Galaxy's innovation growth has fallen exceeding -27%this year. High-entry and exit operations of heavy positions have been questioned?

Author:Corporate research room Time:2022.09.15

This article is based on public information, which is used only as information exchange and does not constitute any investment advice.

Produced/Company Research Office

Text/snow rock

As an old fund company, the Galaxy Fund has developed a history of 20 years, but in recent years, it has been lonely. The company is known to the outside world because of off -site factors, especially the former chairman Liu Lida frequently appeared on the hot search. Although the Galaxy Fund Quickly deny the scandal, but the damage caused by the company's image is also irreparable. It is understood that since the former chairman Liu Lida left in March 2022, the chairman of the Galaxy Fund has been in a vacant state until Song Weigang officially took over on May 11.

Industry insiders said that in recent years, the management of the Galaxy Fund has changed frequently in recent years, which not only has led to a significant loss of losses in the Galaxy Fund, but also leads to the active rights and interests of the Galaxy Fund. What about the trend?

The scale of the Galaxy Fund fell by 9.69 billion yuan in the first quarter

The decline in performance originated from frequent changes in executives?

On May 12, Galaxy Fund Management Co., Ltd. issued a change of senior management personnel. Song Weigang, chairman of the new fund management company, has the appointment date on May 11, 2022. According to the announcement, Song Weigang is currently a member of the Party Committee, Deputy General Manager, Director of Trade Union, and Secretary of the Party Committee of Galaxy Fund Management Co., Ltd. It is reported that this is the 6th chairman of the Galaxy Fund since its establishment in June 2002.

Liu Lida, former chairman of Galaxy Fund Management Co., Ltd., left office in March 2022 due to work changes. It is understood that Liu Lida has repeatedly exposed negative news in 2021.

It is worth noting that the Galaxy Fund executives have continued to change since 2015. Especially from 2019 to 2021, the general manager and other executive positions have changed frequently. The above factors have also led to the golden time of the Milky Way Fund many times. In August 2015, the general manager of Galaxy Fund, You Xiang, left due to personal reasons.

In February 2016, Liu Lida became the new general manager of the Galaxy Fund; in December 2017, Liu Lida was transferred to the chairman of the company, and Fan Yongwu served as the general manager.

On May 28, 2019, Fan Yongwu resigned for personal reasons, and Liu Lida was re -appointed. Liu Lida has been in the post of general manager for nearly a year. On April 23, 2020, the general manager of Gao Jianling Xinyinhe Fund, but on September 15, 2021, Gao Jian also resigned due to personal reasons, and Liu Lida once again served as the general manager.

On January 14, 2022, Galaxy Fund and Galaxy Golden Control issued public recruitment announcements in the entire market. After four months, the Galaxy Fund finally entered the "time" of the general manager recruitment.

Earlier, on March 12, 2021, Qian Ruinan, deputy general manager of Galaxy Fund, left for personal reasons. He had previously worked in the company for more than 10 years. On November 11, 2020, the deputy general manager Wang Qingren resigned for his personal reasons and left the date of office on November 10, 2020. Only 5 months have passed by his new.

With the explosive development of the public offering industry in recent years, competition among institutions has become increasingly fierce, and the frequent flow of senior staff of institutions has become a common phenomenon in the industry. Industry insiders believe that the new executives can bring new directions and business philosophy to the company in order to explore a path that suits them in fierce competition. However, too frequent changes in executives may affect the stability of the company's policy, and it will also affect the overall performance of the fund company, and the frequency change of executives will also increase additional running -in costs.

(The data comes from the same flowers)

According to the data of Tonghua Shun, at the end of 2019, the management scale of the Galaxy Fund was 97.1 billion yuan, and by the fourth quarter of 2020 to 120.580 billion yuan, the scale declined. In 2021, its fund scale not only did not rise, but at the end of the year, it fell to 117.519 billion yuan. It can be said that it is perfect to miss the 2020 public fund.

As of the end of the first quarter of 2022, the management scale of Galaxy Fund fell again. In the first quarter, the Galaxy Fund was only 107.829 billion yuan, ranking 47th among the fund companies, a decrease of 9.69 billion yuan from the end of 2021. According to the first quarterly report, the non -monetary management scale of the Galaxy Fund was 77.148 billion yuan, a decrease of 4.49%from the month of 80.774 billion yuan at the end of 2021. However, the overall scale of the Galaxy Fund rose to 114.152 billion yuan in the second quarter of 2022.

