Insufficient capacity utilization still raises funds?American New Technology IPO: Low dependent dealer's debt repayment capacity

Author:Investment Times Time:2022.09.16

During the reporting period, the proportion of US -New Technology's export revenue accounted for more than 95%, and the export relying on the distribution model, the distribution revenue accounted for more than 80%. At the same time, the company's operating cash flow continues to be negative, and the short -term debt repayment capacity is under pressure

"Investment Times" researcher Xin Yi

The severe tension of global wood resources has spawned "ecological wood" and "environmentally friendly wood". Environmental protection plastic wood profiles are "wood" synthesized by plastic and wood fibers.

Recently, the company that mainly produces plastic wood composite materials and its products -Meixin Technology Co., Ltd. (hereinafter referred to as Meixin Technology) officially submitted a prospectus to the Shenzhen Stock Exchange and applied for logging in to the GEM.

In this IPO, the company plans to publicize the issuance of RMB ordinary shares (A shares) of no more than 29.7169 million shares, and 958 million yuan to raise funds will be used for "the industrialization project of the new technology of the United States and New Technology (Phase I)" "R & D Center Construction Project", "Marketing Network Construction Project" and supplementary mobile funds.

"Investment Times" researcher consulted the U.S. New Science and Technology Prospectus noticed that from 2019 to 2021 and 2022 (hereinafter referred to as the reporting period), the company's export revenue accounted for more than 95%, and export relying on the distribution model, distribution of distribution, distribution The income accounted for more than 80%. During the period, the operating cash flow continued to negative, the accounts receivable increased, and the short -term debt repayment capacity was under pressure; in addition, the capacity utilization rate was less than 90%.

In response to the above situation, the Emperor Investment Times researcher's email communication outline to the relevant departments of the United States and New Technology, as of the press time, has not yet received a reply from the company.

Exports accounted for over 95%

During the reporting period, the operating income of the United States and New Technology was 350 million yuan, 497 million yuan, 695 million yuan, and 193 million yuan, respectively. The profits were 20.942 million yuan, 65.139 million yuan, 93.488 million yuan, and 18.7343 million yuan.

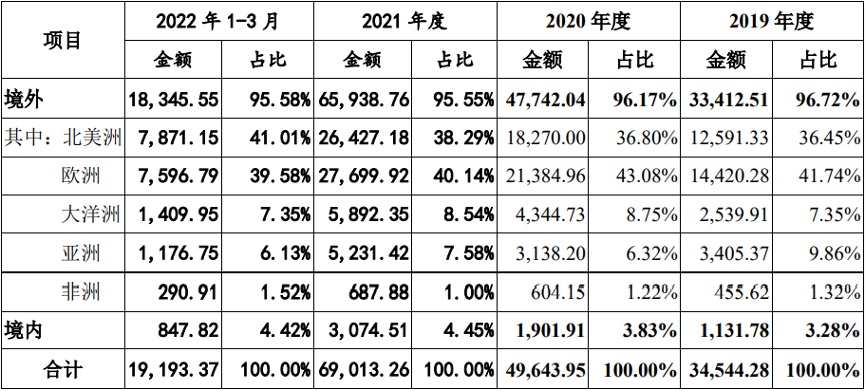

It is worth noting that during the reporting period, the proportion of US -New Technology's overseas sales revenue accounted for 96.72%, 96.17%, 95.55%, and 95.58%of the main business income, all of which were above 95%. Correspondingly, the export settlement of US dollars has also brought exchange loss to the United States and New Technology, with each period of -29.415 million yuan, 13.203 million yuan, 1.771 million yuan, and 554,400 yuan, accounting for -12.37% of the total current profit, respectively-12.37%, respectively. , 17.05%, 1.64%, and 2.57%, the effect of fluctuations is obvious.

Specifically, the overseas sales of the United States and New Technology are dominated by the European and American markets. Among them, the proportion of US market sales revenue accounts for 28.86%, 32.98%, 29.86%, and 30.63%, respectively. In the tariff list promulgated by the United States, the company's plastic wood profile products are currently imposed by 25%of tariffs, which has a certain impact on the business exported to the United States.

On the other hand, the US -New Technology market covers more than 50 countries or regions around the world. Considering the cost of operation and maintenance of sales channels, the company mainly cooperates with the target market regional dealers. The company mainly focuses on the distribution model, and the proportion of distribution revenue in each period is 82.58%, 78.57%, 83.23%, and 85.22%, respectively, accounting for more than 80%.

However, the researcher of the Investment Times noticed that the number of dealers in US -New Technology declined year by year, and during the reporting period, 110, 100, 90, and 88 were respectively. Especially in 2019, US New Technology ended with the cooperation with dealer Leadvision International Limited. The dealer achieved revenue of 13.6284 million yuan in 2018, accounting for 47.66%of the sales revenue of the dealer.

