Just now, the offshore RMB has broken the "7" for the first two years

Author:Huaxia Times Time:2022.09.15

Text/Liu Jia

China Times (chinatimes.net.cn) reporter Liu Jia Beijing report

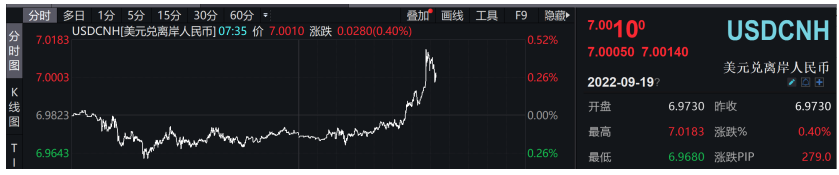

On the evening of September 15th, more offshore RMB to the US dollar's exchange rate that reflected the expected international investors fell below the "7.0" mark and lowered to 7.0183.

It is worth noting that this is the first time since August 2020, the US dollar exchange rate has broken the "7" for the first time in the offshore market.

At the same time, the exchange rate of the US dollar on the shore also approached the "7.0" mark, with a minimum depreciation to 6.9998.

According to data from the Foreign Exchange Trading Center on the day, the middle price of the RMB was reported at 6.9101, which was raised by 15 points.

Faced with the continuous decline of the RMB exchange rate, the central bank had decisively shot on September 5th and decided that starting from September 15, 2022, the foreign exchange deposit reserve ratio of financial institutions was 2 percentage points. To 6%. This is also the second time the central bank has lowered the foreign exchange deposit reserve ratio during the year.

Regarding the key point of falling below the "7.0", industry insiders pointed out that short -term "breaking 7" does not mean that the RMB exchange rate price will have a sharp downward process. During the year, the renminbi will remain similar to the US dollar index trend. In this process, there is no point that must be kept. What is really important is that maintaining the RMB exchange rate is basically stable.

Faced with the depreciation of the RMB exchange rate in this round, Liu Guoqiang, the deputy governor of the central bank, also responded at the new routine blower of the National Office on September 5 that at present, the Chinese foreign exchange market is operating normally, the flow of cross -border funds is orderly, and the US currency is subject to US currency. Although the policy overflow has an impact, the impact is controllable.

Liu Guoqiang pointed out that China's economy has not changed for a long time. China's exchange rate mechanism is based on market supply and demand, the reform of the exchange rate system is continuously deepened, macro -prudential management has been continuously improved, and the exchange rate elasticity has increased significantly.

In terms of the future trend of the renminbi, Liu Guoqiang believes that "the long -term trend of the renminbi should be clear, and the recognition of the future world will continue to increase; The point is not allowed. Don't bet on a certain point. Reasonable and balanced, basic stability is what we like to see. We also have the strength to support it.

Edit: Meng Junlian

- END -

Extraordinary ten -year colorful Zhongyuan Luoyang: strong industrial cities revive glory

Henan Daily client reporter Tian Yilong Li ZongkuanInvestment promotion is fast -m...

Stabilize the economic market and grasp one "implementation" and two "overall planning"

Since March, the new coronary pneumonia and the Ukraine crisis have led to increas...