Announcement on the continued delay in paying part of the taxes and fees related to the manufacturing industry

Author:SME public service platform Time:2022.09.15

In order to thoroughly implement the decision -making and deployment of the Party Central Committee and the State Council, and further support the development of small and medium -sized enterprises in manufacturing, the manufacturing small and medium -sized enterprises (including individual wholly -owned enterprises, partnerships, individual industrial and commercial households, the same below) will continue to delay the payment of some taxes and fees policies The announcement of the relevant matters is as follows:

1. Since September 1, 2022, the announcement of the "Announcement of the Ministry of Finance of the State Administration of Taxation on continuing the implementation of the implementation of small and medium -sized enterprises in the manufacturing industry to delay the payment of some taxes and fees (2022 No. 2) has enjoyed the delay of the tax and fees of 50 %Of manufacturing medium -sized enterprises and small and micro enterprises that delay 100%of taxes and fees have continued to extend 4 months after the expiration of the slow payment period for the expiration of the slow payment and fees.

2. Delayed taxes and fees include the period of affiliated in November, December 2021, February, March, April, May, June (monthly monthly) or 2021 In the first quarter and the second quarter (quarterly paid), corporate income tax, personal income tax, domestic value -added tax, domestic consumption tax and attached urban maintenance construction tax, educational expenses, and local education additions, excluding buckles Payment, collection and payment, and taxes paid when applying for invoicing from tax authorities.

3. The delayed taxes paid paid in November 2021 and February 2022 will be paid in the warehouse before the announcement of this announcement after September 1, 2022, and you can voluntarily choose to apply for tax refund (fee) and enjoy the continuous and slow payment policy.

4. After the expiry of the post -end payment period stipulated in this announcement, the taxpayer shall pay the corresponding month or quarterly taxes and fees in accordance with the law. Apply for extension of tax payment.

V. Taxpayers who do not meet the requirements of this announcement and deceive the policies for the enjoying tax payment, the tax authorities will be dealt with seriously in accordance with the relevant provisions such as the "Taxation and Management Law of the People's Republic of China" and the implementation rules.

6. This announcement will be implemented from the date of issuance.

Special announcement.

Ministry of Finance of the State Administration of Taxation

September 14, 2022

- END -

Deloitte: Science and Technology Board's performance is eye -catching, A -share IPO financing amount this year is expected to set a record

Deloitte China ’s Capital Market Service Department of professional service agenc...

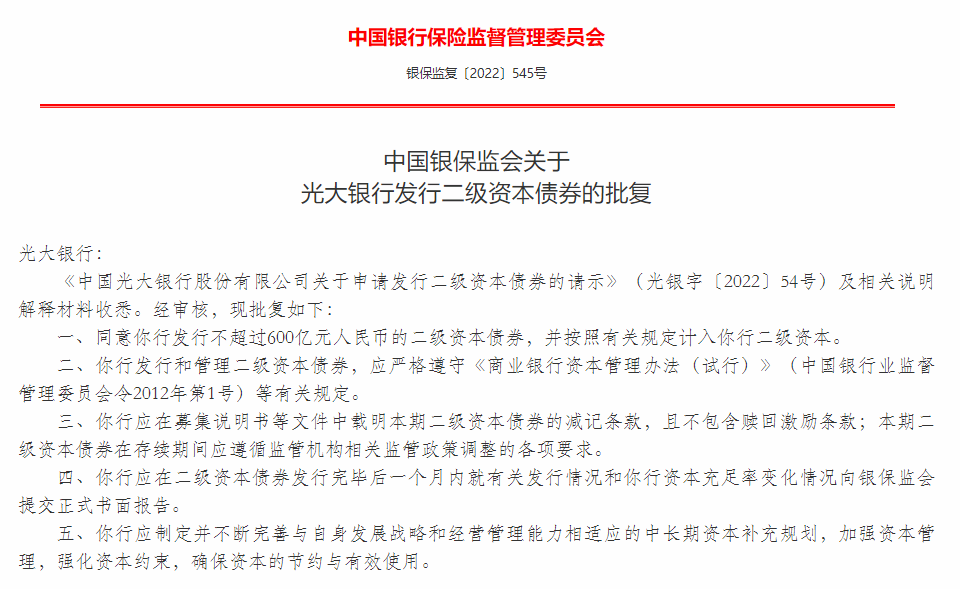

Everbright Bank plans to issue 60 billion yuan second -level capital bonds for approval

[Dahecai Cube News] On August 9, the CBRC approved that the Everbright Bank issued...