While moving the holdings, what chess under the Founder of the Shanghai "King Fried" plot with the Ant Group?

Author:Daily Economic News Time:2022.09.14

Recently, the Fosuna's actions that have attracted much attention in the capital market have continued to reduce holdings on the one hand. On the one hand, some assets have been reduced. On the other hand, they joined the Ant Group to win the "King Fried" plot with Ant Group.

Fosun International (HK00656, HK $ 4.56, a market value of HK $ 38 billion) has always been divided into its business fields with the themes of health, happiness, wealth, and intelligence. Guo Guangchang, the head of the head, also recently posted a Weibo saying: "China is always the most important base for Fosun." However, with the rating of Fosun and the pressure of its debt, Fosun was also questioned by the international rating agency: "Is it a bit tight at hand?"

According to the incomplete statistics of the reporter of the Daily Economic News, such as the previous disclosure of the Related Companies of Fosuna's previous disclosure, this round of capital has been moving or over 10 billion.

For market rumors, on September 14, the CEO of Fosun International and CFO Gong Ping told reporters of the Daily Economic News that the so -called "Chinese regulatory authorities required banks and some state -owned enterprises to find out and Fosuna companies related to overseas media reports "Express", it is purely azu. The recent reduction of holdings is to further improve rating, consolidate liquidity security mats, and enhance the ability to span the economic cycle. At the same time, this is also a normal continuation of the financial strategy in recent years.

If it is fully implemented, the amount reduction may exceed 10 billion

Since the beginning of this year, the Fosuna has reduced some assets under the name. According to the incomplete statistics of the reporter, if the relevant reduction plan is implemented, the estimated amount of reduction is approximately 16.7 billion yuan.

Data source: announcement of each listed company, reporter drawing

Among the 12 minus holdings statistics from reporters, the larger amount includes Hainan Mining (SH601969, 7.64 yuan, market value 15.5 billion yuan), Miracle Novai (US), LLC, Tsingtao Beer (HK00168, HK $ 71.1, a market value of 970 HK $ 100 million), Fosun Pharmaceutical (SH600196, stock price of 33.76 yuan, market value of 90.1 billion yuan) and Jinhui wine (SH603919, stock price 25.88 yuan, and a market value of 13.1 billion yuan).

First in February this year, Hainan Mining announced that Shanghai Fosun Industrial Investment Co., Ltd. reduced its holdings by 20.22 million shares, and the estimated amount of holdings was about 266 million yuan. In August, Shanghai Fosun Industry Investment Co., Ltd. continued to plan to reduce Hainan mining, with a reduction of 61.03 million shares. According to the latest closing price estimation, the amount of this reduction was about 1.937 billion yuan.

By April, Fosun International issued an announcement that it will sell Miracle Novai (US) and LLC's total equity, with a total cost of US $ 740 million, or about RMB 5.15 billion.

In May, Fosun International issued an announcement saying that it was planned to sell 47.59 million shares of Qingdao Beer, worth 2.951 billion Hong Kong dollars, or about RMB 2.626 billion.

The reduction of Fosun Pharmaceutical and Golden Best has aroused strong market attention. Fosun Pharmaceutical, Yuyuan and Jin Huijiu's stock price have also fallen to a certain time in the near future.

On September 3, Fosun Pharmaceutical announced that Shanghai Fosun High Technology (Group) Co., Ltd. plans to reduce its holdings of not more than 809 million shares. If calculated at the latest closing price, the market value of this part of the stock is about 2.7 billion yuan.

Image source: Data map

On September 13th, Yuyuan (SH600655, a stock price of 7.52 yuan, and a market value of 29.3 billion yuan) issued an announcement saying that its wholly -owned subsidiary Hainan Yuzhu Enterprise Management Co., Ltd. (hereinafter referred to as "Hainan Henzhu") intends to sell it through the agreement transfer method The Jinhui wine is 65.94 million shares, and the proposed transfer price of the target shares is RMB 29.38/share, and the total transaction price is about 1.94 billion yuan. Among them, the 8%of the Jinhui wine transferred to Gansu Atte Investment Group Co., Ltd. has completed the transfer procedures for the completion of the transfer procedures.

