Changyingtong's actual controller's technical funding value has been overestimated by equity, Teng Nuo white gloves or floating profit exceeding 70 million

Author:Jin Ziyan Time:2022.09.16

"Golden Syllabus" North Capital Center Mu Xi/Author Xihai/Risk Control

As a senior managers of listed companies, the importance of financial officers on the flow of funds and capital distribution of enterprises is obvious. From 2018 to 2019, Wuhan Changyingtong Optoelectronics Technology Co., Ltd. (hereinafter referred to as "Changyingtong") replaced the financial director twice. Among them, Wu Weigang, who resigned in 2018, transferred his equity to Changyingtong's actual controller Piabin's realization of disputes, and was transferred to other transferee after mediation.

Back to history, the patented technology capital contribution of the actual controller Piabin, or the vision of the "karate" type of capital contribution. In July 2010, Piabin increased its capital to Changyingtong with a proprietary technology. At that time, the evaluation value of the proprietary technology was RMB 210.479 million. In fact, the proprietary technology has not been directly applied to the actual operation by Changyingtong, and there is an overestimated situation. Later, Pi Yabin replaced the original non -patented technology capital contributing to 210.479 million yuan with cash and debt. The cash that was used to make up for capital and fund -fundraising funds was actually the source of the transfer of equity. The monetary funds used by Piabin before were only 9.75 million yuan.

1. In the past, the fact that the factory of the factory of the factory of the factory was the shareholders holding the shares of the shareholders, the relationship or "unusual"

The deeper the riverbed, the calm the water surface. According to research, the Northern Capital Center of "Jin Securities" found that the enterprises that Changyingtong invested abroad, in fact, is actually a company holding shareholders holding shareholders in Changyingtong.

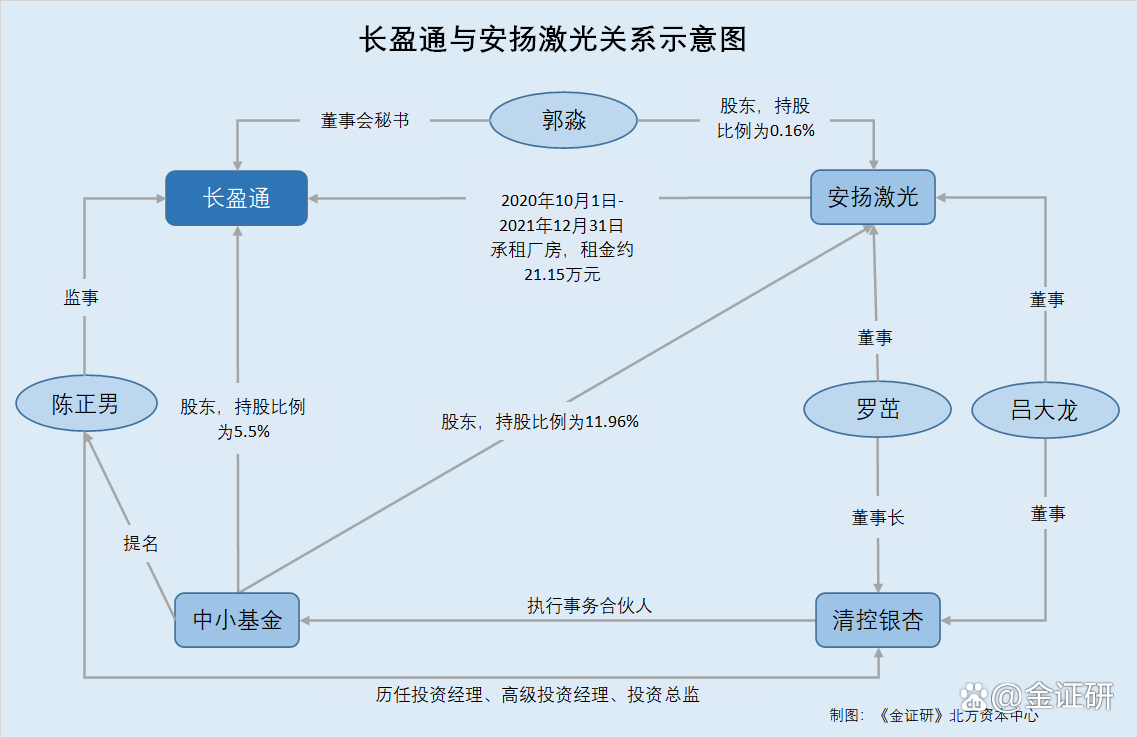

1.1 Factory lessee Anyang Laser, the company's secretary Guo Miao invested foreign investment

According to the prospectus of August 29, 2022 (hereinafter referred to as the "prospectus"), Wuhan Anyang Laser Technology Co., Ltd. (hereinafter referred to as "Anyang Laser") is the secretary of the board of directors of Changyingtong. Enterprises, their main business are the R & D and sales of femlose fiber laser, leather second fiber laser laser.

