Every time it is traded (evening edition) 丨 Northern Fund's net sales of 4.132 billion yuan, but buying 250 million lithium ore leadership against the trend; lithium battery faucet was sold by 760 million funds from north;

Author:Daily Economic News Time:2022.09.15

On September 15, the Shanghai Index fell 1.16%. Northern Fund sold 4.13 billion yuan in net net today. Among them, the Shanghai Stock Connect was sold 1.725 billion yuan, and the Shenzhen Stock Connect was sold 2.407 billion yuan.

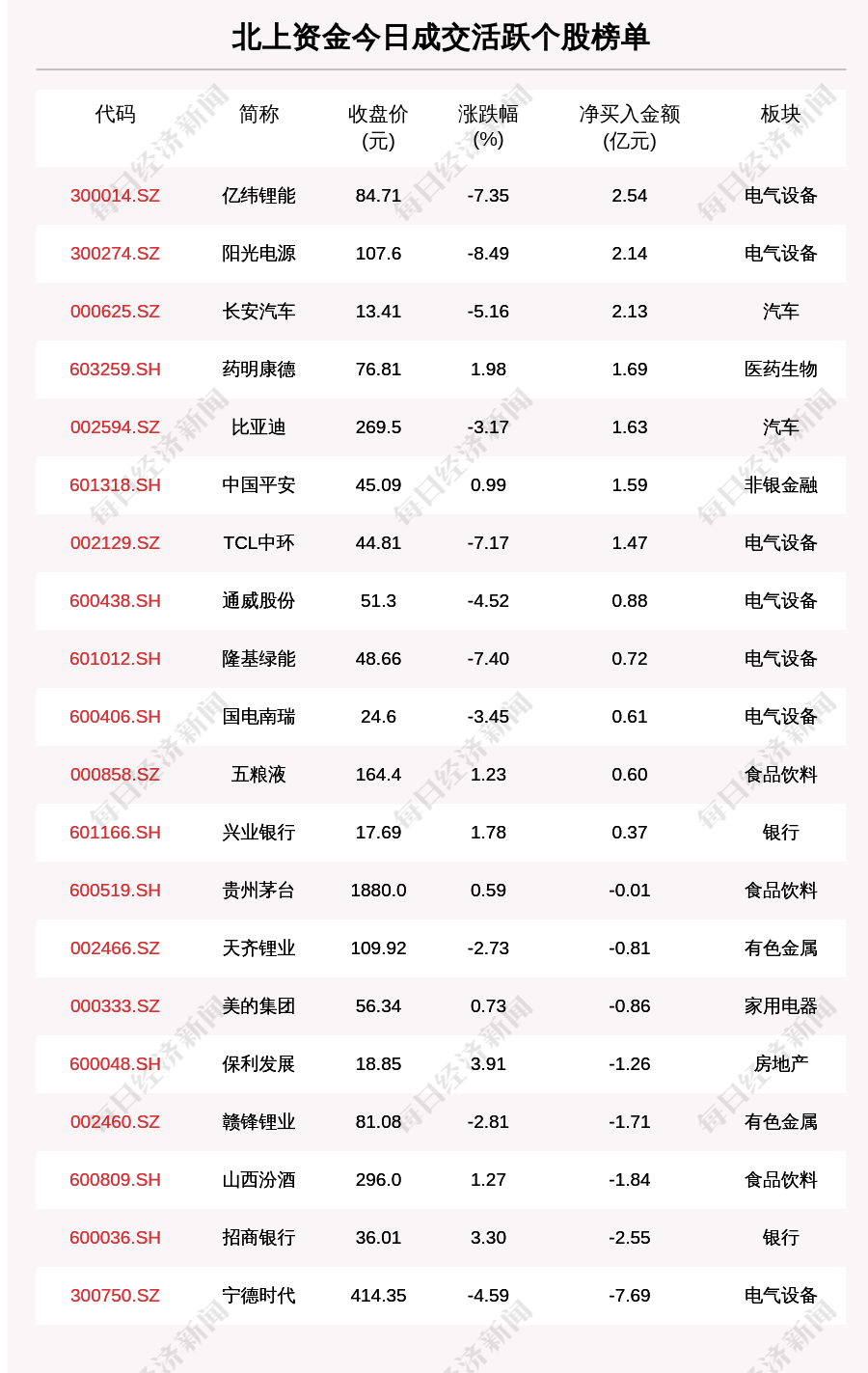

9月15日,北上资金成交活跃个股榜单中,净买入个股共12只,金额最多的是亿纬锂能(300014.SZ,收盘价:84.71元),净买入2.537亿元;净A total of 8 stocks were sold, and the largest amount was the Ningde Times (300750.SZ, the closing price: 414.35 yuan), and sold 769.3 billion yuan.