From the perspective of the scale changes in the past three years, although the scale of the Galaxy Fund has risen in 2020, the size of the non -currency category of Galaxy Fund has not been stable. In the first quarter of 2021, the size of non -currency funds fell to 72.669 billion yuan, which rose in the following three quarters, with the scale of 75.118 billion yuan, 80.04 billion yuan, and 80.774 billion yuan. It fell to 77.148 billion yuan, and the second quarter rose to 83.763 billion yuan.

9 years of Galaxy veteran Shen Yufei stepped down,

Multiple funds under the successor Zheng Weishan lost money in the first half of the year

Galaxy Fund Management Co., Ltd. was established in June 2002. It has been issued and managed by many funds, covering a series of varieties such as stocks, mixed, bonds, and currencies. Regarding the problem of significant losses in the Galaxy Fund, some people in the industry believe that in addition to a certain relationship with the changes in executives, it is also related to the fund manager. In recent years, fund managers transferred from public equity to private equity are common. Since the beginning of this year, this trend has intensified in the fund circle. According to incomplete statistics from the media, as of May 11, 103 fund managers have left during the year, an increase of 22.89%over the same period last year, a new high in recent years.

In the first quarter of this year, Xiao Xiao, who has successively had Baoying Fund, Han Qing, "Medicine Brother" of "Big Margin Public Funding Product Champion", Jin Gechen, "Medicine Brother", ICBC Credit "Tram Coffee" Yan Siqian, Cathay Fund veteran After Yang Fei, Galaxy Fund veterans Shen Yufei, and Hua An Fund, many public offering veterans announced their departure. Recently, Dong Chengfei, the longest -known fund manager in the industry, and Lin Sen, the manager of E Fund Fund private".

It is worth noting that on March 17, the "veteran" of "veteran" Shen Yufei left three funds in the Galaxy Fund for 9 years -Galaxy Industrial Power Hybrid, Galaxy Zhilian Hybrid, and Galaxy Research Selection. The size of the three funds before the departure was 2.3 billion yuan. At present, Shenyufei has not been in charge of the fund. Among them, Zheng Weishan, manager of Galaxy Industry Power Hybrid, Galaxy Zhilian Hybrid Employment Fund Manager, and Yuan Xi, a selected hybrid hiring fund manager in Galaxy Research.

Shen Yufei's long -term performance is good. According to Wind data, his long -term managed Galaxy Zhilian Theme Fund has rewarded as high as 15.15%in 6 years and more than 1/10 in the first ranking. The other two funds revenue ranked about 1/3 of the same kind. Zheng Weishan, the manager of the Galaxy Industry Power and Galaxy Hybrid Employment Fund, is also the manager of the most management of the Galaxy Fund.

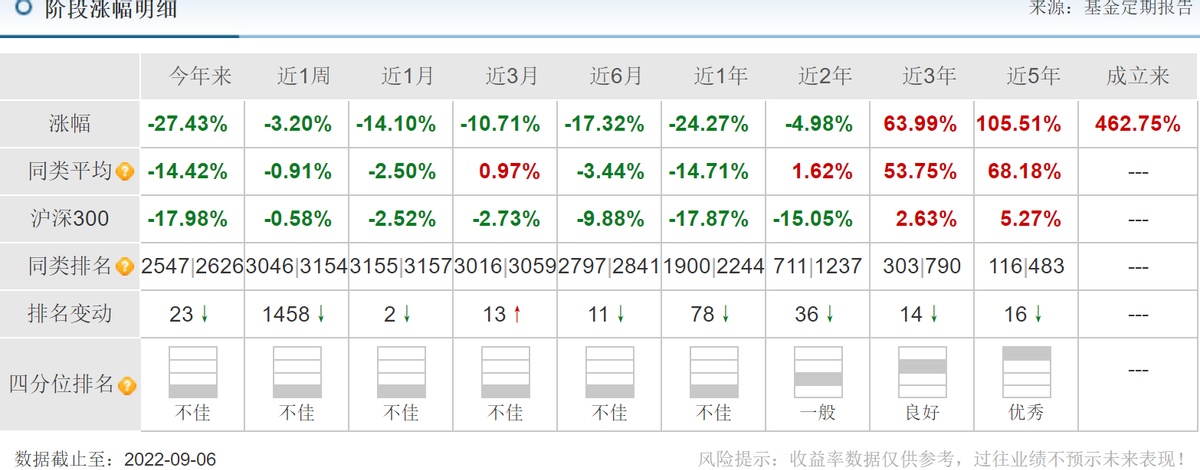

(Data comes from Tiantian Fund Network as of September 6)

However, Zheng Weishan's performance this year was a bit unsatisfactory. All the four funds suffered losses. Among them, the largest galaxy innovation growth mixed A/C declined the largest declines of -27.43%and -27.72%, respectively. Galaxy Zhilian Hybrid also had a loss of -17.42%, and the mixed power of the Galaxy industry also had a loss of -15.89%. Even if the cycle is stretched, four funds have been in a loss in the past year.