In fact, Anyang Laser is not only invested by Guo Miao, secretary of Changyingtong's board of directors.

According to the prospectus, as of December 31, 2021, Anyang Laser rented a 101 factory building, including the MCVD area of 150 square meters of the 101 plant and the Ritta Tower area of 550 square meters. The lease period was October 1, 2020, respectively By December 31, 2021, from October 1st, 2020 to June 30, 2021, the rent was 30 yuan per square meter per month.

As of August 29, 2022, the above -mentioned lease was terminated. Anyang laser no longer leased real estate to Changyingtong, and Changyingtong took back the above real estate.

According to the research of the Northern Capital Center of "Jin Securities", from October 1, 2020 to December 31, 2021, Anyang Laser paid about 211,500 yuan to Changyingtong.

However, the relationship between Changyingtong and Anyang laser may not only be there.

1.2 Shareholders Kim Ding Venture Capital, Bulls Venture Capital, and Bull Investment are consistent action relationships, with a total of 11.53% shares holding 11.53%

According to the prospectus, as of August 29, 2022, Wuhan Jinding Entrepreneurship Investment Co., Ltd. (hereinafter referred to as "Jinding Venture Capital") directly held Changyingtong 5 million shares. The ratio is 7.08%. Wuhan Bulls Entrepreneurship Investment Co., Ltd. (hereinafter referred to as "Bull Venture Capital") directly holds 2.5 million shares of Changyingtong, with a shareholding ratio of 3.54%of Changyingtong.

In addition, Wuhan Bull Investment Management Co., Ltd. (hereinafter referred to as "Bull Investment") directly holds Changyingtong 703,900 shares, and Bull Investment holds 1%of Changyingtong's shareholding. Bulls Investment, Bull Venture Capital and Jinding Venture Capital (hereinafter collectively referred to as "Bulls") hold a total of 11.53%of Changyingtong. In addition, Bull Investment holds 100%equity of Bull Venture Capital, and Bull Investment holds 29.13%of Jinding Venture Capital at the same time. The "Bulls" has a consistent action relationship.

1.3 Shareholder Small and Small Fund holds 5.5%and nominate supervisors to Changyingtong.

According to the prospectus, as of August 29, 2022, the SME Development Fund (Jiangsu Nantong Co., Ltd.) (hereinafter referred to as the "Small and Small Fund") holds 38.835 million shares, and the small and medium -sized funds hold the Changyingtong's holding of Changyingtong The share ratio is 5.5%. In addition, the executive affairs partners of the small and medium -sized funds are Qingkong Ginkgo Entrepreneurship Investment Management (Beijing) Co., Ltd. (hereinafter referred to as "Clearing Ginkgo Ginkgo"), and it is represented by Luo Jiu.

On December 10, 2019, Bull Investment transferred the shares it held to SMEs. From January 10, 2020, small and medium -sized funds have become shareholders of Changyingtong. In addition, the small and medium -sized funds nominated Chen Zhengnan as the supervisor of Changyingtong. Chen Zhengnan's term was from August 2020 to August 2023. In addition, from August 29, 2022, the signing of the offering from 2016, Chen Zhengnan, the supervisor of Changyingtong, served as the investment manager, senior investment manager, and investment director of Qingkong Ginkgo.

That is to say, on August 29, 2022, 2022, the Small and Medium Fund was a shareholder of Changyingtong, and the shareholding ratio of Changyingtong was 5.5%, and Chen Zhengnan was nominated as the supervisor of Changyingtong.

In addition, on August 29, 2022, the signing of the prospectus from 2016, Chen Zhengnan all worked in Qingkong Ginkgo. According to the data of the Market Supervision and Administration Bureau, Clearing Ginkgo Ginkgo was established on July 10, 2015. Its business scope is investment management and corporate management. As of August 25, 2022, Luo Jiu and Lu Dalong were the chairman and director of Ginkgo Ginkgo. And clearing the record of changes in Luo Jiu and Lu Dalong.

