Zhengbang Technology plans to transfer some pig breeding assets this year to double the income of pig sales in stock

Author:Daily Economic News Time:2022.09.15

Zhengbang Technology (SZ002157, closing price of 5.46 yuan, and a market value of 17.37 billion yuan) continued to sell assets.

On the evening of September 15th, Zhengbang Technology issued an announcement that the company signed a cooperation framework agreement with Hubei Food Co., Ltd. (hereinafter referred to as "Hubei Food Company") to reach an agreement on the cooperation of the Hubei pig breeding industry chain. The company intends to transfer some of its subordinate pig breeding industries to Hubei Grain Company, and Hubei Grain Company enters the pig breeding industry.

Since this year, Zhengbang Technology has announced all or part of the equity of 20 holding subsidiaries. In response to the investor on the Shenzhen Stock Exchange interactive platform, "Is the company's current situation that has reached the serious situation of selling piglets?" Zhengbang Technology admits that the company has adjusted the sales strategy according to the industry and its own operation. The inventory further accelerates the return of funds and thickens the company's capital reserves to start and develop.

Asset -selling crisis

Zhengbang Technology is continuing to sell assets and seek self -help through "weight loss".

On the evening of September 15, Zhengbang Science and Technology announced that the company signed a cooperation framework agreement with the Hubei Food Company to reach an agreement on the cooperation of the Hubei pig breeding industry chain. The company intends to transfer some of its subordinate pig breeding industries to Hubei Grain Company.

According to the announcement, Hubei Province Grain Company can lease the above -mentioned pig breeding industry assets to Zhengbang Technology or its designated main business, and provide the feed/raw materials required for production and operation to the leased Zhengbang Technology or its designated entity, and the conditions are the same as the same comparison. The industry is more competitive. After the formal agreement is signed, the company will fulfill the corresponding information disclosure obligations in accordance with the requirements of relevant laws and regulations.

Zhengbang Technology stated that the company and Hubei Food Company established a partnership with the principles of complementary advantages and mutual benefit, which is conducive to giving full play to the industrial advantages of both parties, enhancing the market competitiveness of both parties, achieved win -win cooperation and common development, and meets the company's actual development. It is necessary to give full play to the advantages of the feed supply company in Hubei Province, extend the industrial chain to the downstream breeding industry. At the same time, the company can obtain a stable source of feed supply in Hubei and around Empower the company and promote the company's future business development.

Since this year, Zhengbang Technology has announced all or part of the equity of 20 holding subsidiaries.

At the end of 2021, Zhengbang Technology's asset -liability ratio had reached 92.60%. By the end of the first half of 2022, the asset -liability ratio reached 102.88%, which was already in a state of incomparable debt. There was also a case of overdue payment of business tickets. Zhengbang Technology and subsidiaries had a total of 877 million yuan in overdue payment balance.

Pig sales income decreases

On September 9th, Zhengbang Technology disclosed a briefing of the sales of pigs, and 613,500 pigs were sold in August (including 254,300 piglets and 359,200 commercial pigs), a decrease of 30.48%month -on -month, a year -on -year decrease of 64.16%; The month -on -month decrease of 1.24%, a year -on -year decrease of 74.35%.

The average sales price of commercial pigs (after deducting piglets) was 21.46 yuan/kg, an increase of 1.83%over the previous month; averaged 75.66 kg/head, an increase of 6.55%from the previous month.

From January to August 2022, the company sold a total of 6.341 million pigs, a year -on -year decrease of 39.37%; cumulative sales revenue was 6.387 billion yuan, a year -on -year decrease of 73.27%.

In the first August of this year, the significant decline in the sales of Shengbang Science and Technology pigs also led to the company's sales ranking from the second place in the same period last year to fourth place, lower than Makiyuan (SZ002714, the stock price of 59.39 yuan, a market value of 31.6083 billion yuan), and warm). Family (SZ300498, the stock price of 21.95 yuan, a market value of 143.690 billion yuan) and new hope (SZ000876, the stock price of 14.99 yuan, and a market value of 68.036 billion yuan).

Zhengbang Technology stated that the company's sales in August and sales revenue decreased significantly, mainly due to the adjustment of the company's operating strategy adjustment and optimization capacity, and the number of pigs' sales decreased greater, mainly due to the company's adjustment of the rhythm of the column. From January to August this year, the company's pig sales and sales revenue decreased significantly, mainly due to the decline in domestic pig prices and narrowing scale.

Compared with the sales and sales revenue of Zhengbang Technology, the sales and sales of pig companies such as Wen's shares, new hope, and Muyuan shares have increased. Among them, Muyuan's pig sales in August increased by 89.9%year -on -year, and pig sales revenue increased by 175.4%year -on -year.

Daily Economic News

- END -

Seven companies in Xinjiang are selected as the list of national breeding formation companies

In the laboratory of Xinjiang Jinfengyuan Seed Industry Co., Ltd., employees check...

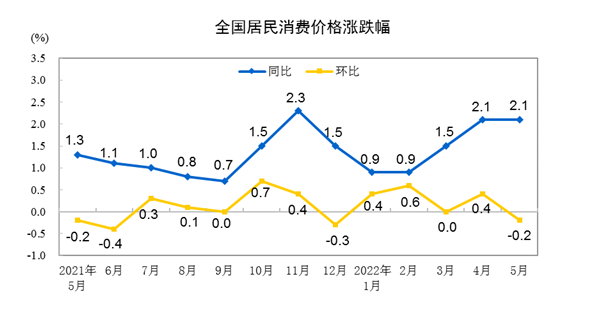

In May, the consumer prices nationwide rose by 2.1% year -on -year decreased by 0.2% month -on -mont

According to the National Bureau of Statistics, in May 2022, consumer prices acro...