(Data comes from Tiantian Fund Network as of September 6)

Galaxy innovation growth this year's yield -27.43%,

Doubt about the entry and exit operation of heavy warehouses?

For the fund managed by Zheng Weishan, Kimin is most concerned about the Galaxy Innovation and Growth Mixed Fund.

Galaxy Innovation and Growth Mixed A was established on December 29, 2010, with the fund size of 16.697 billion yuan as of September 6. However, the fund's yield this year was -27.43%, the yield in the past March was -10.71%, the yield in the past June was -17.32%, and the yield in the past year was -24.27%. Due to the poor performance this year, similar rankings are naturally at the bottom.

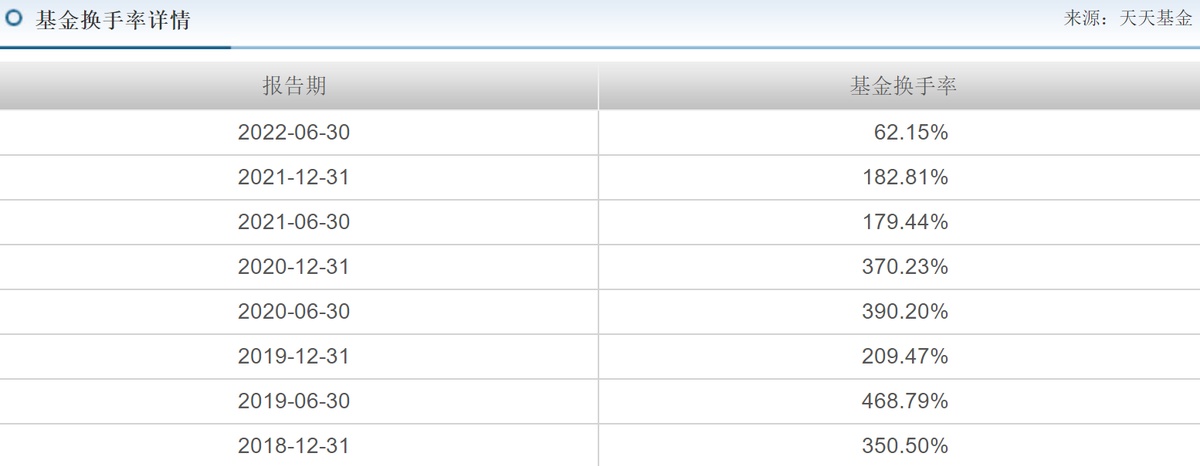

(Data comes from Tiantian Fund Network)

After Zheng Weishan took over the fund in May 2019, although the style of the semiconductor was continued, the fund's turnover rate was quite high. In the second quarter of 2019, the turnover rate was as high as 468.79%, and the second quarter of 2020 also reached 390.20%. Essence People in the industry said that if funds are poured into the semiconductor sector, the strategy of heavy warehouse semiconductor may benefit. However, if the funds are withdrawn from the sector, the fund's performance can be imagined.

(Data comes from Tiantian Fund Network)

According to the first quarter report, the top ten heavy stocks of this fund have not changed much. Wanye enterprises have fallen out of the top ten heavy stocks and reduced positions in the north of China. From the perspective of heavy warehouse stocks, it is a large -scale stock, and it belongs to the leading company in the semiconductor sector. From the perspective of the movement of the positioning, it is roughly reduced the semiconductor equipment company to add a semiconductor design company. In the fourth quarter of last year, the second largest heavy warehouse stocks were electrical, and this time it was transferred to the seventh largest heavy warehouse stock.

From the second quarterly report, as of the second quarter report, as of June 30, the fund holding the funds holding Silanwei (8.90%of the position), Siruipu (8.46%), Ruixinwei (8.39%), Times Electric (8.34%of the position), Zhaoyi Innovation (8.11%of the position), Shengbang (7.98%), Northern Huachuang (7.78%), SMIC (7.66%), Shanghai Silicon Industry (7.65%of the position) and Well shares (4.05%of the position).