That is, the small and medium -sized funds are the shareholders of Changyingtong, and they nominate Chen Zhengnan as the supervisor of Changyingtong. The Ginkgo Ginkgo is a partner of the executive affairs of the small and medium -sized funds.

In fact, the small and medium -sized funds are one of the shareholders of Anyang Laser. The partners of their executive affairs Luo Jiu and Lu Dalong, the chairman of the Ginkgo, and Lu Dalong.

1.4 Small and medium -sized funds holding a laser of 11.96%, the chairman and director of the partners of their executive affairs are working on Anyang Laser

According to data from the Market Supervision and Administration Bureau, Anyang Laser was established on December 23, 2010, and its business scope is R & D and production of fiber laser, special laser, etc. As of August 25, 2022, the registered capital of Anyang laser was 30 million yuan. At the same time, the small and medium -sized funds were one of the shareholders of Anyang laser. Luo Jiu and Lu Dalong were all directors of Anyang laser.

From January 15, 2020 to August 25, 2022, Small and Small Fund holds 11.96%of the shares of Anyang laser.

On September 8, 2017, Anyang Laser changed its senior management personnel, and Luo Jiu newly added directors of Anyang Laser. On December 4, 2019, January 15, 2020, January 8, 2021, May 25, 2021, and July 23, 2021, Anyang Laser will change to senior management personnel. Before and after the change, Luo Junjun Director of Laser Laser.

On January 15, 2020, Anyang Laser changed its senior management personnel, and Lu Dalong added a director of Anyang Laser. On January 8, 2021, May 25, 2021, and July 23, 2021, Anyang Laser changed its senior management personnel. Before and after the change, Lu Dalong was a director of Anyang Laser.

That is to say, from September 8th, 2017 to August 25, 2022, Luo Ji is a director of Anyang laser. From January 15, 2020 to August 25, 2022, Lu Dalong was the director of Anyang laser. From January 15, 2020 to August 25, 2022, Small and Small Fund holds 11.96%of the shares of Anyang laser.

According to public information, Luo Jiu, chairman of Ginkgo, and Luo Jiu, the director of Anyang Laser, or the same person. Lu Dalong, the director of the Ginkgo Ginkgo, and Lu Dalong, the director of Anyang Laser, or the same person.

From the above, we can see that from October 1st, 2020 to December 31, 2021, Anyang Laser rented a long -term factory building. As of August 29, 2022, the signing of the prospectus, the proportion of small and medium -sized funds on Changyingtong was 5.5%, and nominated Chen Zhengnan Ren Changyingtong. As of August 25, 2022, the small and medium -sized funds were shareholders of Anyang laser, and their shareholding ratio of Anyang laser was 11.96%. Luo Jiu, the chairman of the small and medium -sized fund executive partners, Qingkong, the chairman of the ginkgo, and Lu Dalong, the director, and the directors of the laser.

According to the prospectus, Changyingtong did not disclose Anyang Laser as a connected parties, nor did it disclose it with the lease of Anyang laser as a connected lease. Changyingtong disclosed Anyang Laser as a company that was invested by the secretary Guo Miao.

The above situation can be seen that Changyingtong holds more than 5%of the shareholders Small and Medium Fund, and at the same time holds 11.96%of the shares of Anyang laser, and the chairman of the small and medium -sized funds who execute the affairs partner Luo Jiu, the chairman of the ginkgo, and Lu Dalong, the director Lu Dalong, are on Anyang Laser. Does it mean that Luo Jiu and Director Lu Dalong is appointed by Qingkong Ginkgo? At the same time, small and medium -sized funds hold more than 5%of Changyingtong and Anyang Laser. In addition to the company's company, the company's secretary Guo Miao invested in foreign investment, the relationship between the two also hides other "associations", and the relationship may be unusual.

It is worth mentioning that the actual controller Pie Yabin has increased its capital to Changyingtong with proper technology, and the value of the proprietary technology has an overestimated situation.

2. The value of the dedication of the proprietary technology of the actual controller is overwhelmed, and then the replacement of the stock transfer or the floating profit exceeds 70 million yuan

His body is right, not allowed to do it, his body is not right, although it does not follow. Investment defects include unsuccessful evaluation, capital verification procedures, or intermediaries do not have corresponding qualifications. The actual controller of Changyingtong has increased its capital to Changyingtong with proper technology, but the value of the technology is overestimated.

