The four -year loss exceeded 2.8 billion yuan, and the "bleeding and listing" Ding -dong Health "group wolf ring"

Author:Radar finance Time:2022.09.14

Radar finance produced | Meng Shuai editor | Shenhai

On September 14, Dingdang Health finally successfully rang the clock in the Hong Kong Stock Exchange.

On the first day of listing, the opening price of Dingdang Health was HK $ 12.34/share. As of the closing of September 14, Dingdang Health closed at HK $ 12/share, which was the same as the issue price. The latest market value of Dingdang Health was HK $ 16.098 billion.

However, behind Dingdang's health market value of more than 10 billion Hong Kong dollars, it has continued to lose money for many years. The prospectus shows that the losses were 103 million yuan, 274 million yuan, 920 million yuan, and 1.599 billion yuan from 2018 to 2021, respectively from 2018 to 2021. The cumulative loss of four years reached 2.896 billion yuan.

Radar Finance noticed that Dingdang Health, which focused on online direct -operated channels and once relying on the slogan of "28 minutes to deliver medicine" to the online pharmaceutical track, was also questioned by many consumers on their distribution services.

At the same time, the Internet medical industry in Dingdang Health is still very fierce. In addition to the end of the giants such as Ali, JD, and Meituan, a number of drug circulation software also stared at Ding Dang's healthy market share.

It took more than a year, Dingdang Health finally made the listing dream

On September 14, another listed company with digital retail pharmaceutical types was born. This company was established in 2014.

The radar Finance learned that Dingdang Health was created by Yang Wenlong, 60, and before the launch of Dingdang Health, Yang Wenlong also founded Kangmei Pharmaceutical. The woman Yanjie Wash of the TV screen swept the TV screen was a product launched by Kangmei Pharmaceutical.

In 2001, Yang Wenlong was established and established Renhe Group, and after the establishment, the acquisition of the acquisition of Zhangshu Qili Pharmaceutical Co., Ltd., Tonggu Weixin Pharmaceutical Co., Ltd., and Xiajiang Sanli Pharmaceutical Factory continued to expand their business maps.

In 2014, when the O2O model of takeaway rose, Yang Wenlong, who had a unique vision, realized the feasibility of this model in the field of medicine and health. The subsequent Yang Wenlong launched the software of Dingdang Fast Pharmaceutical, which officially opened his new entrepreneurial journey.

In June last year, Dingdang Health submitted a listing application to the Hong Kong Stock Exchange, but half a year later, Dingdang Health's listing application "failed". Until March of this year, Dingdang Health submitted a listing application to the Hong Kong Stock Exchange and re -activated the listing process. Five months later, on August 18th, Dingdang Health officially disclosed to the Hong Kong Stock Exchange to carry out the prospectus and listing work through the auditory prospectus.

The prospectus shows that Dingdang Health has sold a total of 33.537 million shares worldwide, of which about 7.2 times the public offering of Hong Kong is excess subscription, and the international offering section has obtained approximately 1.7 times excess subscription.

As the cornerstone investors, Sunshine Insurance, Harvest, and JUMPCAN participated in the issuance of Dingdang Health. The former subscribed for a total of $ 38 million. Among them, Sunshine Insurance subscribed for $ 25 million, Harvest subscribed for $ 10 million, and Jumpcan subscribed for $ 3 million.

For the funds raised this time, Dingdang Health said that about 45.0%is used for business expansion, about 15.0%is used to optimize the technical system and operating platform, about 10.0%is used to improve services and business. The medical industry value chain, potential investment, acquisition or strategic cooperation, about 10.0%of operating funds and other general companies.

Yang Wenlong, chairman and president of Dingdang Health Group's board of directors, said that the company will continue to seize opportunities, take advantage of the wind and waves, and actively expand the business scale, and continue to improve their performance through intelligent and refined operations. Return to investors with green, long -term, and sustainable development.

Radar Finance noticed that Dingdang Health was loved by capital before listing. Tianyancha shows that before this listing, Dingdang Health has received a total of 7 rounds of financing, of which the financing scale of multiple rounds of financing ranges from 300 million yuan to US $ 220 million. Many well -known institutions including SoftBank China Capital, China Merchants Bank International, China Gold, Tianyi Capital, Longmen Investment, Haiying Fund, Taikang Life Insurance, and Tongdao Capital have participated in Dingdang's health financing.