Jointly win the "King Fried" plot with Ant Group

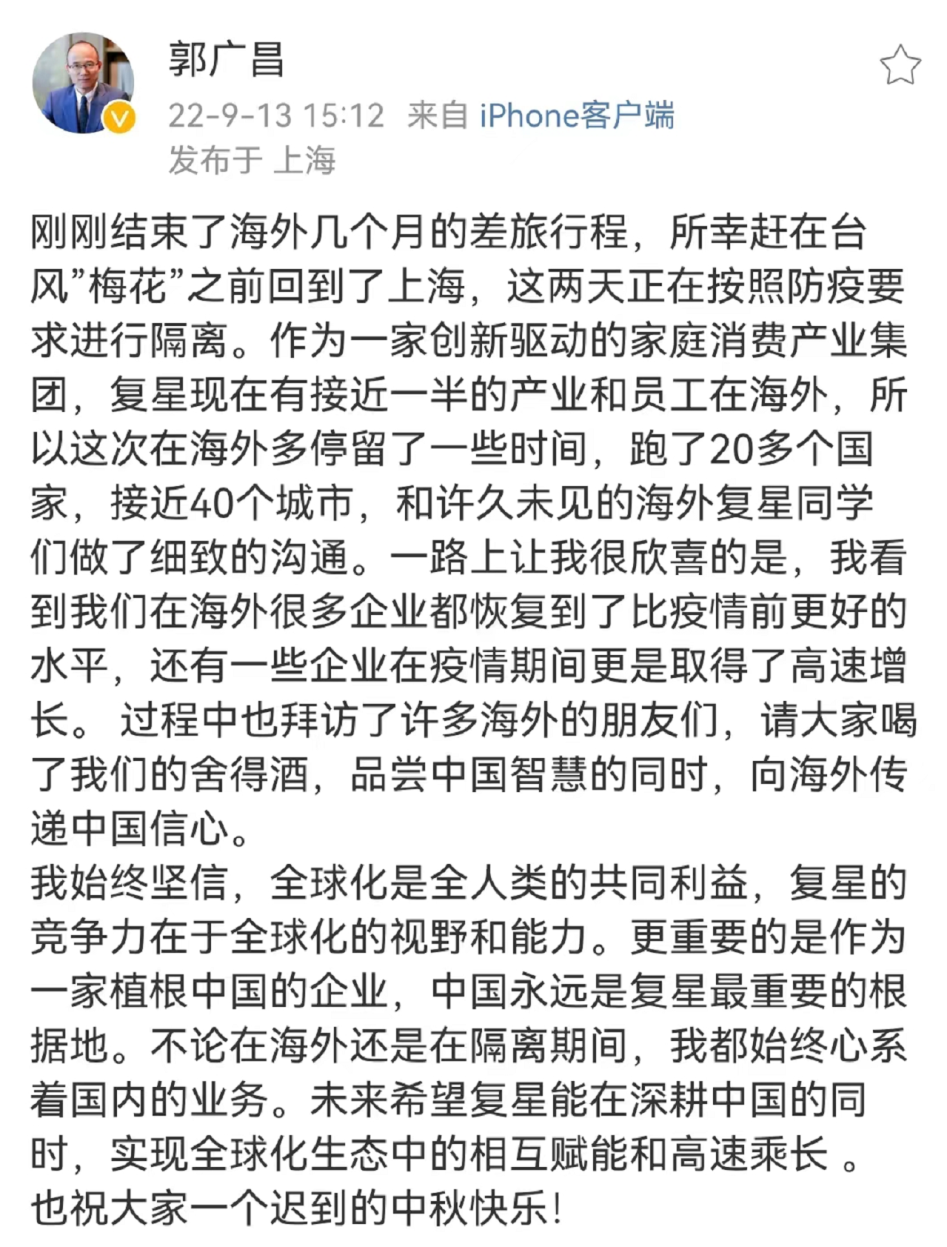

On the afternoon of September 13th, Guo Guangchang, the head of the low -key Fosun, released a long Weibo Weibo on his personal Weibo. Guo Guangchang, who has just returned from overseas, mentioned that "China is always the most important base for Fosun."

Guo Guangchang's move seemed to be eating "reassinual pills" to the market in the outside world.

"I always believe that globalization is the common interest of all mankind, and Fosun's competitiveness lies in the global vision and ability. More importantly, as a company that roots in China, China is always the most important base for Fosun. During my overseas or isolation, I always care about domestic business. In the future, I hope that Fosun can cultivate mutual empowerment and high -speed growth in the global ecosystem while deep cultivation. "Guo Guangchang said.

Photo source: Guo Guangchang Weibo Screenshot

It is worth noting that the Fuming Siferalian reduces its holdings on a large amount and invests in property and land in Shanghai.

On the evening of March 21 this year, Fosun International announced that it plans to acquire 50%equity of the Bund Financial Center (BFC) held by Zhongrong Trust at a cost of 6.342 billion yuan. According to the property valuation report, as of December 31, 2021, the value of BFC property was about 23.078 billion yuan.