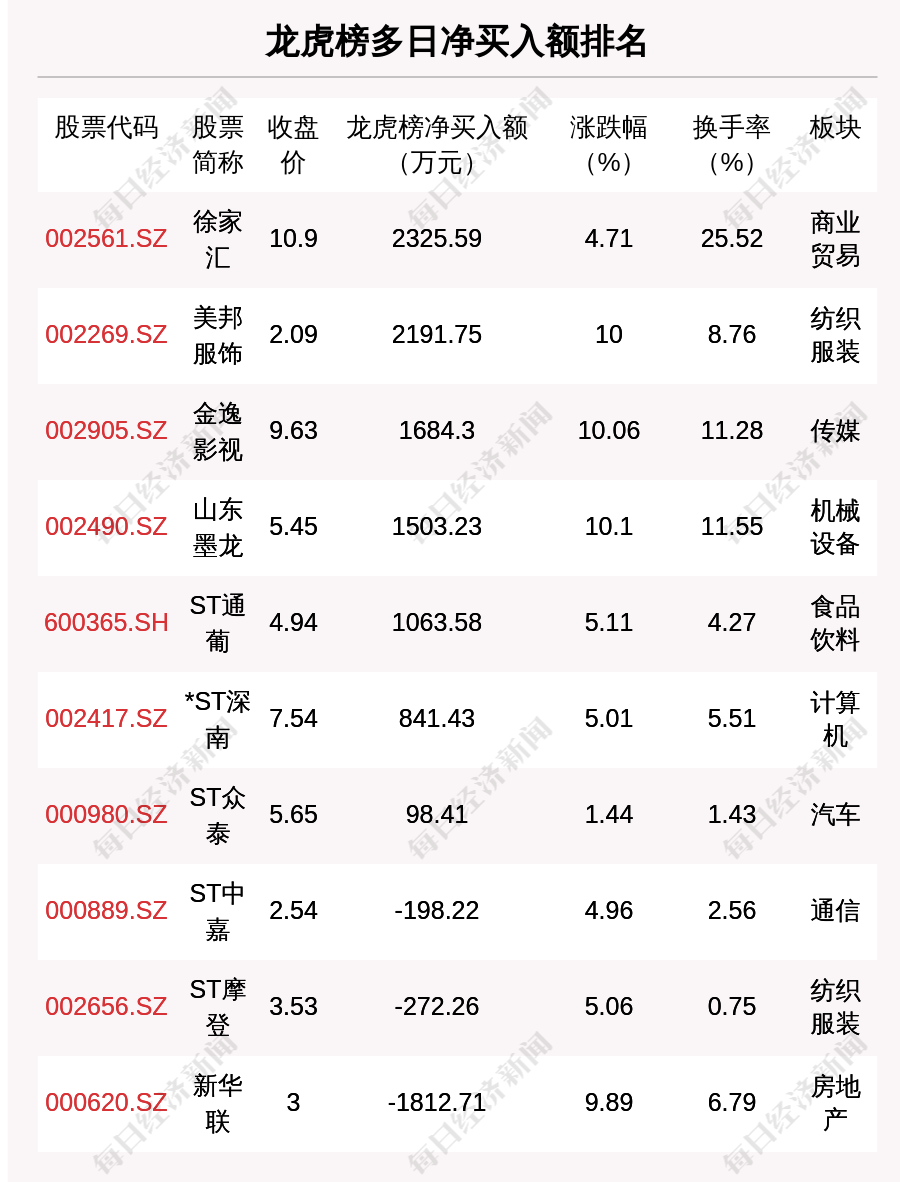

On September 15th, a total of 37 stocks were on the list of the Dragon and Tiger.