In June last year, Dingdang Health completed the last round of financing before the listing. The round of financing was jointly led by TPG Asian Fund, Obo Capital, and Hong as the capital. Institutions followed, the financing amount reached $ 220 million.

It is worth mentioning that SoftBank China Capital is an earlier institutional investor in Dingdang Health, and participates in Dingdang Health financing three times. In this regard, Jiang Min, a partner of SoftBank China Capital, said, "Domestic digital medical care is still in the early stages of commercialization. Dingdang Health has a wider market space. People with wider medical products and services. "

Four years lost more than 2.8 billion yuan

The prospectus shows that Dingdang Health recorded 585 million yuan, 1.276 billion yuan, 2.229 billion yuan, and 3.679 billion yuan in revenue from 2018 to 2021, respectively, with a compound annual growth rate of about 84.6%. Among them, the growth rate of Dingdang's health revenue last year was 65.07%, which was lower than the revenue growth rate of 118.19%and 74.71%in 2019 and 2020.

In the first quarter of this year, Dingdang's health revenue was 987 million yuan, an increase of 26.6%compared with 780 million yuan in the same period last year, but the growth rate was still lower than 55.9%of the same period last year. Even though Dingdang Health has successfully landed in Hong Kong stocks today, it has not yet resolved a profit problem. The prospectus shows that from 2018 to 2021, the losses of Dingdang's health during the year were 103 million yuan, 274 million yuan, 920 million yuan, and 1.599 billion yuan. Its losses showed a tendency to expand year by year. The cumulative loss of four years reached 2.896 billion yuan. Essence During the same period, the losses during the year were 17.6%, 21.5%, 41.3%, and 43.5%, respectively. This indicator continued to rise in four years.

In the first quarter of this year, Dingdang Health still failed to reverse the situation of losses. In the first quarter, the loss was 404 million yuan during the period of Dingdang Health. In other words, the losses of Dingdang Health in the first quarter of this year accounted for 25.27%and 43.91%of its losses last and previous year, respectively, 3.92 times and 1.47 times its losses in 2018 and 2019.

The prospectus shows that according to income, Dingdang health revenue mainly comes from two aspects, which are drugs and medical and health business and other businesses. Among them, Dingdang Health Drugs and Medical and Health Business have a proportion of total revenue from 2018 to 2021, respectively. %, 98.1%, 98.9%, and 96.8%, the proportion of this income is stable at more than 95%per year.

Radar Finance noticed that the drug and medical and health business that contributed 90 % of the revenue of Dingdang health, and the sales channels are divided into online direct -operating, business distribution and offline retail. Among them, from 2018 to 2021, the proportion of revenue contributing to Dingdang Health online channels accounted for 69.3%, 72.5%, 76.9%, and 72.5%of the channels for all channels of drugs and medical and health business, and basically maintained around 70%.

However, the most revenue of online direct -operated channels contributed to the most revenue and the "28 -minute delivery door" as the service slogan, but it was also questioned by many consumers. As of press time, there are as many as 487 complaints related to Dingdang Fast Pharmaceutical on the Black Cat complaint platform. Users cancel the difficulty of order, unqualified product quality, etc.

In addition, Dingdang's health acquisition costs are also rising. The prospectus shows that from 2018 to 2020, the cost of the average user acquisition cost of Dingdang Health self -operated online platform online is 5.9 yuan, 10.3 yuan, and 6.9 yuan, respectively. More than 18 yuan.

In this regard, Dingdang Health explained that the increase in the average number of users in 2021, mainly to open a large number of smart pharmacies, to carry out additional cooperation with various emerging and increasing attention to the brand awareness, and maintain The current traffic platform cooperation, business expansion to new business cities, etc.

The giant end, the track "inner roll"

According to the Ferrisana report, if it is calculated based on the income of 2021, Dingdang Health is the largest product and service provider in the digital pharmacy industry in China, with a market share of 6.8%.

Under different segmented conditions, Dingdang health advantages are not obvious. At present, many Internet giants have long been laid out in the field of digital medical care, such as Ali's health and JD health owned by Ali, and JD.com Health, Meituan, and Hungry Mosho have stared at the cakes of medical timely distribution of the track.