Galaxy Fund stated that in the third quarter, the investment of science and technology tracks will still be continued, and it will pay more attention to industrial fundamental research. As always, the method of selecting individual stocks in the fundamentals as always, and actively find high prosperity and strong growth definition. Science and technology.

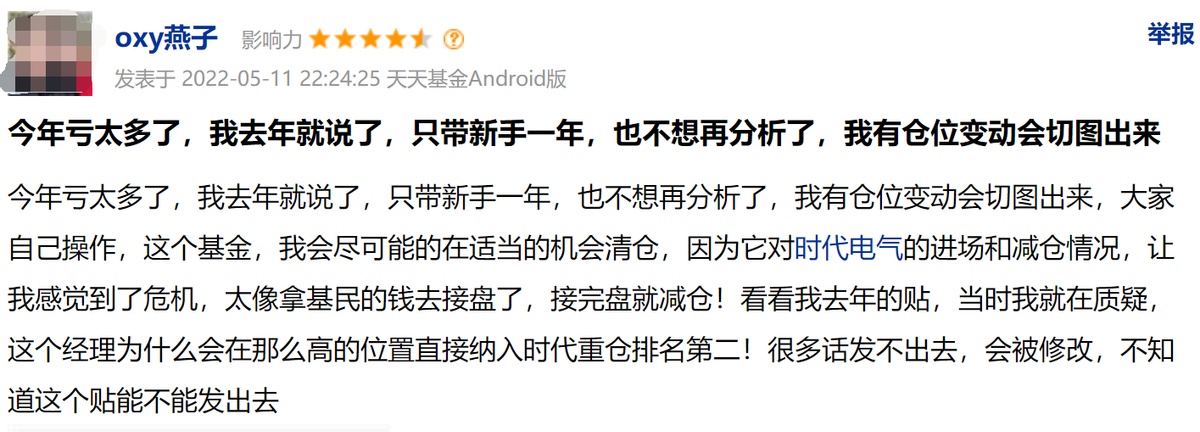

In this regard, Ji Min said that there was too much loss this year and questioned the operation of the fund's stock in Times.

(Data comes from Tiantian Fund Network)

(Data comes from Tiantian Fund Network)

Affected by performance fluctuations, the scale of Galaxy Innovation and Growth Mixed A Fund has fluctuated largely this year. As of June 30, 2022, the Galaxy Innovation and Growth Mixed A, the net assets at the end of the period was 16.697 billion yuan, an increase of 5.36%over the previous period. However, the author found that in the first quarter of this year, the size of the Galaxy Innovation Growth Mixed A A. The net assets at the end of the time was 15.848 billion yuan, a decrease of 8.80%from the previous period. Industry insiders said that the highest point has fallen by 2.6 billion. And from the perspective of data, the purchase share in the first quarter is far greater than the redemption share, and the total share is also rising, but the size of the assets has declined. It can only be explained from the side that the net value of this fund has fallen too much this year, which greatly drags the asset scale. In particular, since August, the fund's net value has declined all the way, and there are no signs of stopping.

In summary, in recent years, the executive team that has frequently changed the Galaxy Fund will inevitably affect the company's development planning. Compared with old -fashioned funds such as China Merchants Fund and E Fund Fund, the development of Galaxy Fund has been relatively inferior in recent years. As of the end of June 2022, the size of the Ichida Fund's management was 1.62 trillion yuan; the scale of the currency market fund was 1.14 trillion yuan, and the industry ranked first.

However, according to Wind data, Galaxy Fund's management scale as of the end of the second quarter was 114.152 billion yuan, ranking 47th in the market. However, the author found that the Galaxy Fund's management scale has exceeded the 100 billion yuan mark in the second quarter of 2020. In the past two years, the size of the Galaxy Fund has not increased significantly. In the future, with the increasingly obvious effect of the industry, where will the Galaxy Fund go from?

- END -

Stabilize and recover!In the first half of the year, Beijing -Tianjin -Hebei realized regional GDP 4.7 trillion yuan

It was learned from the Provincial Bureau of Statistics that in the first half of the year, in the face of the complex and severe international environment, the triple pressure of the domestic econo

In 2022, the top 20 global dairy industry released Yili's growth rate first to win the "Global Five Five"

On August 17, the Dutch Cooperation Bank announced the Top 20 Global Dairy Industr...