Seeing the flying cranes in revenue, adult milk powder is difficult to become "life -saving straw"

Author:Red Star News Time:2022.09.16

↑ Source: Red Star Capital Bureau

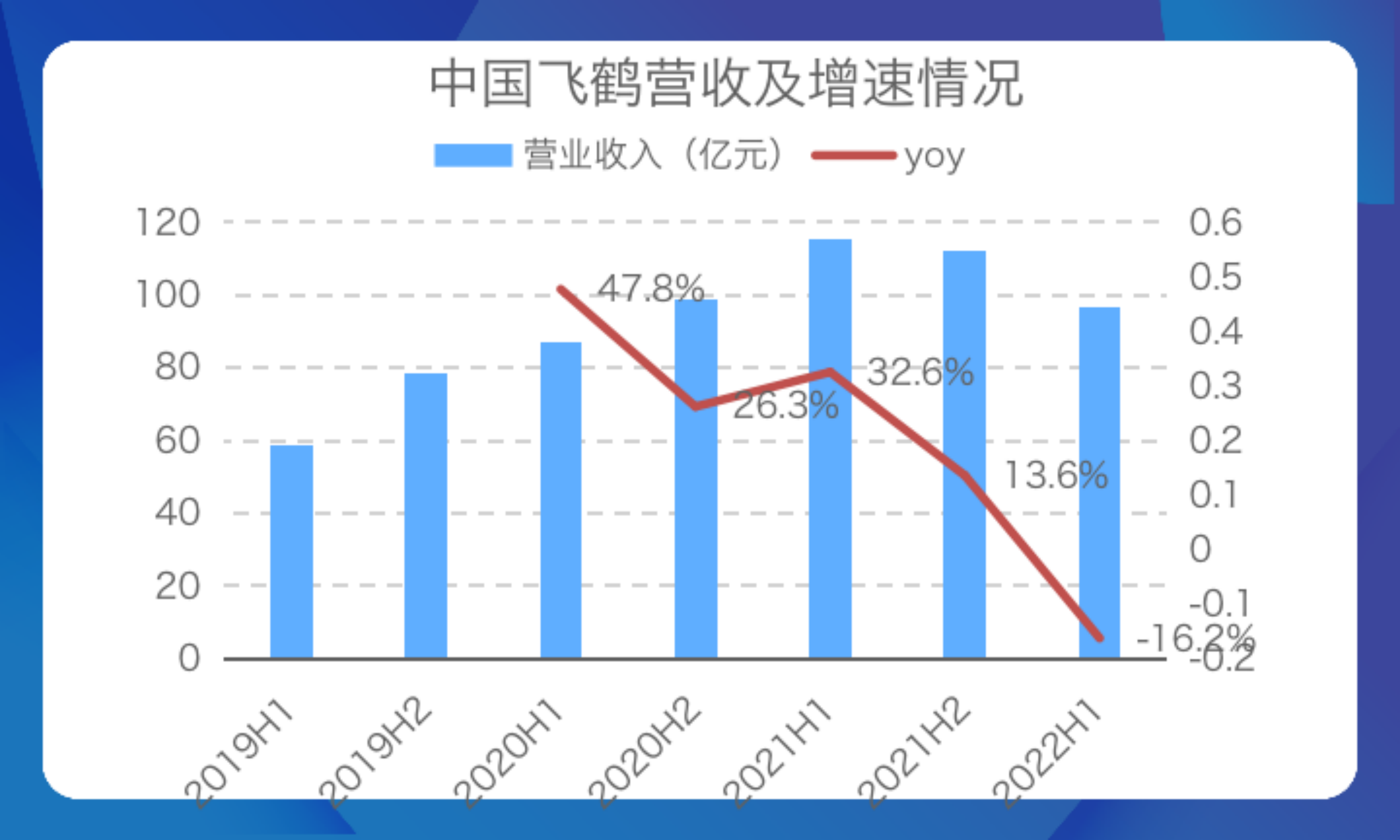

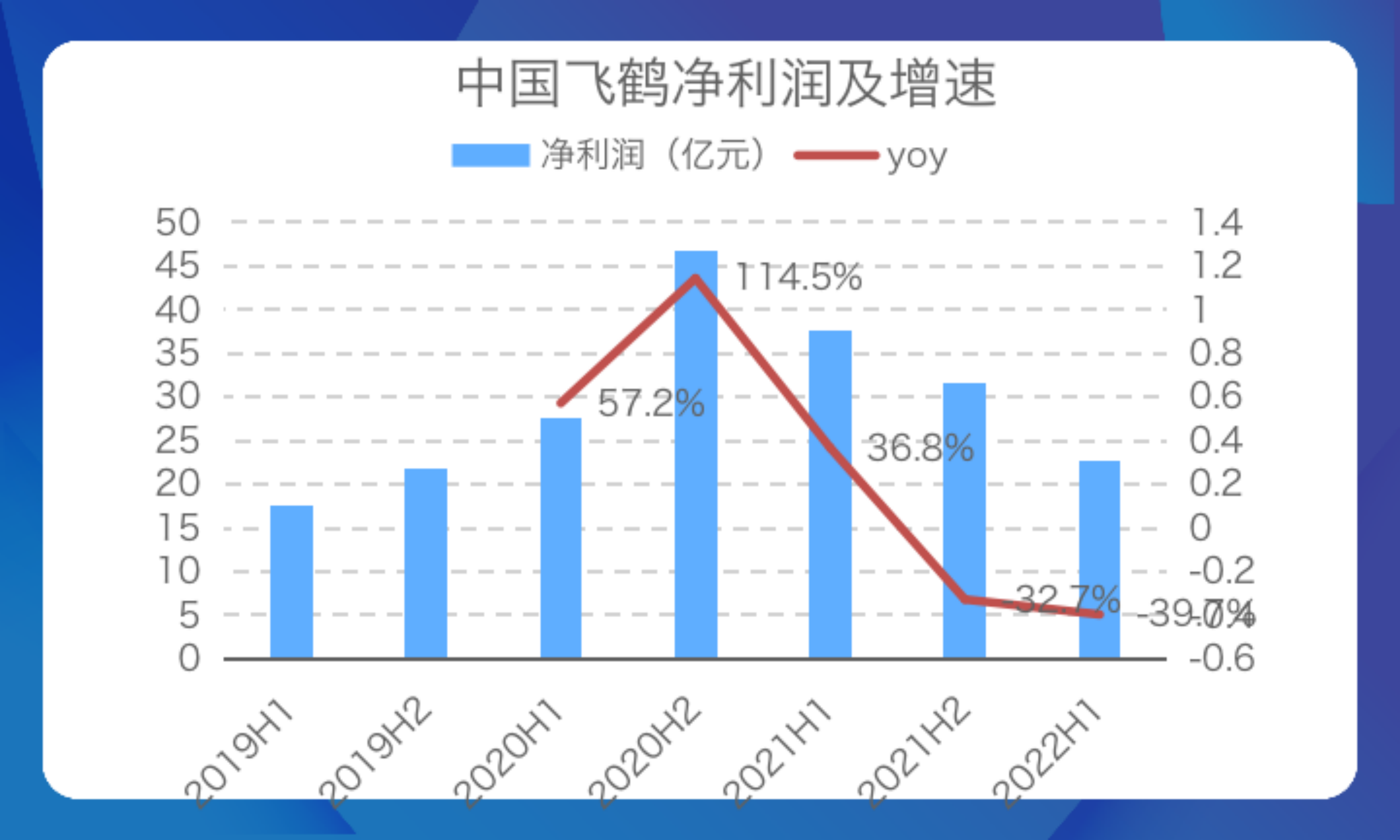

According to China Feihe (HK: 06186) in the first half of 2022, its revenue from January to June was 9.673 billion yuan, a year-on-year decrease of 16.2%; net profit was 2.272 billion yuan, a year-on-year decrease of 39.7%.

For the flying cranes of the main formula of infant formula, the top signal of infant milk powder business may have appeared.

