Tax returns, tax reductions, slow payment of various taxes and fees ... A set of data depends on my country's combined tax support policy →

Author:Changjiang Daily Time:2022.09.15

This year, the state has implemented a new combined tax support policy, and has continuously increased the burden reduction.

A number of tax discounts such as tax refund brings capital live water

Enterprises are the subject of innovation. In the new combined tax support policies implemented by my country this year, a number of tax and fees such as tax refund, R & D expenses plus deduction, etc., providing enterprises to increase their investment in scientific research and accelerate innovation and development.

A photoelectric semiconductor enterprise in Wuhan has just received a value -added tax reserved tax refund tax for August.

Yang Fan, Deputy Director of the Finance Department of a certain Optoelectronics Technology Co., Ltd.: From January to August, a total of 1.51 billion yuan of value -added tax refund was completed. This funding was rained in time, which greatly alleviated the gap in our funds.

Zhou Hongbing, Deputy Director of the State Administration of Taxation's Hubei Provincial Taxation Bureau of Taxation Bureau: We have a collaborative guarantee mechanism for our tax authorities and financial, national treasury, banks and other departments to quickly send tax refund to corporate accounts.

As of August 31, the value -added tax for the value -added tax reserved tax refund to the taxpayer account

According to data from the State Administration of Taxation, as of August 31, this year, a total value -added tax reserved tax refund tax for more than two trillion yuan (2172.3 billion yuan) was refunded to the taxpayer account, exceeding 3.3 times the scale of last year. Among them, over 60 % of the enterprises used the tax refund funds to purchase raw materials and increase investment research and development.

R & D expenses plus deduction to give more capital support for innovation

Supporting enterprises' innovation and development, not only tax refund for capital flow, but also R & D expenses plus deduction.

In Yangzhou, Jiangsu, a bundle of packaging products in a factory building of an optoelectronic technology company is shipped. This year, my country has increased the proportion of scientific and technological small and medium -sized enterprises from 75%to 100%, reducing tax payment, which is equivalent to bringing new funds.

Ding Ling, chief financial officer of a certain Optoelectronics Technology Co., Ltd. in Yangzhou: Our normal research and development costs will not be less than 12 million. The tax of light, I will count about 1.5 million yuan less. In this way, we will dare to vote boldly, how much you can support you how much you can support you.

Zhu Wei, Director of the Municipal Taxation Bureau of the State Administration of Taxation: This is equivalent to a larger funding support for enterprise innovation. The higher the investment cost, the more discounts for corporate income tax enjoyment, which improves the enthusiasm of corporate innovation.

According to the latest policies, in the fourth quarter of this year, industries that deduct R & D expenses at the current 75%proportion of tax increases, uniformly increased the deduction ratio to 100%, and encouraged enterprises to increase investment and improve their innovation capabilities.

Phase retracting social premium expansion delay to relieve funding pressure

On the one hand, tax refunds and taxes, on the other hand, to slowly pay various taxes and fees. Don't look at it just slowly, but it also brings obvious help for companies and individuals who encounter funding pressure in the short term.

Ms. Liang, who is in her 50s this year, has the main source of income at home to make decoration and small infrastructure, and pays one -time social security premiums at the end of the year. This year, affected by the epidemic, construction has decreased. Under such circumstances, Ms. Liang calculated a account for her house.

Nanning citizen Liang Xiaojuan: My husband is a social security paid by 100 %. According to the grade of Nanning City, he will pay about 13,000 yuan a year, and his medical treatment is 167. If I am my own, I have to pay 8900-9000 yuan, plus 3,000 yuan in medical insurance, and I will need 12,000 yuan myself. Two people have a total of 30,000 yuan, and they are indeed a bit nervous at the end of the year.

In May of this year, the state clearly implemented a phased social insurance policy policy. Among them, individual industrial and commercial households and various flexible employees who participate in the basic endowment insurance of enterprise employees can be voluntarily temporarily paid and pay before the end of 2023. The introduction of this policy is undoubtedly a charcoal for Ms. Liang's family.

In addition to the delay, the slow payment policy has also been expanded. On the basis of the three social security premium policies such as catering and retail, such as the implementation of the five specialty industries such as catering and retail, the slowdown policy has been expanded to 17 difficult industries such as agricultural and sideline food processing and textile industry.

Han Xiuqing, Chairman of a Food Co., Ltd. in Guangxi: The social insurance premiums that our company should pay each month is more than 260,000 yuan, and 180,000 yuan can be enjoyed. It is expected that it should be more than 600,000 yuan this year. Some short -time part of funds turnover.

