ST Oma's application for "picking hats" controlling shareholder TCL promised to take part of the responsibility of more liabilities that have been accounted for with the estimated liabilities

Author:Daily Economic News Time:2022.09.16

On the evening of September 16th, ST Oma (SZ002668, stock price of 5.01 yuan, and a market value of 5.431 billion yuan) issued an announcement saying that the company has been eliminated by other risk warnings of stock transactions and has applied to the Shenzhen Stock Exchange to revoke other risk warnings.

In addition, ST Oma also issued an announcement saying that the controlling shareholder TCL Home Appliance Group Co., Ltd. (hereinafter referred to as TCL) promised: If the case with the Shanxi Bank Changzhi Branch, the final amount to the listed company must bear more than the expected liabilities ( That is, more than 353.448 million yuan), TCL will bear the responsibility of exceeding parts.

Apply for "picking hats"

Earlier, a listed company atomic company Tibet Gold Innovation Investment Co., Ltd. (hereinafter referred to as Tibetan Gold) at the Bank of Guangzhou was a 145 million yuan regular deposit pledge that did not perform the decision -making procedures and information disclosure obligations required by laws and regulations, and was suspected of illegal external guarantee. Therefore, starting from September 7, 2021, ST Oma has been implemented by other risk warnings.

In addition to the above matters, ST Oma also has other illegal guarantees, differences, and non -operating funds occupation.

From August to October 2020, ST Oma's Atomic Shanxi Huitong Hengfeng Technology Co., Ltd. (hereinafter referred to as Huitong Hengfeng) provided guarantee to the outside world with a regular single pledge, with a guarantee amount of 900 million yuan. obligation.

In September 2017 and February 2018, listed companies assumed the difference in the "Personal Small Loan Business Cooperation Agreement" signed by the atomic company Fuzhou Wallet Ory E -Commerce Co., Ltd. and Zhengzhou Bank. In April 2018, listed companies The "Personal Credit Loan Business Cooperation Agreement" signed by the Atomic Shanxi Zhiyuan Ronghui Technology Co., Ltd. and Changzhi Bank will be responsible for the difference.

On December 16, 2019, the listed company sold 100%equity of Zhao Guodong, the original controller Zhao Guodong and its controlling enterprise, China Rongjin (Beijing) Technology Co., Ltd. (hereinafter referred to as Zhongrongjin) The company's affiliated parties receivable were 941 million yuan. On October 20, 2020, the listed company announced that the above accounts have been recovered, but they have not been recovered.

After TCL became a new controlling shareholder of listed companies, ST Oma rectified the above matters.

Among them, the Tibetan Gold and Bank of Guangzhou reached the "Calling Agreement". The 900 million yuan bank deposit bill used by Huitong Hengfeng has been executed, and the rights and obligations of the corresponding illegal guarantee have been eliminated.

In addition, listed companies and Zhengzhou Bank reached the "Mediation Agreement", and the corresponding differences have been terminated. At the same time, ST Oma has filed an expected liabilities for the relevant litigation of the Bank of Shanxi's Changzhi Branch.

In terms of funds, at the end of December 2021, listed companies transferred 100%equity of Tibetan Gold (including Tibetan Gold holding 100%equity of Huitong Hengfeng) to Huizhou Zhifeng Industrial Development Co., Ltd. The company is within the scope of the company. As a result, there are no funds occupying by listed companies.

On September 16, ST Oma submitted an application for revocation of other risk warnings to the Shenzhen Stock Exchange.

TCL promise

As mentioned earlier, ST Oma has filed an expected liabilities for the relevant lawsuits of the Bank of Shanxi's Changzhi Branch.

In this regard, TCL promises that if the court civil mediation or final judgment results of the court in the case of ST Oma and Changzhi Branch, the amount that listed companies need to bear exceed the expected liabilities (that is, more than 35.3448 million yuan). Part of the responsibility for payment.

If the TCL has shared the liability for the excess, ST Oma recovered the losses from the debtor and the relevant responsible person, TCL has the right to recover the property priority for the property.

As of August 31, 2022, the borrowing balance provided by TCL to Oma Electric was 497 million yuan. In order to ensure the performance of the commitment, TCL agreed to convert 295 million yuan into a margin for fulfilling commitments. After the case is closed, there is still a balance after the deposit deducts the amount of TCL payable, and the listed company should return TCL.

ST Oma said that accepting the controlling shareholders' commitments this time, listed companies do not need to pay any consideration and do not attach any obligations, which will help promote the company to revoke other risk warnings as soon as possible and safeguard the interests of listed companies and small and medium shareholders, which will not affect the company's independence.

Daily Economic News

- END -

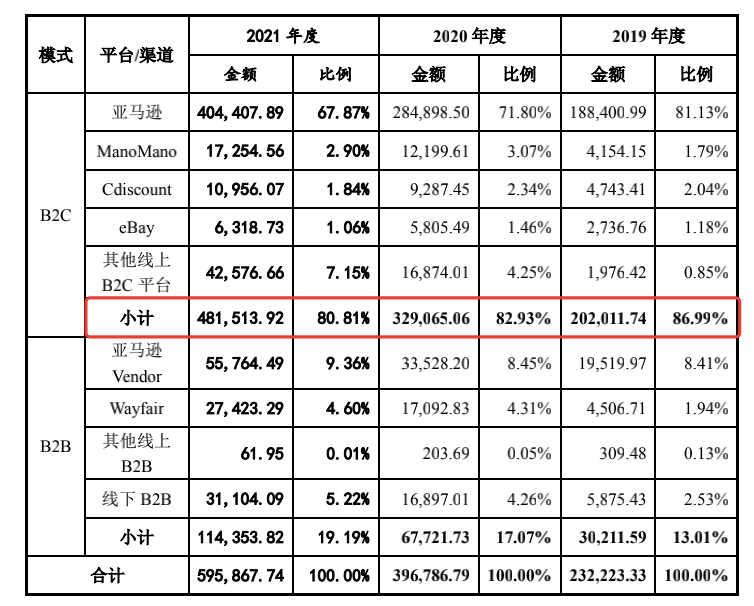

To Europe Technology IPO, the word "Technology" is not realistic

Produced | Company Research Room IPO GroupText | CookyTo Europe, a Chinese home bran...

"Great Kingdom Grain" Black Earth Fenglongjiang | Look at the protection of Heilongjiang Black Land from a set of data

Data 1: 56.1%Heilongjiang is a large agricultural province. It has an existing 157...