↑ Source: Corporate Financial Report, Red Star Capital Bureau

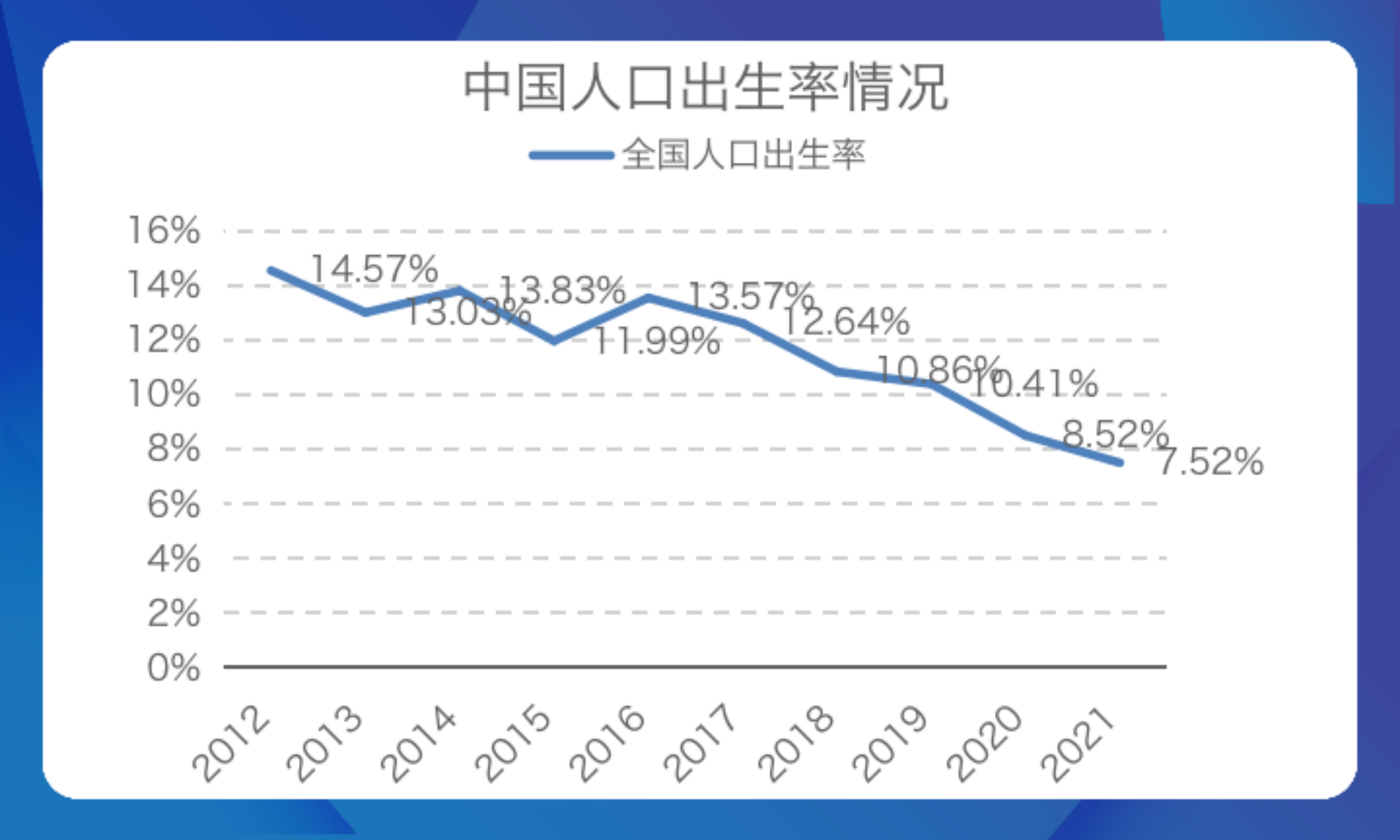

The reason behind this is also obvious: on the one hand, China's birth rate is constantly declining. According to the data of the Chinese Bureau of Statistics, the birth rate of the Chinese population has dropped from 14.57%in 2012 to 7.52%in 2021; and the birth population in 2021 is 10.62 million, and the birth population is 10.62 million. Compared with 12 million in 2020, 1.38 million.

