"2021-2022 ESG Investment Research Case" solicitation!

Author:21st Century Economic report Time:2022.06.21

21st Century Business Herald reporter Shen Junhan Beijing report

In recent years, my country's economy has gradually shifted from a high -speed growth stage to a high -quality development stage. It represents the environment of ENVIRONMENTAL, Social, and Governance. ESG investment concepts that focus on long -term value and sustainable development are more valued by the market.

In 2016, the State Council's "Ten Articles of Investment Investment" put forward four guidelines for the development of venture capital, namely physical venture capital, professional venture capital, credit venture capital and responsibility venture capital, which promoted China, including entrepreneurial investment, mergers and acquisitions investment and industrial investment in China The equity investment industry has vigorously implemented ESG investment.

In 2021, the "China Private Equity Investment Fund Industry Development Report (2021)" released by the China Securities Investment Fund Industry Association shows that the proportion of the administrators of the interviewed by the interviewed by the institution is expected to seize the opportunities for new energy, carbon neutralization and transformation, implementation ESG responsibility investment concept, actively deploy environmental friendly and social friendly green industries.

In recent years, the investment concept of mainstream investment institutions has also changed. In the past, many institutions were paying more attention to financial returns, and now they are changing to non -financial indicators. Whether it is to help the realization of the "double carbon" goal, or to achieve better social benefits, corporate governance and other effects. Many VC/PE institutions have practiced ESG investment concepts with practical actions. They either set up special investment funds or practice ESG investment concepts in the entire investment process.

On June 16 this year, Gao Yan's first RMB carbon neutralized industrial investment fund completed the first account closing, and it is expected that the total fundraising scale will exceed 4 billion yuan. Earlier, Gao Yan also issued the "Carbon neutralization proposal" to hundreds of companies and partners; a month ago, Chunhua Capital announced the establishment of a carbon neutral fund with a total scale of 10 billion yuan; in 2021, in 2021, Shengshi Investment, the parent fund management agency, issued the first carbon neutralization statement in my country's equity investment industry. Last year, Sequoia China joined hands with Vision Science and Technology Group to set up 10 billion -scale carbon neutralized technology funds, and for the first time, carbon neutralization was released. In addition, including CPE Yuanfeng, Junlian Capital, Dashu Capital, Green Capital, etc. In terms of ESG investment practice, they have rich experience and form a mature framework system.

In order to understand the current status of ESG investment in my country's private equity investment industry, publicity and promotion of advanced typical experience, and promote institutions to practice ESG investment. It is guided by the Southern Finance and Economics Group. The collection of ESG Investment Research Cases of the Year was officially launched.

In this case, in accordance with the principles and processes of openness, fairness, and fair reviews, it will adopt investment institutions declaration, LP recommendation, and the organizer nomination. Research cases are combined by the independent writing of institutions and the 21st Century Business Herald. The specific contents include the understanding, understanding and specific practice of ESG investment.

The finalists will be assembled as a research report product "2021-2022 ESG Investment Research Case Collection", and will be awarded the honor of "2021-2022 ESG Investment Special Contribution Agency". This award will follow the "12th China Innovation Capital Annual Meeting "Published.

In addition, the 21st Century Venture Capital Research Institute will also hold the ESG Investment Series Theme Seminar/Salon, and conduct ESG investment research interviews and other activities, and shall work with the 21st Century Economic Herald Venture Edition.

Questionnaire: zhaona@21jingji.com matt@21jingji.com

- END -

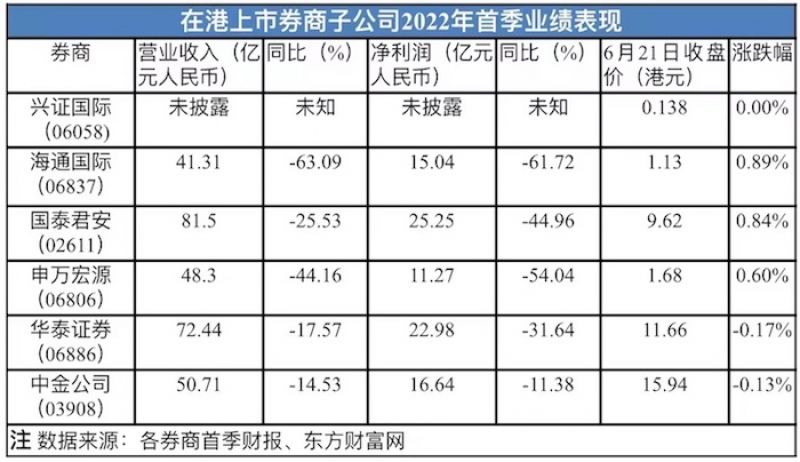

13 brokerage companies stopped business during the year!Under the epidemic, Hong Kong Voucher Commercial Accelerated Horchings

Huaxia Times (chinatimes.net.cn) reporter Wang Jingge Aifeng Shenzhen reportFor Ho...

Shandong has collected 19.597 million mu of wheat, and wheat harvest has exceeded 30 %

At present, Shandong Mai harvest is in an orderly manner. According to agricultural conditions, as of 5 pm on June 8th, the province had received 19.597 million mu of wheat, accounting for 32.6%of th