The first batch of scientific and innovative boards will be released!These eight securities firms soup, interpretation of the industry: beneficial to small and medium investors

Author:Daily Economic News Time:2022.09.16

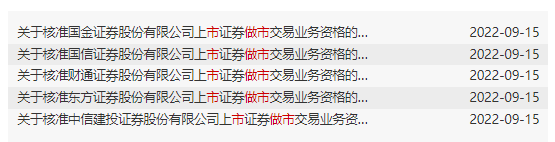

On the evening of September 16th, the SFC website news that the science and technology board of the first eight securities firms was released, namely Shen Wanhongyuan, Huatai Securities, Galaxy Securities, CITIC Construction Investment, Oriental Securities, Caitong Securities, Guoxin, Guoxin Securities and Guojin Securities.

It is worth mentioning that many securities firms have previously announced that they are actively preparing for the science and technology board to do the market. For example, CITIC Securities announced on the evening of July 8 that the board of directors agreed to the company's "Proposal on Carrying out Science and Technology Board Stocks to Do the Municipal Trading Business", authorized the company to apply for management management to apply for relevant business qualifications, and go through relevant approval and filing procedures. Zhejiang merchants, Fang Zheng, and Soochow also said that they will apply for this qualification, but in the end, there are only 8 of the first batch of brokers approved, and many head brokers are absent.

The end of two years will help strengthen the market toughness

The science and technology board launching launch lasted two years, which was interpreted by the industry as a milestone in the history of the science and technology board.

On June 18, 2020, the Chairman of Yihui Manchu stated that it will introduce the city business system on the science and technology innovation board.

In January 2019, the CSRC issued the "Implementation Opinions on the Establishment of Science and Technology Board and Pilot Registration System on the Shanghai Stock Exchange", which proposed that "the introduction of the city business system when the condition is mature", which will be in an orderly manner, which will be orderly. " Promote the establishment of the science and technology board and pilot the registration system.

In March 2019, the Shanghai Stock Exchange issued the "Special Regulations for the Shanghai Stock Exchange Science and Technology Innovation Board Stock Exchange", which clearly stipulates that "science and technology board stock transactions implement bidding transactions. Plate stocks provide bilateral quotation services. "

On January 7, 2022, the CSRC solicited opinions on the pilot of the science and technology board.

On May 13, 2022, the Securities and Futures Commission issued the "Regulations on the Pilot of the Stocks of the Securities Company's Science and Technology Board of Science and Technology Board" to clarify the pilot requirements of the science and technology board as the pilot of the marketing system, and the pilot work will be promoted in an orderly manner. The relevant rules of the market trading business have been solicited from the market to the market, and the sources of funds and stocks and related risk control indicators are clearly made to the market.

The launch of the science and technology board as a city merchant is of great significance for the improvement of the transaction activity itself.

Guoxin Securities pointed out that as of June 30, 2022, there were more than 400 listed companies in science and technology board, with a total market value of about 5.60 trillion yuan. The active degree of activity of the science and technology board stock transactions is extremely important. From the perspective of market transactions, the main value of the market businessmen is:

The first is to significantly improve market liquidity. When the market is sluggish, investors' emotions have been significantly affected, and the level of stock liquidity decreases more significantly, and poor liquidity also in turn affects the investment behavior of institutional investors. In the background of the registration system, the market has steadily expanded, and the liquidity level of some stocks has decreased. The introduction of the market business mechanism is conducive to improving the liquidity and activity of science and technology boards, meet the needs of market transactions, and is conducive to the long -term and healthy development of science and technology boards. In addition, it enhances market activity and provides stronger financing support for the development and growth of science and technology enterprises.

The second is to help market merchants help market prices stable and enhance market toughness. When the market fluctuates, the market business has the responsibility to continue to quote to prevent excessive speculation. Municipal merchants generally have good valuation analysis and value judgment capabilities. The risk tolerance is higher, which is more conducive to maintaining the market price near a reasonable level and maintaining market stability. In particular, the market has fluctuated significantly. The marketing business as a market obligation has played the role of the final offer, and improved the continuity of the quotation at a critical moment, thereby sending valuable price reference information to the market to help the market stabilize and rebound. At the same time, the lower the liquidity of the stock, the more the transaction behavior of individual investors will have a greater impact on the price trend. The addition of market merchants to increase the overall liquidity level, which will also reduce the influence of a single investor on the market, which is conducive to market balance and market balance and Stablize.

The third is that the introduction of city merchants can improve the discovery mechanism of stock prices, which will help improve the price efficiency of the science and technology board stock. At present, with the steady progress of the A -share market registration system, the number of listed stocks has grown rapidly, institutional investors have continued to grow, and investor structure has gradually improved. With the relaxation and decline restrictions of science and technology boards and GEM, some small plates and unpopular stock risks will increase, and it will face a situation of decline in liquidity, unreasonable valuation level, and distorted prices. On the basis of measuring their own risks and income, the city merchants give play to their own professional pricing capabilities for quotation, which will help promote securities prices to return to actual value.

Huatai Securities also clearly pointed out that the science and technology board doing the city business system is actually beneficial to small and medium investors. A market that does not do the marketing system often appears over -reaction of securities prices due to investor "herd effects". The advantages of market merchants in terms of funds, systems, personnel, etc. can maximize the "irrational fluctuations" of the market. Thanks to the forward -looking layout of the science and technology board as the marketing system, the city merchants will definitely become the "Dinghai God Needle" of the science and technology board stock market.