↑ Source: National Bureau of Statistics, Red Star Capital Bureau

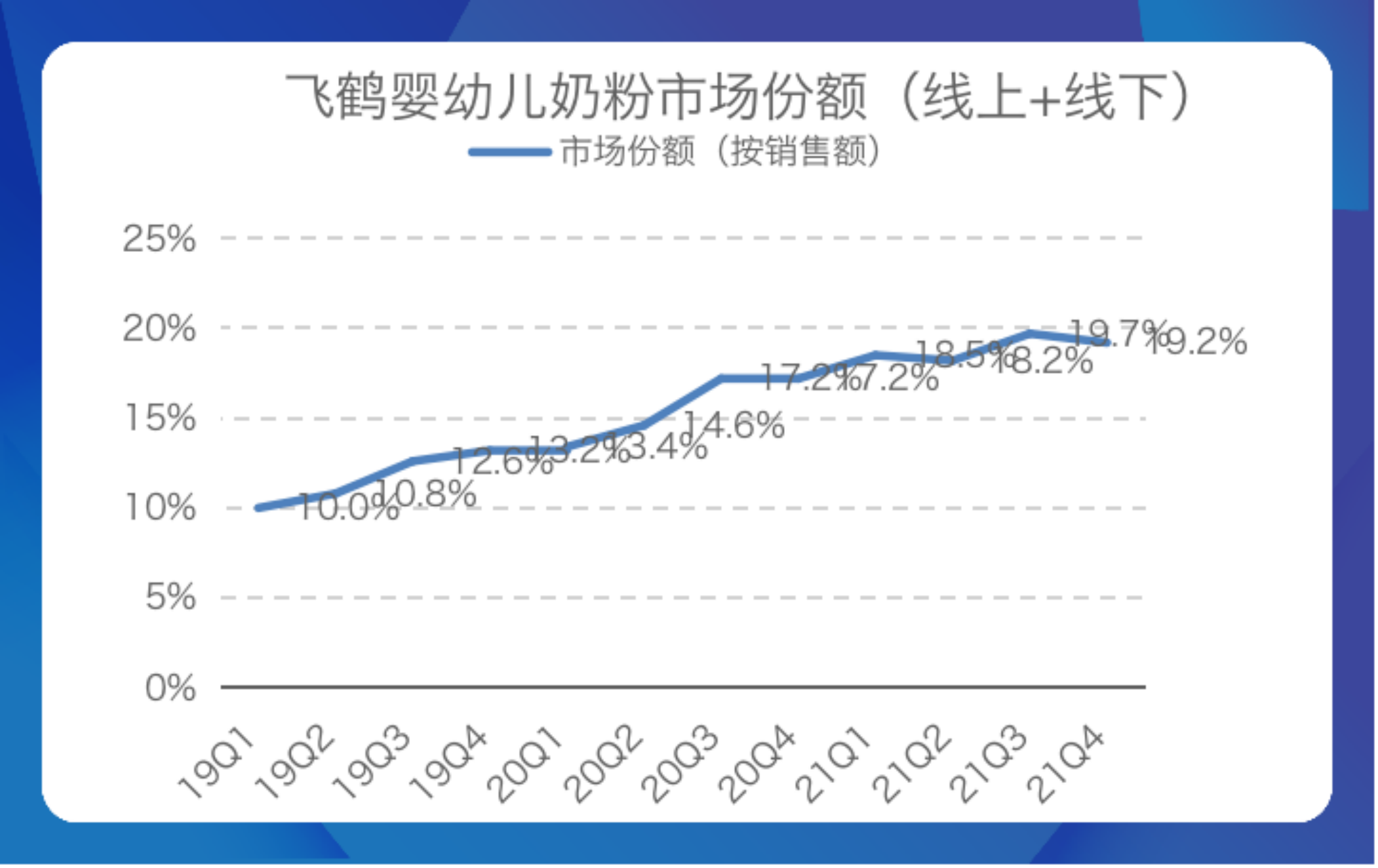

On the other hand, the infant milk powder industry is also competitive. According to Nielsen data, in the first half of 2022, the market share of Feiheyou baby milk powder market was close to 20%, indicating that the market share of Feihe in the first half of this year has basically not increased; in fact, in the fourth quarter of 2021 It has begun to decline.

↑ Source: Nielsen Zero Research Data, Red Star Capital Bureau

For Feihe, if you want to continue to get capital recognition, you need new stories to tell.

In 2021, Feihe launched four adult functional milk powder products in one breath. Management stated that the market size of adult milk powder is 20 billion yuan, and it is expected to increase by 10%this year. In the announcement of the performance early warning announced in the first half of the year, Feihe expressed its optimistic about adult milk powder business, emphasizing that China's population over 60 years of age exceeded 260 million, and the adult milk powder market was huge.

It can be seen that Feihe wants to use adult milk powder as the "second growth curve" of an enterprise. But at present, whether it is the market size, profit space, channel reconstruction or market competition of adult milk powder, Feihe's "victory" is not large.

(one)

"Non -need" product market space is limited

The audience of adult milk powder is huge, there is no doubt.

According to data from the National Bureau of Statistics, as of the end of 2021, the labor age population aged 16-59 was 882 million, accounting for 62.5%of the national population; 267 million people over the age of 60 and over, accounting for 18.9%of the country's population.

However, unlike infant milk powder, from the perspective of user needs, infant milk powder is basically "rigid" for every newborn family, and adult milk powder can be replaced by strong replacement and does not belong to "just need" products.

Public data shows that the current scale of adult milk powder in China is about 20 billion yuan, and the sales scale of infant milk powder in 2018 is 222.1 billion yuan. one.

Therefore, although the number of adult groups is huge, the "non -needed" milk powder product imagination space is also very limited.

(two)

"Low price" product profitability is limited

A large part of the reason for the success of Feihe is that the product is "expensive".

The chairman of Feihe, Leng Youbin, once bluntly said: "Feihe milk powder is folded into a kilo price, the most expensive in the world." He also said: "Consumers' cognition is good or expensive. Although Feihe also has a milk powder product of less than 200 yuan, consumers will not buy it."

