and Winton Capital Management (hereinafter referred to as Winton), all have been appointed. litigation.

"Daily Economic News" reporter noticed that, before that, LME had faced the legal lawsuit filed by the American hedge fund Elliott Associates and Wall Street, a well -known Wall Street Jane Street Global Trading. Nickel transactions were canceled due to the skyrocketing price of nickel nickel. The two companies filed a claim for $ 456 million and $ 15.3 million, respectively.

Today, five more institutions have filed a lawsuit, which is undoubtedly worse for LME.

In fact, AQR, one of the plaintiffs, has repeatedly criticized LME. AQR Chief Investment Officer Clifford Asness said in social media that the "Nickel Crisis" incident was one of his "the worst things that have seen the worst" in his career.

AQR stated in a statement that the hedge fund has applied to the court to ask LME to disclose (in March) related documents. The statement stated that "this application was proposed after LME (March) unilaterally decided to cancel certain nickel transactions, (LME behavior) caused major losses to many market participants."

Another plaintiff Winton spokesman also said that his prosecution was related to the "LME cancellation of Nickel on March 8", and pointed out that LME's decision at that time caused many participants to suffer major losses. Winton also believes that LME "disclosed insufficient" in the "unprecedented" decision -making process, requiring LME to submit more relevant documents that communicate with market participants at the time.

LME responded in a statement that these applications were "no legal basis", and their "will be at appropriate" submitted evidence to refute these views.

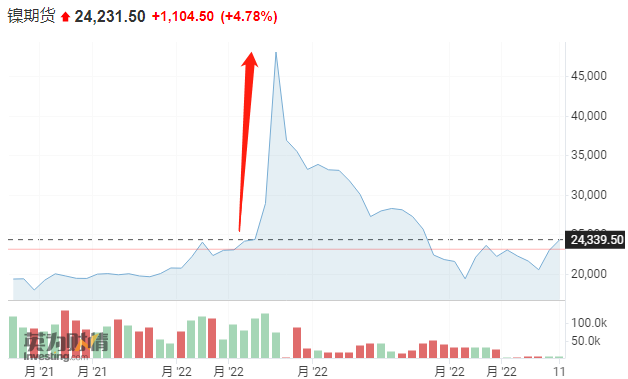

In early March this year, LME staged a "epic -level empty war", which has aroused widespread attention in the global market. On March 7th and 8th, the LME nickel contract continued to skyrocket, once it broke the sky -high price of $ 100,000/ton, and then LME suspended and canceled some nickel futures transactions.

Image source: Yingwei Caiqing

At that time, the announcement of the nickel market increased significantly on March 7, 2022. LME believes that the transactions at the end of the day of the day are in order. However, in the early morning of March 8, 2022, Nickel prices rose sharply in a short period of time. After discussing with LME CLEAR, LME decided to suspend all nickel contract transactions at 08:15 on the same day, and canceled all transactions performed at 00:00 British time on March 8, 2022.

Subsequently, LME's parent company's Hong Kong Stock Exchange stated that the decision to suspend transactions was because the nickel market had disorder. LME trace the transaction traceability is to allow the market to return to LME can be convinced that the market is the last time point for orderly operation. LME nickel trading resumed on March 16, 2022 at the place where all the transactions performed in LME.

Daily Economic News

- END -

West House Port, a loss of 7.031 million yuan in the first half of 2022

On August 12, Nishiya Port (code: 835115.NQ) released the performance report of the 2022 half -year report.From January 1, 2022-June 30, 2022, the company realized operating income of 21,315,400 yuan,

They captured two underwater super IPOs

Your cold bench finally sat warm. This is a sentence that I have recently seen Zha...