2.1 Established by Pie Yabin and Li Yan, as of July 16, 2011 received 10 million yuan in capital contribution

According to the prospectus, as of August 29, 2022, Pi Yabin directly held a shares of Changyingtong 25.96%and through the employee holding platform Wuhan Yingzhong Investment Partnership (limited partnership) "Investment") holds 4.39%of Changyingtong. During the same period, Piabin controlled a total of 30.35%of Changyingtong's shares. It was the controlling shareholder and actual controller of Changyingtong, and served as the chairman and president of Changyingtong.

Back to history, Wuhan Changyingtong Optoelectronics Technology Co., Ltd. (the predecessor of Changyingtong, hereinafter collectively referred to as "Changyingtong") was established by Pi Yabin and Li Yan.

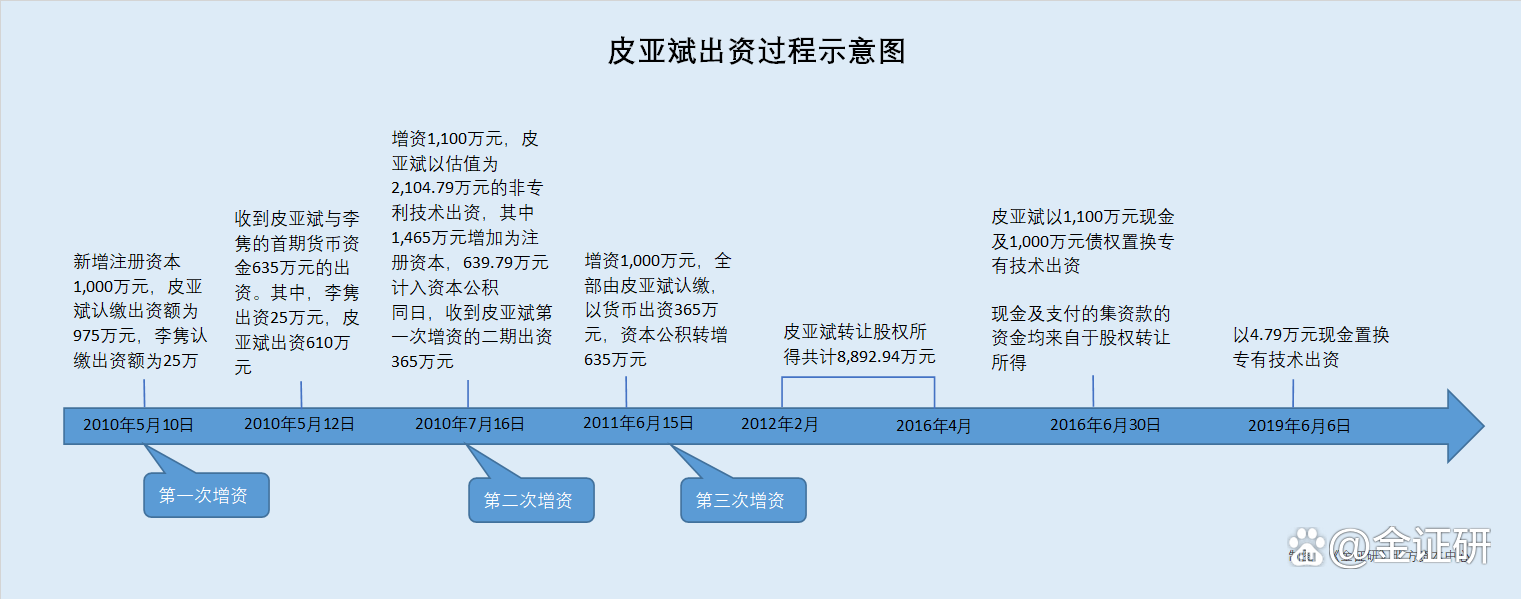

On May 10, 2010, Pie Yabin and Li Yan set up Changyingtong for 10 million yuan in currency. Among them, Piabin subscribed for 9.75 million yuan, and Li Yan recognized the contribution of 250,000 yuan. As of May 12, 2010, Changyingtong received a total of 6.35 million yuan in the first period of capital contribution from Piabin and Li Yan, and the capital contribution method was monetary funds. As of July 16, 2010, Changyingtong received 3.65 million yuan in the second phase of Piabin. That is, as of July 16, 2010, Changyingtong has received 10 million yuan in capital capital at the time of establishment.