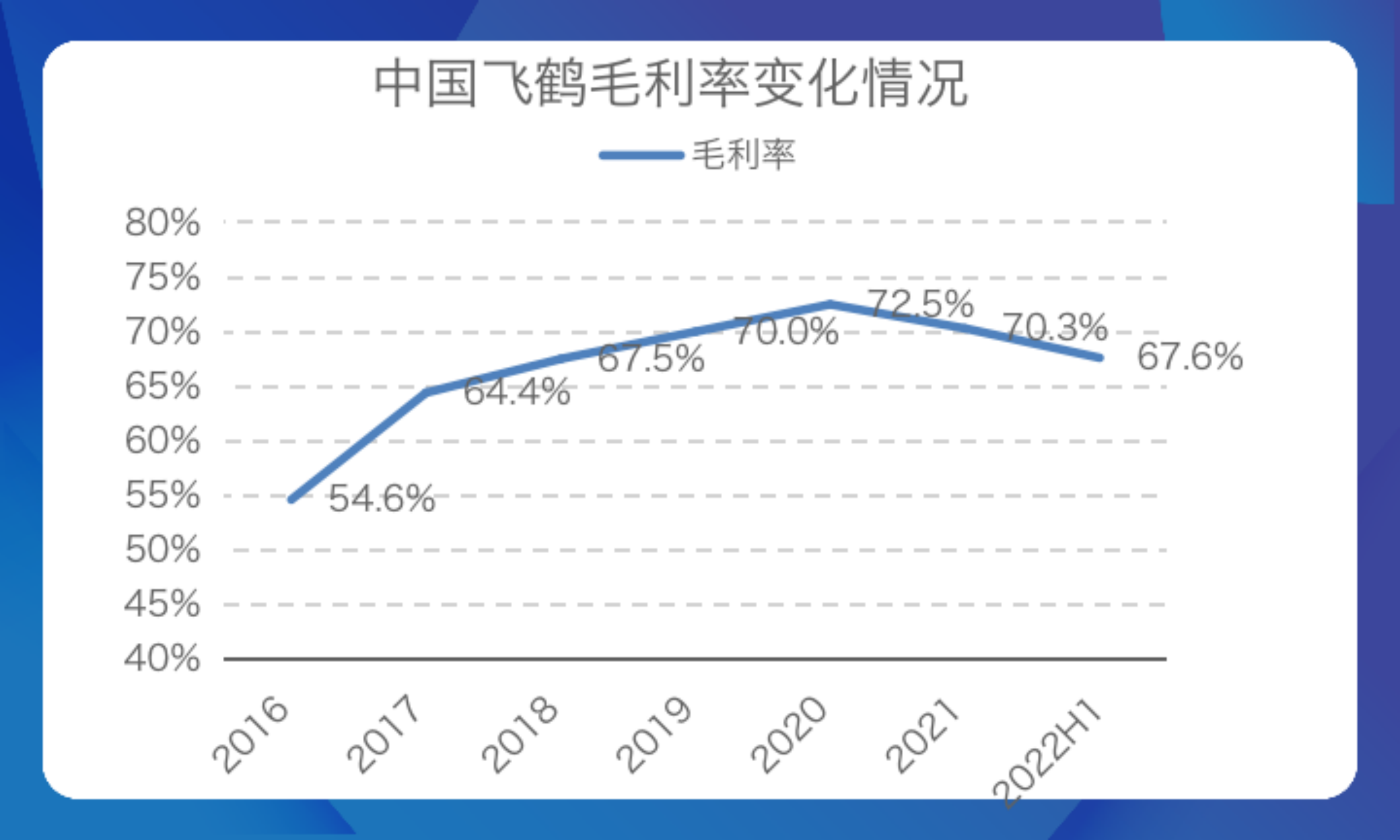

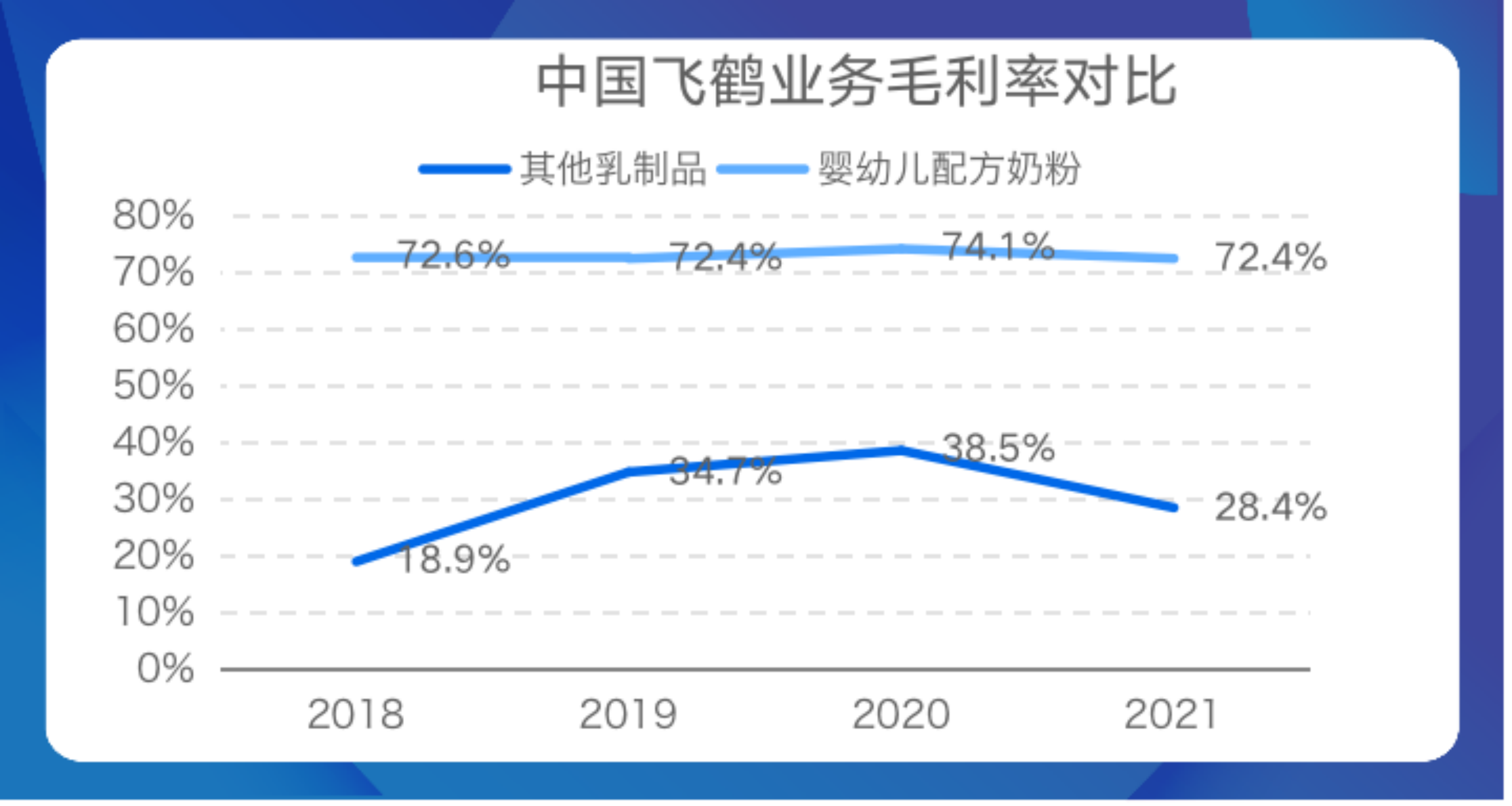

As the price of Fei crane products rose, corporate gross profit margin also went up the way. The financial report shows that the gross profit margin of the corporate increased from 54.6%in 2016 to 72.5%in 2020 (2020 infant milk powder gross margin reached 74.1%), while the gross profit margin of peers was mostly around 40%, and the gross profit margin of Feihe was far away. Gao Tong.

↑ Source: Corporate Financial Report, Red Star Capital Bureau

Parents are willing to buy milk powder for newborns, because parents generally think that expensive is good. But this logic is placed on the adult milk powder market.