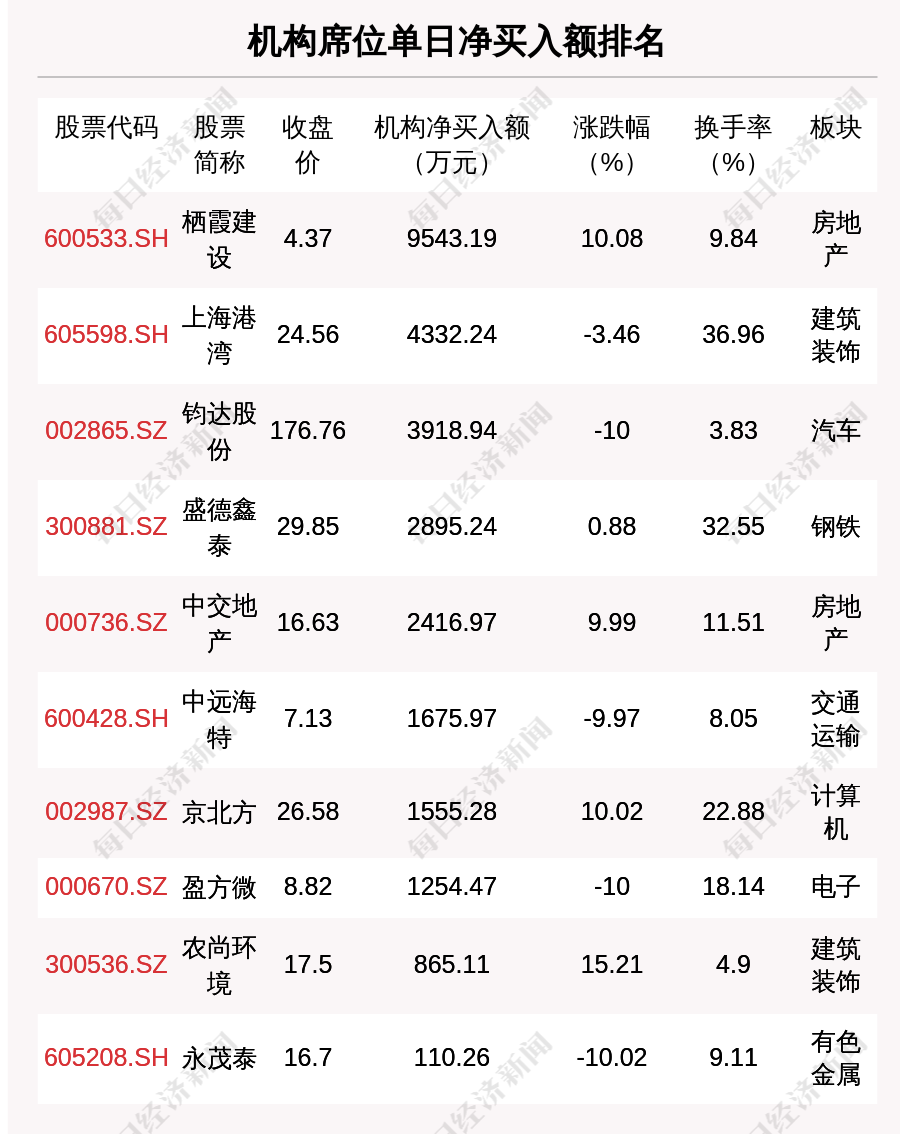

In the Dragon and Tiger List, there are 21 stocks involving a special seat in the institution. The top three of the net purchase are Qixia Construction, Shanghai Harbor, and Junda shares, respectively, 95.431 million yuan, 43.224 million yuan, and 39.189 million yuan, respectively.

Zhongtai Chemistry (002092.SZ) said on the investor interactive platform on September 15 that the company's main product sales and raw materials procurement are mainly domestic, and the import and export business accounts for relatively small. The company's main products are mainly domestic markets, and they are exported to Kazakhstan and Uzbekistan.

Buddhist Fire Energy (002911.SZ) said on the investor interactive platform on September 15 that the company's participation company Guangdong Zhongyan Energy Co., Ltd., the main investment construction, operation and maintenance of the main charging station, will steadily promote the charging pile according to national policies to steadily promote the charging pile business development.

Sanye Spectrum (002876.SZ) said on the investor interactive platform on September 15 that the company attaches great importance to the development of the vehicle display business, and the company will reasonably plan and lay out production capacity based on orders and market development. The company's customers are mainly domestic LCD panels and LCD display modules. The company's operation is normal, and the Longgang new production line is in the stage of production capacity climbing.

Hualan Biological (002007.SZ) said on the investor interactive platform on September 15 that in 2022, the vaccine company has the production capacity of 100 million influenza vaccines, thanks to this company's annual production plan, which has basically completed the annual production plan. As of now, the company has approved a total of 103 batches of influenza vaccines.

