Mechanical ETF (516960) fell 4.63%

Author:Capital state Time:2022.09.15

Mechanical ETF (516960) fell 4.63%

Analysis of the cause of decline: The cost growth of the cost of silicon wafers and battery films affects the profit of photovoltaic components+due to the prevention and control of domestic public health, the overall pressure of the performance of the machinery and equipment industry 2022H1+European and American PMI continued to weaken in August, machine tools and components and other mechanical categories Or there is a slowdown in export growth.

The cost growth of silicon wafers and battery films affects the profits of photovoltaic components. In the early stage, due to the various aspects of Sichuan power limit and domestic public health prevention and control, the leading manufacturers such as Tongwei and other battery films have increased prices many times. As of now, Tongwei has been quoted 9 times during the year; Upward to the highest point. The price increase of silicon wafers and battery films has once again transmitted the pressure to the midstream components. The profit of component has fallen to the industry's low point this year. Some middle -aged component companies have difficulties in survival, and the situation of high prices may be difficult to maintain. On the plate, due to photovoltaic influence, the mechanical and equipment industry fell.

Affected by the prevention and control of domestic public health, the performance of the machinery and equipment industry 2022H1 overall pressure. According to the calculation of Shen Wanhongyuan Securities, with 417 listed companies as a sample, the machinery industry has 22 H1 revenue of 827.7 billion yuan, a year-on-year-4.1%, and the net profit attributable to the mother is 59.5 billion yuan, which is -17.2%year-on-year. Fall 1.29PCT. The decline in revenue is mainly due to the operating rate of public health prevention and control affecting downstream infrastructure/real estate projects. The decline in performance may some extent affects the trend of market stock prices.

The European and American PMI continued to weaken in August, and the risk of slowing down the growth rate of exports such as machine tools and components. In August, the PMI comprehensive index of the United States, Europe, and Japan fell from the previous month. In terms of orders, the US and European manufacturing PMI new orders and new export order indexes have recovered or generally flat, but they are still in the contraction range. The global manufacturing industry is generally sluggish. In the second half of the year, the global economy is facing large downward pressure. Overseas demand overseas may slow down, low -end machine tools, low -end bearing, etc. have not yet established a segmentation of competitive advantages in overseas enterprises The toughness is relatively weak, and the downward pressure is large.

Outlook on the market:

From the perspective of the market, on the one hand, the economic tone remains unchanged, and infrastructure investment is still an important starting point for the economy. In July, infrastructure investment increased by 9.58%year -on -year; in the second half of the year, with the improvement of public health prevention and control, re -production and resumption of production, the construction of infrastructure projects in infrastructure projects, the construction of infrastructure projects It is expected to drive construction machinery needs. On the other hand, new energy vehicles and photovoltaic industries still maintain high prosperity, and the amount of power battery installed capacity and photovoltaic installation machines are expected to continue to bring incremental demand for mechanical equipment. In the future, the rise of the robot industry may open a new development space for the mechanical parts manufacturing industry in the industrial chain. Interested investors can continue to pay attention to Mechanical ETF (516960), but also need to be alert to adjustment brought by short -term market fluctuations.

- END -

Shanghai washing Ba disclosed that the 2022 semi -annual report achieved revenue of 307 million yuan

On August 1st, Shanghai Washingba (code: 603200.SH) released the 2022 semi -annual performance report.From January 1, 2022-June 30, 2022, the company realized operating income of 307 million yuan, an

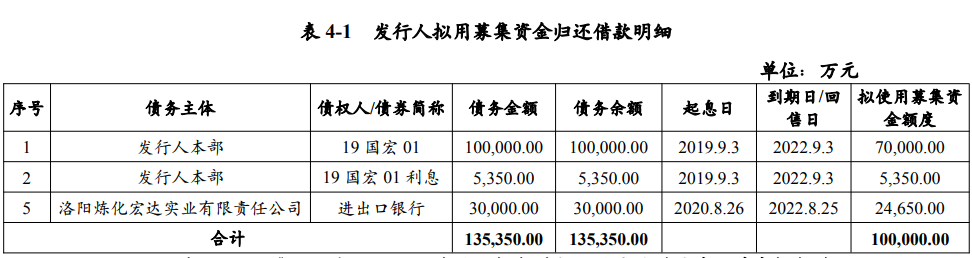

Luoyang Guohong Investment Holding Group's 1 billion yuan votes were issued, and interest rates were 4.35 %

[Dahecai Cube News] On August 17, the reporter learned that Luoyang Guohong Invest...