Before Changyingtong received Pie Yabin's second period of capital, Changyingtong's shareholders' meeting decided that Piabin would increase capital to Changyingtong.

2.2 On July 10, 2010, the shareholders' meeting decided that Piabin increased the capital to Changyingtong 11 million yuan

According to the "reply report on the first public issuance of shares of Changyingtong's first public issuance of shares and the application documents for the listing of the science and technology board" signed on June 10, 2022 (hereinafter referred to as the "Inquiry Letter Reply"), in 2010, 7 On the 10th, Changyingtong held a shareholders' meeting and decided to change Changyingtong's registered capital to 21 million yuan. The newly added registered capital was all subscribed by Piabin.

After the change, Piabin's capital contribution was 20.75 million yuan, and Li Yan's contribution was 250,000 yuan.

2.3 On July 16, 2010, Changyingtong received 14.65 million yuan in capital contributed by Pie Yabin with proprietary technology

On July 13, 2010, Hubei Zhongrui Hengxin Assets Asset Evaluation Co., Ltd. issued the "Evaluation Report" (Hubei Heng Evaluation Report [2010] W021), with July 8, 2010 as the evaluation benchmark date. All Piabin's proposed technology to increase registered capital, that is, the evaluation value of "a optical fiber ring ring with preparation of fiber -fiber band" is RMB 21.0479 million.

On July 14, 2010, Piabin and Changyingtong signed the "Private Technical Transfer Agreement", which agreed that Piabin had submitted it to the "a fiber that uses a fiber -fiber -based optical fiber -based optical fiber to make a presence of fiber -fiber band -made in the invention patent and a practical new patent application. The patent application rights and patent ownership of the ring circle and its manufacturing "and the patent ownership of the patent ownership was transferred to Changyingtong. Changyingtong agreed to add Pie Yabin's capital to Changyingtong for 14.65 million yuan in accordance with the shareholders' conference resolution.

On July 16, 2010, Hubei Hongyuan Accountant Co., Ltd. (hereinafter referred to as "Hubei Hongyuan") issued the "Capital Examination Report" (Ehongyuan Zi Zi [2010] No. 009). Changyingtong has received 14.65 million yuan in capital paid by Piabin with the proprietary technology. Among them, it invested proprietary technology on July 13, 2010, with an evaluation value of RMB 210.479 million. RMB 14.65 million is a new registered capital, with the remaining 6.3979 million yuan as capital reserve.

On July 27, 2010, Changyingtong completed the registration procedures for the industrial and commercial change of the capital increase.

2.4 In July 2011, Changyingtong increased to 31 million yuan, and Piabin's currency contributed 3.65 million yuan

Then, in July 2011, Changyingtong increased its capital to 31 million yuan.

On June 15, 2011, Changyingtong held a shareholders' meeting. All shareholders agreed that the registered capital increased by 10 million yuan. The new registered capital was invested by shareholder Piabin 3.65 million yuan, and the capital reserve increased by 6.35 million yuan. Shareholders Li Yan gave up the capital reserve to increase the registered capital according to the capital reserve that he held. After the capital increase, the registered capital was changed to 31 million yuan. Piabin's capital contributed was 30.75 million yuan, and Li Yan's capital contributed was 250,000 yuan.

On July 1, 2011, Wuhan Kangli Accountant Co., Ltd. issued the "capital verification report" (Kangwa Zi [2011] No. 055). As of June 30, 2011, Changyingtong has received Pie Yabin paid by Piabin. The total number of registered capital was 10 million yuan, of which the currency contributed 3.65 million yuan, and the capital reserve increased by 6.35 million yuan.

On July 6, 2011, Changyingtong completed the registration procedures for the industrial and commercial change of the capital increase.

2.5 As of July 2011, Piabin held a registered capital of 31 million yuan for 9.75 million yuan in currency funds and proprietary technologies

According to the research of the Northern Capital Center of "Jin Securities", as of July 16, 2010, Piabin contributed with proprietary technology, with a evaluation value of RMB 210.479 million. Among them, 14.65 million yuan was newly added to Changyingtong's registered capital, and this time Changyingtong's newly added registered capital was 11 million yuan. In contrast, Piabin invested in the registered capital with a proprietary technology, and the amount of the newly added registered capital this time was 3.65 million yuan. Coincidentally, on May 10, 2010, when Changyingtong was established, Piabin has not yet paid 3.65 million yuan, which happened to be supplemented on July 16, 2010.