BFC is located at No. 600, Zhongsong Road, Shanghai, China. It is a "hive" benchmark project created by Fosun International. It is also the landmark of large -scale all -scale all -scale ecological commercial complexes in the core area of Shanghai Bund. The project opened on December 12, 2019, with a total construction area of more than 420,000 square meters. At present, Fosun International has completed the delivery of BFC equity, holding BFC100%equity. At the beginning of September, the Daily Economic News reported that the Fuyou plot of Huangpu Old Town, Shanghai Huangpu, who was called "epic development difficulty" by some people in the industry, officially "released the list" recently and announced the final implementation subject: Shanghai Yiyou Industrial Development Co., Ltd. and Shanghai Yunzhang Enterprise Management Consulting Co., Ltd.. It can be seen after the equity is penetrated that the main body of the implementation is Yuyuan and Ant Group.

The price of Fuyou Land has not been made public. Judging from the Shanghai City Demon Garden Phase II and Kerry Construction Jinling East Road project, which is based on Huangpu District in the past two years, the value of the land value of the blessing land will exceed 10 billion yuan.

In addition, the conditions of the Fuyou plot also include that the land acquisition unit must sign a state -owned construction land transfer contract to the comprehensive acceptance of project planning resources, and contribute to the comprehensive tax of Huangpu District at no less than 12 billion yuan. After the comprehensive acceptance of the project planning resources, the comprehensive taxation contribution to Huangpu District within 5 years has contributed no less than 14.4 billion yuan.

It is precisely because of the harsh conditions and expensive conditions of the blessing plot, and some media said that the land was the "king bombing" plot.

Fosun response: reduction is a solid liquidity safety pad

In addition to cash, the market has other concerns about Fosun.

On September 14, the CET and CFO Gong Ping told the reporter of "Daily Economic News" through written documents that the so -called "Chinese regulatory authorities required banks and some state -owned enterprises to find out with some state -owned enterprises. "It is purely Ziwu. Fosun has verified from regulatory agencies through multiple channels. The China Banking Regulatory Commission has not required commercial banks to find Fosun's financial opening, and many commercial banks cooperating with Fosun have never received relevant notices.

Regarding the so -called 650 billion debt, Gong Ping said: "The total debt reflected in the report on the main report of Fosun's listing is the debt of all the groups (Yuyuan Pharmaceutical, Portuguese Insurance, etc.), including the group. The subsidiary is an independent legal person, and its debt cannot be borne by the group. Therefore, the so -called more than 600 billion Fosun debt is a statement of a concept of stealing. Especially because the nature of insurance business is underwriting and the debt ratio is high, the merger statement caliber As a result, the total debt is higher. "

In response to the recent reduction of holdings, Gong Ping said: "Fosun's recent reduction is to further improve rating, consolidate liquidity security mats, and enhance the ability to cross the economic cycle. This is also the normal continuation of the financial strategy in recent years. Fosun has recently been The seemingly frequent reduction and sale are the continuation of the financial strategy that has persisted in returning balance in the past few years. "

Regarding the lowering of the rating, Gong Ping said that Moody's scoring card in accordance with its standard financial and credit indicators, in the quantitative dimension, the scoring of Fosun International is BA2, but because its analysts have a macroeconomic and capital market environment in China Very pessimistic, so from a qualitative perspective of subjective judgment, Fosun International's rating to B1.

"With rating management as the starting point, we plan to stabilize and orderly drop the debt from 2022 to 2025 to lengthen the debt period. The group will also increase the cash dividend of the subsidiaries at the same time, control the fixed costs of the headquarters, and steadily optimize the group to steadily optimize the group Credit indicators have consolidated the ability to cross the economic cycle, "Gong Ping said.

In addition, Gong Ping also said that after the overall development of the Fuyou Road project, it will jointly form a total construction surface with an existing Yuyuan Mall, Bund Financial Center, and the second phase of Yuyuan Phase III projects that will be launched. The super -cultural and commercial complex covers many functions such as culture, commerce, office, tourism, leisure, entertainment, and residence, which marks the planning and forming of the "Dazuyuan area". The "Dazuyuan Area" is the iconic industrial project of Shanghai City. It will build a global fashion cultural show with aesthetic charm of Oriental Life, helping Shanghai to build an international fashion capital and enhance the soft power of Shanghai cities.

Daily Economic News

- END -

Real Estate Songdu shares cross -border lithium batteries flashed waist

Radar finance produce | Li Yihui edited | Deep SeaOn August 19, the Housing Enterp...

Shenzhen's largest "vegetable basket" uses "numbers" to solve problems

Shenzhen Pinghu Haiji Xing International Agricultural Product Logistics ParkFocus ...