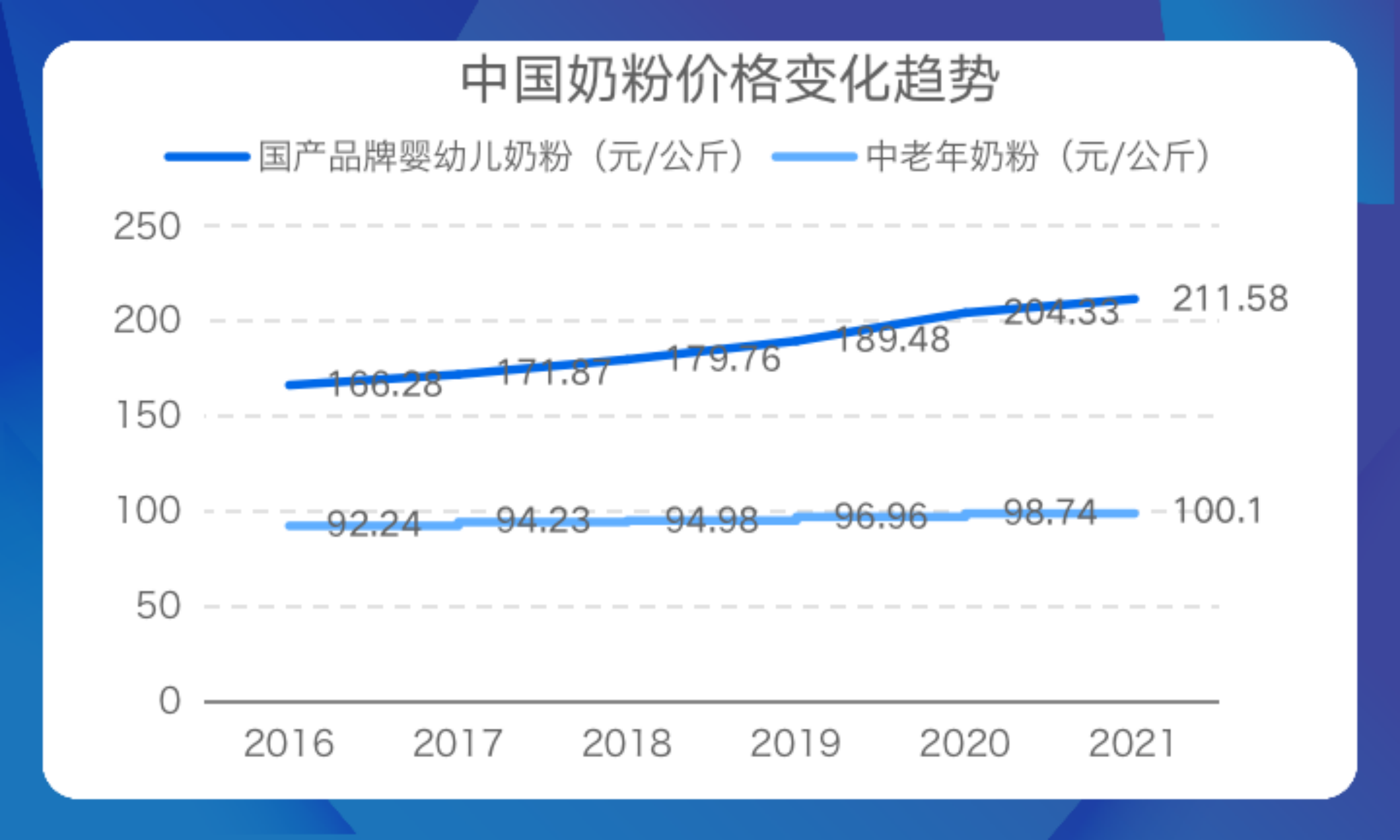

According to statistics from the Huajing Industrial Research Institute, from 2016-2021, the price of middle-aged and elderly milk powder increased from 92.24 yuan/kg to 100.1 yuan/kg; while the price of infant milk powder increased from 166.28 yuan/kg to 211.58 yuan/kg.

↑ Source: Huajing Industrial Research Institute, Red Star Capital Bureau

This shows that the price of middle -aged and elderly milk powder is not only cheaper, but also the price increase is relatively small. Most consumers are unwilling to receive high prices on adult milk powder.

If Feihe wants to make the scale of adult milk powder larger and wants the same profit as baby milk powder, it will need more shipments. Business becomes harder, and it is extremely difficult to achieve large -scale profit.

(three)

The advantages of mother and infant channels are no longer

Infant milk powder sales mainly depend on offline channels, especially offline maternal and infant shops. According to Feihe's financial report, as of the end of 2021, Feihe mainly sold its products through more than 2,000 offline customers (covering about 110,000 retail sales points).

Nielsen data shows that the mother and infant shops are quickly replacing the mainstream channels for Shang Chao to become infant milk powder. From 2011 to 2020, the proportion of maternal and infant store channels increased from 33%to 69%. 44%dropped to 10%.

But infant milk powder is completely different from the channel structure of adult milk powder. According to the data of the Kaidu Consumer Index, the current online shopping is the largest purchase channel for adult milk powder. In 2021, the sales of online shopping channels accounted for 26%, and its sales growth rate was 8.9%year -on -year. It was 20.3%and 18.8%, and the year -on -year growth rate of sales was 1.9%and 8.2%, respectively. In other words, Feihe is an adult milk powder and cannot use the advantages of the mother and baby stores that has been established for many years. On the contrary, Feihe needs to lay out new dealers and sales points to promote adult milk powder. To this end, Feihe needs to pay a lot of manpower and financial resources, and also faces more uncertainty.

The original channel advantages cannot be emphasized, and everything is overwhelmed. This process is destined to be long and may not be effective.

(Four)