Dongfang Risheng (300118.SZ) said on the investor interactive platform on September 15 that the company's "Malaysia 3GW High -efficiency Solar Battery and Component Manufacturing Project" has been put into operation and undertake relevant sales orders in mid -May this year. The company's photovoltaic photovoltaic in the first half of the year Components of China ’s overseas sales and domestic sales accounted for 63.67%and 36.33%, respectively. The main source of overseas income countries is Spain and Brazil.

Xinghua (002109.SZ) said on the investor interactive platform on September 15 that the company's wholly -owned subsidiary Xinghua's methanol device design capacity was 300,000 tons/year. To produce products such as methamine and DMF, the methanol that exports each year is 150,000 tons to 180,000 tons. Judging from the situation in the first few months of this year, the gross profit of methanol products is negative. At present, the company has no plan to expand methanol production capacity. In order to ensure the maximization of the company's benefits, Xinghua Chemical combined with the market market conditions of various products to adjust methanol and other products within a reasonable range.

Yaxiang (301220.SZ) said on the investor interactive platform on September 15 that since 2022, the annual output and sales of the company's Xianglanin products dropped downward, the pressure dropped in 2022 to less than 150 tons, 2023 in 2023 The voltage drops to within 120 tons, the voltage of 2024 and after the pressure is within 100 tons, and the proportion of sales revenue of Chanlanin products accounts for less than 10%of the main business revenue. Whether it will continue to be dropped in follow -up, please continue to pay attention to our disclosure.

Super map software (300036.SZ) on September 15th on the investor interactive platform, the current project of the Fuxia VR immersion experience system procurement project has not been completed. The first stage of related work content has been completed. It is currently in the first stage During the trial operation. It is planned to carry out the first phase of acceptance in October this year. With BIM+GIS+VR technology construction immersive experience system, BIM can display the local building structure, the real data and information of the electromechanical facilities as a whole. Textile materials and other information can effectively see the problem in the construction process of the project and simulate the solution through the project construction process of the virtual roaming experience. In the review of the design plan, it helps to avoid design risks and optimize the design style, and in terms of the overall style of the project and the decoration effect experience, the effect of the overall delivery of the project through the VR immersion type.

Zhonglai (300393.SZ) said on the investor interactive platform on September 15 that what you mentioned is two full black components that match the company's high reflection of black back panels. Among them The TBC battery has not yet achieved mass production. This component represents the company's cutting-edge technology. With the continuous research and development of technology, the performance of this product will be further optimized and improved; Battery.

Skyworth Number (000810.SZ) said on the investor interactive platform on September 15 that the company's automotive electronic business faces the original brand car factory of Tier1, which is positioned as a vehicle human -machine interaction display assembly system and a vehicle intelligent display instrument system. In the first half of 2022, the new settings of the display assembly projects of multiple star models were obtained in the first half of 2022. At present, the original brand car manufacturers and the obtained orders are further increasing. Among them, the company's 12.8-inch suspended human-machine interaction central control central control central control central control central control central control central control central control central control central control central control central control central control central control central control central control central control central control is reached in batch delivery in batches. Relying on the quality of high -quality product, the company also obtained the human -computer interaction mid -control screen system and other projects such as Chery and other brand star models in the third quarter. The company will actively cooperate and support the delivery of brand car OEMs in accordance with the established business plan to achieve the annual operating goals. Zhidu (SZ 000676, closing price: 5.65 yuan) issued an announcement on the evening of September 15th that on September 15, 2022, the company received Zhididu's "Smart Holding Holding Smart Technology Co., Ltd. Co., Ltd. The letter of notification was informed that Zhidu Depp had reduced the holdings of the company's shares by concentrating the bidding method this time. The company's shareholders Zhidu Dupu reduced the company's shares from August 30 to September 2, 2022, and the company's shares were reduced by 1.2044%of the company's total shares.

Coron Pharmaceutical (SZ 002422, closing price: 21.22 yuan) released the performance trailer on the evening of September 15. It is expected that the net profit attributable to shareholders of listed companies in the first three quarters of 2022 is about 1.315 billion to 1.442 billion yuan, a year -on -year increase of 55% ~ 70%; Basic income per share is 0.94 yuan ~ 1.04 yuan. The main reason for the change in performance is that Sichuan Kelun Pharmaceutical Co., Ltd. fully expands the infusion and non -infusion product market, continuously optimizes the product structure, increases the sales of newly approved products, and the profit has increased year -on -year; The market price of the major products of the company has risen, and profits have increased year -on -year;

Anji Technology (SH 688019, closing price: 261.51 yuan) issued an announcement on the evening of September 15 that the company's shareholder Anji Microelectronics Co. LTD. reduction plan was completed, and on September 15, 2022 The shareholding shares account for 2.01%of the company's total shares. From January to December 2021, Anji Technology's operating income composition: integrated circuits account for 100.0%.

