Seven major banks announced the down!It's about your deposit

Author:Nanjing Morning Post Time:2022.09.16

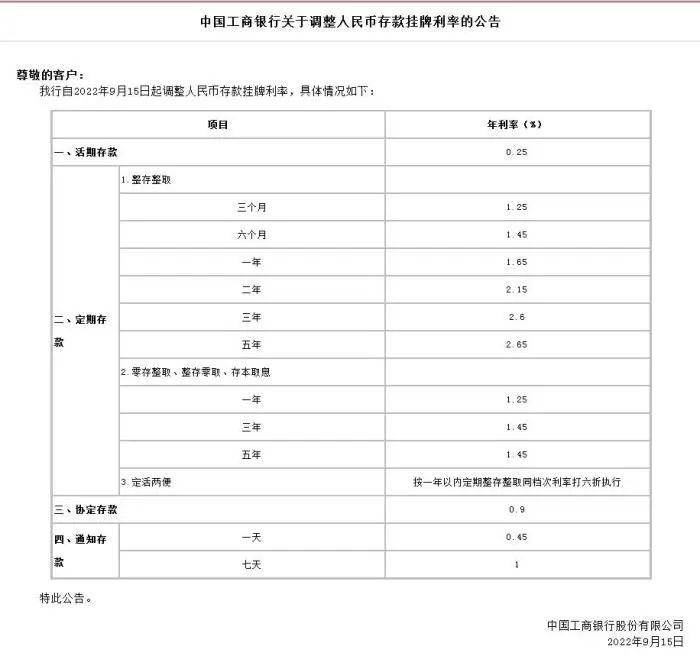

On September 15, the interest rate of personal bank deposits ushered in important changes. Including ICBC, Agricultural Bank of China, Bank of China, CCB, Bank of Communications, Postal Savings Bank, and China Merchants have issued an announcement saying that the listing interest rate of RMB deposits will be adjusted now.

Among them, the three -year regular deposit and large -scale deposit interest rates were reduced by 15 basis points, and the one -year and five -year regular deposit interest rate was reduced by 10 basis points, and the interest rate of the deposit rate was reduced by 0.5 basis points.

Industrial and Commercial Bank of China's announcement on adjusting RMB deposit interest rates. Screenshot from the official website of Industrial and Commercial Bank of China

Why is the deposit interest rate down?

In fact, this round of reduction is no longer the first adjustment of deposit interest rates in this year. According to the central bank's first quarter of 2022, monetary policy enforcement reports, state -owned banks and most joint -stock banks such as Workers and Peasants' Creation Communications and Microelectronics have lowered their interest rates and large -scale deposit interest rates in the one -year or higher period of time in late April. Some local legal entities. It also reduces it accordingly.

The central bank said that the establishment of a market -oriented adjustment mechanism for the establishment of deposit interest rates focuses on promoting further marketization of deposit interest rates, and the guidance of banks is flexible. Banks can refer to market interest rate changes according to their own situation, and independently determine the actual adjustment of its deposit interest rate. After the establishment of the new mechanism, the bank's deposit interest rate has a higher degree of marketization. In the context of the current market interest rates, it is conducive to banks' stable liabilities costs and promoting the further downward downward decline of actual loan interest rates.

In the context of the adjustment of the deposit interest rate mechanism, Wen Bin, chief economist of China Minsheng Bank, pointed out that the decline in the deposit rate of the state -owned bank's deposit rate shows that the effectiveness of the deposit interest rate reform is emerging.

"After the borrowing facilities (MLF) over the mid -August period exceeded the expected interest rate cut 10 basis points, the 10 -year Treasury bond yield rate was sharply reduced, and the quotation interest rate (LPR) of one -year and 5 -year loan markets (LPR) was reduced by 5 and 15 respectively The basis point, the deposit interest rate is reduced, and the decline is generally consistent, indicating that the reform of the deposit interest rate reform is now emerging. "Wen Bin said.

In addition, Dong Ximiao, chief researcher at Zhailian Financial, mentioned that the decline in deposit interest rates is the active act of strengthening banks to strengthen asset -liability management and keep the interest margin basically stable.

This year, under the policy tone of financial support for the real economy, the interest rates of financial institutions such as banks and other financial institutions have continued to decline, which has continued to pressure the net interest difference. According to data from the CBRC, the net interest margin of commercial banks in the second quarter was 1.94%, which continued to narrow 3 base points from the first quarter. Many listed bank executives also mentioned this "pressure" at the performance meeting.

For example, Guo Mang, deputy president of the Bank of Communications, said that in the low interest rate market environment, the interest rate difference level of commercial banks in the second half of the year is still under pressure. From the perspective of the liabilities, affected by the decline in the decline in the investment and consumption willingness of residents and enterprises, the trend of regular deposits is more obvious, and the cost of liabilities has a certain degree of rigidity.

"The net interest difference between commercial banks continues to narrow and needs to control the cost of liability for banks." In response to the narrowing pressure of interest differences, Wen Bin pointed out that at present, the contradiction between credit supply and demand is still large. After the re -pricing in the first quarter of next year, the bank's revenue will be largely squeezed, for which it will further control the cost of bank liabilities.

In addition, Dong Ximiao also mentioned that since this year, in order to better help steady growth and employment, the central bank has adopted a variety of monetary policies and measures, including comprehensive reduction, and increased market liquidity. So the bank is "not bad". However, the market's effective financing demand is insufficient, reducing the motivation of banks to absorb medium- and long -term deposits.

It will drive the economy into a virtuous cycle

What is the significance of the reduction of bank deposit interest rates in this round? Wen Bin believes that the current market entity has a strong willingness to save, reducing the cost of deposit will help stimulate the self -financing needs of market entities, conducive to transforming funds to the entity department, promoting the formation of wide credit, and driving the economy into a virtuous cycle.

Dong Ximiao pointed out that after large banks have lowered deposit interest rates, more banks are expected to follow up, but different banks have different development strategies, liabilities capabilities, and business structures. Overall, the decline of risk -free interest rates in my country's market will be a long -term trend. From the perspective of abroad, there are also "negative interest rates" in some countries and regions.

"For the majority of residents, if there are many deposits and cash management wealth management products in asset allocation, the yield may decline. The relationship between risks and returns should be balanced. Good diversified asset allocation. "Dong Ximiao said.

Source: China News Network

Cover map source: Xinhua News Agency

Edit: Lin Li

- END -

Total investment of about 350 million projects settled in Hanshou High -tech Zone

On the morning of August 22, Hangzhou Science and Technology Coatings Co., Ltd. in...

Pilot project of smart campus construction in Pingdingshan City starts construction

Pingbu Rong Media Reporter Sun Congli Correspondent Fu BingxinOn the morning of Ju...