The approved brokerage firms are all three -year classification and evaluation of "superior students" above level A

It is worth mentioning that many securities firms have disclosed the first batch of science and technology boards as municipal business qualifications in the early stage, but from the current situation, only eight have been approved in the end.

According to the requirements, the brokers who can participate in the first batch of pilot must meet the two major conditions of the two -year category A class A (inclusive) or above in the last three years. In other words, the eight brokers who have obtained the qualifications of the science and technology board as a city business are all the "superior students" of the three -year A -level rating.

However, the first batch of science and technology boards will be released, which means that in the future, more brokers will join the ranks of market merchants without meeting the requirements. Brokerage companies generally believe that the launch of the science and technology board system will not only play a positive role in improving the quality of listed companies in the science and technology board itself, but also have a profound impact on the development of the brokerage industry. CITIC Securities pointed out that from the overseas market, the market system of individual stocks is common. Taking the US stock market as an example, the NYSE (NYSE) and Nasdaq were originally a market-driven market. In order to promote more transparent transactions, the NYSE and Nasdaq decided to adopt the Order-Driven's price limit instruction book system, while retaining the city merchants, forming the current hybrid transaction mechanism. At present, it is not accidental to use a mixed trading mechanism for municipal merchants. It is not accidental. It is a transaction experience that this transaction system is most conducive to gathering liquidity and give investors a relatively better trading experience.

CITIC Securities pointed out that the recorded market business will not have a negative impact on the market. This is because, first of all, the qualifications of the city merchants are very strict, and they need to meet a series of requirements and strict inspections and tests of the exchange of the CSRC at the same time. Under the premise of margin financing, the market will adopt market neutral strategies, and the market strategy will basically maintain a balance of sale within the day. Therefore, the transaction of market merchants has no impact on the long -term trend of the stock price.

Galaxy Securities believes that the launch of the city's business system is of great significance to the high -quality development of science and technology boards. Science and technology board listed companies are mainly scientific and technological innovation companies, focusing on supporting new generation of information technology, high -end equipment, new energy, and high -tech industries and strategic emerging industries such as biomedicine. The launch of the market business system will enhance the liquidity of science and technology boards, which is conducive to the process of science and technology innovation enterprises to the science and technology board listing financing process, and it also helps to reinstate financing of listed companies. At the same time, as a city merchant, through the professional ability of institutional investors in terms of valuation, it will enhance the value discovery function of the science and technology board, so as to guide the funds to better serve the high science and technology innovation attributes and research and development capabilities. Technical enterprises to better promote the development of the national science and technology industry.

At the same time, Galaxy Securities believes that the science and technology board market will give play to the professional pricing function of the city securities firms, suppress speculation and other market stabilizers to provide liquidity for market investors. In the process of doing the market, improving the efficiency of funds, which is conducive to the comprehensive service advantages of business lines such as the wealth management and investment banking of securities companies, and promote the high -quality development of the securities market and the improvement of comprehensive service capabilities.

Shen Wanhongyuan pointed out that the development of science and technology board stocks to do the municipal transaction business will help promote the establishment of a complete science and technology board service chain of securities companies. On the premise of meeting the information isolation requirements of securities companies, it forms a collaborative development effect with other businesses with securities companies. Optimize the business structure of securities companies, improve the efficiency of its own funds and securities in securities companies, enhance comprehensive financial services capabilities and business competitiveness, and promote the high -quality development of securities companies.

Five cases will be terminated with all science and technology board stocks to do the market transaction business

It is worth mentioning that as early as July 15th, the Shanghai Stock Exchange released the "Implementation Rules for the Implementation of the Shanghai Stock Exchange Science and Technology Innovation Board Stocks of the Stocks of the Stocks of the Shanghai Stock Exchange".

"Daily Economic News" noticed that in the rules, the Shanghai Stock Exchange clearly stipulated that according to the market indicators, market performance and regulatory compliance, it will regularly evaluate the market business service and market services. The service evaluation of the city merchants is divided into 5 grades of AA, A, B, C, D, and published each month, and announced the evaluation results to the corresponding city merchants and stock issuers.

If there is one of the following situations in the market, the Shanghai Stock Exchange can terminate all its science and technology board stocks as a market transaction business and announce to the market:

(1) No longer available for listing securities to do the business qualifications of the city;

(2) The results of the annual comprehensive evaluation of the city merchants are D;

(3) The results of the annual comprehensive evaluation of the city merchants are C and the ranking is at the end of 10%;

(4) Severe violations of laws and regulations occur;

(5) Other circumstances stipulated by the Shanghai Stock Exchange or the agreement agreed in the city agreement.

This means that obtaining the qualifications of the city is not a forever for securities firms. In addition, the Shanghai Stock Exchange also emphasizes that the marketing of science and technology board shares should be used as a market transaction business. Business conducts insider trading, manipulation of markets, and other illegal acts or illegal acts or seek other unfair interests.

Daily Economic News

- END -

Among the two Beijing Stock Exchange theme funds, the first batch of theme funds of the Beijing Stock Exchange received positive returns in the second quarter

On July 25, 2022, the theme fund of the two Beibei Stock Exchange was issued, whic...

Stop and stop!After exercise, don't do this anymore →

Do you have the habit of drinking cold drinks immediately after exerciseStopBe car...