The short position is 18.4 billion US dollars!Apple beyond Tesla Cheng Wall Street shortcoming the goal

Author:Daily Economic News Time:2022.09.15

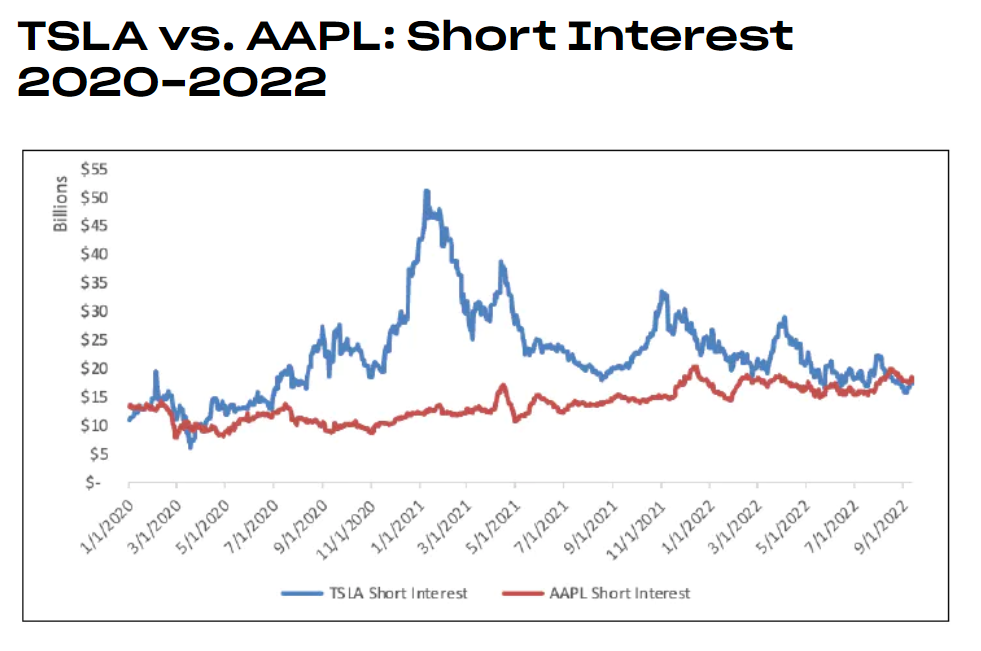

Research reports from S3 PARTNERS S3 PARTNERS show that as of September 13, local time, Apple (AAPL, a stock price of $ 15.531 and a market value of 2.5 trillion US dollars) was unproof short positions of US $ 18.444 billion, while TSLA (TSLA (TSLA (TSLA (TSLA (TSLA (TSLA (TSLA (TSLA (TSLA (TSLA (TSLA The stock price was US $ 30.2.61, with a market value of $ 948 billion) for $ 17.444 billion.

This means that Apple has replaced Tesla to become the number one short target of Wall Street.

Image source: Screenshot of S3 Partners official website

"Since April 2020, Tesla has occupied the top of the list on the short -term short list for 864 days." IHOR DUSANIWSKY, managing director of S3 PARTNERS prediction and analysis department, is studying. The report wrote.

The report also stated that the change of Apple's short position surpassed Tesla, which greatly reflected that the shortness reduced the empty warehouse to Tesla, rather than the active short of Apple. Although the short position shows that the dollar is facing risks, it does not reflect short trading activities that directly affect the stock price.

In addition, Dusanovski also said, "The increase or decrease of short positions is calculated by the increase or decrease of short -selling stocks and changes in stock prices. Therefore, if the number of stocks short is unchanged, the stock is unchanged, but the stock The price of prices will increase. However, when the stock has not been short -term transactions, short -selling or short -term replenishment, the change of short positions has no effect on the market price of related stocks.

Dusanovsky also admits that Tesla has some short supplements in the past 30 days. At the same time, the number of short Apple shares is also increasing.

However, the reporter of "Daily Economic News" noticed that Tesla's stock has performed well in the past three months (June 14-September 14), rising about 37%, and now reported to $ 302.61.

"Baron Weekly" commented that Tesla may not feel sad when he saw Apple surpassing himself in this regard. After all, shorts are usually loser bets that investors who think of stocks will fall. The decline in short interest may indicate that investors no longer think that stocks are overestimated or have great uncertainty.

"Baron Weekly" also said that investors who watched Apple don't have to worry too much. There are several ways to quantify the short -selling interest, and the absolute value of selling short stocks is an indicator. Compared to all stocks that can be traded, the number of shorts selling is also important. Data show that only about 0.7%of the transaction Apple stocks are short, and this value is not large. According to the data compiled by Bloomberg, the average short bears in the Standard 500 Index is about 1.4%.

"Daily Economic News" reporter noticed that although Apple's proportion of short stocks is very low, because its market value is as high as US $ 2.5 trillion, it is about 2.6 times that of Tesla's total market value (948 billion US dollars). Value is also a small number.

Compared to Apple, Tesla currently has about 2.2%of stocks shortly, and this proportion is also slightly higher than the average level of the S & P 500 index. However, as early as April 2020, about 11%of Tesla's trading stocks were short. This was 5 times the current value. At that time, many shorts did not think that the business developed by Tesla could be profitable.

However, in 2020, Tesla delivered about 500,000 cars and generated about $ 2.1 billion in operating profit. In 2023, Wall Street is expected to pay about 1.5 million vehicles, and its operating profit is nearly 15 billion US dollars.

As of now, the highest short proportion of the S & P 500 Index is 3M (MMM, a stock price of $ 117.54, and a market value of US $ 67.134 billion), with a short ratio of 2.44%. According to Bloomberg's previous report, the industrial group is facing some legal issues, including found chemicals in groundwater.

(Cover picture source: Every reporter Zhu Wanping)

(Disclaimer: The content and data of this article are for reference only, do not constitute investment suggestions, verified before use. According to this, the risk is self -affordable.)

Daily Economic News

- END -

good news!7 people and 5 projects in Luzhou have received Agricultural Science and Technology Reward in Zhejiang Province in 2021 ~

A few days ago, Zhejiang Agricultural and Rural Affairs Department announced the 2...

Tang Yin: The government takes on the platform to unblock the "internal cycle" of the enterprise

On the afternoon of June 23, the Tangyin High -tech Industrial Development Zone he...