Large -scale exports make US -New Technology's risk of rising sea freight costs. Since the outbreak of the epidemic, China's export container freight index rose from 897.53:00 on January 3, 2020 to 3274.90 points on March 25, 2022, and the price of sea freight was on the rise. If the market price of the shipping market continues to rise or at a high level in the future, it will adversely affect the company's operating performance.

The main business income of US New Technology is divided by the region (10,000 yuan)

Data source: U.S. New Technology Prospectus

Short -term debt repayment capacity

Data in the prospectus show that the net cash flow generated by the US New Science and Technology periods of various phases is -83.959 million yuan, -116 million yuan, -214 million yuan, and -37.3119 million yuan, respectively. The amount is negative.

According to US -New Technology, in order to accelerate the turnover of funds, reduce the pressure of short -term funds, and improve the efficiency of capital operation, Hong Kong subsidiaries on the receivables of customers through the Hong Kong Star Shin Bank have attached pension financing with pursuit clauses. The factoring financing funds are included in the "short -term loan" and have not been included in operating cash flow, so the net operating cash flow is negative.

Researchers of "Investment Times" found that the amount and proportion of accounts receivables in US -New Technology have risen year by year. At the end of each issue, the company's accounts receivables were 43.1641 million yuan, 86.162 million yuan, 134 million yuan, and 156 million yuan, respectively, accounting for 16.61%, 24.81%, 33.57%, and 34.36%of the current mobile assets. The trend is obvious.

In addition, the payment party of the US -Singapore Technology has some sales receivables from the cases of the customers who signed the contract. They were 35.34%, 45.16%, 39.58%, and 33.36%. Among them, accounts receivables are the highest. During the reporting period, the amount of company factoring financing replies was 118 million yuan, 196 million yuan, 231 million yuan, and 48.13 million yuan, accounting for 33.65%, 39.42%, 33.22%, and 24.92%of the current operating income. It is a Hong Kong subsidiary responsible for customers in Europe and other regions.

Although American New Technology has tried to reduce the pressure of short -term funds through factoring financing, the company still faces greater pressure on short -term debt repayment.

From the perspective of the liability structure, the liabilities of the United States and New Technology are mainly liabilities, and their total liabilities have gradually dropped from 95.31%at the beginning of the reporting period to 78.92%at the end of the period. At the end of each issue, the company's short -term borrowing balance was 118 million yuan, 136 million yuan, 129 million yuan, and 176 million yuan, respectively, accounting for around 50%of the liabilities.

At the end of each period, the mobile ratio of the US and new technology was 1.02, 1.41, 1.49, and 1.41, respectively, and the speed ratio was 0.63, 0.94, 0.81, and 0.81. The dynamic ratio is 1.62, 1.22, 1.90, and 2.11, respectively. It can be seen that the company's mobile ratio and speed ratio are significantly lower than the industry average.

On the contrary, the asset -liability ratio of US New Technology is significantly higher than the comparison company average. Data show that the company's consolidated asset -liability ratio was 73.23%, 54.11%, 46.74%, and 51.32%, respectively; the average asset -liability ratio of the company was 30.63%, 40.41%, 35.69%, and 33.54%, respectively.

US New Technology Cash Flow Table (10,000 yuan)

Data source: U.S. New Technology Prospectus

The capacity utilization rate is less than 90%

The predecessor of Meixin Technology was Huidong Meixin Plastic Wood Material Products Co., Ltd. (hereinafter referred to as Meixin Plastic Wood), which was established in 2004; in March 2021, the overall change of Meixin Plastic Wood was changed to a stock company. The three brothers Lin Dongrong, Lin Dongliang, and Lin Dongqi are the actual controller of the US New Technology.

The main products of the US New Technology are new environmentally friendly plastic wood profiles such as outdoor flooring, wall plates, and combined floors. They are widely used in outdoor environments such as home courtyards, public building facilities, and garden landscape construction.

In this fund -raising plan, US New Technology has 51 billion yuan to invest in the construction of a new type of environmentally friendly plastic wood profile industrialization project (Phase I), accounting for 53.23%of the total fundraising.

However, the company's capacity utilization rate was insufficient. Data show that the capacity utilization rates of each period of US New Technology are 61.18%, 80.15%, 86.27%, and 78.66%, respectively. When the current capacity utilization rate is insufficient, it will be raised and expanded, and how to digest excess capacity may be a big problem for the United States and New Technology.

In addition, US New Technology does not occupy the advantage in R & D investment. Data show that the R & D expenditure of the United States and New Technology was 9.919 million yuan, 13.6167 million yuan, 21.851 million yuan, and 5.28 million yuan, respectively, accounting for 2.84%, 2.74%, 3.15%, and 2.73%of operating income.

- END -

The long triangle demonstration area pilot digital RMB "cross -regional" scene aiming at the "double carbon" goal

A few days ago, the Executive Committee of the Ecological Green Integration Development Demonstration Zone of the Yangtze River Delta jointly issued the Yangtze River Delta Ecological Green Integrati

Development!Chongqing large and medium -sized enterprises "hold hands"

In order to promote the development of large, medium -sized enterprises in Chongqi...