Jinling Sports, which is in place, will retreat if you do not enter

Author:Financial and economic Time:2022.09.15

Wen | Xu Yuanxuan

Some time ago, the "village BA" in Tatanaka, Guizhou, was on fire. The grounded people's sports competition became a hot topic of Douyin. At the same time, the Taipan basketball court became the "pilgrimage" of the national self -media punching point and basketball enthusiasts.

As the most important equipment for basketball games, basketball racks are essential, and it is also an important segmentation track in the sports equipment industry. As long as you have played basketball or have taken physical education classes, you may have heard or seen the brand "Jinling Sports".

This sports equipment that was born in 1987 has become one of the leading companies of sports equipment based on ball -based equipment for decades of efforts, and successfully landed on the A -share motherboard in 2017.

According to Jinling Sports (300651.SZ) in the first half of 2022, Jinling Sports achieved revenue of 170 million yuan in the first half of the year, a year -on -year decrease of 0.93%; the net profit attributable to shareholders of listed companies was about 3.52 million yuan, a year -on -year decrease of 77.93%; basically every time it was every; basically, every time it was; basically, every time it was; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, every year; basically, he was basically every year. The stock income was 0.0273 yuan, a year -on -year decrease of 77.95%.

Jinling Sports, which has been deeply cultivated in the sports equipment industry for many years, has gradually realized its layout in the sports industry.

However, after the listing, Jinling Sports has not actively expanded its "second curve" under the blessing of the capital market, and still cultivates deeply around his original familiar field.

The market will not wait. At the same time as Jinling Sports "stepped in place", investors followed. Why is this private enterprise nicknamed the "king of basketball"?

The core business is overly dependent, and you can't get out of the basketball court

As the earlier establishment of sports equipment suppliers in China, since the establishment of Jinling Sports for decades, it has been actively supplying competition equipment for various balls and comprehensive competitions and providing competition service guarantees to make the brand take root in the industry.

From the NBA China to the CBA, from the Olympic Games to the Asian Games, from the International Field Diamond League to the International Volleyball League, many major domestic and foreign events can see Jinling Sports.

There is no doubt about the industry status, so Jinling Sports successfully landed on the A -share main board in 2017 to become the "first share of sports equipment".

However, after the listing, Jinling Sports has not got rid of its dependence on the original core business.

According to public information, the core business of Jinling Sports has always been ball equipment.

Before the company was listed, from 2013 to 2016, the proportion of revenue of ball equipment increased from 38%to 60%.

In the past three years, this business is still the main industry of Jinling Sports. From 2019 to 2021, ball equipment achieved revenue of 198 million yuan, 180 million yuan, and 230.5 million yuan. 42.11%.

The latest semi -annual report shows that the revenue of ball equipment achieved a revenue of 79.89 million yuan, an increase in revenue ratio to 46.99%.

The proportion of revenue in the core industry has gradually returned to the level before listing, and it also reflects the lag of Jinling Sports on the development of enterprises in the "second curve" development of enterprises from the side.

As we all know, the production costs of basketball products have greatly affected the price fluctuations of raw materials such as upstream steel and glass.

In the past six months, due to changes in external environment, the price of raw materials has risen, which has also affected the production cost of Jinling Sports.

The semi -annual report shows that the operating cost of Jinling Sports in the first half of the year was 119 million yuan, an increase of 8.44%year -on -year. In this regard, the explanation given by the report is "rising raw material procurement prices."

While the cost of ball equipment rose, the income decreased by 3.81%year -on -year.

In addition, the competition service business is also an important part of Jinling Sports.

However, due to the impact of the epidemic, many large -scale events have been canceled or postponed, which has a significant impact on the revenue of Jinling Sports.

For example, the Asian Games, which was scheduled to be held in Hangzhou in September this year, was postponed to next year due to the epidemic, and Jinling Sports was the officer of the official balls and track and field projects of the Asian Games.

Jinling Sports annual reports showed that the event service brought 47.28 million yuan in revenue to Jinling Sports, with a gross profit margin of 60.69%.

The lack of revenue projects and slowing income have also gradually lost confidence in Jinling Sports. This can be reflected from the semi -annual report that "a year -on -year reduction of 77.95%year -on -year".

To make matters worse, the senior management of Jinling Sports also "operates" continuously, so that the confidence of Jinling Sports has dropped again.

On June 1st, 2nd, and 6th this year, the daily closing price rose and declines of the daily closing price and decline in three consecutive trading days reached ± 30%. To this end, Jinling Sports issued an announcement on the evening of June 6 stating that "after verification, the company's actual controller does not have major matters that should be disclosed but not disclosed."

On June 1st, Li Jianfeng and Li Jianang, the controlling shareholders and unanimous actors of Jinling Sports, reduced their holdings of 193,300 and 289,300 Jinling Treasury bonds, respectively.

