Nearly 130 billion Apple goes to the number one short target for Tesla Cheng Wall Street

Author:Cover news Time:2022.09.16

Cover Journalist Zhu Ning

Since April 2020, Tesla has become the number one time Wall Street for more than two consecutive years. However, at present, Apple has finally surpassed Tesla and has become the title of Wall Street's largest short -term goal.

According to the latest data from financial data and analysis companies S3 PARTNERS, as of September 14, local time, Apple's short position was as high as US $ 18.4 billion (about 130 billion yuan), officially surpassed Tesla's short position of US $ 17.4 billion , Becoming the largest short goal of Wall Street.

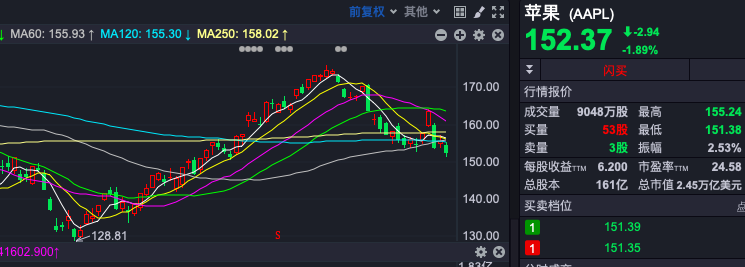

As of the close of September 15 local time, Apple reported 1.89%to $ 152.37 per share.

Apple short positions have increased

S3 PARTNERS predictive analysis director IHOR DUSANIWSKY wrote in the research report that this change reflects a large extent that the short bets have reduced the short bets on Tesla, not the empty are vigorously active and positive As short apples.

Data show that in the past 30 days, the short positions of Apple and Tesla have decreased. Among them, Tesla's short position has decreased to a larger degree: Apple's short position has decreased by $ 790 million, while Tesla's short position has decreased. $ 1864 billion.

It is worth noting that in the past three months, the number of Apple stocks has increased, but the more important influencing factor may be that Apple's stock price has risen. In the past three months, Apple's stock price has risen by nearly 20%, and the overall performance has far exceeded the broader market.

Although the shortcomings have increased, many Wall Street investment banks are still optimistic about Apple's stock price.

Morgan Stanley analyst Erik Woodring said that the content of the Apple conference was "largely in line with expectations", but there was also an unexpected thing. The iPhone 14 series did not increase prices than the previous generation. Woodring believes that this may be worthy of attention, especially when the global economy is weakened and concerns about recession may affect consumer expenditure. "Although the consumer expenditure environment is still challenging, we believe that Apple is still in the best place to pass the difficulty."

Woodring raised Apple's fourth fiscal quarter and annual revenue and profit expectations by 1 % and 3 %, because after the pricing announcement was issued, the bank's average price of the fourth quarter of the iPhone was 845 US dollars, and fiscal 2023 fiscal 2023 The average price is $ 900.

Technology stocks become short gathering places

With the rise of the Federal Reserve ’s interest rate hike, the U.S. stock technology giant has become a hunter on Wall Street. Data show that the top five short targets of Wall Street are Apple, Tesla, Microsoft, Amazon and VISA, and Google's parent company Alphabet ranks sixth.

The reporter noticed that since this year, a series of technology stocks that have soared from the loose monetary policy during the epidemic period have been short. Data show that short -scale technology stocks are one of the most profitable business in the US financial market in the first half of this year.

According to data from S3 Partners, as of June 30, the historical stock price recovery of so -called FAANG series companies such as Meta Platform, Apple, Amazon, Net Fei, and Google's parent company Alphabet have brought 19.8 billion US dollars to the short $ 19.8 billion to the short. Book profit.

Some analysts have pointed out that compared with stocks in other industries, technology stocks are more sensitive to changes in the Fed interest rates. The long -term development of technology companies requires a lot of capital investment. When interest rates rise sharply, technology companies will be more difficult to achieve their long -term goals, and as currency costs rise, their expected future cash flows will decline.

- END -

National Development and Reform Commission: Take strong measures to promote funds to form a physical workload as soon as possible

National Development and Reform Commission:Take strong measures to promote funds to form a physical workload as soon as possibleExperts expect the growth rate of infrastructure investment throughout t

More than a dozen new industrial Internet service providers are well -known companies such as Haier, Hisense, Aokma, etc.

Hello, I want to interrupt it. The problem you mentioned in the production plan of...