According to the Ferrisana report, if it is calculated based on the income of 2021, Dingdang Health ranks third in the Chinese digital retail pharmacy industry, and its market share is 1%, but Dingdang Health and China ’s digital retail pharmacy industry is the first. There is still a large gap between the second service provider. The top two opponents account for 10%and 6.5%in the market. Jingdong Health and Ali Health.

However, Ali Health and JD health, which have been listed on the Hong Kong Stock Exchange, have performed mediocre this year in the capital market. As of the closing of September 14, Ali Health closed at HK $ 4.3/share, with the latest market value of 58.137 billion Hong Kong dollars; JD.com Health closed at HK $ 51.05/share, and the latest market value was HK $ 16.2257 billion. HK $ 100 million and HK $ 79.291 billion.

But even so, Dingdang Health is currently about HK $ 16 billion, compared with the two "predecessors" who have logged in to the capital market, there is still a certain gap.

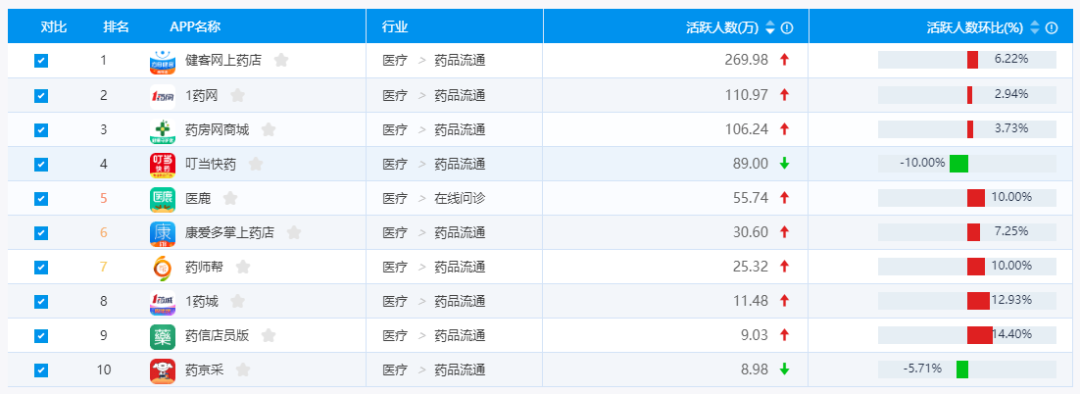

In addition to the giant, Dingdang Health also faces the challenge of other opponents to it. According to Observatory data, with the monthly live data of August, Dingdang Health was launched as early as 2015, and it failed to become the top three of the drug circulation software in August. Jianke Online Pharmacy, 1 Pharmaceutical Network, and Pharmacy Network Mall shared the Dingdang Expressway behind with a monthly work with 2.6998 million, 1.1097 million, and 10.624 million, and the monthly live circulation of the three lives was 6.22%, 2.94%, and 3.73 on the previous month. %growth of.

During the same period, Dingdang Fast Pharmaceuticals ranked fourth in August in the same industry with an 890,000 monthly living, and Dingdang Express was the software that had declined in the first year of the list in the first nine of the list.The live ring decreased by 10%month -on -month, and corresponding to it, many softwares such as medical deer and Kang Aiqian Pharmacy were ranked after Dingdang Fast Medicine, and the monthly month -on -month increase of more than 7%.The relevant person in charge of Dingdang Health said that the innovation of information technology such as 5G and the Internet of Things is still underway. In the second half of the pharmaceutical e -commerce, how to improve the application of digital technology and industry conversion capabilities, and to improve the operational efficiency of all aspects of the operation of science and technology are enterprises.Demand continues to think.For the pharmaceutical e -commerce industry, the ultimate needs of users are not medicine, but to maintain health or recovery.Dingdang Health takes the "28 -minute medicine to the door" service as the starting point, but it will not stop here.

After listing, can Dingdang health succeed in "returning blood"?Radar Finance will continue to pay attention.

- END -

112 (set) products were selected as "Inner Mongolia Gifts" in 2022

Network photo graphics nothing relatedOn August 16, our district announced the lis...

Be wary, "the strongest dollar in history" is here

The US dollar has continued to strengthen recently, and the nominal valid exchange rate that reflects the comprehensive strength of the US dollar has just reached a record high. The unprecedented st