Jinbo Co., Ltd. (SH 688598, closing price: 285.01 yuan) issued an announcement on the evening of September 15th that on September 15, 2022, the company held the eleventh meeting of the third board of directors to review and approve the "Regarding concentrated bidding transactions with centralized bidding transactions Method to repurchase the company's share plan ". The shares repurchased are intended to implement employee holdings or equity incentive plans. The total amount of repurchase funds is not less than RMB 100 million (including), and does not exceed RMB 200 million (inclusive); the repurchase price does not exceed RMB 400/share (inclusive). The average company's stock transactions on the first 30 trading days were 150%of the company's stock transactions; the repurchase period was within 6 months from the date of reviewing and approved the repurchase plan.

Bi Shui Source (SZ 300070, closing price: 5.78 yuan) issued an announcement on the evening of September 15th that as of September 9, 2022, the time limit for the acquisition of the appointment was expired. According to statistics provided by the Shenzhen Branch of China Securities Registration and Settlement Co., Ltd., within August 11, 2022 to September 9, 2022, there are 6,132 accounts, a total of 589,082,010 shares received by the acquirer. The offer. The results of the offer acquisition have been confirmed that after the application, the company's stock will start the market on September 16, 2022 (Friday).

Yiya Tong (SZ 002183, closing price: 6.2 yuan) issued an announcement on the evening of September 15 that the company received the "Notice on the Implementation of the Shareholding Plan for Shares' Holdings Reduction Plan" issued by the company on September 15, 2022. From August 18th, 2022 to September 15, 2022, the company's shares were reduced by about 25.95 million shares through centralized bidding, accounting for 0.9992%of the company's total shares.

Child King (SZ 301078, closing price: 13.25 yuan) issued an announcement on the evening of September 15 that about 60.47 million shares holding company shares (accounting for 5.56%of the company's total share capital) holding a shareholding of more than 5%of the shareholders Investment partnership (limited partnership) plans to reduce the company's shares by centralized bidding transactions from October 14, 2022 to January 13, 2023 (accounting for 1%of the company's total share capital).

Jiangsu Sunshine (SH 600220, closing price: 3.11 yuan) issued an announcement on the evening of September 15 that the company received a unanimous actor Yu Qinfen from the company's controlling shareholder on September 15th. From September 16, 2022 to March 15, 2023), the company's shares increased by centralized bidding transactions, community transactions and other methods. The increase in holdings is not less than 1%of the company's total share capital and no more than 2%. Lake Electric (SH 603355, closing price: 30.13 yuan) issued an announcement on the evening of September 15 that Lake Electric Co., Ltd. recently received the "Approval of the Public Offering of Lake Electric Co., Ltd. Public Distribution Company by the China Securities Regulatory Commission. "Bond Approval", the content of the bond is as follows: The total value of the company's public issuance of the company's publicly issued a total of 1.2 billion yuan can be convertible for corporate bonds, with a term of 6 years.

People (SH 603883, closing price: 34.21 yuan) issued an announcement on the evening of September 15th that as of the announcement date of this reduction plan, the company's controlling shareholder People's Pharmaceutical Group Co., Ltd. directly held approximately 164 million shares of unlimited and circulating shares of the company, accounting for accounting 28.23%of the company's total share capital. The Pharmaceutical Group plans to reduce the number of shares of the company through a large transaction method of the company, which does not exceed 11.65 million shares, and the reduction ratio does not exceed 2%of the company's total share capital. This reduction plan is implemented within six months after the announcement of the announcement. During the implementation of this reduction plan, the company has changes in shares, capital provident funds, and share -shares, and shares such as shares, and shares in response to the number of shares of the shareholding shares.

Baoxin Technology (SZ 002514, closing price: 10.23 yuan) issued an announcement on the evening of September 15th that the company received a written notice from Ms. Cai Chunyu, a consistent actor of the company's actual controller Mr. Ma Wei today, that Cai Chunyu intends Increasing the company's shares such as transactions and other methods, the increase of its own funds to increase its ownership should not be less than RMB 30 million (including) and no more than RMB 60 million (inclusive).