This means that on July 16, 2010, Changyingtong had received 14.65 million yuan paid by Piabin with proprietary technologies, of which 11 million yuan was the funds that Piabin increased into the registered capital for the second time. Thousands of yuan or Pie Yibin set up the amount of the second phase of Changyingtong.

In addition, as of June 30, 2011, Changyingtong's registered capital was 31 million yuan, and Piabin's capital contributed 30.75 million yuan. Among them, at the time of establishment, Piabin and Li Yan's first period of capital contributed 6.35 million yuan in currency funds. During the second phase, Piabin may pay 3.65 million yuan for replacement with exclusive technologies. Based on Li Yan's subscribed capital of 250,000 yuan, when Changyingtong was established, Piabin may actually pay 6.1 million yuan in currency funds. In addition, when Changyingtong increased his capital for the third time, Piabin invested 3.65 million yuan for money. It can be seen that as of July 2011, Piabin had paid 9.75 million yuan in currency funds and contributed to Changyingtong with proper technology, thereby holding a registered capital of 30.75 million yuan in Changyingtong.

It is important that Changyingtong did not use the above proprietary technologies in actual operations.

2.6 Because the proprietary technology used for funding has not been directly applied to the valuation, Piabin replaced the contribution with cash and debt in 2016

According to a question letter, the time point of the research and development process, application, and authorization of Pie Yabin's proprietary technology used for funding. Pi Yabin's technical solution that simulated simulation studies fiber and rings around the ring, and simulates the feasibility verification of the parallel fiber band ring. After designing the corresponding technical solution, it officially submitted a patent application on July 13, 2010. Patent authorization was obtained on October 26, 2011.

The proprietary technology used by Piabin for funding is mainly to bring a ring winding technology, and the use of such methods for large -scale production is facing large craftsmanship problems. It has to be further developed and improved. Therefore, Changyingtong did not use the proprietary technology directly in actual operations, and only used some of its technical solution ideas during the production process.

According to the prospectus, when the invention patent "a fiber -fiber ring for optical fiber gyro" was a long -term capital increase in Changyingtong in July 2010, Piabin invested in Changyingtong by capital contribution, and it was a proprietary technology at that time. The value is 210.479 million yuan. Because Changyingtong did not actually adopt the specific method of the patent for optical fiber surrounding system in the future, it was used to use some of its technical solution ideas during the production process, and the value was overestimated.

In order to consolidate the investment, on June 30, 2016 and June 6, 2019, Piabin used monetary funds to a total of 100.479 million yuan and its debt on Changyingtong. 10,000 yuan contribution. After the patent was replaced, Pie Yabin was presented to Changyingtong.

That is, Changyingtong has not actually used the proprietary technology used by Piabin to increase capital in actual production and operation. The value of the evaluation value of 210.479 million yuan is overvalued. The controller Piabin presented the authorized patent applied for the proprietary technology to Changyingtong.

In December 2015, Changyingtong's actual controller Pie Yabin changed the form of capital contribution.

2.7 The amount of contribution of the proprietary technology, from Piabin transferred Changyingtong's equity income

According to the inquiry letter, on December 21, 2015, Changyingtong held a shareholders 'meeting. All shareholders agreed that all shareholders' investment methods were all currencies.

Among them, Piabin paid Cash of 11 million yuan and 47,900 yuan to Changyingtong on June 30, 2016 and June 6, 2019, respectively, and signed the "Debt Cancellation Agreement" with Changyingtong on June 30, 2016. Pie Yabin offsets Changying's 10 million yuan in debt and its replacement of 10 million yuan in capital contribution.

As of June 6, 2019, Piabin has paid a total of RMB 210.479 million in cash and creditor's rights to replace intangible assets. Shenzhen Pengxin Assets Evaluation Land Real Estate Evaluation Co., Ltd. issued the "Pi Yabin's Changyingtong Credit Asset Traceability Evaluation Report" (Pengxin Consultation Word [2020] No. No. No. 1355) The evaluation value of 10 million yuan of bonds enjoyed by Changyingtong was 10 million yuan on June 30, 2016 on the evaluation benchmark date.

That is to say, in December 2015, Changyingtong's shareholders 'meeting decided that the shareholders' funding method was all currency. Piabin replaced its proprietary technology in July 2010 for the cash of 110.479 million yuan in cash and its claims to Changyingtong's 10 million yuan in debt. Investment.