On May 27th, three directors of Jinling Sports also reduced their holdings of their company shares.

The successor took Jinling Sports a step forward, but not big

However, Jinling Sports can successfully log in to A -share mother -in -law. In addition to the brand recognition of the existing industry, the company's founders have made successors earlier to make the capital market have different longing for the tomorrow of Jinling Sports.

Born in 1985, Li Jiangang, Li Jianang, just graduated from the University of Melbourne in Australia in 2009. He was arranged by his father into different departments of Jinling Sports to study and familiar with the production management process of the enterprise in order to take over early. Li Jiangang, who stayed in the country, has gradually been recognized by Li Chunrong after several "fighting" with the "native" father, and officially signed a cooperation agreement on behalf of the company and Graca, the chairman of the International Volleyball Federation in 2013.

In an interview with the media, Li Jianang once said, "Our goal is to be a well -known international brand. Although this goal is far away, I am willing to pay all my efforts for this."

To this end, Li Jianang was full of confidence and launched an impact on the capital market in 2015.

However, the first impact was unsuccessful, mainly because the capital market believed that Jinling Sports was slightly behind in the business model.

Because the main customers of Jinling Sports are concentrated on G -end or B -end customers such as the government, schools, and sports events, the outside world generally believes that the bargaining power of Jinling Sports with direct sales models is insufficient, and gross profit is easily compressed.

In addition, such customers have the characteristics of special and long periods of payment, which causes a lot of pressure on the timely recovery and inventory turnover of Jinling Sports accounts receivable.

This also formed a bad cycle. The low price force leads to the low gross profit margin, and the long -term period of the long return has led to insufficient cash flow, which has further restricted the development of Jinling Sports.

Therefore, after seeing the problem, Li Jianang reforming the company's business model after the first impact of the capital market in 2015. The proportion of dealer models that are more "friendly" for account receivables are increased.

The prospectus shows that from 2014 to 2016, the proportion of Jinling Sports direct sales models accounted for 72.56%, 67.95%, and 59.81%of the main business revenue, respectively; the distribution model accounted for 27.44%, 32.05%, and 40.19%, respectively.

The change of reform of Jinling Sports revenue in the business model is significant. The income ratio of ball equipment is higher than the proportion of revenue when the direct selling model. During the reporting period, the gross profit of the ball equipment was 41.1%, 52.51%, and 55.33%, which was higher than the company than the company. Main business gross profit.

The successor of the successor helped Jinling Sports successfully listing.

However, the nature of the family business is still deep in the DNA of Jinling Sports.

According to the semi -annual report, the top four shareholders of Jinling Sports are the founders Li Chunrong (18.96%), the general manager Li Jianang (18.84%), the eldest son Li Jianfeng (16.39%), and Li Chunrong's spouse Shi Meihua (2.62%).

A family of four holds a total of 56.81%of the shares, and before listing, the data is 86.10%.

After the listing, Jinling Sports did continue to move forward on the way to modern enterprises, but Li Chunrong, who has been in power, has not really "let go". At the age of 71, he still decided to go forward in Jinling Sports as the company's actual controller.

Choose lying flat, old brands do not choose to tell new stories?

For whether Jinling Sports is in the "place", in addition to the vertical comparison, we can also see one or two through the situation of competitors in the same industry.

Taishan Sports (full known as the Shandong Taishan Sports Industry Group) was established in 1978. Starting from hand -sewing sports mats, after more than 40 years of development, the current Taishan Sports involves high -end sports equipment, negative ion artificial lawn, carbon fiber bicycles, smart ice and snow equipment, smart fitness fitness Equipment and sports engineering and other fields.

On the official website of Taishan Sports, Financial and Economics found that with the heat brought by the Beijing Winter Olympics for the ice and snow sports, Taishan Sports followed the current affairs, set up a R & D team in the ice and snow project, and invested nearly 100 million yuan. , With a self -lubricating function, a high -molecular ice plate, a mobile skiing platform.

In 2021, the domestic snow wax cars developed by Taishan Sports were delivered to the State Sports General Administration, completing the Beijing Winter Olympics competition service and guarantee tasks.

Compared with Taishan Sports, Jinling Sports has a large gap in "chasing fashion".

Facing the question of whether to participate in the ice and snow project, Jinling Sports gave a negative answer when investors interacted in November last year.

The aggressive Yuan universe was also "insulated" in Jinling Sports: Similarly in November last year, the company denied the company's intention to participate in the VR/AR cloud sports game and the concept of the sports+sports concepts.

In response to the "flying disk" this year, Jinling Sports also recently stated that the company has not had any related business.

However, Jinling Sports is also constantly expanding its business boundary.