The adult milk powder market is fiercely competitive

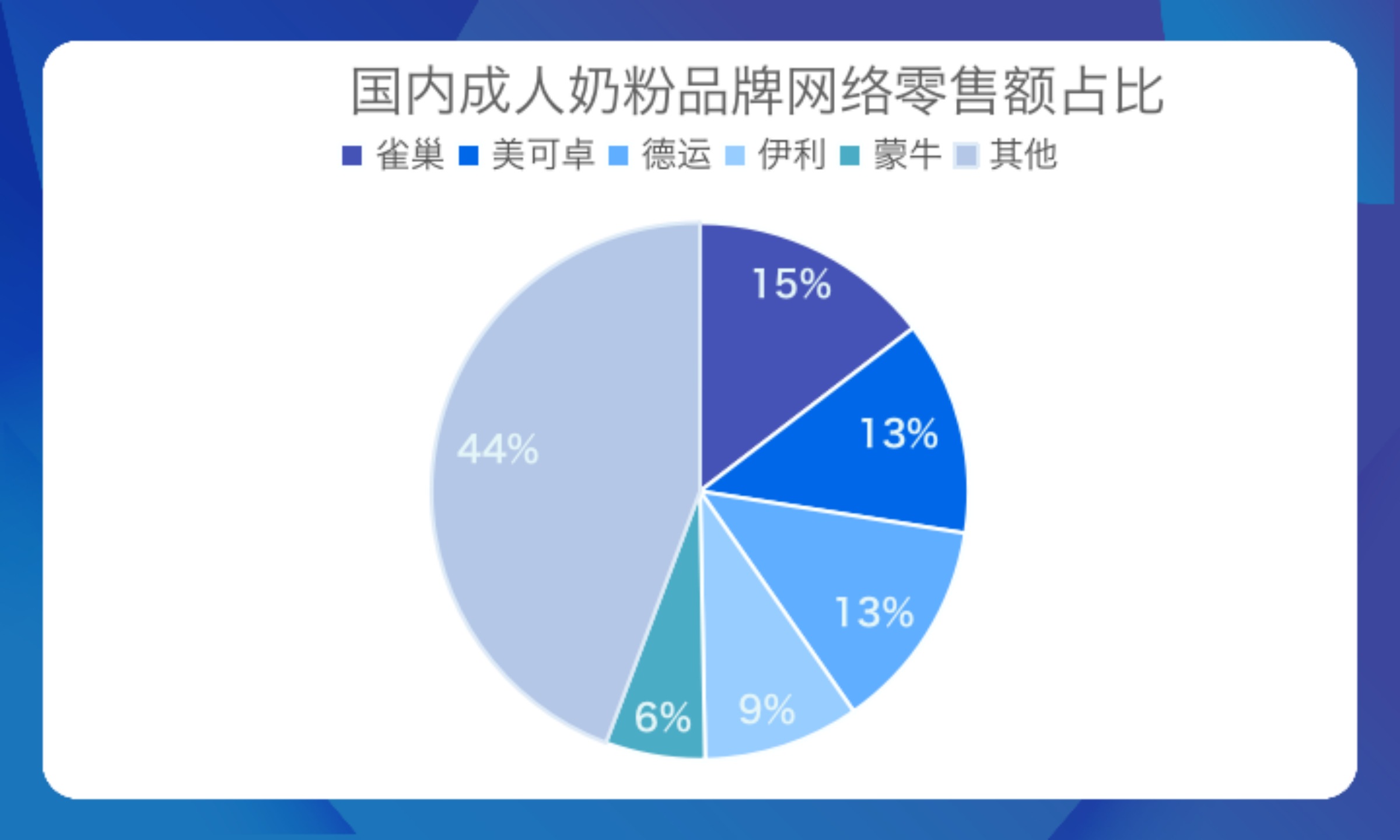

From the perspective of market competition, there are many adult milk powder market players, and the competition is very fierce. According to the research data of ICBC's research, the income of Feihe's adult milk powder in 2021 was about 700 million yuan. According to data from the Foresight Industry Research Institute, in the first quarter of 2019, the top five retail sales of adult milk powder brands in China were Nestlé, Michazo, Deyun, Yili, and Mengniu; the market share reached 55.7%, and the industry concentration was high.

↑ Source: Foresight Industry Research Institute, Red Star Capital Bureau

From the perspective of Tmall data, according to the Magic Mirror Market Intelligence, in this year's 618 sales list, adult milk powder competition is fierce, ranking top five of the total sales of 64.17%, and Feihe ranked 12th.

↑ Source: Magic Mirror Market Information, Red Star Capital Bureau

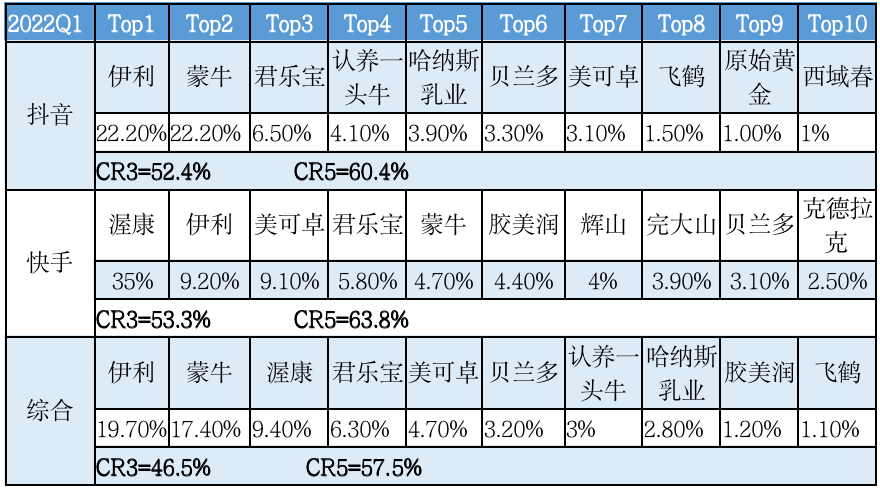

From the perspective of social media platform data, according to the data collection data, Feihe's sales in the social media platform e -commerce (Douyin+Kuaishou) in 2021 also did not enter the top ten, with a share of less than 1%; and in the first quarter of 2022 Only 1.1%.

In contrast, Mengniu's share in 2021 was 2.7%, and by the first quarter of 2022, it has risen to 17.4%, second only to Yili in the top two.

↑ Source: Gaogou data, Red Star Capital Bureau

At present, Feihe's adult milk powder does not occupy an advantageous position compared with the market players; under the fierce market competition, it is not much time for Feihe.

summary

The infant milk powder industry enters the cold winter. Feihe wants to seek the "second growth curve" of an enterprise through adult milk powder. This story sounds beautiful; Crane's "victory" is not large.

Red Star News reporter Liu Yan Fan Di

Edit Yu Dongmei Yang Cheng

- END -

The 4 docks of Yangjiang Port Ji Shu Operation Zone were completed

On September 5th, the Ji Shu Operation Area in Hailing Bay, Yangjiang, Yangjiang, ...

Consumer VR equipment sails, VRETF (159786) has a net inflow of 5 consecutive days

On September 13, the VR sector's traffic continued to be active.Zhaowei Mechanical and Electrical, Lixun's precision led, Lianchuang Electronics, Kaiying Network, China Science and Chuangda, and Light...