Shock 150 US dollars/barrel?International Energy Agency: High oil prices are destroying demand

Author:21st Century Economic report Time:2022.06.08

The 21st Century Economic Herald reporter Peng Qiang Beijing reported

The international oil price is still strong. Even if OPEC+organization accelerates production, it has failed to cool the oil market. Large investment institutions continued to watch oil prices in the third quarter, and energy institutions warned that high oil prices were undermining market demand.

国际能源署(IEA)石油市场负责人Toril Bosoni在接受标普全球普氏采访时指出,当前的高油价已经影响到了经济增长和石油需求,但就目前的信号来看, The overall oil consumption is still strong.

At the beginning of the year, the International Energy Agency predicted that global oil demand increased by 3.2 million barrels per day in 2022, which has now been reduced to 1.8 million barrels per day. At the end of 2021, international oil prices were still below $ 80/barrel. With the outbreak of geopolitical conflicts, sanctions on Russia's crude oil on Russia have decreased accordingly, and international oil prices have risen significantly. Guan, still hovering near $ 120/barrel.

Toril Bosoni said that an important feature of the current oil market is the damage of demand. Consumers are adjusting their crude oil needs based on factors such as energy prices, income, consumption confidence, and alternative energy.

As of the morning of June 8th, Beijing time, the price of WTI crude oil futures delivered in July rose 0.77%to close at $ 119.41/barrel; , Close at $ 120.57/barrel.

In the short -term energy outlook released on June 7, the US Energy Information Administration (EIA) predicts that the average price of Brent crude oil in the second half of 2022 is $ 108/barrel, and the average price of 2023 will be Downs to $ 97/barrel. EIA said that the current crude oil inventory is low, which enlarges the possibility of fluctuations in oil prices.

EIA pointed out that international oil prices are largely influenced by sanctions from all walks of life on Russia. The possible future sanctions and independent companies will affect the output of Russian crude oil and its sales in the global market. Essence

Recently, the European Union announced that it would stop importing oil products from Russia within 6-8 months. EIA predicts that under such conditions, Russia's crude oil output will drop to 9.3 million barrels per day by the fourth quarter of 2023, and the value of 11.3 million barrels per day in the first quarter of 2022 will be.

Although the current OPEC+organization said that it will accelerate production, this cannot reverse the popularity of the current oil market, especially Saudi Arabia also raised its crude oil price. Large institutions have also continued to raise oil prices, but the difference in the highest oil price is also very large.

Jeremy Weir, chief executive officer of Petroleum Trade, said at a recent media event that due to insufficient investment, global oil supply has been insufficient for many years.In a state of tension, the sanctions of Russian oil exports have exacerbated this tension. In the next few months, oil prices may rise to $ 150/barrel or higher. At the same time, the supply chain is tight.Its oil exports shift from Europe to other regions.

Goldman Sachs analysts predict that when the summer demand in the United States reaches its peak, the average oil price in the third quarter may exceed $ 140/barrel.Morgan Chase warned that the highest oil price may reach $ 150/barrel this year, or even $ 175/barrel.

- END -

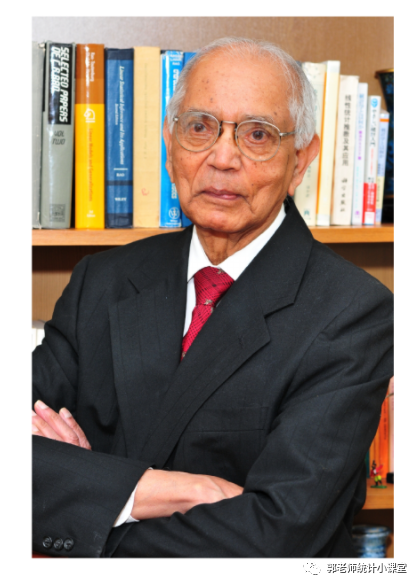

C.R.rao: One hundred years of statistics

The following article comes from WeChat public account: Teacher Guo statistics sma...

Entrepreneurship in Longjiang | Li Feng: Planting a "Red Sea" to break a "blue ocean"

The moment the Shenzhou 14 manned spacecraft was successfully launched, the country was excited. In the East Polar of the motherland, the whole people are boiling, because they follow the Shenzhou 14