In July last year, Jinling Sports established Hainan Jinao joint venture with ABEO in France. ABEO is currently listed on the Paris Stock Exchange. It is the leading product scope of B2B sports and leisure equipment companies in the international market will cover rock climbing, trampoline, locker room, group sports (such as basketball, gymnastics).

In June of this year, the company stated that the business scope was intended to increase new car sales; tram sales, road cargo transportation (excluding dangerous goods).

In response to the newly added business scope, Jinling Sports explained that "the company's car sales are mainly for sports rehabilitation guarantee cars".

In addition, according to the latest semi -annual report and 2021 annual report, Jinling Sports has more "glass", "other equipment and services" and "special equipment manufacturing" in revenue projects in revenue projects. Among them, the "Special Equipment Manufacturing" showed that the revenue was -1.588 million yuan in the annual report last year, and the semi-annual report showed that the income was 1.39 million yuan, and the income increased significantly, but the gross profit margin was -28.08%.

Specific what is "special equipment manufacturing", Jinling Sports has not been detailed in the semi -annual newspaper.

In addition to the cooperation with ABEO, it broke the business category of Jinling Sports, and in the end, the "King of Basketball" still wandered around his "one acre and three points".

Of course, it is not a problem to do special essence, and Jinling Sports also seems to have a "understanding" of its own positioning: After denying that he participated in the ice and snow sports and intentional Yuan universe, the company "acknowledged" the company belongs to SMEs.

We often say that people are most afraid of not knowing themselves clearly. For enterprises, the same is true.

However, as a company with a history of nearly 40 years, and occupying the head status in the industry, and the cultivation of the new generation of successors, Jinling Sports seems to have failed to seize the opportunity to go public. The original business was "upgraded and replaced". Instead, the original business began to decline under the situation of changes in the external environment.

It is undeniable that, as an old -fashioned sports device research and development, manufacturing, and seller, Jinling Sports has brought qualitative changes to the development of the Chinese sports industry with years of industry sedimentation. Essence

Just as the Japanese "God of Management", who just died, said, "concentrate on the deeds and his party, not bored, irritable, and hard work, your life will bloom beautiful flowers and make rich fruit. "

In the opinion of Peter Drucker, the father of modern management, "innovation is creating resources."

Facing the huge incremental space of the Chinese sports industry, whether Jinling Sports has the courage to achieve "creative destruction" of enterprises, use more innovation to tell the story of the capital market, and the "world -renowned sports brand" of Jinling Sports and Li Jianang In terms of dreams, it is very important.

As of the release on September 15th, Jinling Sports closed at 21.90 yuan per share, recorded in the past four years, and plunged more than 50%compared with the highest point in January last year. In the industry's average value of 6.324 billion yuan and medium value 3.975 billion yuan.

- END -

Tangyin Yigou: Accelerate the pace of investment promotion to boost economic development

In order to boost the economic development of the whole town, accelerate the pace ...

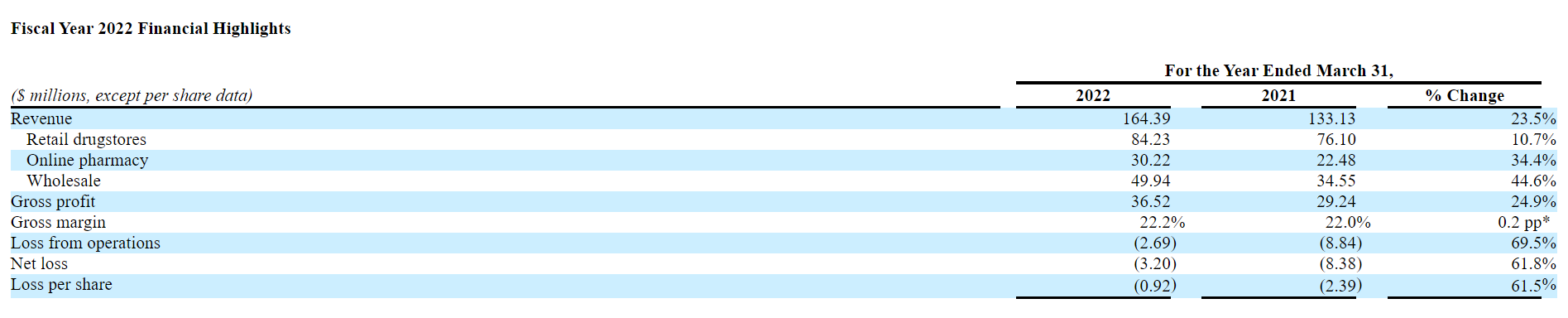

Jiuzhou Da Pharmacy 2022 Treasury losses narrowed 61.8% year -on -year

On July 28, 2022, the US -listed company Jiuzhou Pharmacy (CJJD.US) announced the ...