It should be pointed out that Piabin's cash used to fund and borrowed Changyingtong all came from Pie Yabin's transfer of Changyingtong's equity.

According to the inquiry letter, Piabin, on June 30, 2016, replaced the original non -patented technology for 2,10.479 million yuan on June 6, 2019 for the cash of 479,000 yuan on June 6, 2019 for the cash 6.6 million yuan on June 6, 2019. , The sources of funds used to make up for capital and pay funding funds are transfers to equity income. And from February 2012 to April 2016, Piabin transferred a total of 88,929,400 yuan.

According to the research of the Northern Capital Center of "Jin Xieyan", as of June 30, 2011, Piabin paid a total of 9.75 million yuan in currency funds and contributed it with proprietary technology to obtain a registered capital of Changyingtong 30.75 million yuan. From February 2012 to April 2016, Piabin transferred a total of 88,929,400 yuan of equity income, of which Piabin used to make up for the cash that was contributed and the source of funds paid funding for funding was to transfer equity income. However, Piabin's capital increase was flawed.

According to the inquiry letter, according to Changyingtong's industrial and commercial registration materials, relevant evaluation reports, capital verification reports, and shareholders' meeting resolutions, Changyingtong shareholders Pie Yabin's intangible asset valuation of intangible assets is too high, and the exchanges of intangible assets have not been replaced when they are contributed. The part of the capital provident fund part and the replacement of the debt has not been performed, and there is a flawed flaw.

According to Article 27 of the Company Law, the price of non -monetary property as a funding should be evaluated and verified that the property shall not be overestimated or underestimated.

It can be seen that in the process of increasing Changyingtong's capital increase in Changyingtong, Changyingtong's actual controller Pi Yabin had an overestimated situation of proper technology that had been funded. Is there any violation of the above provisions?

The above situation shows that on May 10, 2010, Changyingtong increased its capital for the first time, and the registered capital was 10 million yuan. Among them, Piabin subscribed for 9.75 million yuan, and Li Yan recognized the contribution of 250,000 yuan. On May 12, 2010, Changyingtong received the initial funding of Pi Yabin and Li Yan, a total of 6.35 million yuan in currency funds. On July 16, 2010, Changyingtong received 3.65 million yuan in the second phase of Piabin.

Coincidentally, on the same day when Changyingtong received the second phase of Piabin's investment in Piabin, Changyingtong had received 14.65 million yuan paid by Piabin with the proprietary technology, of which 11 million yuan was included in Piabin's second capital increase. The amount of capital of registered capital is 3.65 million yuan or the amount of the second phase of the two -phase funding of Pi Yabin to set up Changyingtong. In June 2011, Changyingtong conducted the third capital increase, with a new registered capital of 10 million yuan. Among them, Piabin invested 3.65 million yuan in currency and increased by 6.35 million yuan in capital reserve.

Regarding the proprietary technology used by Piabin for funding, because the proprietary technology has not been directly applied to the actual operation by Changyingtong, there is an oversupple value. Later, Pi Yabin replaced the original non -patented technology to invest 210.479 million yuan with cash and debt.

It can be seen from the process of Pi Yabin's investment to Changyingtong that due to the high valuation of the proprietary technical valuation of the proprietary technology at that time, and then the cash and fundraising contributed by the equity price replacement technology, Piabin may only be in 2010. On May 10th and June 15, 2011, a total of 9.75 million yuan in cash was paid, and the registered capital of Changyingtong was 30.75 million yuan. In addition, on the basis of the above -mentioned registration capital, Piabin transferred a total of 88,929,400 yuan from February 2012 to April 2016. Ya Bin transferred over 70 million yuan through stock transfer or floating.

It is better to be clumsy. Can Changyingtong tell his "story"?

- END -

The amount of import and export is steadily rising!In the first half of the year, the scale of foreign trade in Beijing -Tianjin -Hebei was 10 % of the country

I learned from Tianjin Customs that in the first half of this year, the total value of foreign trade imports and exports in Beijing -Tianjin -Hebei reached 2.35 trillion yuan, an increase of 12.5%over

Anti -Office of the New Coronatte Pneumonic Pneumonia Institute of Pneumonia in Nanshan District, Shenzhen (No. 137)

New type of coronary virus pneumonia in Nanshan District, ShenzhenPrevention and C...