Tianhai Defense (SZ 300008, closing price: 4.3 yuan) issued an announcement on the evening of September 15th that as of September 14, 2022, the company has accumulated a total of 11.45 million in the company's shares through concentrated bidding transactions through a concentrated bidding transaction. Stocks account for 0.66%of the company's total share capital, the highest transaction price is 4.78 yuan/share, the lowest transaction price is 3.99 yuan/share, and the total amount of payment is about 50.12 million yuan. So far, the company's repurchase shares have been implemented.

China Gold (SH 600916, closing price: 13.59 yuan) issued an announcement on the evening of September 15th that as of the disclosure of this announcement, Suqian Hanbang Investment Management Co., Ltd. held 46.35 million shares of China Gold Jewelry Co., Ltd. It accounts for 2.76%of the company's total share capital. After the internal decision -making of Suqian Hanbang, Suqian Hanbang intends to reduce the company's shares held in total through centralized bidding and large transactions. Those who adopt a large transaction reduction, during the disclosure of the reducing holding plan during the disclosure of the holding holding plan, will be reduced by the date of 3 trading days after the trading day. Within 6 months after 15 trading days.

Hikvision (SZ 002415, closing price: 28.99 yuan) issued an announcement on the evening of September 15th that the company intends to use its own funds to repurchase some companies in a concentrated bidding trading system through the Shenzhen Stock Exchange trading system RMB ordinary shares (A shares) shares. The company's repurchase shares will be used to cancel the registered capital in accordance with the law. The total funds for this repurchase do not exceed RMB 2.5 billion (inclusive), and not less than RMB 2 billion (inclusive). All funds required for the repurchase are derived from the company's own funds. The repurchase price does not exceed RMB 40/share (inclusive) repurchase period from the company's shareholders' meeting to review and pass the date of this repurchase shares.

① As of 19:15 in Beijing time, Dow Futures fell 0.18%, the S & P 500 Index Futures fell 0.21%, and the NASA futures fell 0.38%.

② "Monster Stocks" still multiplied (HKD, the stock price is 189.42 US dollars, and the market value is US $ 35.51 billion) to increase by 10.37%before the market to US $ 209.07. Retaled 311.78%yesterday.

③ Nafei (NFLX, the stock price of $ 224.12, a market value of US $ 99.667 billion) rose 2.22%before the market to $ 229.10. In the document provided by the advertisers, Nai Fei expects that the company will soon launch a low -price subscription service, which will reach a milestone of 40 million subscriptions in the third quarter of 2023.

④ Shell Group (SHEL, the stock price of $ 54.21, a market value of 195.892 billion US dollars) announced that the current CEO Ben Van Beurden will leave at the end of 2022. Wael Sawan will be the company's next CEO. Effective from January 1 next year.

⑤ The US Department of Labor said that the US railway company and trade unions have reached a temporary labor agreement to avoid strikes. As of press time, the United Pacific (UNP, a stock price of US $ 217.95, a market value of US $ 136.105 billion) rose nearly 4%, CSX transportation (CSX, a stock price of US $ 31.23, a market value of US $ 66.871 billion) rose 2.50%, Norfolk South (NSC, the stock price 238.04 US dollars was 238.04 US dollars The market value of 55.909 billion US dollars) rose 1.50%. ⑥ Russia's Deputy Prime Minister Novak said that Russia's natural gas exports to the European Union this year will decrease by 50 billion cubic meters.

The Deputy Governor of the European Central Bank Kingson said that the inflation rate is expected to be unacceptable this year and next year. Economic growth will slow down, and monetary policy is still loose.

太 Developers said that Ethereum "merged" update was completed. As of press time, the price of Ethereum has not changed much, at $ 1589.17 per/American.

日 The results of trade statistics released by Japan's Ministry of Finance on the 15th show that due to the significant depreciation of imported goods in imports, the trade deficit in Japan has experienced a trade deficit for 13 consecutive months. The trade deficit in August reached 2.82 trillion yen, a record high.

, At 20:30 Beijing time, the US retail sales in August were released from the previous month (previous value: 0%, forecast value: -0.1%); the number of people who first applied for unemployed relief in the United States on September 10 (previous value: 222,000, Forecast value: 227,000 people).

Daily Economic News

- END -

Wolong District went all out to fight drought to fight against 32,500 acres of autumn crops "drinking and quenching thirst"

Reporter Wang Yidi Correspondent Cao FeiOn August 16th, in a farmland in Hezhuang ...

"Fanxing Bright Core Future" Shaoxing Yuecheng Binhai High -level Talent Project Road Show Special successfully held

On the afternoon of August 12, the high -level talent project of the Star Bright C...