Not only is the social insurance premiums slowed down, but also the phased payment is also implemented for medical insurance. According to the policy, the overall fund deposit can be paid more than 6 months. From July this year, individual industrial and commercial households who participate in small and medium -sized enterprises and individual industrial and commercial households who are insured in the form of insurance are paid for 3 months of employee medical insurance units, and slow During the payment period, exempting late fees.

Qiu Jun, Director of the Taxation Bureau of the State Administration of Taxation: We cooperated with the Human Resources Society, Medical Insurance and other departments to launch (the employee medical insurance unit's payment is slowly paid) "exemption to enjoy". Eligible market entities and individuals can automatically enjoy the slow payment policy without applying.

According to the State Administration of Taxation, as of the end of July this year, a total of 591.3 billion yuan was handled. Among them, a total of 65.7 billion yuan in social insurance premiums were handled in April to July alone.

Target tax policy gang special difficulties in special difficulties over the difficult level

At present, the preferential tax and fees issued in my country are inclusive and targeted. Among them, there are many assistance policies for special difficulties such as civil aviation and railway transportation and catering. From May to September each year, it is a hot period of tourism in Inner Mongolia. At the Ulanhot Airport, the staff told reporters that due to the affected by the epidemic in the past two years, tourists have decreased, and the number of flight flights has also declined.

Xiu Zongxi, deputy general manager of the Wulanhot Branch of the Inner Mongolia Autonomous Region Civil Aviation Airport Group Co., Ltd.: July -August belongs to the peak season of the aviation market. We have guaranteed a total of 1644 transportation and landing. Compared with the same period last year, it increased. There are also obvious gaps.

In order to alleviate the capital pressure brought about by the decrease in civil aviation companies, this year, my country suspended the prepaid value -added tax for aviation transportation and railway transportation companies. At the same time, in order to support the difficulties of the integrated industries, various local tax support policies have also been implemented in various places.

Xiu Zongxi, deputy general manager of the Wulanhot Branch of the Inner Mongolia Autonomous Region Civil Aviation Airport Group Co., Ltd.: Since 2021, it has applied for a total value -added tax to retain a tax refund of 2.38 million yuan and reduced the tax use tax of 260,000 yuan.

Xu Guochen, Deputy Director of the Taxation Bureau of the State Administration of Taxation: Since the beginning of this year, more than 800 transportation service companies in the city have accumulated more than 1,800 million yuan in value -added tax.

Not only civil aviation, but also for catering, retail, tourism, highway water railway transportation, agricultural and sideline food processing industry, but also many support policies. Like a bus company with more than 3,400 employees in Nanning, it costs about 3.7 million yuan per month. After the social security premiums are slowed, coupled with the tax refund, companies can obtain a policy dividend of over 100 million yuan.

Liu Xiaowen, Manager of the Finance and Financing Department of Nanning Public Transport Co., Ltd.: We have successfully applied for three social security expenses from May to December this year. Tax refunds, which alleviate the pressure of the company's funds to a certain extent and ensure the normal operation of the enterprise.

Data show that since the beginning of this year, industries that have been affected by the epidemic have increased taxes, reduction, reduction, and tax rebate of 62.1 billion yuan, and promoting the recovery and development of difficult industries.

(Source: CCTV News Client)

【Edit: Shang Pei】

For more exciting content, please download the "Da Wuhan" client in the major application markets.

- END -

The first prefabricated industry park construction group standards are released

The article comes from: prefabricated dishes observation (WeChat public account)The standard formulation of the prefabricated vegetable industry park has provided a standard basis for the upgrading an

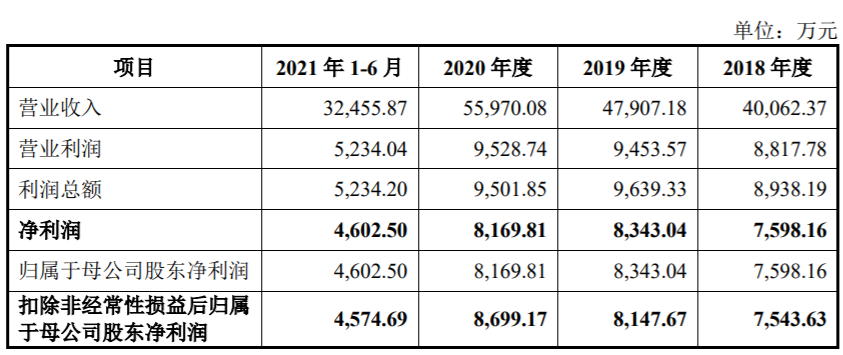

Keichuan Technology and Guanghua shares will be reviewed on August 4th MIPO

On August 2, 2022, the eighteenth issuance review committee was scheduled to hold ...